As Planned, the Accelerated Safeguard Plan

Will Be Presented to the Commercial Court in the Next Few

Days

Resumption of Trading on 29 June at Market

Opening

Regulatory News:

The court-appointed administrators have transmitted to the ORPEA

Group (Paris:ORP) the results of the vote of all classes of

affected parties on the draft accelerated safeguard plan, details

of which are set out in the annex to this press release.

Of the 10 classes of parties affected, 6 approved the draft

accelerated Safeguard Plan by the required majority (more than

2/3), 3 others, including the shareholders, supported the draft

accelerated Safeguard Plan by more than 50% and the OCEANE class

voted 49.2% in favor of the plan (50,8% against).

In the coming days, pursuant to the provisions of article L.

626-32 of the French Commercial Code, the Company will apply to the

Nanterre Commercial Court for approval of the accelerated safeguard

plan through a cross-class cram down.

If the Court considers that the legal conditions are met, ORPEA

could thus finalize its financial restructuring in the second half

of 2023, in accordance with its corporate interest. The Company

will then be able to pursue the implementation of its Refoundation

Plan.

Insofar as the accelerated safeguard plan has not been approved

by all classes of affected parties, and assuming that the plan is

approved by the Court, existing shareholders should hold, after

completion of the capital increases and in the absence of

reinvestment, around 0.04% of the Company's share capital. The

theoretical value of the shares would be around €0.02.

Under these conditions, the main characteristics of the capital

increases implemented as part of the financial restructuring plan

will be as follows (for further details on the terms and conditions

of the capital increases, investors are invited to refer to the

appendix to the Company's press release dated 26 May 2023):

1. The Equitisation Capital Increase

- Capital increase with shareholders' preferential subscription

rights, guaranteed by the Unsecured Creditors subscribing, where

applicable, by offsetting their claims

- Issue price : €0.0601 per new share

- Number of issued shares : 64,629,157,149

- Amount (share premium included) : €3,886,205,8751

- Percentage of ownership of existing shareholders who do not

contribute : around 0.1%

2. Groupement Capital Increase

- Capital increase with cancellation of preferential subscription

rights reserved for named investors, for the benefit of Caisse des

Dépôts et Consignations, Mutuelle Assurance Instituteurs de France

(MAIF), CNP Assurances and MACSF Epargne Retraite (or its

affiliates) (the « Groupement »), with, a priority right for

the shareholders2

- Issue price : €0.0178 per new share

- Number of issued shares : 65,173,064,696

- Amount (share premium included) : €1,160,080,552

- Percentage of ownership of existing shareholders who do not

contribute : 0.05%

3. Rights Issue

- Rights issue, to which the members of the Groupement have

undertaken to subscribe by exercising their preferential

subscription rights, for an amount of approximately 196 million

euros, the balance, i.e. approximately 194 million euros, being

backstopped by a group of 5 institutions holding a significant

share of the Company’s unsecured debt (the “SteerCo”)

- Issue price: €0.0133 per new share

- Number of issued shares : 29,324,787,415

- Amount (share premium included) : €390,019,673

- Percentage of ownership of existing shareholders who do not

contribute : 0.04%

Following the suspension of trading on 28 June 2023, all

financial instruments issued by ORPEA S.A. (shares, debt securities

and related instruments) will resume trading on Thursday 29 June

2023 at market opening.

APPENDIX - RESULTS OF THE VOTE OF THE

CLASSES OF AFFECTED PARTIES ON THE DRAFT ACCELERATED SAFEGUARD

PLAN

Class n°1 – Class of creditors secured by

the new money privilege (privilege de conciliation)

Results of votes

expressed

VOTING RIGHTS

TOTAL VOTES EXPRESSED

FOR

AGAINST

€1,936 million

€1,936 million

100%

€1,936 million

100%

-

0%

Class n°2 – Class of secured creditors

1

Results of votes

expressed

VOTING RIGHTS

TOTAL VOTES EXPRESSED

FOR

AGAINST

€1,666 million

€1,666 million

100%

€1,666 million

100%

-

0%

Class n°3 – Class of secured creditors

2

VOTING RIGHTS

TOTAL VOTES EXPRESSED

FOR

AGAINST

€320 million

€296

Million

93%

€256

million

86%

€40

Million

14%

Class n°4 – Class of secured creditors

3

VOTING RIGHTS

TOTAL VOTES EXPRESSED

FOR

AGAINST

€109 million

€109

million

100%

€109

million

100%

-

0%

Class n°5 – Class of secured tax and social

creditors

Results of votes

expressed

TOTAL VOTES EXPRESSED

FOR

AGAINST

100%

100%

-

Class n°6 – Class of public

creditors

Results of votes

expressed

It should be noted that in accordance with Article L. 626-30-2

paragraph 7 of the French Commercial Code, within a class, the vote

on the adoption of the plan may be replaced by an agreement which,

after consultation with its members, receives the approval of

two-thirds of the votes held by them.

To this end, the members of Class n°6 entered into an agreement

dated 23 May 2023 approving the draft accelerated safeguard plan

for the Company.

Class n°7 – Class of unsecured creditors

1

Results of votes

expressed

VOTING RIGHTS

TOTAL VOTES EXPRESSED

FOR

AGAINST

€ 3,135 million

€ 2,863 million

91%

€1,591

million

56%

€1,272

million

44%

Class n°7bis – Class of unsecured creditors

2

Results of votes

expressed

VOTING RIGHTS

TOTAL VOTES EXPRESSED

FOR

AGAINST

€523 million

€523

Million

100%

€276 million

53%

€247 million

47%

Class n°8 – Class of unsecured creditors

3

Results of votes

expressed

DROITS DE VOTE

TOTAL VOTES EXPRESSED

FOR

AGAINST

€509 million

€492

Million

97%

€242 million

49%

€250 million

51%

Class n°9 – Class of shareholders

Results of votes

expressed

Number of shares making up the capital: 64,693,851

Votes validly

expressed

For

%

Against

%

7,946,890

50.80%

7,695,835

49.20%

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 21 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https://www.orpea-group.com/en

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120 and CAC Mid 60 indices.

1 The maximum total amount (including share premium) of this

capital increase will be equal to (x) the total principal amount in

euros of the Company's unsecured indebtedness (i.e. 3,822,719,247

euros) plus (y) 70% of the total amount of accrued but not due

interest on the unsecured debt on or before 24 March 2023

(excluded), i.e. 24,871,699 euros and (z) the amount of accrued or

due interest on Unsecured Debt between 24 March 2023 (included) and

the date of adoption of the Accelerated Safeguard Plan by the

Specialized Commercial Court of Nanterre (included), i.e.

38,614,929 euros. Assuming that the Accelerated Safeguard Plan is

adopted by the Specialized Commercial Court of Nanterre on 24 July

2023 (i.e. at the end of the 4-month period following the date of

the judgment opening the Accelerated Safeguard Procedure on 24

March 2023), the maximum total amount of the capital increase would

therefore be 3,886,205,875 euros.

2 This priority right will only benefit shareholders existing

prior to the launch of the Equitisation Capital Increase and will

therefore not benefit unsecured creditors who may become

shareholders of the Company following the Equitisation Capital

Increase.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230628063857/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net Toll-free number for

shareholders: 0 805 480 480

Investor Relations NewCap Dusan Oresansky Tel.: 01

44 71 94 94 ORPEA@newcap.eu

Press Relations ORPEA Isabelle Herrier-Naufle

Press Relations Director Tel.: 07 70 29 53 74

i.herrier-naufle@orpea.net Image7 Charlotte Le Barbier //

Laurence Heilbronn 06 78 37 27 60 - 06 89 87 61 37

clebarbier@image7.fr lheilbronn@image7.fr

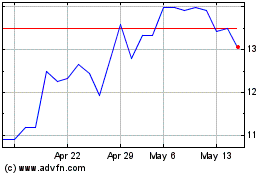

Orpea (EU:ORP)

Historical Stock Chart

From Apr 2024 to May 2024

Orpea (EU:ORP)

Historical Stock Chart

From May 2023 to May 2024