Trading update: good start to the year until mid-March; end of the

quarter and short term outlook significantly affected by

coronavirus situation

Paris, April, 8, 2020: Tarkett

today gives an update on its sales and expected performance for the

first quarter. The Group is also providing initial views on

business trends for the second quarter which is expected to be

severely affected by the escalation of travel and social

restrictions decided by public authorities in various geographies

over the last few weeks.

Q1 net sales In EMEA, net sales

were performing in line with management’s expectations until

mid-March. North America was recording improving trends following a

depressed fourth quarter 2019 with commercial carpet better

oriented than initially anticipated. The Sport business, which is

in its low season, was also doing well with a sustained level of

growth. The level of activity in CIS countries was stable compared

to last year, while Latin America was continuing to grow double

digit on an organic basis.

The deployment of lockdown measures accelerated

mid-March in both Europe and North America. It resulted in the halt

of construction projects and the shutdown of many flooring

retailers and distributors in several areas, primarily in South

Europe. To adapt to this reduced demand, some of our manufacturing

sites have been operating at reduced capacity or have been

temporarily shutdown. In Europe, facilities concerned by the

temporary shutdown are progressively reopening but operate at

reduced capacity. Until now, most sites which have suspended

operations continued satisfying customer demand by delivering

products from existing inventories. Tarkett has applied all

required actions to protect its employees, customers and partners

in all geographies, including social distancing on production sites

and remote work for support functions.

China focusFor Tarkett, China is represents less

than 1% of consolidated net revenues. Net sales were affected by

the coronavirus outbreak and lockdown measures in February. Since

then, there has been a rebound of the activity: revenues in March

were only slightly down compared to last year. The two

manufacturing sites in China, which focus on the Chinese and

South-East Asian markets, were closed during the lockdown phases.

They both resumed production early March and are now back to normal

production level.

Q1 Sales and estimated Adjusted EBITDA Overall,

net revenues were penalized by a significant slowdown at the end of

the quarter particularly in Europe and amounted to €612 million in

the first quarter or a decrease of -2.1% as reported and -2.9% on a

like-for-like basis. In spite of a good level of productivity and

cost reduction aligned with the “Change to win” plan, lockdown

measures generated production disruptions and higher logistic

complexity. This weighed on the Group’s adjusted EBITDA that should

be comprised between €40 million and €43 million in Q1 2020

compared to €43.1 million in Q1 2019.

Net sales by segment

|

€ million |

Q1 2020 |

Q1 2019 |

Change |

o/w LfL |

|

EMEA |

228 |

239 |

-4.5% |

-3.6% |

|

North America |

196 |

196 |

+0.3% |

-2.7% |

|

CIS, APAC & LATAM |

110 |

113 |

-2.4% |

-1.2% |

|

Sports |

77 |

77 |

-0.1% |

-3.7% |

|

Total Group |

612 |

624 |

-2.5% |

-2.9% |

Implemented measures As the

lockdown measures have been strengthened and extended to most

countries and regions over the past few days, Tarkett expects

further disruption in Q2 2020. Lockdown measures have been

implemented early April in Russia and in other CIS countries. The

Group is now seeing impacts on demand in all its key geographies

outside China.

In order to mitigate the negative impact on its

results, Tarkett implemented a vigorous set of measures,

including:

- Temporary lay-offs and reduction in working time in all

locations concerned, including for support functions, in compliance

with schemes proposed by local governments;

- Drastic reduction of discretionary costs and deferral of

expenses.

The Group also remains focused on protecting its

cash flows:

- Capex will be limited to safety and a selection of key

productivity projects. They should be significantly reduced to

around €80 million compared to €125 million in 2019;

- Strict management of working capital with daily monitoring

tools;

- Cancellation of the dividend initially proposed, as

communicated on March 18th.

LiquidityTarkett has a solid

liquidity to cope with the consequences of the pandemic. The Group

has solid bank relationships and last year refinanced its revolving

credit facility and a large part of its private placements with a

solid rate of renewals from existing creditors (above 95% for the

RCF). As a result of the refinancing, the Group has no major debt

installment to pay before 2022 (i.e. maturity of €150 million in

June 2022).

At the end of March, the Group had a cash

position of €210 million and available undrawn credit lines of €500

million, out of which €443 million are confirmed. Gross debt

amounted to €887 million at the end of March (out of which €2

million to repay before year end). The Group is also reviewing the

possibility of leveraging credit arrangements proposed by the

French government and the possibility to set up additional lines

with its main banks to better navigate this challenging environment

and be ready to benefit from the recovery when it materializes.

As the current situation will likely affect its

adjusted EBITDA for the first half and for the full year 2020,

Tarkett is not in a position to confirm its leverage ratio target

for the end of the year (Net Debt to Adjusted EBITDA before IFRS 16

between 1.5x and 2.5x). In addition, given the extraordinary

circumstances the Group initiated discussions with its banks to

waive its financial covenant (leverage of 3.5x end of June and 3.0x

end of December).

OutlookTarkett is expecting its

activity to be severely hit in the second quarter. Considering the

unprecedented level of uncertainty, accurate impacts cannot be

quantified at the moment for the first half nor for the full year.

It will depend on many different factors including the scope and

duration of the epidemic and the prevention and support measures

adopted by local governments.

In the short term, the management team is

focused on protecting the health and safety of employees and

partners, adapting its cost base to a lower level of activity,

while ensuring the continuity of service to its customers.

Tarkett’s balanced portfolio between geographies, end markets and

channels should help the Group during this challenging period and

provide opportunities at the time of the recovery.

The Group will release its Q1 earnings

as planned on April 28 and will provide more details upon this

release.

Annual General Meeting – April 30,

2020In compliance with French regulations, the 2020

Shareholder's Meeting will exceptionally be held in closed session.

A live audio webcast will be made available to allow shareholders

to follow the meeting and presentation. Shareholders will be able

to vote either by post ahead of the Meeting or by giving a proxy to

the Chairman of the Shareholders’ Meeting.

Financial calendar

- April 28, 2020: Q1 2020 financial results - press release

after close of trading on the Paris market and conference call the

following morning

- April 30, 2020: Annual General Meeting of Shareholders

Investor Relations

ContactTarkett – Emilie Megel –

emilie.megel@tarkett.com

Media contactsTarkett -

Véronique Bouchard Bienaymé - communication@tarkett.com Brunswick -

tarkett@brunswickgroup.com - Tel.: +33 (0) 1 53 96 83 83

Forward Looking Statements

This press release may contain forward-looking

statements. Such forward-looking statements do not constitute

forecasts regarding results or any other performance indicator, but

rather trends or targets. These statements are by their nature

subject to risks and uncertainties as described in the Company’s

annual report registered in France with the French Autorité des

Marchés financiers available on its website (www.tarkett.com).

These statements do not reflect the future performance of the

Company, which may differ significantly. The Company does not

undertake to provide updates of these statements.

About Tarkett

With a history of 140 years, Tarkett is a

worldwide leader in innovative flooring and sports surface

solutions, with net sales of around €3 billion in 2019. Offering a

wide range of products including vinyl, linoleum, rubber, carpet,

wood, laminate, artificial turf and athletics tracks, the Group

serves customers in over 100 countries across the globe. Tarkett

has 12,500 employees and 33 industrial sites, and sells 1.3 million

square meters of flooring every day, for hospitals, schools,

housing, hotels, offices, stores and sports fields. Committed to

change the game with circular economy, the Group has implemented an

eco-innovation strategy based on Cradle to Cradle® principles, with

the ultimate goal of contributing to people’s health and wellbeing,

and preserving natural capital. Tarkett is listed on Euronext Paris

(compartment A, ISIN: FR0004188670, ticker: TKTT) and is included

in the following indices: SBF 120 and CAC Mid 60. Further

information about Tarkett is available from its website

www.tarkett.com.

Appendices

Reconciliation table for alternative performance

indicators (not defined by IFRS)

- Organic growth measures the change in net sales as compared

with the same period in the previous year, at constant scope of

consolidation and exchange rates. The exchange rate effect is

calculated by applying the previous year’s exchange rates to sales

for the current year and calculating the difference as compared

with sales for the current year. It also includes the impact of

price adjustments in CIS countries intended to offset movements in

local currencies against the euro.

- Scope effects reflect:

- current-year sales for entities not included in the scope of

consolidation in the same period in the previous year, up to the

anniversary date of their consolidation;

- the reduction in sales relating to discontinued operations that

are not included in the scope of consolidation for the current year

but were included in sales for the same period in the previous

year, up to the anniversary date of their disposal.

- Adjusted EBITDA is the operating income before depreciation,

amortization and the following adjustments: restructuring costs,

gains or losses on disposals of significant assets, provisions and

reversals of provisions for impairment, costs related to business

combinations and legal reorganizations, expenses related to

share-based payments and other one-off expenses considered

non-recurring by their nature.

- 2020_04_08_Tarkett_Trading Update_VUS

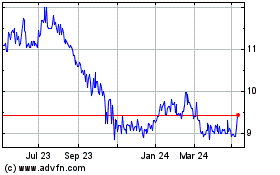

Tarkett (EU:TKTT)

Historical Stock Chart

From Oct 2024 to Nov 2024

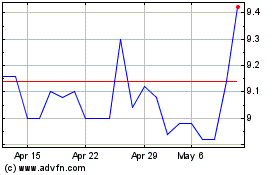

Tarkett (EU:TKTT)

Historical Stock Chart

From Nov 2023 to Nov 2024