0001555279

false

0001555279

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): August 8, 2023

908 Devices Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39815 |

|

45-4524096 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

645

Summer Street

Boston,

MA

02210

(Address

of principal executive offices, including zip code)

(857)

254-1500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each

class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

MASS |

The NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 ( §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On August 4, 2023, 908 Devices Inc. (the “Company”)

entered into a Default Waiver and First Amendment to Loan and Security Agreement (the “Amended Loan Agreement”), by

and between, the Company, as borrower, and Silicon Valley Bank, a division of First-Citizens Bank & Trust Company (successor

by purchase to the Federal Deposit Insurance Corporation as Receiver for Silicon Valley Bridge Bank, N.A. (as successor to Silicon Valley

Bank)), as lender (the “Lender”).

The Amended Loan Agreement provides for a revolving line of credit

of up to $10.0 million. The outstanding principal amount of any advance shall accrue interest at a floating rate per annum equal to the

greater of (i) four and one-half percent (4.50%) and (ii) the “prime rate” as published in The Wall Street Journal

for the relevant period minus one-half percent (0.50%). The Company’s obligations under the Amended Loan Agreement are secured by

substantially all of the Company’s assets, excluding its intellectual property, which is subject to a negative pledge. The revolving

line of credit under the Amended Loan Agreement terminates on November 2, 2025. As of August 4, 2022, no amounts were outstanding

under the Amended Loan Agreement.

Pursuant to the Amended Loan Agreement, the Lender waived filing any

legal action or instituting or enforcing any rights and remedies it may have had against the Company in connection with the Company’s

failing to maintain all of its operating accounts, depository accounts and excess cash with the Lender, as previously required prior to

the effectiveness of the Amended Loan Agreement.

The Amended Loan Agreement contains certain financial covenants, including

a requirement that the Company maintain $20.0 million on account at or thru the Lender, and the amount of unrestricted and unencumbered

cash minus advances under the Amended Loan Agreement, is not less than the amount equal to the greater of (i) $10.0 million or (ii) nine

(9) months of cash burn. The Amended Loan Agreement contains customary representations and warranties, as well as certain non-financial

covenants, including limitations on, among other things, the Company’s ability to change the principal nature of its business, dispose

of the Company’s business or property, engage in any change of control transaction, merge or consolidate with any other entity or

to acquire all or substantially all the capital stock or property of another entity, incur additional indebtedness or liens, pay dividends

or make other distributions on capital stock, redeem the Company’s capital stock, engage in transactions with affiliates or otherwise

encumber the Company’s intellectual property, in each case, subject to customary exceptions.

The foregoing description of the Amended Loan Agreement does not purport

to be complete and is qualified in its entirety by reference to the full text of the Amended Loan Agreement, which is attached hereto

as Exhibit 10.1 and incorporated by reference herein.

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 8, 2023, 908 Devices Inc. (“908 Devices”)

announced its financial results for the second quarter ended June 30, 2023. A copy of the press release is being furnished as Exhibit 99.1

to this Report on Form 8-K.

The information contained in Item 2.02 of this Current Report on Form 8-K

is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be

incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the

Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth in Item 1.01 of this Form 8-K above

regarding the Loan Agreement is incorporated by reference in response to this Item 2.03.

| Item

9.01 | Financial

Statements and Exhibits. |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 8, 2023 |

908 Devices Inc. |

| |

|

|

| |

By: |

/s/ Michael S. Turner |

| |

|

Name: Michael S. Turner |

| |

|

Title: Chief Legal and Administrative Officer |

Exhibit 10.1

DEFAULT WAIVER AND FIRST AMENDMENT

TO

LOAN

AND SECURITY AGREEMENT

This DEFAULT WAIVER AND

FIRST AMENDMENT TO LOAN AND SECURITY AGREEMENT (this “Agreement”) is entered into as of August 4, 2023, by

and between SILICON VALLEY BANK, a division of First-Citizens Bank & Trust Company (successor by purchase to the Federal

Deposit Insurance Corporation as Receiver for Silicon Valley Bridge Bank, N.A. (as successor to Silicon Valley Bank)) (“Bank”)

and 908 DEVICES INC., a Delaware corporation (“Borrower”).

Recitals

A. Bank

and Borrower have entered into that certain Loan and Security Agreement dated as of November 2, 2022, (as the same may from time

to time be amended, modified, supplemented or restated, the “Loan Agreement”). Bank has extended credit to Borrower

for the purposes permitted in the Loan Agreement.

B. Borrower

acknowledges that Borrower is currently in default under Section 7.2 of the Loan Agreement for failing to maintain all of its operating

accounts, depository accounts and excess cash with Bank or Bank’s Affiliates, as required by Section 5.9(a) of the Loan

Agreement (the “Waived Defaults”).

C. Borrower

has requested that Bank waive its rights and remedies against Borrower, limited specifically to the Waived Defaults. Although Bank is

under no obligation to do so, Bank is willing to not exercise its rights and remedies against Borrower related to the specific Waived

Defaults on the terms and conditions set forth in this Agreement, so long as Borrower complies with the terms, covenants and conditions

set forth in this Agreement.

D. Borrower

has further requested that Bank amend the Loan Agreement to make certain revisions to the Loan Agreement as more fully set forth herein.

Bank has agreed to so amend certain provisions of the Loan Agreement, but only to the extent, in accordance with the terms, subject to

the conditions and in reliance upon the representations and warranties set forth below.

Agreement

Now,

Therefore, in consideration of the foregoing recitals and other good and valuable consideration, the receipt and adequacy of

which is hereby acknowledged, and intending to be legally bound, the parties hereto agree as follows:

1. Definitions.

Capitalized terms used but not defined in this Agreement shall have the meanings given to them in the Loan Agreement.

2. Waiver

of Default. Subject to the conditions precedent set forth in Section 11 below, Bank hereby waives filing any legal action or

instituting or enforcing any rights and remedies it may have against Borrower with respect to the Waived Defaults. Accordingly, hereinafter,

Borrower shall be in compliance with such sections. Bank’s agreement to waive the Waived Defaults (a) in no way shall be deemed

an agreement by Bank to waive Borrower’s compliance with the above-referenced section as of all other dates, and (b) shall

not limit or impair the Bank’s right to demand strict performance of such section as of all other dates.

3. Amendments

to Loan Agreement.

3.1 Section 1.4

(Fees; Expenses). Sections 1.4(b) and 1.4(c) of the Loan Agreement hereby are amended and restated in their entirety to

read as follows:

“(b) [Reserved];

and

(c) Termination

Fee. Upon termination of this Agreement or the termination of the Revolving Line for any reason prior to the Revolving Line Maturity

Date, in addition to the payment of any other amounts then-owing, a termination fee (the “Termination Fee”) in an amount

equal to (i) one percent (1.0%) of the Revolving Line if such termination occurs prior to November 1, 2023, (ii) sixty-six

one hundredth of one percent (0.66%) of the Revolving Line if such termination occurs on or at any time after November 1, 2023 but

prior to November 1, 2024 or (iii) thirty-three one hundredth of one percent (0.33%) of the Revolving Line if such termination

occurs on or at any time after November 1, 2024 but prior to the Revolving Line Maturity Date, which shall be fully earned and non-refundable

as of such date; provided that no Termination Fee shall be charged if (x) the credit facility hereunder is replaced with a new facility

from Bank or (y) Bank is placed in receivership.”

3.2 Section 1.9

(Incremental Loan). Section 1.9 (Incremental Loan) of the Loan Agreement hereby is deleted in its entirety.

3.3 Section 5.3

(Financial Statements, Reports). Section 5.3(c) of the Loan Agreement hereby is amended and restated in its entirety to

read as follows:

“(c) Financial

Statements. As soon as available, but no later than thirty (30) days after the last day of each month if there is any Advance outstanding

as of the last day of such month, a company prepared consolidated cash flows, balance sheet and income statement covering Parent’s

consolidated operations for such month in a form reasonably acceptable to Bank; provided that, on or immediately prior to any Advance,

the monthly financial statements provided for in this Section 5.3(c) shall be delivered for the most recent month as if an Advance

was outstanding as of the last day of such month;”

3.4 Section 5.9(a) (Accounts).

Section 5.9(a) of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(a) Maintain

the lesser of (i) Twenty Million Dollars ($20,000,000) (or its Dollar Equivalent) in Borrower’s operating accounts and depository

accounts at or through Bank or (ii) all of Borrower’s, any of its Subsidiaries’, and any Guarantor’s operating

accounts, depository accounts and excess cash with Bank or Bank’s Affiliates; provided, however, that notwithstanding the foregoing

subpart (ii), (A) 908 Germany may maintain Deposit Accounts at financial institutions in Germany listed on the Perfection Certificate

delivered by Borrower to Bank on or prior to the Effective Date so long as the aggregate amount in such accounts does not exceed Two Million

Five Hundred Thousand Dollars ($2,500,000) at any time, (B) 908 China may maintain Deposit Accounts at financial institutions in

China listed on the Perfection Certificate delivered by Borrower to Bank on or prior to the Effective Date so long as the aggregate amount

in such accounts does not exceed Five Hundred Thousand Dollars ($500,000) at any time and (C) Borrower may maintain its PayPal processor

account (“PayPal Account”) and the Bill.com processor account (“Bill.com Account”), in each case,

existing on the Effective Date and disclosed in the Perfection Certificate so long as all funds (x) in the PayPal Account in excess

of One Hundred Thousand Dollars ($100,000) and (y) in the Bill.com Account in excess of Five Thousand Dollars ($5,000), in each case,

are transferred at least monthly to an account of Borrower maintained with Bank, (the accounts in subclauses (A) – (C), collectively,

the “Permitted Accounts”).”

3.5 Section 5.9(c) (Accounts).

Section 5.9(c) of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(c) In

addition to and without limiting the restrictions in (a), Borrower shall provide Bank five (5) Business Days prior written

notice before establishing any Collateral Account at or with any bank or financial institution other than Bank or Bank’s Affiliates.

For each Collateral Account that Borrower at any time maintains, Borrower shall cause the applicable bank or financial institution (other

than Bank) at or with which any Collateral Account is maintained to execute and deliver a Control Agreement or other appropriate instrument

with respect to such Collateral Account to perfect Bank’s Lien in such Collateral Account in accordance with the terms hereunder

which Control Agreement may not be terminated without the prior written consent of Bank. The provisions of the previous sentence shall

not apply to (i) the Permitted Accounts, (ii) other deposit accounts exclusively used for payroll, payroll taxes, and other

employee wage and benefit payments to or for the benefit of Borrower’s employees and identified to Bank by Borrower as such (iii) deposit

accounts outside the United States holding funds in trust or escrow, solely for the benefit of or payable to Borrower’s customers

or other third parties, and holding no funds of Borrower, in each case, identified to Bank by Borrower as such and (iv) subject to

compliance with Section 5.9(a), other deposit accounts of Borrower disclosed in the Updated Perfection Certificate as of the First

Amendment Effective Date or otherwise notified to Bank in accordance with this clause (c) (the accounts described in clauses (i),

(ii), (iii) and (iv) are the “Excluded Accounts”).”

3.6 Section 5.17

(Cash Collateralization Trigger). Section 5.17 (Cash Collateralization Trigger) of the Loan Agreement hereby is amended and restated

in its entirety to read as follows:

“5.17 Cash

Collateralization Trigger. Upon the occurrence of the Cash Trigger Level, Borrower hereby authorizes and directs Bank to immediately

transfer to a blocked account to be established by and held at Bank (the “Pledged Account”) (from any one or a combination

of Borrower’s accounts at Bank) an aggregate amount of cash equal to the aggregate amount of the Obligations (including, for the

avoidance of doubt, the portion of the Advances) outstanding at such time in order to cash collateralize all such Obligations (a “Cash

Collateralization”). It is understood and agreed by Borrower that the occurrence of the Cash Trigger Level shall constitute an immediate

Cash Collateralization of the Obligations, irrespective of any delay by Bank in effecting such transfer.”

3.7 Section 9

(Notices). The reference to “Silicon Valley Bank” in Section 9 (Notices) of the Loan Agreement hereby is amended

and restated in its entirety to read “Silicon Valley Bank, a division of First-Citizens Bank & Trust Company (successor

by purchase to the Federal Deposit Insurance Corporation as Receiver for Silicon Valley Bridge Bank, N.A. (as successor to Silicon Valley

Bank))",

3.8 Section 12.2

(Definitions). The following terms and their respective definitions hereby are added or amended and restated in their entirety in

Section 12.2 of the Loan Agreement, as appropriate, to read as follows:

“908 Germany” is 908 Devices

GmbH (formerly known as TRACE Analytics GmbH), a company incorporated under the laws of Germany.

“First Amendment Effective Date”

means August 4, 2023.

3.9 Section 12.2

(definitions). The term “Obligations” hereby is amended and restated in its entirety to read as follows:

““Obligations”

are Borrower’s obligations to pay when due any debts, principal, interest, fees, Bank Expenses, the Termination Fee, and other amounts

Borrower owes Bank now or later, whether under this Agreement, the other Loan Documents, or otherwise, including, without limitation,

all obligations relating to Bank Services and interest accruing after Insolvency Proceedings begin and debts, liabilities, or obligations

of Borrower assigned to Bank, and to perform Borrower’s duties under the Loan Documents.”

3.10 Section 12.2

(Definitions). The terms “Aggregate Anniversary Fee”, “Annual Anniversary Fee”, “Election Period”,

“Increase Effective Date” and “Incremental Revolving Line Commitment”, and their respective definitions in Section 12.2

of the Loan Agreement are deleted in their entirety.

3.11 Exhibit A

(Compliance Statement). The Compliance Statement set forth in Exhibit A to the Loan Agreement hereby is replaced with

Exhibit A attached hereto.

3.12 Schedule

I (LSA Provisions). The LSA Provisions set forth in Schedule I to the Loan Agreement hereby is replaced with Schedule I

attached hereto.

| 4. | Limitation of Agreement. |

4.1 This

Agreement is effective for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be

a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, or (b) otherwise prejudice

any right or remedy which Bank may now have or may have in the future under or in connection with any Loan Document.

4.2 This

Agreement shall be construed in connection with and as part of the Loan Documents, and all terms, conditions, representations, warranties,

covenants and agreements set forth in the Loan Documents, except as herein amended, are hereby ratified and confirmed and shall remain

in full force and effect.

5. Representations

and Warranties. To induce Bank to enter into this Agreement, Borrower hereby represents and warrants to Bank as follows:

5.1 Immediately

after giving effect to this Agreement (a) the representations and warranties contained in the Loan Documents are true, accurate and

complete in all material respects as of the date hereof (except to the extent such representations and warranties relate to an earlier

date, in which case they are true and correct as of such date), and (b) no Default or Event of Default (other than the Waived Default)

has occurred and is continuing. Borrower understands and agrees that in modifying the existing Obligations, Bank is relying upon Borrower’s

representations, warranties, and agreements, as set forth in the Loan Documents;

5.2 Borrower

has the power and authority to execute and deliver this Agreement and to perform its obligations under the Loan Agreement, as amended

by this Agreement;

5.3 The

organizational documents of Borrower delivered to Bank on the Effective Date remain true, accurate and complete and have not been amended,

supplemented or restated and are and continue to be in full force and effect;

5.4 The

execution and delivery by Borrower of this Agreement and the performance by Borrower of its obligations under the Loan Agreement, as amended

by this Agreement, have been duly authorized by all necessary action on the part of Borrower;

5.5 The

execution and delivery by Borrower of this Agreement and the performance by Borrower of its obligations under the Loan Agreement, as amended

by this Agreement, do not and will not contravene (a) any law or regulation binding on or affecting Borrower, (b) any contractual

restriction with a Person binding on Borrower, (c) any order, judgment or decree of any court or other governmental or public body

or authority, or subdivision thereof, binding on Borrower, or (d) the organizational documents of Borrower;

5.6 The

execution and delivery by Borrower of this Agreement and the performance by Borrower of its obligations under the Loan Agreement, as amended

by this Agreement, do not require any order, consent, approval, license, authorization or validation of, or filing, recording or registration

with, or exemption by any governmental or public body or authority, or subdivision thereof, binding on Borrower, except as already has

been obtained or made; and

5.7 This

Agreement has been duly executed and delivered by Borrower and is the binding obligation of Borrower, enforceable against Borrower in

accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, liquidation, moratorium

or other similar laws of general application and equitable principles relating to or affecting creditors’ rights.

6. Release

by Borrower.

6.1 FOR

GOOD AND VALUABLE CONSIDERATION, Borrower hereby forever relieves, releases, and discharges Bank and its present or former employees,

officers, directors, agents, representatives, attorneys, and each of them, from any and all claims, debts, liabilities, demands, obligations,

promises, acts, agreements, costs and expenses, actions and causes of action, of every type, kind, nature, description or character whatsoever,

whether known or unknown, suspected or unsuspected, absolute or contingent, arising out of or in any manner whatsoever connected with

or related to facts, circumstances, issues, controversies or claims existing or arising from the beginning of time through and including

the date of execution of this Agreement (collectively “Released Claims”). Without limiting the foregoing, the Released Claims

shall include any and all liabilities or claims arising out of or in any manner whatsoever connected with or related to the Loan Documents,

the Recitals hereto, any instruments, agreements or documents executed in connection with any of the foregoing or the origination, negotiation,

administration, servicing and/or enforcement of any of the foregoing.

6.2 By

entering into this release, Borrower recognizes that no facts or representations are ever absolutely certain and it may hereafter discover

facts in addition to or different from those which it presently knows or believes to be true, but that it is the intention of Borrower

hereby to fully, finally and forever settle and release all matters, disputes and differences, known or unknown, suspected or unsuspected;

accordingly, if Borrower should subsequently discover that any fact that it relied upon in entering into this release was untrue, or that

any understanding of the facts was incorrect, Borrower shall not be entitled to set aside this release by reason thereof, regardless of

any claim of mistake of fact or law or any other circumstances whatsoever. Borrower acknowledges that it is not relying upon and has not

relied upon any representation or statement made by Bank with respect to the facts underlying this release or with regard to any of such

party’s rights or asserted rights.

6.3 This

release may be pleaded as a full and complete defense and/or as a cross-complaint or counterclaim against any action, suit, or other proceeding

that may be instituted, prosecuted or attempted in breach of this release. Borrower acknowledges that the release contained herein constitutes

a material inducement to Bank to enter into this Agreement, and that Bank would not have done so but for Bank’s expectation that

such release is valid and enforceable in all events.

6.4 Borrower

hereby acknowledges and agrees that Borrower has no offsets, defenses, claims, or counterclaims against Bank with respect to the Obligations,

or otherwise, and that if Borrower now has, or ever did have, any offsets, defenses, claims, or counterclaims against Bank, whether known

or unknown, at law or in equity, all of them are hereby expressly WAIVED and Borrower hereby RELEASES Bank from any liability thereunder.

6.5 Borrower

hereby represents and warrants to Bank, and Bank is relying thereon, as follows:

(a) Except

as expressly stated in this Agreement, neither Bank nor any agent, employee or representative of Bank has made any statement or representation

to Borrower regarding any fact relied upon by Borrower in entering into this Agreement.

(b) Borrower

has made such investigation of the facts pertaining to this Agreement and all of the matters appertaining thereto, as it deems necessary.

(c) The

terms of this Agreement are contractual and not a mere recital.

(d) This

Agreement has been carefully read by Borrower, the contents hereof are known and understood by Borrower, and this Agreement is signed

freely, and without duress, by Borrower.

(e) Borrower

is the sole and lawful owner of all right, title and interest in and to every claim and every other matter which it releases herein, and

Borrower has not heretofore assigned or transferred, or purported to assign or transfer, to any person, firm or entity any claims or other

matters herein released. Borrower shall indemnify Bank, defend and hold it harmless from and against all claims based upon or arising

in connection with prior assignments or purported assignments or transfers of any claims or matters released herein.

7. Updated

Perfection Certificate. In connection with this Agreement, Borrower has delivered an updated Perfection Certificate (the “Updated

Perfection Certificate”). Borrower and Bank acknowledge and agree that, from and after the date of this Agreement, each reference

in the Loan Documents to the “Perfection Certificate” shall be deemed to be a reference to the Updated Perfection Certificate.

Borrower acknowledges, confirms and agrees the disclosures and information Borrower provided to Bank in the Updated Perfection Certificate

have not changed as of the date hereof.

8. Prior

Agreement. The Loan Documents are hereby ratified and reaffirmed and shall remain in full force and effect. Borrower hereby ratifies,

confirms, and reaffirms all terms and conditions of all security or other collateral granted to the Bank, and confirms that the indebtedness

secured thereby includes, without limitation, the Obligations. This Agreement is not a novation and the terms and conditions of this Agreement

shall be in addition to and supplemental to all terms and conditions set forth in the Loan Documents. In the event of any conflict or

inconsistency between this Agreement and the terms of such documents, the terms of this Agreement shall be controlling, but such document

shall not otherwise be affected or the rights therein impaired.

9. Integration.

Except as expressly modified pursuant to this Agreement, the terms of the Loan Documents remain unchanged and in full force and effect.

This Agreement and the Loan Documents represent the entire agreement about this subject matter and supersede prior negotiations or agreements.

All prior agreements, understandings, representations, warranties, and negotiations between the parties about the subject matter of this

Agreement and the Loan Documents merge into this Agreement and the Loan Documents.

10. Fees

and Expenses. Borrower shall pay to Bank on the date first listed above all Bank Expenses due and owing as of the date hereof. The

fees and expenses listed in the previous sentence may be debited from any of Borrower’s accounts at Bank.

11. Conditions

to Effectiveness. The parties agree that the obligations of Bank herein shall be effective upon the satisfaction of each of the following

conditions precedent, each in form and substance satisfactory to Bank in its sole discretion, on or prior to the date first listed above:

11.1 this

Agreement duly executed on behalf of Borrower;

11.2 a

secretary’s certificate of Borrower with respect to Borrower’s Operating Documents, incumbency, specimen signatures and resolutions

authorizing the execution and delivery of this Agreement and the other Loan Documents to which it is a party;

11.3 a

good standing certificate of Borrower, certified by the Secretary of State of the state of incorporation of Borrower and certain other

jurisdictions in which Borrower is qualified to conduct business, as follows: Commonwealth of Massachusetts, Commonwealth of Pennsylvania,

State of North Carolina, State of Maryland and State of California, dated as of a date no earlier than thirty (30) days prior to the date

hereof;

11.4 certified

copies, dated as of a recent date, of financing statement and other lien searches of Borrower, as Bank may request and which shall be

obtained by Bank, accompanied by written evidence (including any UCC termination statements) that the Liens revealed in any such searched

either (i) will be terminated prior to or in connection with the execution of this Agreement, or (ii) in the sole discretion

of Bank, will constitute Permitted Liens;

11.5 the

completed Updated Perfection Certificate, duly executed by Borrower;

11.6 evidence

satisfactory to Bank that the insurance policies required for Borrower are in full force and effect, including appropriate evidence showing

notice of cancellation, lender loss payable and additional insured clauses or endorsements in favor of Bank

11.7 Borrower’s

payment of Bank’s legal fees and expenses incurred in connection with this Agreement; and

11.8 such

other documents as Bank may reasonably request to effectuate the terms of this Amendment.

12. Miscellaneous.

12.1 This

Agreement shall constitute a Loan Document under the Loan Agreement; the failure to comply with the covenants contained herein shall constitute

an Event of Default under the Loan Agreement; and all obligations included in this Agreement (including, without limitation, all obligations

for the payment of principal, interest, fees, and other amounts and expenses) shall constitute obligations under the Loan Agreement and

secured by the Collateral.

12.2 Each

provision of this Agreement is severable from every other provision in determining the enforceability of any provision.

12.3 This

Agreement may be executed in any number of counterparts and all of such counterparts taken together shall be deemed to constitute one

and the same instrument.

12.4 The

Loan Documents are hereby amended wherever necessary to reflect the changes described above.

12.5 Section 11.9

of the Loan Agreement applies to this Agreement.

12.6 This

Agreement and the rights and obligations of the parties hereto shall be governed by and construed in accordance with the laws of the Commonwealth

of Massachusetts.

[Signature page follows]

In

Witness Whereof, the parties hereto have caused this Agreement to be executed as a sealed instrument under the laws of the

Commonwealth of Massachusetts as of the date first written above.

| BANK |

|

BORROWER |

|

FIRST-CITIZENS BANK & TRUST COMPANY (SUCCESSOR BY PURCHASE

TO THE FEDERAL DEPOSIT INSURANCE CORPORATION AS RECEIVER FOR SILICON VALLEY BRIDGE BANK, N.A. (AS SUCCESSOR TO SILICON VALLEY BANK))

|

|

908 DEVICES INC.

|

| By: |

/s/ Nick Currie |

|

By: |

/s/ Joseph H. Griffith IV |

| Name: |

Nick Currie |

|

Name: |

Joseph H. Griffith IV |

| Title: |

Managing Director |

|

Title: |

Chief Financial Officer |

SCHEDULE I

LSA PROVISIONS

| LSA Section |

LSA Provision |

| 1.1(a) - Revolving Line – Availability |

Amounts borrowed under the Revolving Line may be prepaid or repaid and, prior to the Revolving Line Maturity Date, reborrowed, subject to the applicable terms and conditions precedent herein. |

| 1.3(a) – Interest Payments – Advances |

Interest on the principal amount of each Advance is payable in arrears monthly (i) on each Payment Date, (ii) on the date of any prepayment and (iii) on the Revolving Line Maturity Date. |

| 1.3(a) – Interest Rate – Advances |

The outstanding principal amount of any Advance shall accrue interest at a floating rate per annum equal to the greater of (i) four and one half of one percent (4.50%) and (ii) the Prime Rate minus the Prime Rate Margin, which interest shall be payable in accordance with Section 1.3(a). |

| 1.3(e) – Interest Computation |

Interest shall be computed on the basis of the actual number of days elapsed and a 360-day year for any Credit Extension outstanding. |

| 1.4(a) – Revolving Line Commitment Fee |

A fully earned, non-refundable commitment fee of Seventy Thousand Dollars ($70,000) which was previously paid by Borrower on November 2, 2022. |

| 12.2 – “Borrower” |

“Borrower” means 908 Devices Inc., a Delaware corporation. |

| 12.2 – “Effective Date” |

“Effective Date” is November 2, 2022. |

| 12.2 – “Payment Date” |

“Payment Date” is the last calendar day of each month. |

| 12.2 – “Prime Rate” |

“Prime Rate” is the rate of interest per annum from time to time published in the money rates section of The Wall Street Journal or any successor publication thereto as the “prime rate” then in effect; provided that if such rate of interest, as set forth from time to time in the money rates section of The Wall Street Journal, becomes unavailable for any reason as determined by Bank, the “Prime Rate” shall mean the rate of interest per annum announced by Bank as its prime rate in effect at its principal office (such Bank announced Prime Rate not being intended to be the lowest rate of interest charged by Bank in connection with extensions of credit to debtors); provided that, in the event such rate of interest is less than zero percent (0.0%) per annum, such rate shall be deemed to be zero percent (0.0%) per annum for purposes of this Agreement. |

| 12.2 – “Prime Rate Margin” |

“Prime Rate Margin” is one half of one percent (0.50%). |

| 12.2 – “Revolving Line” |

“Revolving Line” is an aggregate principal amount equal to Ten Million Dollars ($10,000,000). |

| 12.2 – “Revolving Line Maturity Date” |

“Revolving Line Maturity Date” is November 3, 2025. |

Exhibit 99.1

908 Devices Reports Second Quarter 2023 Financial

Results and Updates 2023 Revenue Outlook

Revenue increases 9% compared to prior year,

driven by handheld revenue growth of 27%

BOSTON

– August 8, 2023 – 908 Devices Inc. (Nasdaq: MASS), a pioneer of purpose-built handheld and desktop devices

for chemical and biochemical analysis, today reported financial results for the quarter ended June 30, 2023.

“We delivered solid results in the second

quarter driven by robust demand for our handheld devices and strong recurring revenue,” said Kevin J. Knopp, CEO and Co-founder.

“We continue to capture opportunities for our flagship handheld device, which is being increasingly recognized as the standard for

trace detection of fentanyls and synthetic opioids. We are also excited about an upcoming product launch that broadens our desktop portfolio

in bioprocessing and further positions us for growth.”

Recent Highlights

| • | Revenue of $12.1 million for the second quarter 2023, increasing 9% compared to the second quarter 2022 |

| o | Handheld revenue was $8.8 million, increasing 27% year over year |

| o | Desktop revenue was $3.1 million, decreasing 15% year over year |

| o | Recurring revenue was $4.0 million, increasing 39% year over year |

| • | Achieved recurring revenue of at least one third of total revenue for the third consecutive quarter |

| • | Ended the second quarter 2023 with $153 million in cash, cash equivalents and marketable securities with no debt outstanding |

| • | Introduced the MX908 Beacon for remote area monitoring of toxic aerosol and vapor hazards, enabling first responders to gather ongoing

intelligence while ensuring public safety |

| • | Presented 19 posters and a key oral presentation on multi-omics at the American Society for Mass Spectrometry (ASMS) Conference |

| • | Expanded the MX908 pilot program to the state of Tennessee following success in Ohio, deploying more handheld devices in the field

for trace identification of counterfeit pharmaceuticals and other priority drugs |

Second Quarter 2023 Financial Results

Revenue was $12.1 million for the three months

ended June 30, 2023, a 9% increase over the prior year period. This was primarily driven by growth in handheld devices and recurring

revenue. The installed base grew to 2,590 devices with 122 devices placed during the second quarter 2023.

Recurring revenue grew $1.1 million to $4.0 million

or 39% over the prior year period. This was driven by growth in service revenue as well as handheld accessory and consumable revenues.

Gross profit was $5.8 million for the second quarter of 2023, compared

to $6.6 million for the corresponding prior year period. Gross margin was 48% as compared to 60% for the corresponding prior year period.

The decline in gross margin was largely due to timing of production levels of devices, higher material costs with warranty and manufacturing

activities, and the higher non-cash charges for intangible amortization and stock-based compensation during the second quarter of 2023.

Operating expenses were $16.7 million for the

second quarter of 2023, compared to $15.0 million for the corresponding prior year period. This increase was driven by salaries and related

costs from higher headcount, an increase in stock-based compensation and an increase in acquisition related costs for intangible amortization

and valuation of contingent milestones, offset in part by a reduction in director and officer insurance premiums.

Net loss was $9.3 million for the second quarter

of 2023, compared to $8.1 million for the corresponding prior year period. Net loss per share was $0.29 for the second quarter of 2023,

compared to a net loss per share of $0.26 for the corresponding prior year period.

Cash, cash equivalents and marketable securities were $153 million

as of June 30, 2023.

2023 Guidance

908 Devices now expects full year 2023 revenue

to be in the range of $49 million to $52 million, representing 4% to 11% growth over full year 2022, which compares to its previous expectations

of $48 million to $52 million.

Webcast Information

908 Devices will host a conference call to discuss

the second quarter 2023 financial results before market open on Tuesday, August 8, 2023 at 5:30 am Pacific Time / 8:30 am Eastern

Time. A webcast of the conference call can be accessed at https://ir.908devices.com/news-events/events. The webcast will be archived

and available for replay for at least 90 days after the event.

About 908 Devices

908

Devices is revolutionizing chemical and biochemical analysis with its simple handheld and desktop devices, addressing critical-to-life

applications. The Company’s devices are used at the point-of-need to interrogate unknown and invisible materials and provide quick,

actionable answers to directly address some of the most critical problems in life sciences research, bioprocessing, pharma / biopharma,

forensics and adjacent markets. The Company is headquartered in the heart of Boston, where it designs and manufactures innovative products

that bring together the power of mass spectrometry, microfluidic sampling and separations, software automation, and machine learning.

Forward Looking Statements

This

press release includes “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. All statements other than statements of historical facts are forward-looking statements, including, without limitation, statements

regarding the Company’s future revenue and growth. Words such as “may,” “will,” “expect,” “plan,”

“anticipate,” “estimate,” “intend” and similar expressions (as well as other words or expressions

referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These forward-looking statements

are based on management’s current expectations and involve known and unknown risks, uncertainties and assumptions which may cause

actual results to differ materially from any results expressed or implied by any forward-looking statement, including the risks outlined

under “Risk Factors” and elsewhere in the Company’s filings with the Securities and Exchange Commission which are available

on the SEC's website at www.sec.gov. Additional information will be made available in our annual and quarterly reports

and other filings that we make from time to time with the SEC. Although the Company believes that the expectations reflected in its forward-looking

statements are reasonable, it cannot guarantee future results. The Company has no obligation, and does not undertake any obligation,

to update or revise any forward-looking statement made in this press release to reflect changes since the date of this press release,

except as may be required by law.

Investor Contact:

Carrie Mendivil

IR@908devices.com

Media

Contact:

Barbara Russo

brusso@908devices.com

908 DEVICES INC.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

(unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue: | |

| | |

| | |

| | |

| |

| Product revenue | |

$ | 9,595 | | |

$ | 9,082 | | |

$ | 16,617 | | |

$ | 15,589 | |

| Service revenue | |

| 2,354 | | |

| 1,526 | | |

| 4,594 | | |

| 3,048 | |

| License and contract revenue | |

| 145 | | |

| 498 | | |

| 370 | | |

| 775 | |

| Total revenue | |

| 12,094 | | |

| 11,106 | | |

| 21,581 | | |

| 19,412 | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | |

| Product cost of revenue | |

| 4,800 | | |

| 3,304 | | |

| 8,586 | | |

| 6,276 | |

| Service cost of revenue | |

| 1,448 | | |

| 1,057 | | |

| 2,718 | | |

| 2,126 | |

| License and contract cost of revenue | |

| 52 | | |

| 111 | | |

| 99 | | |

| 247 | |

| Total cost of revenue | |

| 6,300 | | |

| 4,472 | | |

| 11,403 | | |

| 8,649 | |

| Gross profit | |

| 5,794 | | |

| 6,634 | | |

| 10,178 | | |

| 10,763 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 5,525 | | |

| 4,293 | | |

| 10,923 | | |

| 8,198 | |

| Selling, general and administrative | |

| 11,208 | | |

| 10,710 | | |

| 23,211 | | |

| 20,455 | |

| Total operating expenses | |

| 16,733 | | |

| 15,003 | | |

| 34,134 | | |

| 28,653 | |

| Loss from operations | |

| (10,939 | ) | |

| (8,369 | ) | |

| (23,956 | ) | |

| (17,890 | ) |

| Other income, net | |

| 1,522 | | |

| 270 | | |

| 1,955 | | |

| 376 | |

| Benefit for income taxes | |

| 71 | | |

| - | | |

| 122 | | |

| - | |

| Net loss | |

$ | (9,346 | ) | |

$ | (8,099 | ) | |

$ | (21,879 | ) | |

$ | (17,514 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to common stockholders | |

$ | (0.29 | ) | |

$ | (0.26 | ) | |

$ | (0.68 | ) | |

$ | (0.56 | ) |

| Weighted average common shares outstanding | |

| 32,199,156 | | |

| 31,413,431 | | |

| 32,083,122 | | |

| 31,312,559 | |

908 DEVICES INC.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash, cash equivalents and marketable securities | |

$ | 152,687 | | |

$ | 188,422 | |

| Accounts receivable, net | |

| 10,308 | | |

| 10,033 | |

| Inventory | |

| 14,135 | | |

| 12,513 | |

| Prepaid expenses and other current assets | |

| 3,947 | | |

| 4,658 | |

| Total current assets | |

| 181,077 | | |

| 215,626 | |

| Operating lease, right-of-use assets | |

| 7,136 | | |

| 3,956 | |

| Property and equipment, net | |

| 2,940 | | |

| 3,083 | |

| Goodwill | |

| 10,185 | | |

| 10,050 | |

| Intangible, net | |

| 8,162 | | |

| 8,488 | |

| Other long-term assets | |

| 1,330 | | |

| 1,384 | |

| Total assets | |

$ | 210,830 | | |

$ | 242,587 | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 7,520 | | |

$ | 10,244 | |

| Deferred revenue | |

| 10,814 | | |

| 7,514 | |

| Operating lease liabilities | |

| 1,860 | | |

| 1,468 | |

| Total current liabilities | |

| 20,194 | | |

| 19,226 | |

| Long-term debt, net of discount and current portion | |

| — | | |

| 15,000 | |

| Deferred revenue, net of current portion | |

| 8,474 | | |

| 11,496 | |

| Other long-term liabilities | |

| 7,703 | | |

| 6,266 | |

| Total liabilities | |

| 36,371 | | |

| 51,988 | |

| Total stockholders' equity | |

| 174,459 | | |

| 190,599 | |

| Total liabilities and stockholders' equity | |

$ | 210,830 | | |

$ | 242,587 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

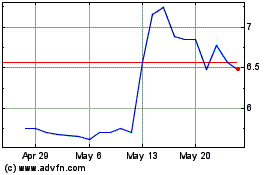

908 Devices (NASDAQ:MASS)

Historical Stock Chart

From Dec 2024 to Jan 2025

908 Devices (NASDAQ:MASS)

Historical Stock Chart

From Jan 2024 to Jan 2025