Unilever Looking to Reposition Portfolio After GSK Consumer Healthcare Approach -- Update

January 17 2022 - 3:37AM

Dow Jones News

By Kyle Morris

Unilever PLC said Monday that it has decided to expand its

presence in higher-growth categories after it made an approach for

GSK Consumer Healthcare over the weekend that could potentially be

worth $68 billion.

The Anglo-Dutch consumer-goods group said that, following a

review process, it has concluded that its future strategic

direction lies in materially expanding its presence in

higher-growth categories such as health, beauty, and hygiene. Such

categories offer higher rates of sustainable market growth, with

opportunities to drive growth through investment and innovation,

and through leveraging the company's presence in emerging markets,

it said.

As part of the plan, major acquisitions would be combined with

the accelerated divestment of lower-growth brands and

businesses.

Consumer health has good potential for synergies and GSK

Consumer Healthcare would be a strong strategic fit, the company

said. The acquisition of GSK Consumer Healthcare would create scale

and a growth platform for the combined portfolio in the U.S.,

China, and India, with further opportunities in other emerging

markets.

On Jan. 15, Unilever said it had approached GlaxoSmithKline PLC

and Pfizer Inc. about a deal for their consumer-healthcare joint

venture.

A major initiative to enhance performance will be announced

later this month, the company said.

Write to Kyle Morris at kyle.morris@dowjones.com

(END) Dow Jones Newswires

January 17, 2022 03:22 ET (08:22 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

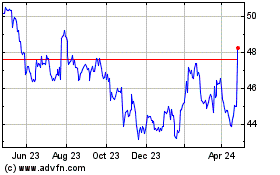

Unilever (EU:UNA)

Historical Stock Chart

From Jun 2024 to Jul 2024

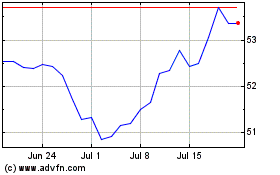

Unilever (EU:UNA)

Historical Stock Chart

From Jul 2023 to Jul 2024