VEON to Hold Capital Markets Day 2024, Sharing Mid-Term Ambition to Accelerate Local Currency Topline Growth to 16%-19% CAGR

June 06 2024 - 1:00AM

VEON to Hold Capital Markets Day 2024, Sharing Mid-Term Ambition to

Accelerate Local Currency Topline Growth to 16%-19% CAGR

Dubai and Amsterdam, 6 June 2024: VEON Ltd.

(NASDAQ: VEON, Euronext Amsterdam: VEON), a global digital operator

that provides converged connectivity and online services (“VEON”

or, together with its subsidiaries, the “Group”), today holds its

Capital Markets Day (“CMD 2024”), sharing its medium-term financial

and operational ambitions, as well as its growth strategy through

2027.

In its CMD 2024 materials, the Group will disclose the

following key ambitions through 2027:

- Medium-term revenue growth at a compound annual growth rate

(“CAGR”) from 2023 to 2027 of 16%-19% in local currency.

- Medium-term EBITDA growth with a CAGR from 2023 to 2027 of

19%-22% in local currency.

- EBITDA margin expansion by 3 percentage points by 2027.

- USD 900 million to 1.0 billion in equity free cashflow (“EFCF”)

by 2027.

- Focusing on its DO1440 and AI1440 strategy, increasing the

share of multiplay customers to 50% by the end of 2027 and

capturing greater wallet share through expansion in adjacent

verticals.

The Group’s medium-term ambitions also include decreasing

leverage; increasing the share of localized debt, with the share of

USD and EUR-denominated debt decreasing to below 50%. The Group

aims to maintain a leverage ratio below 1.5x and extend the average

tenor of its debt from 3.4 years in Q1 2024 to over 4 years by

2027.

“Over the past three years, we have transformed our companies

into digital operators and demonstrated that emerging markets are

in fact an exciting growth opportunity for global investors. Our

aspirations from 2023 through 2027 set the bar higher as we aim for

16%-19% CAGR growth in our Group revenues, 19%-22% CAGR growth in

our Group EBITDA and close to USD 1 billion in equity free cash

flow generation. As our investors will hear at our Capital Markets

Day, we are optimistic about the potential of our markets, and

confident in the foundations that we built with our digital

operator strategy to capture wallet share. Furthermore, we are also

set to unlock greater growth opportunities with augmented

intelligence as we launch our AI1440 focus,” said Kaan

Terzioglu, VEON Group CEO. “We remain focused on turning

this operational success vision into investor value with further

steps in delayering our business and enhancing the accessibility of

our assets to local investors.”

|

Ambition 2021 CMD |

Performance delivered |

2027 Ambition |

|

10-14% Revenue & EBITDA3-year CAGR, in local currency |

15.4% revenue and 14.8% EBITDA CAGR in local currency from 2021

CMD |

16-19% revenue CAGR between 2023 and 2027 in local currency |

|

Mid-single digit revenue growth, 3-year CAGR, in USD |

-1.7% revenue growth, CAGR in USD from 2021 CMD |

19-22% EBITDA CAGR between 2023 and 2027 in local currency |

|

+3 p.p. EBITDA margin expansion by 2024 |

Flat EBITDA margin from 2021 CMD, marginally maintained |

+3 p.p. EBITDA margin expansion by 2027 |

|

<20% last twelve months (“LTM”) capex intensity in 2024 |

19% LTM capex intensity in 1Q24;USD 434 million EFCF in 2023 |

USD 900 million to USD 1.0 billion EFCF by 2027 |

|

c.70% 4G user penetration by 2024 |

62% 4G user penetration in 1Q2425% of customer base in multiplay

B2C segment in 1Q24 |

DO1440+ and AI1440 strategy: 50% of customer base in multiplay B2C

segment by 2027 |

During VEON’s Capital Markets Day 2024, to be held at 10:00am

Gulf Standard Time today virtually and in-person in Dubai, Group

CEO Kaan Terzioglu and Group CFO Joop Brakenhoff will present the

details of the Group’s strategy and key ambitions. In addition, the

CEOs of VEON’s Group’s operating companies will provide updates on

each of their companies’ ambitions through 2027, including the

following:

|

Operating company |

Ambition by 2027 |

|

Pakistan |

- Revenue CAGR from 2023 to 2027 of 19-22%

- Non-connectivity revenue to reach 24% of total revenue by

2027

- 50% of total revenue to come from digital businesses

|

|

Ukraine |

- Revenue CAGR from 2023 to 2027 of 10-13%

- Non-connectivity revenue c.10% in total revenue

- Non-connectivity revenue growth of >50%

- EFCF growth of 10-15%

|

|

Kazakhstan |

- Revenue CAGR from 2023 to 2027 of 14-17%

- Capex intensity reduction by 4 p.p. from 2023

- EBITDA margin increase by 1 p.p. from 2023

- EFCF growth of 100%

- Note: All figures for Kazakhstan include TNS+ and will be

adjusted if the sale completes

|

|

Bangladesh |

- Revenue CAGR from 2023 to 2027 of 15-18%

- EBITDA margin improvement to over 45%

- Non-connectivity revenue to reach 20% of total revenue

- Deliver annual EFCF of USD 100 million

|

|

Uzbekistan |

- Revenue CAGR from 2023 to 2027 of 26-29%

- Data & digital revenue CAGR from 2023 to 2027 of

28-31%

- AdTech revenue CAGR from 2023-2027 of 101-104%

|

Going forward, the Group aims to upstream

dividends from all operating companies without restrictions,

including from Ukraine, following an eventual softening of capital

controls.

VEON 2024 CMD webcast and presentation

To register and access the CMD webcast, please click here or

copy and paste this link to the address bar of your browser:

https://veon-2024-investor-day.open-exchange.net/registration

Once registered, you will receive a registration confirmation

message at the email address provided during registration with a

link to access the webcast.

The full CMD presentation will be made available on the VEON

website at https://www.veon.com/investors/ following the event.

About VEON

VEON is a digital operator that provides converged connectivity

and digital services to nearly 160 million customers. Operating

across six countries that are home to more than 7% of the world’s

population, VEON is transforming lives through technology-driven

services that empower individuals and drive economic growth.

Headquartered in Amsterdam, VEON is listed on NASDAQ and Euronext.

For more information visit: www.veon.com

Disclaimer

This release contains “forward-looking statements,” as the

phrase is defined in Section 27A of the U.S. Securities Act of

1933, as amended, and Section 21E of the U.S. Securities Exchange

Act of 1934, as amended. Forward-looking statements are not

historical facts, and include statements relating to, among other

things, VEON’s strategy, divestment plans and medium-term financial

and operating ambitions. Forward-looking statements are inherently

subject to risks and uncertainties, many of which VEON cannot

predict with accuracy and some of which VEON might not anticipate.

The forward-looking statements contained in this release speak only

as of the date of this release. VEON does not undertake to publicly

update, except as required by U.S. federal securities laws, any

forward-looking statement to reflect events or circumstances after

such dates or to reflect the occurrence of unanticipated events.

Furthermore, elements of this release contain or may contain,

“inside information” as defined under the Market Abuse Regulation

(EU) No. 596/2014.

Contact

VEONHande Asik Group Director of Communications

pr@veon.com

Investor RelationsFaisal Ghoriir@veon.com

- VEON Capital Markets Day 2024

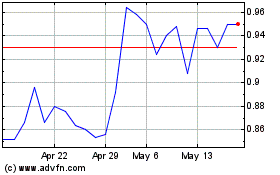

VEON (EU:VEON)

Historical Stock Chart

From Nov 2024 to Dec 2024

VEON (EU:VEON)

Historical Stock Chart

From Dec 2023 to Dec 2024