- Revenues grew 29.3 percent to $232.2

million, primarily reflecting contributions from Harry & David,

which the Company acquired in September 2014.

- Adjusted EBITDA*, excluding stock-based

compensation, was a loss of $4.1 million, reflecting the

seasonality of Harry & David. Excluding Harry & David,

Adjusted EBITDA increased 95.3 percent to $6.5 million.

- Adjusted EPS* was a loss of $0.13 per

share, reflecting the Harry & David seasonality. Excluding

Harry & David, Adjusted EPS increased $0.03 per share to $0.01

per diluted share.

- Company raises its guidance for Fiscal

2015 Adjusted EBITDA and Adjusted EPS.

(*Adjusted EBITDA, Adjusted EPS and Adjusted Net Loss exclude

one-time costs associated with the integration of Harry & David

and the impact of the Fannie May warehouse fire.)

1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS), the world’s leading

florist and gift shop, today reported revenues from continuing

operations grew 29.3 percent to $232.2 million for its fiscal 2015

third quarter, ended March 29, 2015, compared with revenues from

continuing operations of $179.6 million in the prior year period.

The Company said the increase in revenues primarily reflected

contributions from Harry & David which the Company acquired on

September 30, 2014. Total revenues also grew, excluding Harry &

David, reflecting solid growth in the Company’s Gourmet Food and

Gift Baskets and BloomNet segments, somewhat offset by modestly

lower revenues in the Company’s Consumer Floral segment due to the

Saturday placement of the Valentine holiday.

Gross profit margin for the third quarter was 41.0 percent,

consistent with the prior year period. Operating expense ratio was

48.0 percent, up 540 basis points, compared with 42.6 percent in

the prior year period, primarily reflecting increased operating

expenses associated with Harry & David.

Adjusted EBITDA for the quarter, excluding stock-based

compensation, was a loss of $4.1 million, compared with $3.3

million in the prior year period, reflecting the seasonal losses

associated with Harry & David. Excluding Harry & David,

Adjusted EBITDA, excluding stock-based compensation, increased 95.3

percent to $6.5 million, reflecting contributions from the

Company’s Gourmet Foods and Gift Baskets segment and continued

strong year-over-year performance in its Consumer Floral segment.

Adjusted Net Loss* from continuing operations attributable to the

Company was $8.5 million, or ($0.13) per share, compared with a net

loss of $1.4 million, or ($0.02) per share in the prior year

period. Excluding Harry & David, Adjusted Net Income*

attributable to the Company and Adjusted EPS from continuing

operations was $342,000 and $0.01 per diluted share,

respectively.

Reported EBITDA loss, excluding stock-based compensation, was

$6.8 million, compared with $3.3 million in the prior year period.

Reported net loss from continuing operations attributable to the

Company was $10.5 million, or ($0.16) per share, compared with a

net loss of $1.4 million, or ($0.02) per share in the prior year

period.

Jim McCann, CEO of 1-800-FLOWERS.COM, said, “During the fiscal

third quarter, we saw solid performance across all of our business

segments while facing a number of headwinds, most notably the

significant seasonality of the Harry & David business, the

Saturday placement of the Valentine holiday and the lingering

impacts of the Thanksgiving Day fire on our Fannie May Fine

Chocolates business. Regarding Harry & David, during the third

quarter, while the business generated an anticipated loss, we were

pleased to see year-over-year improvements in both top and

bottom-line results. As we continue our integration of Harry &

David, we plan to build on this by leveraging our business

platform, our growing family of gift brands and the millions of

customers we serve across all of our business channels.” McCann

noted that, excluding Harry & David, the Company’s Gourmet

Foods and Gift Baskets segment achieved strong top and bottom-line

growth during the quarter.

McCann also noted that the Company’s was pleased with the

performance of its consumer floral business. “Valentine’s Day is

always challenging because of its varying day placement and

unpredictable winter weather. With that said, we achieved

year-over-year growth in our gross profit margin and bottom-line

contribution as we were able to largely mitigate the modestly lower

order volumes related to the Saturday placement. We believe these

results reflect the strength of the 1-800-FLOWERS.COM brand and the

expansion of our leadership position in the floral gifting

space.”

During the fiscal third quarter, the Company attracted 815,000

new customers. Approximately 1.9 million customers placed orders

during the quarter, of whom 56.4 percent were repeat customers.

This reflects the Company’s successful efforts to engage with its

customers with truly original product designs and relevant

marketing programs designed to deepen its relationships as their

trusted Florist and Gift Shop for all of their celebratory

occasions.

The Company provides selected financial results for its Consumer

Floral, BloomNet wire service and Gourmet Foods and Gift Baskets

business segments in the tables attached to this release and as

follows:

SEGMENT RESULTS FROM CONTINUING

OPERATIONS:

- 1-800-FLOWERS.COM

Consumer Floral: During the fiscal 2015 third quarter,

revenues in this segment were $116.7 million, down 4.5 percent,

compared with $122.3 million in the prior year period reflecting

the Saturday placement of the Valentine holiday during the quarter.

Gross margin increased 30 basis points to 39.2 percent, compared

with 38.9 percent in the prior year period. Gross margin benefited

from enhanced sourcing and logistics as well as strong customer

service metrics. Combined with efficient marketing programs, these

factors resulted in a contribution margin increase of 12.5 percent

to $12.6 million, compared with $11.2 million in the prior year

period.

- BloomNet Wire

Service: Revenues for the quarter were $23.0 million, up 1.7

percent compared with $22.6 million in the prior year period. Gross

margin for the quarter increased 150 basis points to 54.8 percent,

compared with 53.3 percent in the prior year period, reflecting

revenue mix, which included growth in sales of higher-margin

services, such as web-marketing and directory advertising programs

as well as pricing initiatives. As a result of these factors,

segment contribution margin increased to $7.3 million, compared

with $7.1 million in the prior year period.

- Gourmet Food and

Gift Baskets: Revenues for the fiscal third quarter were

$93.0 million, compared with $35.3 million in the prior year

period. The significant increase primarily reflects the

contributions from Harry & David. Excluding Harry & David,

revenues grew at a double-digit pace, primarily reflecting benefits

from the Easter holiday day placement early in the Company’s fourth

quarter which resulted in some sales being captured at the end of

its fiscal third quarter. Gross margin for the quarter increased 90

basis points to 39.6 percent, compared with 38.7 percent in the

prior year period. Segment contribution margin was a loss of $5.4

million, compared with a loss of $3.2 million in the prior year

period, primarily reflecting the seasonality of the Harry &

David business. Excluding Harry & David’s contribution loss of

$4.9 million, and adjusting for the impact of the Fannie May

warehouse fire on Thanksgiving Day, 2014, segment contribution

margin increased to $400,000.

Company Guidance:

The Company’s guidance for fiscal 2015 includes contributions

from the addition of the Harry & David business, which it

acquired on September 30, 2014.

- Regarding total net revenues for fiscal

2015, the Company continues to anticipate generating revenues from

continuing operations in excess of $1.1 billion.

- In terms of bottom-line results, based

on its results through the first nine months of fiscal 2015, the

Company is raising its guidance for Adjusted EBITDA, excluding

stock-based compensation, which it now anticipates will exceed $90

million for the full fiscal year, and for Adjusted EPS, which it

now anticipates will exceed the high end of its previous guidance

range of $0.45-to-$0.50 per diluted share.

The Company noted that its fiscal 2015 guidance for top and

bottom-line results does not include Harry & David’s results

for the fiscal first quarter of the year which is typically their

lowest in terms of revenues and includes a substantial bottom-line

loss.

Definitions:

* EBITDA: Net income (loss) before interest, taxes,

depreciation, amortization. Free Cash Flow: net cash provided by

operating activities less capital expenditures. Category

contribution margin: earnings before interest, taxes, depreciation

and amortization, before the allocation of corporate overhead

expenses. The Company presents EBITDA, Adjusted EBITDA from

continuing operations and Free Cash Flow because it considers such

information meaningful supplemental measures of its performance and

believes such information is frequently used by the investment

community in the evaluation of similarly situated companies. The

Company also uses EBITDA and Adjusted EBITDA as factors used to

determine the total amount of incentive compensation available to

be awarded to executive officers and other employees. The Company's

credit agreement uses EBITDA and Adjusted EBITDA to measure

compliance with covenants such as interest coverage and debt

incurrence. EBITDA and Adjusted EBITDA are also used by the Company

to evaluate and price potential acquisition candidates. EBITDA,

Adjusted EBITDA and Free Cash Flow have limitations as analytical

tools and should not be considered in isolation or as a substitute

for analysis of the Company's results as reported under GAAP. Some

of the limitations of EBITDA and Adjusted EBITDA are: (a) EBITDA

and Adjusted EBITDA do not reflect changes in, or cash requirements

for, the Company's working capital needs; (b) EBITDA and Adjusted

EBITDA do not reflect the significant interest expense, or the cash

requirements necessary to service interest or principal payments,

on the Company's debts; and (c) although depreciation and

amortization are non-cash charges, the assets being depreciated and

amortized may have to be replaced in the future and EBITDA does not

reflect any cash requirements for such capital expenditures. EBITDA

and Free Cash Flow should only be used on a supplemental basis

combined with GAAP results when evaluating the Company's

performance.

About 1-800-FLOWERS.COM,

Inc.

1-800-FLOWERS.COM, Inc. is the world’s leading florist and gift

shop. For more than 38 years,

1-800-FLOWERS® (1-800-356-9377 or www.1800flowers.com) has

been helping deliver smiles for our customers with gifts for every

occasion, including fresh flowers and the finest selection of

plants, gift baskets, gourmet foods, confections, candles, balloons

and plush stuffed animals. As always, our 100% Smile Guarantee®

backs every gift. 1-800-FLOWERS.COM was named a winner of

the 2015 “Best Companies to Work for in New York State” award by

The New York Society for Human Resource Management (NYS-SHRM).

1-800-FLOWERS.COM was awarded the 2014 Silver Stevie Award,

recognizing the organization's outstanding Customer Service and

commitment to our 100% Smile Guarantee®.

1-800-FLOWERS.COM received a Gold Award for Best User

Experience on a Mobile Optimized Site for

the 2013 Horizon Interactive Awards. The Company’s

BloomNet® international floral wire

service (www.mybloomnet.net) provides a broad range of

quality products and value-added services designed to help

professional florists grow their businesses profitably.

The 1-800-FLOWERS.COM “Gift Shop” also includes gourmet

gifts such as premium, gift-quality fruits and other gourmet

items from Harry & David® (1-877-322-1200 or

www.harryanddavid.com), popcorn and specialty treats from: The

Popcorn Factory® (1-800-541-2676 or

www.thepopcornfactory.com); cookies and baked gifts from

Cheryl’s® (1-800-443-8124 or www.cheryls.com); premium

chocolates and confections from Fannie May®

(www.fanniemay.com and www.harrylondon.com); gift

baskets and towers from 1-800-Baskets.com®

(www.1800baskets.com); carved fresh fruit arrangements from

FruitBouquets.com (www.fruitbouquets.com); top quality

steaks and chops from Stock

Yards® (www.stockyards.com); as well as premium branded

customizable invitations and personal stationery from

FineStationery.com®(www.finestationery.com). The Company’s

Celebrations® brand (www.celebrations.com) is a source for

creative party ideas, must-read articles, online invitations and

e-cards, all created to help people celebrate holidays and the

everyday. Shares in 1-800-FLOWERS.COM, Inc. are

traded on the NASDAQ Global Select Market, ticker symbol: FLWS.

Special Note Regarding Forward Looking Statements:

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements represent the Company's

current expectations or beliefs concerning future events and can

generally be identified by the use of statements that include words

such as "estimate," "expects," "project," "believe," "anticipate,"

"intend," "plan," "foresee," "likely," "will," or similar words or

phrases. These forward-looking statements are subject to risks,

uncertainties and other factors, many of which are outside of the

Company's control, which could cause actual results to differ

materially from the results expressed or implied in the forward-

looking statements, including, among others: the Company's ability

to achieve its reiterated guidance for revenue and its raised

guidance for Adjusted EBITDA and Adjusted EPS for fiscal year 2015;

its ability to manage the significantly increased seasonality of

its business; its ability to cost effectively acquire and retain

customers; the outcome of contingencies, including legal

proceedings in the normal course of business; its ability to manage

expenses associated with sales and marketing and necessary general

and administrative and technology investments and general consumer

sentiment and economic conditions that may affect levels of

discretionary customer purchases of the Company's products. The

Company undertakes no obligation to publicly update any of the

forward-looking statements, whether as a result of new information,

future events or otherwise, made in this release or in any of its

SEC filings except as may be otherwise stated by the Company. For a

more detailed description of these and other risk factors, and a

list of definitions of non-GAAP terms, including EBITDA and Free

Cash Flow, among others, please refer to the Company's SEC filings

including the Company's Annual Reports on Form 10-K and its

Quarterly Reports on Form 10-Q. Consequently, you should not

consider any such list to be a complete set of all potential risks

and uncertainties.

Conference Call:

The Company will conduct a conference call to discuss the

results for its fiscal 2015 third quarter today, Tuesday, April 28,

2015 at 11:00 am EDT. The call will be web cast live via the

Internet and can be accessed from the Investor Relations section of

the 1-800-FLOWERS.COM, Inc. website at www.1800flowersinc.com. A

recording of the call will be posted on the Investor Relations

section of the Company's website within two hours of the live

call's completion. A telephonic replay of the call can be accessed

for 48 hours beginning at 2:00 pm EDT on the day of the call at

1-855-859-2056 or 1-404-537-3406 (international); enter conference

ID: 27458954.

Note: The following attached tables are an integral part of

this press release without which the information presented in this

press release should be considered incomplete.

1-800-FLOWERS.COM, Inc. and

SubsidiariesCondensed Consolidated Balance Sheets(In

thousands)

March 29,2015

June 29,2014

Assets (unaudited) Current assets: Cash and cash

equivalents $52,721 $5,203 Receivables, net 31,493 13,339 Insurance

receivable 1,477 - Inventories 82,350 58,520 Deferred tax assets

6,898 5,156 Prepaid and other 14,953 9,600 Total current assets

189,892 91,818 Property, plant and equipment, net 152,081

60,147 Goodwill 99,690 60,166 Other intangibles, net 58,489 44,616

Deferred tax assets - 2,002 Other assets 13,005 8,820 Total assets

$513,157 $267,569

Liabilities and Stockholders'

Equity Current liabilities: Accounts payable $33,245 $24,447

Accrued expenses 94,546 49,517 Current maturities of long-term debt

14,509 343 Total current liabilities 142,300 74,307

Long-term debt 121,125 - Deferred tax liabilities 21,204 649 Other

liabilities 8,542 6,495 Total liabilities 293,171 81,451 Total

1-800-FLOWERS.COM, Inc. stockholders' equity 217,944 183,199

Noncontrolling interest in subsidiary 2,042 2,919 Total equity

219,986 186,118 Total liabilities and equity $513,157 $267,569

1-800-FLOWERS.COM, Inc. and

SubsidiariesSelected Financial InformationCondensed

Consolidated Statements of Income(Unaudited, in thousands,

except for per share data)

Three Months Ended

Nine Months Ended

March 29,2015

March 30,2014

March 29,2015

March 30,2014

Net revenues: E-commerce (combined online and telephonic) $177,903

$139,918 $671,023 $400,893 Other 54,334 39,673 222,192 168,083

Total net revenues 232,237 179,591 893,215 568,976 Cost of revenues

136,915 106,048 504,155 333,159 Gross profit 95,322 73,543 389,060

235,817 Operating expenses: Marketing and sales 70,574 51,581

228,172 143,716 Technology and development 10,389 6,045 25,318

16,762 General and administrative 22,772 13,865 61,998 41,944

Depreciation and amortization 7,825 4,932 21,605 14,657 Total

operating expenses 111,560 76,423 337,093 217,079 Operating income

(loss) (16,238) (2,880) 51,967 18,738 Interest expense and other,

net 1,631 249 5,022 959 Income (loss) from continuing operations

before income taxes (17,869) (3,129) 46,945 17,779 Income tax

expense (benefit) from continuing operations (7,056) (1,391) 16,796

6,590 Income (loss) from continuing operations (10,813) (1,738)

30,149 11,189 Income from discontinued operations, net of tax - 13

- 434 Net income (loss) $(10,813) $(1,725) $30,149 $11,623 Less:

Net loss attributable to noncontrolling interest (318) (300) (877)

(341) Net income (loss) attributable to 1-800-FLOWERS.COM, Inc.

$(10,495) $(1,425) $31,026 $11,964

Basic net income (loss) per common share

attributable to 1-800-

FLOWERS.COM, Inc.

From continuing operations $(0.16) $(0.02) $0.48 $0.18 From

discontinued operations $- $0.00 $- $0.01 Basic net income per

common share $(0.16) $(0.02) $0.48 $0.19

Diluted net income (loss) per common share

attributable to 1-800-

FLOWERS.COM, Inc.

From continuing operations $(0.16) $(0.02) $0.46 $0.17 From

discontinued operations $- $0.00 $- $0.01 Diluted net income per

common share $(0.16) $(0.02) $0.46 $0.18 Weighted average

shares used in the calculation of net income per common share Basic

64,909 64,214 64,433 64,010 Diluted 64,909 64,214 67,134 66,429

1-800-FLOWERS.COM, Inc. and

SubsidiariesSelected Financial InformationCondensed

Consolidated Statements of Cash Flows(Unaudited, in

thousands)

Nine Months Ended

March 29,2015

March 30,2014

Operating activities Net income $30,149 $11,623

Reconciliation of net income to net cash

provided by operating activities, net of

acquisitions:

Operating activities of discontinued operations - 869 Gain on sale

of discontinued operations - (815) Depreciation and amortization

21,605 14,657 Amortization of deferred financing costs 1,076 229

Deferred income taxes (4,071) (1,376) Non-cash impact of write-offs

related to warehouse fire 29,522 - Insurance proceeds for warehouse

fire related to property damage 30,000 - Acquisition transaction

costs 925 - Bad debt expense 1,170 1,027 Stock based compensation

4,405 3,491 Other non-cash items 748 433 Other non-cash items:

Receivables (36,647) (5,492) Insurance receivable (1,477) -

Inventories 37,448 (5,585) Prepaid and other 7,489 4,162 Accounts

payable and accrued expenses 14,967 197 Other assets (1,026) (274)

Other liabilities 679 426

Net cash provided by operating

activities

136,962 23,572

Investing activities Acquisitions, net

of cash acquired (133,117) (1,385) Capital expenditures (20,946)

(14,458) Investing activities of discontinued operations - 500

Other 642 18

Net cash used in investing activities

(153,421) (15,325)

Financing activities Acquisition

of treasury stock (5,730) (7,423) Proceeds from exercise of

employee stock options 5,303 334 Proceeds from bank borrowings

239,500 120,000 Repayment of bank borrowings (169,567) (120,002)

Debt issuance costs (5,642) - Other 113 4

Net cash

provided by (used in) financing activities 63,977 (7,087)

Net change in cash and equivalents 47,518 1,160 Cash and

equivalents: Beginning of period 5,203 154 End of period $52,721

$1,314

1-800-FLOWERS.COM, Inc. and

SubsidiariesSelected Financial Information - Segment

Information(Unaudited, in thousands)

Three Months Ended

March 29,2015

Impact

ofWarehouseFire

Impact ofAcquisition

Costs

Impact of Integration and

Severance Costs

AdjustedMarch

29,2015

March 30,2014

% Change Net revenues from continuing

operations:

1-800-Flowers.com Consumer Floral $116,705 $- $- $- $116,705

$122,256 -4.5% BloomNet Wire Service 22,950 100 - - 23,050 22,571

2.1% Gourmet Food & Gift Baskets 92,951 3,338 - - 96,289 35,330

172.5% Corporate 283 - - - 283 202 40.1% Intercompany eliminations

(652) - - - (652) (768) 15.1%

Total net revenues from continuing operations $232,237

$3,438 $- $- $235,675 $179,591

31.2%

Three Months Ended

March 29,2015

Impact

ofWarehouseFire

Impact ofAcquisition

Costs

Impact of Integration

andSeverance Costs

AdjustedMarch

29,2015

March 30,2014

% Change Gross profit from continuing

operations: 1-800-Flowers.com Consumer Floral $45,716 $- $- $-

$45,716 $47,565 -3.9% 39.2% - - - 39.2% 38.9% BloomNet Wire Service

12,574 20 - - 12,594 12,019 4.8% 54.8% - - - 54.6% 53.3% Gourmet

Food & Gift Baskets 36,846 888 - - 37,734 13,686 175.7% 39.6% -

- - 39.2% 38.7% Corporate (*) 186 - - - 186 273 -31.9% 65.7%

- - - 65.7% 135.1%

Total gross

profit from continuing operations $95,322 $908 $-

$- $96,230 $73,543 30.8% 41.0% 26.4%

0.0% 0.0% 40.8% 41.0%

Three Months Ended

EBITDA from continuing operations,

excluding

stock- based compensation

March 29,2015

Impact

ofWarehouseFire

Impact ofAcquisition

Costs

Impact of Integration and

Severance Costs

AdjustedMarch

29,2015

March 30,2014

% Change Category Contribution Margin from

continuing operations: 1-800-Flowers.com Consumer Floral

$12,557 $- $- $- $12,557 $11,165 12.5% BloomNet Wire Service 7,290

20 - - 7,310 7,079 3.3% Gourmet Food & Gift Baskets (5,413)

955 - - (4,458) (3,180) -40.2%

Category Contribution Margin Subtotal 14,434 975 - - 15,409 15,064

2.3% Corporate (*) (22,847) - - 1,730

(21,117) (13,012) -62.3%

EBITDA from continuing

operations $(8,413) $975 $- $1,730 $(5,708) $2,052 -378.2%

Add: Stock-based compensation 1,623 - -

- 1,623 1,279 26.9%

EBITDA from continuing

operations, excluding stock-based compensation $(6,790)

$975 $- $1,730 $(4,085) $3,331 -222.6%

1-800-FLOWERS.COM, Inc. and

SubsidiariesSelected Financial Information - Segment

Information (continued)(Unaudited, in thousands)

Nine Months Ended

March 29,2015

Impact

ofWarehouseFire

Impact of PurchaseAccounting

Adjustment to Deferred Revenue

Impact of PurchaseAccounting

Adjustment for |Inventory Fair Value Step-Up

Impact ofAcquisition

Costs

Impact ofIntegration

andSeverance Costs

AdjustedMarch 29,

2015

March30, 2014

%Change

Net revenues from continuing operations:

1-800-Flowers.com

Consumer Floral $290,703 $- $- $- $- $- $290,703 $290,938 -0.1%

BloomNet Wire Service 63,071 350 - - - - 63,421 62,829 0.9% Gourmet

Food & Gift Baskets 539,979 16,934 1,621 - - - 558,534 216,193

158.3% Corporate 795 - - - - - 795 600 32.5% Intercompany

eliminations (1,333) - - - - -

(1,333) (1,584) 15.8%

Total net revenues from

continuing operations $893,215 $17,284 $1,621

$- $- $- $912,120 $568,976 60.3%

Nine Months Ended

March 29,2015

Impact

ofWarehouseFire

Impact of PurchaseAccounting

Adjustment toDeferred Revenue

Impact of Purchase Accounting

Adjustment for Inventory FairValue Step-Up

Impact ofAcquisition

Costs

Impact ofIntegration

andSeverance Costs

AdjustedMarch 29,

2015

March 30, 2014

%Change

Gross profit from continuing operations:

1-800-Flowers.com Consumer Floral $113,027 $- $- $- $- $- $113,027

$113,166 -0.1% 38.9% - - - - - 38.9% 38.9% BloomNet Wire Service

34,725 70 - - - - 34,795 33,566 3.7% 55.1% - - - - - 54.9% 53.4%

Gourmet Food & Gift Baskets 240,645 6,745 1,621 4,760 - -

253,771 88,328 187.3% 44.6% - - - - - 45.4% 40.9% Corporate (*) 663

- - - - - 663 757 -12.4% 83.4% - - - -

- 83.4% 126.2%

Total gross profit from

continuing operations $389,060 $6,815 $1,621

$4,760 $- $- $402,256 $235,817

70.6% 43.6% 39.4% 0.0% 0.0% 0.0%

0.0% 44.1% 41.4%

Nine Months Ended

EBITDA from continuing operations, excluding stock- based

compensation

March 29,2015

Impact

ofWarehouseFire

Impact of PurchaseAccounting

Adjustment toDeferred Revenue

Impact of PurchaseAccounting

Adjustment for Inventory Fair Value Step-Up

Impact of Acquisition

Costs

Impact ofIntegration

andSeverance Costs

AdjustedMarch

29,2015

March 30,2014

%Change

Category Contribution Margin from continuing operations:

1-800-Flowers.com Consumer Floral $29,334 $- $- $- $- $-

$29,334 $26,274 11.6% BloomNet Wire Service 20,455 70 - - - -

20,525 20,043 2.4% Gourmet Food & Gift Baskets 82,607

6,486 1,621 4,760 - - 95,474

25,817 269.8% Category Contribution Margin Subtotal 132,396

6,556 1,621 4,760 - - 145,333 72,134 101.5% Corporate (*) (58,824)

- - - 4,062 2,135 (52,627) (38,739) -35.9%

EBITDA from continuing operations

$73,572 $6,556 $1,621 $4,760 $4,062 $2,135 $92,706 $33,395 177.6%

Add: Stock-based compensation 4,405 - -

- - - 4,405 3,491 26.2%

EBITDA from

continuing operations, excluding stock-based compensation

$77,977 $6,556 $1,621 $4,760 $4,062

$2,135 $97,111 $36,886 163.3%

1-800-FLOWERS.COM, Inc. and

SubsidiariesSelected Financial Information - Appendix A –

Reconciliations of Historical Information(Unaudited, in

thousands)

Three Months Ended Nine

Months Ended

Reconciliation of net income (loss)

from continuing operations to adjusted net

income (loss) from continuing

operations attributable to 1-800-

FLOWERS.COM, Inc.:

March 29,2015

March 30, 2014

March 29, 2015

March 30, 2014

Income (loss) from continuing operations $(10,813) $(1,738)

$30,149 $11,189 Less: Net loss attributable to noncontrolling

interest (318) (300) (877) (341)

Income (loss) from

continuing operations attributable to 1-800-FLOWERS.COM, Inc.

(10,495) (1,438) 31,026 11,530 Add: Impact of warehouse fire, net

of tax 726 - 4,253 - Add: Purchase accounting adjustment to

deferred revenue, net of tax - - 1,052 - Add: Purchase accounting

adjustment for inventory fair value step-up, net of tax - - 3,088 -

Add: Integration and severance costs, net of tax 1,236 - 1,385 -

Add: Acquisition costs, net of tax 77 - 2,636 -

Adjusted

income (loss) from continuing operations attributable to

1-800-FLOWERS.COM, Inc. $(8,456) $(1,438) $43,440 $11,530 Less:

Income (loss) attributable to Harry & David (8,798) -

29,707 -

Adjusted income (loss) from continuing

operations attributable to 1-800-

FLOWERS.COM, Inc., excluding income

(loss) attributable to Harry & David

$342 $(1,438) $13,733 $11,530

Income (loss)

per common share from continuing operations attributable to

1-800-FLOWERS.COM, Inc. Basic $(0.16) $(0.02) $0.48

$0.18 Diluted $(0.16) $(0.02) $0.46 $0.17

Adjusted

net income (loss) per common share from continuing operations

attributable to 1-800-FLOWERS.COM, Inc. Basic $(0.13)

$(0.02) $0.67 $0.18 Diluted $(0.13) $(0.02) $0.65 $0.17

Adjusted net income (loss) per common

share from continuing operations

attributable to 1-800-FLOWERS.COM, Inc.

, excluding income (loss)

attributable to Harry &

David

Basic $0.01 $(0.02) $0.21 $0.18 Diluted $0.01 $(0.02)

$0.20 $0.17

Weighted average shares used in the

calculation of net income (loss) and adjusted

net income (loss) per common share from

continuing operations attributable to

1-800-FLOWERS.COM, Inc.

Basic 64,909 64,214 64,433 64,010 Diluted 67,571

64,214 67,134 66,429

1-800-FLOWERS.COM, Inc. and

SubsidiariesSelected Financial Information -- Appendix A –

Reconciliations of Historical Information

(continued)(Unaudited, in thousands)

Three Months Ended

Nine Months Ended

Reconciliation of income (loss) from

continuing operations attributable to

1-800-Flowers.com, Inc. to Adjusted

EBITDA from Continuing Operations,

excluding stock-based compensation(**)

and EBITDA attributable to Harry & David:

March 29,2015

March 30, 2014

March 29, 2015

March 30, 2014

Income (loss) from continuing operations attributable to

1-800-FLOWERS.COM, Inc. $(10,495) $(1,438) $31,026 $11,530 Add:

Interest expense and other, net 1,631 249 5,022 959 Depreciation

and amortization 7,825 4,932 21,605 14,657 Income tax expense - -

16,796 6,590 Less: Net loss attributable to noncontrolling interest

318 300 877 341 Income tax benefit 7,056 1,391 - - EBITDA

from continuing operations (8,413) 2,052 73,572 33,395 Add:

Stock-based compensation 1,623 1,279 4,405 3,491

EBITDA

from continuing operations, excluding stock-based compensation

(6,790) 3,331 77,977 36,886 Add: Impact of warehouse fire

975 - 6,556 - Add: Purchase accounting adjustment to deferred

revenue, net of tax - - 1,621 - Add: Purchase accounting adjustment

for inventory fair value step-up - - 4,760 - Add: Acquisition costs

- - 4,062 - Add: Integration and severance costs 1,730 -

2,135 -

Adjusted EBITDA from continuing operations, excluding

stock-based compensation $(4,085) $3,331 $97,111 $36,886 Less:

EBITDA attributable to Harry & David (10,591) - 53,912 -

Adjusted EBITDA from continuing

operations, excluding stock-based

compensation and EBITDA attributable to

Harry & David

$6,506 $3,331 $43,199 $36,886 (*) Corporate

expenses consist of the Company’s enterprise shared service cost

centers, and include, among other items, Information Technology,

Human Resources, Accounting and Finance, Legal, Executive and

Customer Service Center functions, as well as Stock-Based

Compensation. In order to leverage the Company’s infrastructure,

these functions are operated under a centralized management

platform, providing support services throughout the organization.

The costs of these functions, other than those of the Customer

Service Center, which are allocated directly to the above

categories based upon usage, are included within corporate expenses

as they are not directly allocable to a specific segment.

(**) Performance is measured based on segment contribution margin

or segment Adjusted EBITDA, reflecting only the direct controllable

revenue and operating expenses of the segments. As such,

management’s measure of profitability for these segments does not

include the effect of corporate overhead, described above,

depreciation and amortization, other income (net), nor does it

include one-time charges or gains. Management utilizes EBITDA, and

adjusted financial information, as a performance measurement tool

because it considers such information a meaningful supplemental

measure of its performance and believes it is frequently used by

the investment community in the evaluation of companies with

comparable market capitalization. The Company also uses EBITDA and

adjusted financial information as one of the factors used to

determine the total amount of bonuses available to be awarded to

executive officers and other employees. The Company’s credit

agreement uses EBITDA and adjusted financial information to measure

compliance with covenants such as interest coverage and debt

incurrence. EBITDA and adjusted financial information is also used

by the Company to evaluate and price potential acquisition

candidates. EBITDA and adjusted financial information have

limitations as an analytical tool, and should not be considered in

isolation or as a substitute for analysis of the Company's results

as reported under GAAP. Some of these limitations are: (a) EBITDA

does not reflect changes in, or cash requirements for, the

Company's working capital needs; (b) EBITDA does not reflect the

significant interest expense, or the cash requirements necessary to

service interest or principal payments, on the Company's debts; and

(c) although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and EBITDA does not reflect any cash requirements

for such capital expenditures. Because of these limitations, EBITDA

should only be used on a supplemental basis combined with GAAP

results when evaluating the Company's performance.

Click here to subscribe to Mobile Alerts for 1-800-Flowers.

1-800-FLOWERS.COM, Inc.Investors:Joseph D. Pititto,

516-237-6131invest@1800flowers.comorMedia:Yanique Woodall,

516-237-6028ywoodall@1800flowers.com

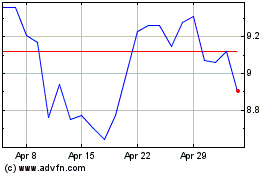

1 800 Flowers Com (NASDAQ:FLWS)

Historical Stock Chart

From Jun 2024 to Jul 2024

1 800 Flowers Com (NASDAQ:FLWS)

Historical Stock Chart

From Jul 2023 to Jul 2024