Solid 4Q for Conceptus - Analyst Blog

February 11 2013 - 4:10AM

Zacks

Contraception device maker-

Conceptus Inc. (CPTS) reported earnings per share

(EPS) of 17 cents during the fourth quarter of fiscal 2012,

compared with a net loss of 8 cents per share in the year-ago

quarter. The reported EPS surpassed the Zacks Consensus Estimate by

5 cents. The improvement in the bottom line was primarily driven by

low interest and other expenses during the quarter. For fiscal

2012, EPS was 16 cents compared with a net loss of 25 cents per

share in 2011.

Revenues in the reported quarter

recorded a robust hike of 21.5% year over year (up 23.6% at

constant exchange rate or CER) to $40.7 million, beating of the

Zacks Consensus Estimate of $40 million. This includes a 19.3%

increase in domestic sales to $32.2 million and growth of 30.8% in

international sales to $8.5 million. Net sales for fiscal 2012 were

$140.7 million, up 10.8% and beating the Zacks Consensus Estimate

of $140 million. Revenues remained in line with the company’s

guided range of $140–$144 million.

Even amid several macroeconomic

headwinds in the form of persistent unemployment and limited

consumer spending, the improvement in the reported quarter

primarily came on the back of a 13.5% increase in organic revenues

and the exit of the company’s direct peer

Hologic’s (HOLX) Adiana from the permanent birth

control market. The conversion of Adiana’s market share added 7.1%

to the company’s growth in the reported quarter. Moreover,

Conceptus’ gradual progress in improving commercial execution is

steadily accelerating its growth rate.

Conceptus derives a major share of

its revenues from the Essure permanent birth control system. The

domestic sales for Essure during the quarter were up 20.6% year

over year.

Sales of the Essure system depends

on the number of physicians trained to perform the procedure.

Conceptus is striving toward making the system available worldwide

by raising consumer and physician awareness as well as training

physicians to perform the procedure.

During the reported quarter, the

company expanded its U.S. physician penetration by enrolling 427

new physicians into preceptorship, certifying approximately 288

physicians and transitioning approximately 77 physicians to

performing procedures in the office setting. To date, around 16,000

physicians are fully equipped to perform the Essure procedure.

Conceptus reported gross profit of

$34.2 million, up 22.5% from $27.9 million in the fourth quarter of

2011. Gross margin during the quarter expanded 66 basis points

(bps) to 84.1%.

Operating expenses declined 19.1%

to $24.9 million, driven by the company's lower marketing

expenditures related to the direct-to-consumer campaign, lower

selling expenses associated with sales force headcount reductions

and lower legal fees. As a result, operating margin during the

reported quarter expanded a huge 3133 bps to 22.9%.

Conceptus exited the fiscal with

cash, cash equivalents and short-term investments of $69.9 million

compared with $101.4 million at the end of fiscal 2011. In the

third quarter, the company’s cash flow from operations was $11.2

million.

Guidance

Conceptus provided its fiscal 2013 outlook. The company expects

annual revenues in the range of $155–$159 million, up 10%–13% year

over year. The current Zacks Consensus Estimate of $159 million

remains at the upper end of the guided range.

Our

recommendation

The exit of Adiana from the

permanent birth control market should be highly beneficial for

Conceptus. The company is upbeat regarding the fact that under the

Patient Protection and Affordable Care Act of 2010 (“PPACA”), the

entire list of contraceptive methods approved by the U.S. Food and

Drug Administration (“FDA”), including the Essure procedure, will

be covered by all private insurance plans. We believe that these

recent tailwinds will largely benefit the company’s sales

performance as it will increase access and affordability of the

Essure procedure worldwide. However, we remain concerned about the

limited growth visibility arising from difficult macroeconomic

conditions, resulting in a weak hysteroscopic sterilization

market.

Currently, Conceptus retains a

Zacks Rank #2 (Buy). Other medical stocks such as

ResMed (RMD) and Acadia Healthcare

Company (ACHC), carry a Zacks Rank #1 (Strong Buy) and

warrant a look.

ACADIA HEALTHCR (ACHC): Free Stock Analysis Report

CONCEPTUS INC (CPTS): Free Stock Analysis Report

HOLOGIC INC (HOLX): Free Stock Analysis Report

RESMED INC (RMD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

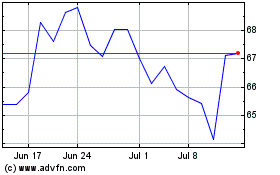

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jun 2024 to Jul 2024

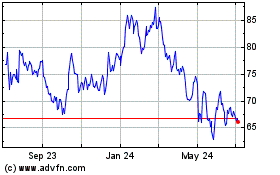

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jul 2023 to Jul 2024