Current Report Filing (8-k)

February 26 2016 - 6:29AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 25, 2016

Acadia Healthcare Company, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-35331 |

|

45-2492228 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

6100 Tower Circle, Suite 1000, Franklin, Tennessee 37067

(Address of Principal Executive Offices)

(615) 861-6000

(Registrant’s Telephone Number, including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. |

Regulation FD Disclosure. |

Acadia Healthcare Company, Inc. (the “Company”)

today filed its Annual Report on Form 10-K for the year ended December 31, 2015 and is providing reconciliations of adjusted income from continuing operations attributable to the Company to its audited statement of income for the year ended

December 31, 2015. The updated reconciliations reflect a $7.0 million increase in the provision for income taxes compared to that reported in the Company’s earnings release issued February 16, 2016. This is due to an

acquisition-related tax benefit that the Company determined could not be recognized until a future period. This change did not have an impact on the Company’s adjusted consolidated tax rate of 29.0% or its adjusted income from continuing

operations attributable to the Company, adjusted EBITDA or net cash provided by continuing operating activities for the three months or year ended December 31, 2015. The reconciliations of non-GAAP financial measures are attached as Exhibit

99 hereto and are incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99 |

|

Reconciliations of Non-GAAP Financial Measures |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ACADIA HEALTHCARE COMPANY, INC. |

|

|

|

|

| Date: February 25, 2016 |

|

|

|

By: |

|

/s/ Christopher L. Howard |

|

|

|

|

|

|

Christopher L. Howard |

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99 |

|

Reconciliations of Non-GAAP Financial Measures |

Exhibit 99

Acadia Healthcare Company, Inc.

Reconciliation of Net Income Attributable to Acadia Healthcare Company, Inc. to Adjusted EBITDA

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2015 |

|

|

Year Ended December 31, 2015 |

|

| |

|

Form 10-K |

|

|

Earnings Release |

|

|

Form 10-K |

|

|

Earnings Release |

|

| |

|

(in thousands) |

|

| Net income attributable to Acadia Healthcare Company, Inc. |

|

$ |

34,566 |

|

|

$ |

41,557 |

|

|

$ |

112,554 |

|

|

$ |

119,545 |

|

| Income from discontinuing operations, net of income taxes |

|

|

(28 |

) |

|

|

(28 |

) |

|

|

(111 |

) |

|

|

(111 |

) |

| Net loss attributable to noncontrolling interests |

|

|

(614 |

) |

|

|

(614 |

) |

|

|

(1,078 |

) |

|

|

(1,078 |

) |

| Provision for income taxes |

|

|

18,594 |

|

|

|

11,603 |

|

|

|

53,388 |

|

|

|

46,397 |

|

| Interest expense, net |

|

|

28,810 |

|

|

|

28,810 |

|

|

|

106,742 |

|

|

|

106,742 |

|

| Depreciation and amortization |

|

|

18,630 |

|

|

|

18,630 |

|

|

|

63,550 |

|

|

|

63,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

99,958 |

|

|

|

99,958 |

|

|

|

335,045 |

|

|

|

335,045 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity-based compensation expense (a) |

|

|

5,896 |

|

|

|

5,896 |

|

|

|

20,472 |

|

|

|

20,472 |

|

| Debt extinguishment costs (b) |

|

|

839 |

|

|

|

839 |

|

|

|

10,818 |

|

|

|

10,818 |

|

| Loss on foreign currency derivatives (c) |

|

|

— |

|

|

|

— |

|

|

|

1,926 |

|

|

|

1,926 |

|

| Transaction-related expenses (d) |

|

|

5,156 |

|

|

|

5,156 |

|

|

|

36,571 |

|

|

|

36,571 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

111,849 |

|

|

$ |

111,849 |

|

|

$ |

404,832 |

|

|

$ |

404,832 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See footnotes.

Acadia Healthcare Company, Inc.

Reconciliation of Adjusted Income from Continuing Operations Attributable to Acadia Healthcare Company, Inc. to

Net Income Attributable to Acadia Healthcare Company, Inc.

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2015 |

|

|

Year Ended December 31, 2015 |

|

| |

|

Form 10-K |

|

|

Earnings Release |

|

|

Form 10-K |

|

|

Earnings Release |

|

| |

|

(in thousands, except per share amounts) |

|

| Net income attributable to Acadia Healthcare Company, Inc. |

|

$ |

34,566 |

|

|

$ |

41,557 |

|

|

$ |

112,554 |

|

|

$ |

119,545 |

|

| Income from discontinuing operations, net of income taxes |

|

|

(28 |

) |

|

|

(28 |

) |

|

|

(111 |

) |

|

|

(111 |

) |

| Provision for income taxes |

|

|

18,594 |

|

|

|

11,603 |

|

|

|

53,388 |

|

|

|

46,397 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations attributable to Acadia Healthcare Company, Inc. before income taxes |

|

|

53,132 |

|

|

|

53,132 |

|

|

|

165,831 |

|

|

|

165,831 |

|

| Adjustments to income from continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt extinguishment costs (b) |

|

|

839 |

|

|

|

839 |

|

|

|

10,818 |

|

|

|

10,818 |

|

| Loss on foreign currency derivatives (c) |

|

|

— |

|

|

|

— |

|

|

|

1,926 |

|

|

|

1,926 |

|

| Transaction-related expenses (d) |

|

|

5,156 |

|

|

|

5,156 |

|

|

|

36,571 |

|

|

|

36,571 |

|

| Income tax provision reflecting tax effect of adjustments to income from continuing operations (e) |

|

|

(16,834 |

) |

|

|

(16,834 |

) |

|

|

(62,392 |

) |

|

|

(62,392 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted income from continuing operations attributable to Acadia Healthcare Company, Inc. |

|

$ |

42,293 |

|

|

$ |

42,293 |

|

|

$ |

152,754 |

|

|

$ |

152,754 |

|

| Weighted-average shares outstanding - diluted |

|

|

71,145 |

|

|

|

71,145 |

|

|

|

68,391 |

|

|

|

68,391 |

|

| Adjusted income from continuing operations attributable to Acadia Healthcare Company, Inc. per diluted share |

|

$ |

0.59 |

|

|

$ |

0.59 |

|

|

$ |

2.23 |

|

|

$ |

2.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See footnotes.

Acadia Healthcare Company, Inc.

Footnotes

We have included certain

financial measures in this report, including EBITDA, Adjusted EBITDA and Adjusted income from continuing operations, which are “non-GAAP financial measures” as defined under the rules and regulations promulgated by the SEC. We define

EBITDA as net income adjusted for loss from discontinued operations, net interest expense, income tax provision and depreciation and amortization. We define Adjusted EBITDA as EBITDA adjusted for equity-based compensation expense, debt

extinguishment costs, gain on foreign currency derivatives and transaction-related expenses.

EBITDA, Adjusted EBITDA and Adjusted income from continuing

operations are supplemental measures of our performance and are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). EBITDA, Adjusted EBITDA and Adjusted income from

continuing operations are not measures of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from

operating activities as measures of our liquidity. Our measurements of EBITDA, Adjusted EBITDA and Adjusted income from continuing operations may not be comparable to similarly titled measures of other companies. We have included information

concerning EBITDA, Adjusted EBITDA and Adjusted income from continuing operations in this report because we believe that such information is used by certain investors as measures of a company’s historical performance. We believe these measures

are frequently used by securities analysts, investors and other interested parties in the evaluation of issuers of equity securities, many of which present EBITDA, Adjusted EBITDA and Adjusted income from continuing operations when reporting their

results. Our presentation of EBITDA, Adjusted EBITDA and Adjusted income from continuing operations should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items.

| (a) |

Represents the equity-based compensation expense of Acadia. |

| (b) |

Represents debt extinguishment costs related to the repayment of $97.5 million of the Company’s 12.875% Senior Notes due 2018, including a prepayment premium of $7.5 million and the write-off of $3.3 million of

deferred financing costs. |

| (c) |

Represents the change in fair value of foreign currency derivatives purchased by Acadia related to acquisitions in the U.K. during 2015 and in July 2014. |

| (d) |

Represents transaction-related expenses incurred by Acadia related to acquisitions. |

| (e) |

Represents the income tax provision adjusted to reflect the tax effect of the adjustments to income from continuing operations based on tax rates of 28.5% and 27.9% for the three months ended December 31, 2015 and 2014,

respectively, and 29.0% and 31.7% for the year ended December 31, 2015 and 2014, respectively. |

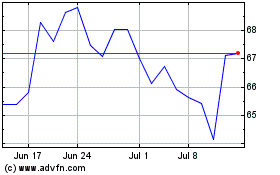

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jun 2024 to Jul 2024

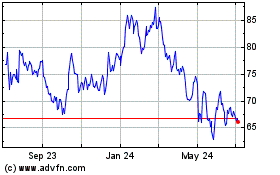

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jul 2023 to Jul 2024