FY 2023 Results - Strong performance across the board

Paris, 07 March 2024, 5:45pm

FY 2023

RESULTS1

STRONG PERFORMANCE ACROSS THE

BOARD

- Record

EBITDA at €798m, up 19% yoy

- Strong

performance of legacy businesses – Photosol’s secured portfolio at

893 MWp up 77% yoy

- Record net

income (Group share) at €354m, +8%

adjusted2 yoy despite negative FX

effects3 amounting to

€105m

- Operating

cash flow4 at €583m, up 35% vs.

FY 2022

- Healthy

balance sheet: 1.4x corporate net financial

debt/EBITDA5 (vs. 1.5x in FY

2022)

- Proposed

dividend €1.98, +3% vs. 2022

FY 2023 HIGHLIGHTS

- Continuous

growth in operating performance

- Energy

Distribution:

- Retail &

Marketing

- Gross margin at

€849m up 6% (+3% LFL6) – Outstanding performance of the retail

network in the Caribbean region – Eastern Africa renewed network

delivering robust growth - Bitumen slightly behind due to political

context in Nigeria

- Volume at +4% -

Strong catch up of the aviation business in Africa and in the

Caribbean region

- Support &

Services

- Gross margin (excl.

SARA) up by 45%, illustrating the relevance of vessel ownership in

a context of increasing shipping rates

- Renewable

Electricity Production:

- First-prize winner

of CRE tenders – 257MWp secured

- International

development progressing in Italy and Spain

- Full carbon

footprint assessment of Rubis Photosol finalised – Photosol to be

included in the updated Think Tomorrow 2022-2025 CSR

Roadmap from 2024

- CDP rating at B

reiterated for the third year

- First Sea

Cargo Charter annual disclosure report issued in Jun-23

(reporting of all Rubis chartering activity in 2022 and measurement

of their alignment with a decarbonisation trajectory)

- Publication of

Rubis new Code of Ethics to reaffirm the

foundation of the ethical approach as the Group continues its

transformation in a rapidly changing world (Jun-23).

KEY FIGURES

CONSOLIDATED FINANCIAL STATEMENTS AS OF 31

DECEMBER 2023

|

(in million euros) |

FY 2023 |

FY 2022 |

Var % |

|

Revenue |

6,630 |

7,135 |

-7% |

|

EBITDA |

798 |

669 |

19% |

|

o/w Energy Distribution |

797 |

680 |

17% |

|

o/w Renewable Electricity Production |

29 |

18 |

66% |

|

EBIT |

621 |

509 |

22% |

|

o/w Energy Distribution |

647 |

540 |

20% |

|

o/w Renewable Electricity Production |

4 |

-1 |

ns |

|

Net income, Group share |

354 |

263 |

35% |

|

EPS (diluted), in euros |

3.42 |

2.55 |

34% |

|

Operating cash flow before change in working capital (1) |

583 |

432 |

35% |

|

Cash flow from operations |

563 |

421 |

34% |

|

Capital expenditure |

283 |

258 |

10% |

|

o/w Energy Distribution |

206 |

215 |

-4% |

|

o/w Renewable Electricity Production |

77 |

44 |

77% |

|

Net financial debt (NFD) |

1,360 |

1,286 |

6% |

|

NFD/EBITDA |

1.8x |

2.0x |

-0.1x |

|

Corporate net financial debt (2) (corporate NFD) |

992 |

929 |

7% |

|

Corporate NFD/EBITDA |

1.4x |

1.5x |

-0.1x |

(1) Operational cash flow after

net financial costs and tax and before change in working

capital.(2) Corporate net financial debt –

excluding non-recourse debt – see Appendix for further detail.

On 7 March 2024, Clarisse Gobin-Swiecznik,

Managing Partner, commented on the results: "Once again, Rubis'

balanced model, combining legacy businesses and renewables, thrived

in 2023's uncertain market, more than delivering on its goals.

Operations were particularly dynamic in the

Caribbean, both in Retail & Marketing and Support &

Services, generating a strong financial performance, with a net

income at +8% when restated for the exceptional elements.

Marking significant progress, Rubis Photosol has

increased its secured portfolio by 77% over the year. This momentum

makes us confident about 2030 ambitions, which will be updated in

September as we will be holding a dedicated Photosol Day.

Thanks to the unwavering dedication, talent, and

collaborative spirit of our teams, the ambitious plans we had set

ourselves for 2023 have been exceeded. I am proud and thankful to

each and every one of Rubis’ employees and enthusiastic to see what

we will achieve together in the journey we have ahead of us.

As we enter 2024, the global economic and

geopolitical landscape remains somewhat unpredictable. We believe

Group EBITDA could land between €725m to €775m in 2024. Profit

before tax should increase, following the same trend as the strong

operating performance we expect, which will balance the headwinds

related to ongoing FX uncertainty.

As regards dividend, we are confident in our

ability to continue growing its amount.”

FY 2023 FINANCIAL

PERFORMANCE

FY 2023 has seen very strong increase in EBITDA

to €798m (+19% yoy) and EBIT to €621m (+22% yoy).

In 2022 and 2023, Group EBITDA and EBIT include

Nigeria FX pass-through to customers, for €34m and €32m

respectively. When adjusted for this effect and exceptional items,

EBITDA increased by 15% yoy and EBIT by 17% yoy.

The 35% increase in cash flow from operating

activities to €583m, in line with the 35% rise in net income,

attests to the quality of the Group’s results.

Rubis corporate net financial debt (corporate

NFD) reached €992m at the end of 2023, leading to a corporate

NFD/EBITDA at 1.4x (-0.1x vs. 2022).

Capex reached €283m, of which €77m were

dedicated to the Renewable Electricity Production branch. The

remaining €206m notably include the purchase of two LPG

vessels.

On the back of these strong operating and

financial results and a solid balance sheet in FY 2023, the

management proposes another increase in dividend per share to €1.98

(+3% vs. 2022).

ENERGY DISTRIBUTION

Retail & Marketing

2023 has seen volume increasing by 4% vs. 2022,

which was already particularly strong. When excluding exceptional

items and FX effect in Nigeria, gross margin stayed stable at -2%.

EBIT landed at €475m, vs. €396m in FY 2022 (+20% yoy, +4% LFL7).

Capex increased to €155m (+10% yoy).

VOLUME SOLD AND GROSS MARGIN BY

PRODUCT IN FY 2023

| |

Volume (in '000

m3) |

Gross margin (in €m) |

Adjusted gross margin (1)

(in €m) |

|

|

FY 2023 |

FY 2022 |

FY 2023 vs. FY 2022 |

FY 2023 |

FY 2022 |

FY 2023 vs. FY 2022 |

FY 2023 |

FY 2022 |

FY 2023 vs. FY 2022 |

|

LPG |

1,279 |

1,221 |

5% |

303 |

295 |

3% |

303 |

295 |

3% |

|

Fuel |

4,048 |

3,843 |

5% |

449 |

403 |

11% |

438 |

422 |

4% |

|

Bitumen |

391 |

424 |

-8% |

96 |

102 |

-6% |

65 |

68 |

-5% |

|

TOTAL |

5,718 |

5,487 |

4% |

849 |

801 |

6% |

806 |

785 |

3% |

(1) Adjusted for exceptional

items and FX effects.

LPG growth in 2023 was

underpinned by a strong demand in bulk product in Morocco,

Portugal, Kenya and South Africa. Gross margin grew by 3%, as unit

margin slightly decreased (-2%) impacted by the product mix.

As regards fuel:

- retail (service

stations, representing 59% of FY23 fuel gross margin) volume

increased by 4% over the year, driven by Kenya and Rwanda where the

rebranding programme continues to prove its relevance, and the

Caribbean region where the trend was particularly dynamic all year

long, with an acceleration at year-end, boosted by the holiday

season. Gross margin increased by 22%;

- commercial and

industrial (C&I, representing 24% of FY23 fuel gross margin)

volume decreased by 4% yoy. Excluding Haiti, volume remained stable

(-0.2%). Kenya and the French Antilles were under pressure on this

segment. This softer than expected demand was partly offset by the

strong performance of the Eastern Caribbean region, where Guyana

activity remained at a very high level. Gross margin decreased by

-9% yoy, -7% excluding Haiti;

- the strong volume

growth momentum observed in the aviation segment (representing 13%

of FY23 fuel gross margin) since the beginning of 2023 continued

all year long, landing at +36% yoy. This increase was driven by

Kenya, where total volume for the year more than doubled (unit

margin remained stable on that market), and the Caribbean region

where activity was particularly strong. Gross margin increased by

12%.

Bitumen volume was down 8% yoy.

This decrease is explained by the lower volume in Nigeria,

following elections. South Africa, Gabon and Cameroon showed

particularly strong dynamics, with volume and margins increasing.

Adjusted gross margin decreased by 5% yoy.

VOLUME SOLD AND GROSS MARGIN BY

REGION IN FY 2023

|

|

Volume (in '000

m3) |

Gross margin (in €m) |

Adjusted Gross margin (1)

(in €m) |

|

|

FY 2023 |

FY 2022 |

FY 2023 vs. FY 2022 |

FY 2023 |

FY 2022 |

FY 2023 vs. FY 2022 |

FY 2023 |

FY 2022 |

FY 2023 vs. FY 2022 |

|

Europe |

876 |

856 |

2% |

208 |

197 |

6% |

208 |

197 |

6% |

|

Caribbean |

2,219 |

2,173 |

2% |

306 |

280 |

9% |

306 |

280 |

9% |

|

Africa |

2,623 |

2,458 |

7% |

334 |

324 |

3% |

291 |

308 |

-6% |

|

TOTAL |

5,718 |

5,487 |

4% |

849 |

801 |

6% |

806 |

785 |

3% |

(1) Adjusted for exceptional

items and FX effects.

Adjusted unit margin came in at

141€/m3, down 2% yoy.

EBIT BY REGION

|

(in million euros) |

FY 2023 |

FY 2022 |

Var % |

|

Europe |

60 |

58 |

4% |

|

Caribbean |

194 |

134 |

45% |

|

Africa |

222 |

205 |

8% |

|

TOTAL Retail & Marketing |

475 |

396 |

20% |

By region, the dynamics of this year were as

follows:

-

Europe continues to benefit from its strong LPG

positioning (LPG accounts for 92% of regional gross profit). This

segment remained stable in volume (+2%). Gross margin increased by

6% benefiting from the increase in LPG sales. The 4% growth in EBIT

was mainly explained by increased margins in France and Spain;

- the

Caribbean region - excluding Haiti - remained

buoyant, with volume up 5%, following two consecutive years of

double-digit growth. Operating conditions were optimal, with gains

in market share and a sharp rise in margins across the board

(+10%), leading to an outstanding increase in EBIT: +45%. Guyana,

Jamaica, Grenada and Antigua, as well as a relative recovery in

Haiti contributed to this strong growth in results;

- lastly, in

Africa, gross margin was down 6%, adjusted for the

sequencing of payment in 2023 by the State of the 2022 revenue

shortfall in Madagascar (€11.3m) and the neutralisation of foreign

exchange losses in Nigeria (€31.5m). The extreme tension on the

foreign exchange front in Kenya in H1 and Nigeria all year long has

severely offset the operating performance in FY 2023.

Support &

Services

The Support & Services

activities recorded EBIT of €172m (+20% yoy) in FY 2023,

underpinned by the strong performance of shipping, in the Caribbean

region, enhanced by the ownership of two additional LPG vessels

since H1 2023.

Volume (+15%) and margins (+15%) have seen

strong growth over the year, driven by the bitumen supply activity

over this first-half, and shipping operations in the second half,

on the back of the strong inflation observed worldwide on shipping

rates.

The SARA refinery and logistics operations

present specific business models with stable earnings profile.

Shipping activities present decarbonisation

challenges for the Group. Leveraging its participation to the Sea

Cargo Charter, and as part of its decarbonation strategy, Rubis

works on several measures aimed at reducing its environmental

footprint, among which the sourcing and use of biofuel and/or

methanol as the main driver, coupled with slow steaming and

potential on-board CCS.

Capex reached €51m (-31% yoy) and are mainly

coming from the acquisition of two new LPG vessels in the Caribbean

and one bitumen vessel.

RENEWABLE ELECTRICITY

PRODUCTION

The level of assets in operation grew by 13%

over 2023. The secured portfolio reached 893 MWp, up from

504 MWp at the end of Dec-22. As regards pipeline, 14 new

projects reached the RTB (Ready-to-Build8) status, representing a

total of 346MWp, including 197MWp related to the Creil former

military base.

Revenue reached €49m over FY 2023. EBITDA

reached €29m over FY 2023. At the end of Dec-23, the level of

non-recourse project debt amounted €367m.

FINANCIAL AND OPERATIONAL DATA

|

Operational data |

FY 2023 |

FY 2022 |

Var % |

Var % annualised (1) |

|

Assets in operation (MWp) |

435 |

384 |

13% |

n/a |

|

Electricity production (GWh) |

472 |

339 |

39% |

16% |

|

Sales (in €m) |

49 |

32 |

52% |

27% |

|

EBITDA |

29 |

18 |

66% |

38% |

|

CAPEX |

77 |

44 |

77% |

48% |

|

Non-recourse project debt |

367 |

357 |

3% |

n/a |

(1) Annualised

assuming Q1 accounts for 1/6 of the yearly performance.

2023 saw Rubis Photosol’s first steps outside of

France with the investment in Italy, in a portfolio of 10

photovoltaic and agrivoltaic projects totalling close to 100 MWp9.

Among this portfolio, four projects have been already acquired

after reaching the RTB status. Their capacity reaches 44 MWp.

Photosol also acquired three RTB projects in Spain (Alicante

region) representing 30 MWp, whose commissioning is planned in

2025.

In its strategy to unlock additional market

opportunities, Rubis Photosol has acquired two rooftop operators:

Mobexi, at the end of 2022, and ENER 5, early 2024. These

companies come as a complement to the existing offer and will be

leveraged in the upcoming co-development of bundled offers for BtoB

customers with the Energy Distribution branch.

Photosol 2030 ambitions are confirmed:

-

accumulated capex will reach

€2.7bn over 2023-2030, of which

€700m over 2023-2025;

-

EBITDA will contribute to Rubis Group EBITDA by

at least 25% by 2030;

- installed

capacities will reach 1 GWp by 2025,

3.5 GWp by 2030.

The complete carbon footprint assessment of

Rubis Photosol's activities is now finalised and will be published

in due course in Rubis’ 2023 Universal Registration Document. This

achievement will enable the integration of Rubis Photosol in the

Group CSR Roadmap.

BULK LIQUID STORAGE (JV)

Rubis Terminal JV has delivered

solid performance with +14% yoy storage revenue growth to €267m.

EBITDA has increased by 16% to €143m in FY 2023. This performance

is explained by the use of the new capacities developed in 2022,

combined with the effect of inflation. Utilisation rate in FY23

reached 95%.

The product mix stayed stable over the year, at

71% of non-fuel products and strategic reserves.

The share of Rubis profit stood at €13.2m in FY

2023.

OUTLOOK

The solid performance of 2023 illustrates the

ability of Rubis’ business model to generate strong cashflow

through its legacy businesses while continuing to increase its

return to shareholders and growing its activities. Medium-term

growth drivers identified previously remain fully valid:

- LPG will continue

growing in emerging countries where this energy is promoted as a

cleaner alternative to replace wood or charcoal for heating and

cooking;

- fuel will develop:

- in Eastern Africa

driven by the refurbishment of service stations and,

- in the Caribbean

region driven by tourism and increased activity in high-growth

potential countries (Guyana, Suriname);

- bitumen will

increase, underpinned by the need for infrastructure in Western

Africa;

- shipping and supply

activities will continue their growth, with the optimisation of the

fleet and the acquisition of new vessels;

- Renewable

Electricity Production will pursue its development in France as

planned, with small-scale PV plants, further expansion in Europe

and leverage Rubis Énergie footprint for bundled BtoB offers.

For 2024, within Energy Distribution, the Group

anticipates the Caribbean region will normalise, after an

outstanding growth in 2023. Europe and Africa are expected to

benefit from 2023 positive momentum. The Renewable division will

continue developing according to plans.

As a result, Group EBITDA is expected to reach

€725m to €775m. Net income Group share should remain stable despite

the first-time application of the Global Minimum Tax representing

an impact estimated between €20m and €25m.

As a reminder, the targets set in the context of

the Think Tomorrow 2022-2025 CSR Roadmap are:

-

Environment/climate:

- scopes 1 and 210:

-30% CO2 emissions by 2030,

- scope 3A10: -20%

CO2 emissions by 2030 (mainly outsourced transportation i.e., 45%

of scope 3A);

- Social: 30% women

on average in Management Committees of the Energy Distribution

division by 2025.

In addition, in 2023, 100% of the Group's

employees have been made aware of ethical and anti-corruption

rules.

EXTRA-FINANCIAL RATING

- MSCI: AA

(reiterated in Dec-23)

- Sustainalytics:

30.7 (from 29.7 previously)

- ISS ESG: C (from C-

previously)

- CDP: B (reiterated

in Feb-24)

Webcast for the investors and

analystsDate: 7 March 2024, 6:00pmLinks to register for

the webcast:

- FR:

https://channel.royalcast.com/rubisfr/#!/rubisfr/20240307_1

- UK:

https://channel.royalcast.com/landingpage/rubisen/20240307_1

Participants from Rubis:

- Jacques Riou, Managing Partner

- Clarisse Gobin-Swiecznik, Managing

Partner

- Bruno Krief, CFO

Upcoming events

Q1 2024 trading update: 7 May 2024 (after market

close)

General Meeting: 11 June 2024

Q2 & H1 2023 results: 5 September 2024 (after

market close)

Photosol Day: 17 September 2024

|

Press Contact |

Analyst Contact |

|

RUBIS - Communication department |

RUBIS - Clémence Mignot-Dupeyrot, Head of IR |

|

Tel: +33 (0)1 44 17 95 95 presse@rubis.fr |

Tel: +33 (0)1 45 01 87 44 investors@rubis.fr |

appendix

1. Q4 FIGURES

REVENUE BREAKDOWN

|

Revenue (in €m) |

Q4 2023 |

Q4 2022 |

Q4 2023 vs. Q4 2022 |

Q3 2023 vs. Q3 2022 |

|

Energy Distribution |

1,702 |

1,795 |

-5% |

-22% |

|

Retail & Marketing |

1,447 |

1,506 |

-4% |

-23% |

|

Europe |

198 |

200 |

-1% |

-11% |

|

Caribbean |

622 |

628 |

-1% |

-18% |

|

Africa |

627 |

678 |

-7% |

-30% |

|

Support & Services |

255 |

289 |

-12% |

-18% |

|

Renewable Electricity Production |

8 |

7 |

+6% |

+22% |

|

Bulk Liquid storage (JV) - For information

only |

69 |

63 |

+9% |

+14% |

|

TOTAL |

1,710 |

1,802 |

-5% |

-22% |

RETAIL & MARKETING: VOLUME SOLD AND GROSS

MARGIN BY PRODUCT IN Q4

|

|

Volume (in '000

m3) |

Gross margin (in €m) |

Adjusted gross margin (1)

(in €m) |

|

|

Q4 2023 |

Q4 2022 |

Q4 2023 vs. Q4 2022 |

Q4 2023 |

Q4 2022 |

Q4 2023 vs. Q4 2022 |

Q4 2023 |

Q4 2022 |

Q4 2023 vs. Q4 2022 |

|

LPG |

327 |

313 |

5% |

76 |

76 |

0% |

76 |

76 |

0% |

|

Fuel |

1,043 |

934 |

12% |

112 |

121 |

-8% |

112 |

121 |

-8% |

|

Bitumen |

85 |

109 |

-21% |

22 |

38 |

-42% |

15 |

4 |

307% |

|

TOTAL |

1,456 |

1,355 |

7% |

210 |

235 |

-11% |

203 |

201 |

1% |

(1) Adjusted for exceptional

items and FX effects.

RETAIL & MARKETING: VOLUME SOLD AND GROSS

MARGIN BY REGION IN Q4

|

|

Volume (in '000

m3) |

Gross margin (in €m) |

Adjusted gross margin (1)

(in €m) |

|

|

Q4 2023 |

Q4 2022 |

Q4 2023 vs. Q4 2022 |

Q4 2023 |

Q4 2022 |

Q4 2023 vs. Q4 2022 |

Q4 2023 |

Q4 2022 |

Q4 2023 vs. Q4 2022 |

|

Europe |

227 |

219 |

4% |

53 |

47 |

12% |

53 |

47 |

12% |

|

Caribbean |

568 |

520 |

9% |

82 |

72 |

14% |

82 |

72 |

14% |

|

Africa |

660 |

616 |

7% |

75 |

116 |

-35% |

68 |

82 |

-17% |

|

TOTAL |

1,456 |

1,355 |

7% |

210 |

235 |

-11% |

203 |

201 |

1% |

(1) Adjusted for exceptional

items and FX effects.

2. ADJUSTMENTS AND

RECONCILIATIONS

COMPOSITION OF NET DEBT/EBITDA EXCLUDING IFRS

16

|

(in million euros) |

FY 2023 |

FY 2022 |

Var % |

|

Corporate net financial debt (4) (corporate NFD) |

992 |

929 |

7% |

|

LTM EBITDA (a) |

798 |

669 |

19% |

|

LTM Rental expenses IFRS 16 (b) |

46 |

40 |

15% |

|

LTM EBITDA Photosol prod (c) |

34 |

|

|

|

LTM EBITDA pre IFRS 16 & excl. Photosol prod (a)-(b)-(c) |

717 |

629 |

14% |

|

Corporate NFD/LTM EBITDA pre IFRS 16 & excl. Photosol

prod |

1.4x |

1.5x |

-0.1x |

|

Non-recourse project debt |

367 |

357 |

3% |

|

Total Net financial debt (NFD) |

1,360 |

1,286 |

6% |

|

NFD/LTM EBITDA pre IFRS 16 |

1.9x |

2.0x |

-0.1x |

NET INCOME TO ADJUSTED NET INCOME

|

(in million euros) |

FY 2023 |

FY 2022 |

Var % |

|

Net Income Group Share (reported) |

354 |

263 |

35% |

|

Goodwill impairment |

- |

40 |

|

|

Costs linked to Photosol acquisition |

6 |

16 |

|

|

M&A-related litigation refund |

-17 |

- |

|

|

Other |

-1 |

-1 |

|

|

Adjusted Net Income Group Share |

342 |

317 |

8% |

|

EPS (diluted), in euros |

3.42 |

2.55 |

34% |

|

Adjusted EPS (diluted), in euros |

3.32 |

3.16 |

5% |

|

IFRS 2 expenses |

9 |

8 |

|

|

Adjusted Net Income Group Share excluding IFRS 2

expenses |

350 |

326 |

8% |

3. FINANCIAL

STATEMENTS

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

ASSET (in thousands of euros) |

31/12/2023 |

31/12/2022 |

|

Non-current assets |

|

|

|

Intangible assets |

90,665 |

79,777 |

|

Goodwill |

1,659,544 |

1,719,170 |

|

Property, plant and equipment |

1,746,515 |

1,662,305 |

|

Property, plant and equipment – right-of-use assets |

230,764 |

221,748 |

|

Interests in joint ventures |

310,671 |

305,127 |

|

Other financial assets |

168,793 |

204,636 |

|

Deferred taxes |

28,770 |

18,911 |

|

Other non-current assets |

11,469 |

9,542 |

|

TOTAL NON-CURRENT ASSETS (I) |

4,247,191 |

4,221,216 |

|

Current assets |

|

|

|

Inventory and work in progress |

651,853 |

616,010 |

|

Trade and other receivables |

781,410 |

770,421 |

|

Tax receivables |

34,384 |

36,018 |

|

Other current assets |

42,214 |

21,469 |

|

Cash and cash equivalents |

589,685 |

804,907 |

|

TOTAL CURRENT ASSETS (II) |

2,099,546 |

2,248,825 |

|

TOTAL ASSETS (I + II) |

6,346,737 |

6,470,041 |

|

EQUITY AND LIABILITIES (in thousands of

euros) |

31/12/2023 |

31/12/2022 |

|

Shareholders’ equity |

|

|

|

Share capital |

128,994 |

128,692 |

|

Share premium |

1,553,914 |

1,550,120 |

|

Retained earnings |

948,449 |

1,054,652 |

|

TOTAL |

2,631,357 |

2,733,464 |

|

Non-controlling interests |

131,588 |

126,826 |

|

EQUITY (I) |

2,762,945 |

2,860,290 |

|

Non-current liabilities |

|

|

|

Borrowings and financial debt |

1,166,074 |

1,299,607 |

|

Lease liabilities |

200,688 |

196,914 |

|

Deposit/consignment |

151,785 |

148,588 |

|

Provisions for pensions and other employee benefit obligations |

40,929 |

40,163 |

|

Other provisions |

137,820 |

98,008 |

|

Deferred taxes |

83,659 |

92,480 |

|

Other non-current liabilities |

148,259 |

94,509 |

|

TOTAL NON-CURRENT LIABILITIES (II) |

1,929,214 |

1,970,269 |

|

Current liabilities |

|

|

|

Borrowings and short-term bank borrowings (portion due in less than

one year) |

783,519 |

791,501 |

|

Lease liabilities (portion due in less than one year) |

38,070 |

27,735 |

|

Trade and other payables |

792,512 |

781,742 |

|

Current tax liabilities |

25,245 |

28,771 |

|

Other current liabilities |

15,232 |

9,733 |

|

TOTAL CURRENT LIABILITIES (III) |

1,654,578 |

1,639,482 |

|

TOTAL EQUITY AND LIABILITIES (I + II + III) |

6,346,737 |

6,470,041 |

CONSOLIDATED INCOME STATEMENT

|

(in thousands of euros) |

%2023/2022 |

31/12/2023 |

31/12/2022 |

|

NET REVENUE |

-7% |

6,629,977 |

7,134,728 |

|

Consumed purchases |

|

(4,945,929) |

(5,690,380) |

|

External expenses |

|

(488,810) |

(403,404) |

|

Employee benefits expense |

|

(253,739) |

(236,965) |

|

Taxes |

|

(143,646) |

(134,485) |

|

EBITDA |

19% |

797,853 |

669,494 |

|

Other operating income |

|

6,740 |

940 |

|

Net depreciation and provisions |

|

(189,454) |

(167,747) |

|

Other operating income and expenses |

|

6,222 |

6,327 |

|

CURRENT OPERATING INCOME |

22% |

621,361 |

509,014 |

|

Other operating income and expenses |

|

7,350 |

(58,136) |

|

OPERATING INCOME BEFORE SHARE OF NET INCOME FROM JOINT

VENTURES |

39% |

628,711 |

450,878 |

|

Share of net income from joint ventures |

|

14,930 |

5,732 |

|

OPERATING INCOME AFTER SHARE OF NET INCOME FROM JOINT

VENTURES |

41% |

643,641 |

456,610 |

|

Income from cash and cash equivalents |

|

15,869 |

11,868 |

|

Gross interest expense and cost of debt |

|

(87,858) |

(42,363) |

|

COST OF NET FINANCIAL DEBT |

136% |

(71,989) |

(30,495) |

|

Interest expense on lease liabilities |

|

(12,370) |

(10,234) |

|

Other finance income and expenses |

|

(134,409) |

(80,116) |

|

PROFIT (LOSS) BEFORE TAX |

27% |

424,873 |

335,765 |

|

Income tax |

|

(57,860) |

(63,862) |

|

NET INCOME |

35% |

367,013 |

271,903 |

|

NET INCOME, GROUP SHARE |

35% |

353,694 |

262,896 |

|

NET INCOME, NON-CONTROLLING INTERESTS |

48% |

13,319 |

9,007 |

CONSOLIDATED STATEMENT OF CASH FLOWS

|

(in thousands of euros) |

31/12/2023 |

31/12/2022 |

|

TOTAL CONSOLIDATED NET INCOME |

367,013 |

271,903 |

|

Adjustments: |

|

|

|

Elimination of income of joint ventures |

(14,930) |

(5,732) |

|

Elimination of depreciation and provisions |

222,146 |

100,928 |

|

Elimination of profit and loss from disposals |

1,344 |

84 |

|

Elimination of dividend earnings |

(363) |

(190) |

|

Other income and expenditure with no impact on cash (1) |

7,623 |

65,270 |

|

CASH FLOW AFTER COST OF NET FINANCIAL DEBT AND

TAX |

582,833 |

432,263 |

|

Elimination of income tax expenses |

57,860 |

63,862 |

|

Elimination of the cost of net financial debt and interest expense

on lease liabilities |

84,359 |

40,729 |

|

CASH FLOW BEFORE COST OF NET FINANCIAL DEBT AND

TAX |

725,052 |

536,854 |

|

Impact of change in working capital* |

(91,682) |

(31,353) |

|

Tax paid |

(70,752) |

(84,543) |

|

CASH FLOWS RELATED TO OPERATING ACTIVITIES |

562,618 |

420,958 |

|

Impact of changes to consolidation scope (cash acquired - cash

disposed) |

387 |

57,031 |

|

Acquisition of financial assets: Energy Distribution division |

(3,396) |

|

|

Acquisition of financial assets: Renewable Energies division |

(8,543) |

(341,122) |

|

Acquisition of property, plant and equipment and intangible

assets |

(283,340) |

(258,416) |

|

Change in loans and advances granted |

(30,252) |

(451) |

|

Disposal of property, plant and equipment and intangible

assets |

6,175 |

5,942 |

|

(Acquisition)/disposal of other financial assets |

(193) |

(2,779) |

|

Dividends received |

6,111 |

34,609 |

|

Other cash flows from investing activities |

|

4,063 |

|

CASH FLOWS RELATED TO INVESTING ACTIVITIES |

(313,051) |

(501,123) |

CONSOLIDATED STATEMENT OF CASH FLOWS

(CONTINUED)

|

(in thousands of euros) |

31/12/2023 |

31/12/2022 |

|

Capital increase |

4,096 |

3,404 |

|

Share buyback (capital decrease) |

|

(5) |

|

(Acquisition)/disposal of treasury shares |

633 |

(41) |

|

Borrowings issued |

1,028,541 |

1,191,102 |

|

Borrowings repaid |

(1,092,443) |

(847,812) |

|

Repayment of lease liabilities |

(36,516) |

(33,180) |

|

Net interest paid (2) |

(81,285) |

(38,908) |

|

Dividends payable |

(197,524) |

(191,061) |

|

Dividends payable to non-controlling interests |

(13,993) |

(11,303) |

|

Acquisition of financial assets: Renewable Energies division |

(14,627) |

(5,306) |

|

Other cash flows from financing operations |

8,502 |

(41,975) |

|

CASH FLOWS RELATED TO FINANCING ACTIVITIES |

(394,616) |

24,915 |

|

Impact of exchange rate changes |

(70,173) |

(14,733) |

|

Impact of change in accounting policies |

|

|

|

CHANGE IN CASH AND CASH EQUIVALENTS |

(215,222) |

(69,983) |

|

Cash flows from continuing operations |

|

|

|

Opening cash and cash equivalents (3) |

804,907 |

874,890 |

|

Change in cash and cash equivalents |

(215,222) |

(69,983) |

|

Closing cash and cash equivalents (3) |

589,685 |

804,907 |

|

Financial debt excluding lease liabilities |

(1,949,593) |

(2,091,108) |

|

Cash and cash equivalents net of financial debt |

(1,359,908) |

(1,286,201) |

(1) Including change in fair value of financial

instruments, IFRS 2 expense, goodwill (impairment), etc.(2)

Net financial interest paid includes the impacts related to

restatements of leases (IFRS 16).(3) Cash and cash equivalents

net of bank overdrafts.

|

(*) Breakdown of the impact of change in working

capital: |

|

|

Impact of change in inventories and work in progress |

(79,897) |

|

Impact of change in trade and other receivables |

(68,257) |

|

Impact of change in trade and other payables |

56,472 |

|

Impact of change in working capital |

(91,682) |

1 The Management Board, which met on 6 March

2024, approved the accounts for the 2023 financial year; these

accounts were examined by the Supervisory Board on 7 March 2024.

With regard to the process of certification of the accounts, the

Statutory Auditors have to date substantially completed their audit

procedures.

2 Excluding exceptional items among which, in

2022 one-off impact of the sale of the terminal in Turkey, items

related to Photosol acquisition, Haiti impairment and other

non-significant elements, and in 2023 amounts received related to

the positive outcome of an M&A-related litigation – See

Appendix for further details.

3 FX impact reaching €105m (€74m net), of which

€67m in Nigeria (of which €32m were included in the gross margin)

and €19m in Kenya.

4 Operating cash flow after net financial costs

and tax and before change in working capital.

5 Debt excluding Photosol SPV non-recourse

project debt; EBITDA excluding IFRS 16 – lease obligations – See

Appendix for further details.

6 LFL: Like-for-like i.e., excluding exceptional

items and FX effects.

7 LFL: Like-for-like i.e., excluding exceptional

items and FX effects.

8 RTB: Ready-to-build – Project fully permitted,

land and interconnection secured.

9 Acquisition is confirmed by project once the

RTB status is obtained.

10 Rubis Énergie constant scope – Baseline

2019.

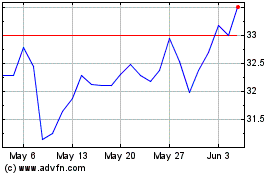

Rubis (EU:RUI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rubis (EU:RUI)

Historical Stock Chart

From Nov 2023 to Nov 2024