Vopak reports strong FY 2024 results, increases dividend distribution and announces a new share buyback program

February 19 2025 - 1:00AM

UK Regulatory

Vopak reports strong FY 2024 results, increases dividend

distribution and announces a new share buyback program

The Netherlands, 19 February 2025

Vopak reports strong FY 2024 results, increases dividend

distribution and announces a new share buyback program

Key highlights FY 2024

Improve

- Net profit -including exceptional items- FY 2024 of EUR 376

million and EPS of EUR 3.12

- Proportional EBITDA -excluding exceptional items1-

increased in FY 2024 by EUR 16 million to a record of EUR 1,170

million

- Successfully completed share buyback program of EUR 300

million, proposed a dividend of EUR 1.60 per share and announced a

new share buyback program of EUR 100 million that will start on 20

February 2025 and will run until the end of 2025

Grow

- In 2024, we made good progress on the expansions of our gas

infrastructure in Canada, India and the Netherlands and on the

industrial expansions in China and Saudi Arabia

- EemsEnergyTerminal launched an open season for the storage and

regasification of LNG after 2027

Accelerate

- In 2024, we progressed in new energies and sustainable

feedstocks developments by repurposing capacity in Singapore,

Brazil and the Netherlands and by investing in battery energy

storage in the US and the Netherlands

- Committed EUR 15 million to further develop infrastructure for

waste-based feedstocks at Vlaardingen terminal in the

Netherlands

|

Q4 2024 |

Q3 2024 |

Q4 2023 |

|

In EUR millions |

2024 |

2023 |

| |

|

|

|

|

|

|

| |

|

|

|

IFRS Measures -including

exceptional items- |

|

|

|

336.9 |

325.0 |

352.8 |

|

Revenues |

1,315.6 |

1,425.6 |

|

63.9 |

99.3 |

87.4 |

|

Net profit / (loss) attributable to holders of ordinary shares |

375.7 |

455.7 |

|

0.56 |

0.83 |

0.69 |

|

Earnings per ordinary share (in EUR) |

3.12 |

3.63 |

| |

|

|

|

|

|

|

|

210.2 |

219.4 |

219.7 |

|

Cash flows from operating activities (gross) |

947.5 |

943.1 |

|

-120.0 |

-111.0 |

247.4 |

|

Cash flows from investing activities (including derivatives) |

-495.3 |

109.6 |

| |

|

|

|

|

|

|

| |

|

|

|

Alternative performance

measures -excluding exceptional items-

1 |

|

|

|

485.0 |

479.1 |

494.1 |

|

Proportional revenues |

1,917.5 |

1,941.9 |

|

276.7 |

294.1 |

282.3 |

|

Proportional group operating profit / (loss) before depreciation

and amortization (EBITDA) |

1,170.2 |

1,154.0 |

| |

|

|

|

|

|

|

|

214.2 |

233.3 |

228.8 |

|

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

934.6 |

963.5 |

|

79.0 |

97.5 |

109.0 |

|

Net profit / (loss) attributable to holders of ordinary shares |

403.1 |

412.9 |

|

0.67 |

0.83 |

0.87 |

|

Earnings per ordinary share (in EUR) |

3.34 |

3.29 |

| |

|

|

|

|

|

|

| |

|

|

|

Business

KPIs |

|

|

|

35.4 |

35.2 |

35.2 |

|

Storage capacity end of period (in million cbm) |

35.4 |

35.2 |

|

20.4 |

20.3 |

20.6 |

|

Proportional storage capacity end of period (in million cbm) |

20.4 |

20.6 |

| |

|

|

|

|

|

|

|

93% |

92% |

91% |

|

Subsidiary occupancy rate |

92% |

91% |

|

93% |

92% |

91% |

|

Proportional occupancy rate |

93% |

91% |

| |

|

|

|

|

|

|

| |

|

|

|

Financial KPIs 1 |

|

|

|

11.8% |

15.1% |

12.8% |

|

Proportional operating cash return |

15.1% |

14.0% |

|

2,672.0 |

2,574.9 |

2,286.4 |

|

Net interest-bearing debt |

2,672.0 |

2,286.4 |

|

2.35 |

2.28 |

1.99 |

|

Total net debt : EBITDA |

2.35 |

1.99 |

| |

|

|

|

|

|

|

| |

|

|

|

Sustainability

performance |

|

|

| |

|

|

|

Total Injury Rate (TIR) |

0.21 |

0.16 |

| |

|

|

|

Process Safety Event Rate

(PSER) |

0.08 |

0.09 |

| |

|

|

|

Total GHG emissions

2 - Scope 1 & 2 (in 1,000 metric tons) |

209.0 |

253.7 |

| |

|

|

|

Percentage women in senior

management positions |

22% |

20% |

CEO message

“I am proud to reflect on our successes during 2024. The Vopak

team has delivered on our strategic priorities to improve our

sustainability and financial performance, grow our footprint in gas

and industrial terminals, and accelerate progress in new energies

and feedstocks. The demand for our infrastructure services

continued to be strong across most business units, underpinned by a

proportional occupancy of 93% and leading to a record level of

proportional EBITDA. On safety, which is our most important

priority, we delivered solid results in both personal and process

safety. We made good progress on the expansions of our gas

infrastructure in Canada, India and the Netherlands and on

industrial expansions in China and Saudi Arabia. In India, our

joint venture AVTL, is exploring options to fund growth through a

local listing. In multiple locations around the world we are

repurposing capacity for new energies and in the US and the

Netherlands we made our first investments in battery energy

storage. Driven by strong cash generation from our portfolio and

our robust financial position, we are proposing an increase in the

dividend distribution of 6.7% compared to 2023 and announcing a new

share buyback program of up to EUR 100 million in 2025. We look

forward to providing further updates on our strategic priorities

and long-term outlook during our Capital Markets Day on 13 March

2025.”

Financial Highlights for FY 2024

- Demand for our services was healthy during 2024. Throughput

levels in our industrial terminals increased year-on-year factoring

in new industrial capacity being commissioned in China. Gas

terminals performance showed firm throughput levels, backed by

growing energy demand and energy security considerations around the

globe. Amidst weak chemical markets, the demand for storage

infrastructure was stable. In the oil hub locations, solid storage

demand was primarily driven by the continued growth in oil demand

globally and the rerouting of trade flows. Despite some market

challenges in Mexico, demand in the other oil distribution

terminals remained firm.

IFRS Measures -including exceptional

items-

- Revenues were EUR 1,316 million (FY 2023: EUR

1,426 million). Adjusted for the divestment impacts of chemical

distribution terminals in Rotterdam (2023), Savannah (2023) and

Lanshan (2024) of EUR 157 million and negative currency translation

effects of EUR 5 million, revenues increased by 4% year-on-year.

The positive performance was driven by favorable storage demand

across different geographies and markets and the contribution of

growth projects.

- Operating expenses consisting of personnel and

other expenses were EUR 662 million in 2024 (2023: EUR 739

million). Adjusted for positive divestment impacts of EUR 84

million and currency translation effects of EUR 2 million, expenses

increased by EUR 9 million, mainly due to increased personnel

expenses which were partially offset by lower energy and utility

expenses.

- Cash flows from operating activities increased

by EUR 5 million to EUR 948 million compared to FY 2023 EUR 943

million, an increase mainly as a result of higher dividend receipts

from joint ventures and associates which increased by EUR 73

million compared to 2023, partially offset by the decrease in

operational result due to divestments.

- Net profit attributable to holders of ordinary

shares was EUR 376 million in FY 2024 compared to FY 2023

EUR 456 million. The decrease reflects the divestment impacts and

exceptional items recognized. Earnings per share (EPS) for FY 2024

was EUR 3.12 compared to EUR 3.63 for FY 2023.

- Shareholder distribution:

- 2024 share buyback program of up to EUR 300

million announced on 14 February 2024, was completed on 9 December

2024. A total of 7,924,438 ordinary shares, 6.30% of the company’s

outstanding shares, were repurchased, at an average price of EUR

37.86 per share. For further details on the share buyback program

please visit our website.

- Dividend of EUR 1.60 (2023: EUR 1.50) per

ordinary share payable in cash, will be proposed at the Annual

General Meeting on 23 April 2025. This represents an increase of

6.7% compared to 2023, in line with Vopak’s stable to progressive

dividend policy which aims to maintain or grow the annual dividend

subject to market conditions.

- 2025 share buyback program of up to EUR 100

million. Today we are announcing a share buyback program that will

start on 20 February 2025 and will run until the end of 2025,

barring unforeseen circumstances.

Alternative performance measures -excluding

exceptional items-3

- Proportional revenues were EUR 1,918 million,

(FY 2023: EUR 1,942 million) an 8% increase after adjusting for

divestment impacts of EUR 155 million and negative currency

translation effects of EUR 9 million.

- Proportional EBITDA increased to EUR 1,170

million (FY 2023: EUR 1,154 million). Adjusted for divestment

impacts of EUR 75 million and negative currency translation effects

of EUR 5 million, proportional EBITDA increased by EUR 96 million

(9% year-on-year), driven mainly by growth project contribution.

Compared to Q3 2024, proportional EBITDA decreased by EUR 17

million to EUR 277 million in Q4 2024, primarily driven by negative

one-offs of EUR 20 million. The one-offs were primarily related to

currency revaluation of specific receivables, EemsEnergyTerminal

financial impact due to technical challenges, certain provisions

and other items. As previously mentioned, EemsEnergy Terminal in

the Netherlands, continues to face temporary technical challenges

which have financial implications. The aim is to have these

challenges resolved during 2025. The terminal remains fully

operational.

- Proportional EBITDA margin FY 2024 was 57% (FY

2023 56%).

- EBITDA was EUR 935 million (FY 2023: EUR 964

million). Adjusted for divestment impacts of EUR 76 million and

negative currency translation effects of EUR 4 million, EBITDA

increased by EUR 51 million (6% year-on-year). The increase was

driven by favorable storage demand across the various markets and

geographies and positive growth project contribution. Q4 2024

EBITDA was EUR 214 million (Q3 2024: EUR 233 million), the decrease

was caused by negative one-off items this quarter of EUR 18

million.

- Proportional growth investments in 2024 were

EUR 391 million (FY 2023: EUR 299 million). Consolidated

growth capex in 2024 was EUR 305 million (FY 2023: EUR 247

million) both reflecting growth investments in India, Belgium, the

United States, the Netherlands and Canada.

- Proportional operating capex decreased to EUR

265 million compared to EUR 290 million in FY 2023, mainly due to

the divestment of the chemical distribution terminals.

Operating capex, which includes sustaining and IT

capex, was EUR 232 million (FY 2023: EUR 255 million), lower than

the same period last year, due to divestment impacts.

- Proportional operating cash flow FY 2024

increased by EUR 11 million (1% year-on-year) to EUR 806 million

(FY 2023: EUR 795 million) driven mainly by strong business

performance that offset divestment impacts and by lower

proportional operating capex. Proportional operating cash

flow per share in 2024 increased to EUR

6.69 per share (FY 2023: EUR 6.34) reflecting improved cash flow

and the cancellation of shares related to the share buyback

program.

Business KPI

- Proportional occupancy rate at the end of FY

2024 was 93% (FY 2023: 91%) and increased compared to Q3 2024

(92%), reflecting solid demand for infrastructure services.

Financial KPIs

- Proportional operating cash return FY 2024

improved to 15.1% compared to 14.0% in FY 2023. The increase was

mainly due to increased proportional free cash flow and lower

average capital employed due to divestments.

- Total net debt : EBITDA ratio was 2.35x at the

end of Q4 2024 (Q3 2024: 2.28x). Proportional leverage in Q4 2024

was 2.67x compared to 2.60x in Q3 2024.

Exceptional items in Q4 2024:

- Due to a negative market outlook for the imports of clean

petroleum products into Mexico, an impairment charge of EUR 58

million for the Veracruz cash-generating unit was recorded. The

impairment was triggered by a decline in occupancy and related cash

flows at the Veracruz terminal following a significant loss of

commercial activity from a customer.

- The SPEC LNG terminal is expected to benefit from increased LNG

imports into Colombia which will be required in the short to

medium-term to compensate for the energy deficit in the country. As

a result, a reversal of impairment previously recognized in 2022 of

EUR 30 million for the SPEC cash-generating was recorded.

- Primary equity issue of AVTL in India resulting in a gain on

partial dilution of EUR 13 million. The transaction represents a

shareholding of 3.4% in AVTL. As a result of this transaction,

Vopak’s shareholding in AVTL diluted from 49.0% to 47.3%. A further

exceptional gain will be reported once all conditions have been

fulfilled.

1 See Enclosure 3 for reconciliation to

the most directly comparable subtotal or total specified by IFRS

Accounting Standards

2 2024 GHG

emissions in the table of 253.7 thousand MT reflects a revised

operational boundary compared to 425 thousand MT of FY 2023 .

Further details can be found in Enclosure 3 of the press release

and the 2024 Annual Report's Sustainability notes

3 To supplement Vopak’s financial information

presented in accordance with IFRS, management periodically uses

certain alternative performance measures to clarify and enhance

understanding of past performance and future outlook. For further

information please refer to page 7 of the press

release.

For more information please contact:

Vopak Press: Liesbeth Lans - Manager External

Communication, e-mail: global.communication@vopak.com

Vopak Analysts and Investors: Fatjona Topciu -

Head of Investor Relations, e-mail:

investor.relations@vopak.com

The analysts’ presentation will be given via an on-demand audio

webcast on Vopak’s corporate website, starting at 10:00 AM CET on

19 February 2025.

Auditor’s involvement

This press release and enclosures of the press release are based on

the 2024 Financial Statements. The Financial Statements are

published in accordance with statutory provisions. The auditor has

issued an unqualified auditor’s report on the Financial

Statements.

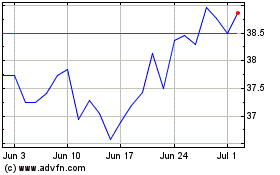

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

From Jan 2025 to Feb 2025

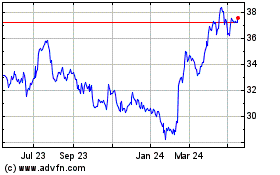

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

From Feb 2024 to Feb 2025