Nyrstar NV to exercise put option in NN2 for EUR 20 million

Regulated Information – Inside information –

Press release issued in the framework of article 7:97 BCCA

Nyrstar

NV to exercise put

option in NN2 for EUR 20 million

28 July 2022 at 07.00 CEST

Nyrstar NV (the “Company”) today advises

that it has completed its detailed review process in respect of the

decision whether or not to exercise the put option that the Company

has in relation to its entire 2% shareholding in NN2 NewCo Limited

(“NN2”), which holds the former Nyrstar operational

group, entitling it to sell such 2% to Nyrstar Holdings Plc (or

another member of the Trafigura group) for a fixed amount

of EUR 20 million (the “Put Option”). The review

process started in the fourth quarter of 2021 in light of the Put

Option’s expiry date on 31 July 2022.

Considering the independent expert report

prepared by Moore Corporate Finance, which values the 2%

shareholding in NN2 in a range of EUR 0 million to EUR 3.4 million,

the opinion of the independent directors of the Company, questions

and comments raised by certain minority shareholders and other

information made available to it, the Company believes it is in its

corporate benefit to exercise the Put Option. Further, the exercise

of the Put Option limits the Company’s liquidity risks for the

foreseeable future and avoids insolvency that would, on the basis

of current projections, have arisen in the second quarter of 2023.

A full summary of the background, the process followed and the

summary of the analysis is made below. The Company informs that it

will exercise the Put Option before the expiry on 31 July 2022.

Background

In October 2018, the former Nyrstar group

initiated a review of its capital structure (the "Capital Structure

Review") in response to the challenging financial and operating

conditions being faced by the Nyrstar group. The Capital Structure

Review identified a very substantial additional funding requirement

that the Nyrstar group was unable to meet without a material

reduction of the Nyrstar group's indebtedness. Consequently, the

Capital Structure Review necessitated negotiations between the

Nyrstar group's financial creditors that ultimately resulted in the

restructuring of the Nyrstar group, which became effective on 31

July 2019 (the “Restructuring”). As a result of the Restructuring,

Trafigura Group Pte. Ltd., via its indirect 98% ownership of the

new holding company NN2, became the ultimate parent company of the

former (direct and indirect) subsidiaries of the Company (the

"Operating Group”), with the remaining 2% stake in NN2 (and thereby

the Operating Group) being owned by the Company.

The lock-up agreement (“Lock-Up Agreement”)

entered into on 14 April 2019 between, among others, the Company

and representatives of its key financial creditor groups, envisaged

that the Company, Trafigura Pte Ltd (“Trafigura”) and Nyrstar

Holdings Limited ("Nyrstar Holdings", a Trafigura special-purpose

vehicle incorporated, amongst other things, for the purpose of

implementing the Restructuring, now known as Nyrstar Holdings Plc)

would enter into a deed confirming their agreement in respect of

(i) certain steps necessary for the implementation of the

restructuring as envisaged in the Lock-Up Agreement and (ii) the

terms of the ongoing relationship between the Company and the

Trafigura group (the "NNV-Trafigura Deed"). The NNV-Trafigura Deed

was duly executed on 19 June 2019.

Pursuant to the NNV-Trafigura Deed, the Company

and Trafigura also agreed that Trafigura granted an option to the

Company to require Nyrstar Holdings(or another Trafigura entity) to

purchase the Company's entire interest in NN2. The terms of this

option are set out in a separate deed, dated 25 June 2019, between

the Company, Trafigura and Nyrstar Holdings (the "Put Option

Deed"). Under the terms of the Put Option Deed, the Company can put

all (but not only a part) of its 2% holding in NN2 to Trafigura at

a price equal to EUR 20 million (subject to any applicable

mandatory regulatory conditions to the sale being satisfied).

The Put Option served to give liquidity to the Company for, and

enhance and crystallise the value of, an otherwise illiquid 2%

minority holding in NN2, a non-listed company, in the corporate

benefit of the Company. The Put Option can be exercised by the

Company until 31 July 2022.

Report by Independent

Directors

As a result of Urion Holdings (Malta) Ltd, a

subsidiary of Trafigura B.V., holding 24,42% in the Company and

also indirectly controlling Nyrstar Holdings, Nyrstar Holdings

constitutes a related party of the Company in the meaning of IAS 24

such that article 7:97 of the Belgian Code of Companies and

Associations (the “BCCA”) applies to the decision whether or not to

exercise the Put Option.

On 18 November 2021, the Company announced that

it had appointed Moore Corporate Finance, to prepare an independent

expert’s opinion (the “Expert Report”) for the independent

directors of the Company (“Committee of Independent Directors”), in

the framework of article 7:97 BCCA. The independent expert’s

opinion was to advise the Committee of Independent Directors in

examining the benefit to the Company, taking all relevant

circumstances into account, of the exercise or non-exercise of the

Put Option that the Company has in relation to its (entire) 2%

investment in NN2. In making its decision on whether or not

to exercise the Put Option, the Committee of Independent Directors

was to also duly consider any substantiated third-party bids,

including of the Company’s shareholders other than Trafigura and/or

of other stakeholders and third parties, that it may receive in

respect of the 2% shareholding in NN2. Any such bids for the 2%

shareholding in NN2 were requested to be addressed to the Company

prior to 15 February 2022. As advised by the Company in the annual

report and financial statements issued on 13 April 2022, via a

press release on 27 May 2022 and at the annual general shareholders

meeting on 28 June 2022, the Company has not received any bids.

Moore Corporate Finance was asked to advise on

the following:

- The current valuation of the Operating Group and the equity

value to be assessed for the Company’s 2% equity interest in

NN2.

- The financial consequences of (not) exercising the Put Option

for the Company and possible other consequences related to such

decision.

- Benefits and disadvantages for the Company if the Board

resolves to exercise the Put Option, including considering the

alternative investments that the Board could consider pursuing with

the proceeds of the Put Option. In doing so, the expert was

instructed to consider the financial viability of the Company over

at least the next 24 months, after date of issuance of the Expert

Report if it decides to not exercise the Put Option.

- The potential outcomes under the alternative options to the

exercise of the Put Option, including the ability of the Company to

sell the 2% stake in NN2 to a third party and the likely sales

proceeds that the Company may be able to generate from such a

sale.

In preparing the Expert Report, Moore Corporate

Finance has reviewed the information made available by Nyrstar and

by the Operating Group to conduct the valuation of the Operating

Group and was given the opportunity to request additional

information and engage in a question-and-answer process with both

Nyrstar and the Operating Group. In addition, Moore Corporate

Finance has, among other things, reviewed certain publicly

available business and historic financial information relating to

the Company and the Operating Group as well as other market data to

test the robustness and reasonableness of the information and

projections provided by the Company and the Operating Group

management. Moore Corporate Finance has confirmed that it

found no indication to doubt the reliability of the information

provided. The information was requested pursuant to the

information rights granted to the Company by Trafigura in the

framework of the Restructuring and stored in an electronic data

room. The Committee of Independent Directors requested the

Company’s management to facilitate this process and monitored that

BDO, the Company’s statutory auditor, was duly informed early in

the process and was given the opportunity to raise questions,

including with Moore Corporate Finance.

As part of the review process, the Company’s

management assessed the amounts that would be repayable under the

Company’s EUR 13.5 million Limited Recourse Loan Facility (“LRLF”)

with NN2 if the decision of the Board were to exercise the Put

Option. This assessment of the repayment obligations of the

LRLF was shared with Moore Corporate Finance. It is noted that

there are limited recourse provisions in the LRLF which limit

the Company’s obligations to make any repayments under the LRLF and

NN2’s recourse to the Company, to the extent of the Company ’s net

assets (as defined in the LRLF). . It has been concluded by

the Company’s analysis of the LRLF that there will be no immediate

repayment obligation of the EUR 9.8 million that is currently

outstanding under the LRLF, nor for the foreseeable future given

the current and forecast value of the Company’s net assets (as

defined in the LRLF). The Company will continue to monitor the

development of its net asset position to consider whether any

repayment of the LRLF would be needed.

Certain minority shareholders have raised

questions and comments in the framework of the Put Option for Moore

Corporate Finance at the occasion of the Company’s annual

shareholders meeting on 28 June 2022 (see minutes on the Company’s

website). The Committee of Independent Directors has considered

these questions and also ensured that these questions and comments

were passed to Moore Corporate Finance and/or considered by the

Company’s management in the memoranda prepared by management for

the Committee of Independent Directors.

The Expert Report concluded that the benefits

for the Company of exercising the Put Option is a degree of

financial security considering that its valuation shows that the

strike price of the Put Option (EUR 20 million) by far exceeds its

valuation of the 2% holding in NN2 (which lies in a range of EUR 0

million to EUR 3.4 million as at 31 May 2022). This in turn

limits the Company’s liquidity risks for the foreseeable future and

avoids insolvency that would risk, on the basis of current

projections, to arise in the second quarter of 2023. Further, based

on the valuation, the exercise of the Put Option for EUR 20 million

is significantly higher than the amount a third party would be

likely willing to pay. The disadvantages are that the Company’s

major asset will be realised and thus its activity will now consist

in managing the proceeds of the Put Option and the management of

the ongoing legal and other regulatory proceedings. The

Expert Report lists a number of investments for the Company that

are suited in such circumstances, which the Board of Directors is

considering.Decision to exercise the Put

Option

The Committee of Independent Directors has

considered the Expert Report, as well as the information provided

by the Company’s management when evaluating the decision whether or

not to exercise the Put Option as well as the comments raised by

certain minority shareholders at the occasion of the latest annual

shareholders meeting. On this basis, the Committee of Independent

Directors has advised the Company’s board of directors on the

exercise or non-exercise of the Put Option in accordance with

article 7:97 of the BCCA.

The key conclusions from the detailed review

conducted by the Committee of Independent Directors in accordance

with article 7:97 of the BCCA which were material for the decision

by the Company to exercise the Put Option are summarised as

follows:

- The valuation performed by Moore Corporate Finance shows that

the fair market valuation of the Company’s 2% equity interest is in

the range of EUR 0 million to EUR 3.4 million as at 31 May 2022.

This valuation is substantially below the EUR 20 million exercise

price of the Put Option. The amount of EUR 20 million that the

Company would receive upon exercising the Put Option would thus

result in a clear financial advantage to the Company compared to

not exercising it. The Put Option expires on 31 July

2022.

- The exercise of the Put Option would result in the cancellation

of NN2’s commitments under the LRLF and the requirement for

repayment of certain amounts outstanding thereunder (subject to the

limited recourse provisions). The net effect of any

obligation to repay amounts under the LRLF would be to reduce the

portion of the EUR 20 million proceeds received from the exercise

of the Put Option available for use by the Company. However,

the limited recourse provisions of the LRLF result in the Company

not being required to pay amounts under the LRLF to the

extent it would not have sufficient Company net assets (as defined

in the LRLF). This allows deduction of the Company’s non-LRLF

liabilities (including its contingent liabilities), which are

broadly defined. (The Company net assets are defined in the LRLF

and such definition is unrelated to IFRS or Belgian GAAP rules and

reporting).

As long as the Company net asset position,

calculated on the basis of the provisions of the LRLF, remains

negative, the EUR 20 million that the Company will receive upon

exercising the Put Option (and the sale completing subject to any

applicable mandatory regulatory conditions being satisfied) will

therefore not be required to be used towards repayment of the LRLF.

However, exercising the Put Option would terminate the provision of

certain ongoing operational and administrative services under the

LRLF (the “Ongoing Services”). The effect of the latter would be

minimal as the Ongoing Services period also automatically expires

on 31 July 2022.

- As a result of the limited recourse provisions in the

LRLF, the exercise of the Put Option provides the Company with

sufficient headroom to cover its expected near-term costs and

consider appropriate use for the net proceeds In this context,

however, and as noted above, the Company will continue to monitor

the development of its Company Net Asset position to consider

whether any repayment of the LRLF needs to be made in accordance

with its terms.

- The consequence of exercising the Put Option (and the sale

completing subject to any applicable mandatory regulatory

conditions being satisfied) will result in the Company forfeiting

the opportunity to receive future dividends from NN2, if any, and

will result in the Company no longer having the option to dispose

of the Company’s 2% equity interest in NN2 to a third party or

Trafigura at a potentially higher price than the Put Option

exercise price of EUR 20 million. The Company has assessed

the probability of not exercising the Put Option and instead

waiting until a future moment in time when the value of the

Company’s 2% equity interest would exceed EUR 20 million or a third

party or Trafigura would offer more. The Company considers,

based on the Expert Report and lack of interest shown, including by

sector players, that this seems a very unlikely hypothesis as the

Company has already approached the market to learn whether there

would be a possibility of any substantiated third-party bids and

did not receive any bids since the announcement in its press

release on 18 November 2021.

- Importantly, the proposition not to exercise the Put Option

before it is set to expire on 31 July 2022 would likely place the

Company in insolvency during H1 2023 as the Company’s liquidity

forecasts, in the absence of the EUR 20 million of Put Option

proceeds, show the Company becoming illiquid in Q2 2023.

The opinion of the Committee of Independent

Directors is therefore as follows:

On the basis of the considerations set out

above, including the Expert Report, the information provided [by

management] in Annex 2 as well as the comments made by minority

shareholders, the Committee is of the opinion that the decision to

exercise the Put Option is not such as to imply a disadvantage to

the Company that, in light of its current policies, would be

manifestly illegitimate.

Furthermore, the Committee is of the opinion

that it is unlikely that the decision to exercise the Put Option

would lead to disadvantages for the Company which will not be

outweighed by the benefits for the Company of such decision.

The Company’s statutory auditor, BDO, has

reviewed the Expert Report, the report by the Committee and the

minutes of the Board of Directors of the Company in accordance with

article 7:97 BCCA and its assessment is as follows.

Based on our review, nothing has come to our

attention that causes us to believe that the financial and

accounting data reported in the advice of the committee of

independent directors dated 27 July 2022 and in the minutes of the

administrative body dated 27 July 2022, which justify the proposed

transaction, are not consistent, in all material respects, compared

to the information we have in the context of our assignment as

statutory auditor of Nyrstar NV.

Our assignment is solely executed for the

purposes described in article 7:97 of the Code of Companies and

Associations and therefore our report is not to be used for any

other purpose.

The Expert Report, the report by the Committee

and BDO’s report are all available on the Company’s website:

https://www.nyrstar.be/en/investors/results-reports-and-presentations/2022

About Nyrstar

NV

The Company is incorporated

in Belgium and, following completion of the

recapitalisation/restructuring has a 2% shareholding in

the Nyrstar group. The Company is listed on Euronext

Brussels under the symbol NYR. For further information please visit

the Nyrstar website: www.nyrstar.be.

About Moore Corporate

Finance

Moore Corporate Finance is the largest

independent professional services provider in Belgium. Moore

Corporate Finance provides services in the areas of Accountancy,

Audit, Business Analytics, Business Consulting, Corporate Finance,

Interim Management and Tax & Legal Services. As a member of

Moore Global – a global accounting and consulting network – Moore

Corporate Finance assists its clients in more than 100 countries.

More information about Moore Corporate Finance can be found at

www.moore.be

For further information

contact:

Anthony

Simms - Head of External

Affairs & Legal

anthony.simms@nyrstar.com

Regulated Information – Inside information – Press release

issued in the framework of article 7:97 BCCANyrstar NV to exercise

put option in NN2 for EUR 20 million28 July 2022 at 07.00

CESTNyrstar NV (the “Company”) today advises that it has completed

its detailed review process in respect of the decision whether or

not to exercise the put option that the Company has in relation to

its entire 2% shareholding in NN2 NewCo Limited (“NN2”), which

holds the former Nyrstar operational group, entitling it to sell

such 2% to Nyrstar Holdings Plc (or another member of the Trafigura

group) for a fixed amount of EUR 20 million (the “Put Option”). The

review process started in the fourth quarter of 2021 in light of

the Put Option’s expiry date on 31 July 2022.Considering the

independent expert report prepared by Moore Corporate Finance,

which values the 2% shareholding in NN2 in a range of EUR 0 million

to EUR 3.4 million, the opinion of the independent directors of the

Company, questions and comments raised by certain minority

shareholders and other information made available to it, the

Company believes it is in its corporate benefit to exercise the Put

Option. Further, the exercise of the Put Option limits the

Company’s liquidity risks for the foreseeable future and avoids

insolvency that would, on the basis of current projections, have

arisen in the second quarter of 2023. A full summary of the

background, the process followed and the summary of the analysis is

made below. The Company informs that it will exercise the Put

Option before the expiry on 31 July 2022.BackgroundIn October 2018,

the former Nyrstar group initiated a review of its capital

structure (the "Capital Structure Review") in response to the

challenging financial and operating conditions being faced by the

Nyrstar group. The Capital Structure Review identified a very

substantial additional funding requirement that the Nyrstar group

was unable to meet without a material reduction of the Nyrstar

group's indebtedness. Consequently, the Capital Structure Review

necessitated negotiations between the Nyrstar group's financial

creditors that ultimately resulted in the restructuring of the

Nyrstar group, which became effective on 31 July 2019 (the

“Restructuring”). As a result of the Restructuring, Trafigura Group

Pte. Ltd., via its indirect 98% ownership of the new holding

company NN2, became the ultimate parent company of the former

(direct and indirect) subsidiaries of the Company (the "Operating

Group”), with the remaining 2% stake in NN2 (and thereby the

Operating Group) being owned by the Company.The lock-up agreement

(“Lock-Up Agreement”) entered into on 14 April 2019 between, among

others, the Company and representatives of its key financial

creditor groups, envisaged that the Company, Trafigura Pte Ltd

(“Trafigura”) and Nyrstar Holdings Limited ("Nyrstar Holdings", a

Trafigura special-purpose vehicle incorporated, amongst other

things, for the purpose of implementing the Restructuring, now

known as Nyrstar Holdings Plc) would enter into a deed confirming

their agreement in respect of (i) certain steps necessary for the

implementation of the restructuring as envisaged in the Lock-Up

Agreement and (ii) the terms of the ongoing relationship between

the Company and the Trafigura group (the "NNV-Trafigura Deed"). The

NNV-Trafigura Deed was duly executed on 19 June 2019.Pursuant to

the NNV-Trafigura Deed, the Company and Trafigura also agreed that

Trafigura granted an option to the Company to require Nyrstar

Holdings(or another Trafigura entity) to purchase the Company's

entire interest in NN2. The terms of this option are set out in a

separate deed, dated 25 June 2019, between the Company, Trafigura

and Nyrstar Holdings (the "Put Option Deed"). Under theterms of the

Put Option Deed, the Company can put all (but not only a part) of

its 2% holding in NN2 to Trafigura at a price equal to EUR 20

million (subject to any applicable mandatory regulatory conditions

to the sale being satisfied). The Put Option served to give

liquidity to the Company for, and enhance and crystallise the value

of, an otherwise illiquid 2% minority holding in NN2, a non-listed

company, in the corporate benefit of the Company. The Put Option

can be exercised by the Company until 31 July 2022.Report by

Independent DirectorsAs a result of Urion Holdings (Malta) Ltd, a

subsidiary of Trafigura B.V., holding 24,42% in the Company and

also indirectly controlling Nyrstar Holdings, Nyrstar Holdings

constitutes a related party of the Company in the meaning of IAS 24

such that article 7:97 of the Belgian Code of Companies and

Associations (the “BCCA”) applies to the decision whether or not to

exercise the Put Option.On 18 November 2021, the Company announced

that it had appointed Moore Corporate Finance, to prepare an

independent expert’s opinion (the “Expert Report”) for the

independent directors of the Company (“Committee of Independent

Directors”), in the framework of article 7:97 BCCA. The independent

expert’s opinion was to advise the Committee of Independent

Directors in examining the benefit to the Company, taking all

relevant circumstances into account, of the exercise or

non-exercise of the Put Option that the Company has in relation to

its (entire) 2% investment in NN2. In making its decision on

whether or not to exercise the Put Option, the Committee of

Independent Directors was to also duly consider any substantiated

third-party bids, including of the Company’s shareholders other

than Trafigura and/or of other stakeholders and third parties, that

it may receive in respect of the 2% shareholding in NN2. Any such

bids for the 2% shareholding in NN2 were requested to be addressed

to the Company prior to 15 February 2022. As advised by the Company

in the annual report and financial statements issued on 13 April

2022, via a press release on 27 May 2022 and at the annual general

shareholders meeting on 28 June 2022, the Company has not received

any bids.Moore Corporate Finance was asked to advise on the

following:i. The current valuation of the Operating Group and the

equity value to be assessed for the Company’s 2% equity interest in

NN2.ii. The financial consequences of (not) exercising the Put

Option for the Company and possible other consequences related to

such decision.iii. Benefits and disadvantages for the Company if

the Board resolves to exercise the Put Option, including

considering the alternative investments that the Board could

consider pursuing with the proceeds of the Put Option. In doing so,

the expert was instructed to consider the financial viability of

the Company over at least the next 24 months, after date of

issuance of the Expert Report if it decides to not exercise the Put

Option.iv. The potential outcomes under the alternative options to

the exercise of the Put Option, including the ability of the

Company to sell the 2% stake in NN2 to a third party and the likely

sales proceeds that the Company may be able to generate from such a

sale.In preparing the Expert Report, Moore Corporate Finance has

reviewed the information made available by Nyrstar and by the

Operating Group to conduct the valuation of the Operating Group and

was given the opportunity to request additional information and

engage in a question-and-answer process with both Nyrstar and the

Operating Group. In addition, Moore Corporate Finance has, among

other things, reviewed certain publicly available business and

historic financial information relating to the Company and the

Operating Group as well as other market data to test the robustness

and reasonableness of the information and projections provided by

the Company and the Operating Group management. Moore Corporate

Finance has confirmed that it found no indication to doubt the

reliability of the information provided. The information was

requested pursuant to the information rights granted tothe Company

by Trafigura in the framework of the Restructuring and stored in an

electronic data room. The Committee of Independent Directors

requested the Company’s management to facilitate this process and

monitored that BDO, the Company’s statutory auditor, was duly

informed early in the process and was given the opportunity to

raise questions, including with Moore Corporate Finance.As part of

the review process, the Company’s management assessed the amounts

that would be repayable under the Company’s EUR 13.5 million

Limited Recourse Loan Facility (“LRLF”) with NN2 if the decision of

the Board were to exercise the Put Option. This assessment of the

repayment obligations of the LRLF was shared with Moore Corporate

Finance. It is noted that there are limited recourse provisions in

the LRLF which limit the Company’s obligations to make any

repayments under the LRLF and NN2’s recourse to the Company, to the

extent of the Company ’s net assets (as defined in the LRLF). . It

has been concluded by the Company’s analysis of the LRLF that there

will be no immediate repayment obligation of the EUR 9.8 million

that is currently outstanding under the LRLF, nor for the

foreseeable future given the current and forecast value of the

Company’s net assets (as defined in the LRLF). The Company will

continue to monitor the development of its net asset position to

consider whether any repayment of the LRLF would be needed.Certain

minority shareholders have raised questions and comments in the

framework of the Put Option for Moore Corporate Finance at the

occasion of the Company’s annual shareholders meeting on 28 June

2022 (see minutes on the Company’s website). The Committee of

Independent Directors has considered these questions and also

ensured that these questions and comments were passed to Moore

Corporate Finance and/or considered by the Company’s management in

the memoranda prepared by management for the Committee of

Independent Directors.The Expert Report concluded that the benefits

for the Company of exercising the Put Option is a degree of

financial security considering that its valuation shows that the

strike price of the Put Option (EUR 20 million) by far exceeds its

valuation of the 2% holding in NN2 (which lies in a range of EUR 0

million to EUR 3.4 million as at 31 May 2022). This in turn limits

the Company’s liquidity risks for the foreseeable future and avoids

insolvency that would risk, on the basis of current projections, to

arise in the second quarter of 2023. Further, based on the

valuation, the exercise of the Put Option for EUR 20 million is

significantly higher than the amount a third party would be likely

willing to pay. The disadvantages are that the Company’s major

asset will be realised and thus its activity will now consist in

managing the proceeds of the Put Option and the management of the

ongoing legal and other regulatory proceedings. The Expert Report

lists a number of investments for the Company that are suited in

such circumstances, which the Board of Directors is

considering.Decision to exercise the Put OptionThe Committee of

Independent Directors has considered the Expert Report, as well as

the information provided by the Company’s management when

evaluating the decision whether or not to exercise the Put Option

as well as the comments raised by certain minority shareholders at

the occasion of the latest annual shareholders meeting. On this

basis, the Committee of Independent Directors has advised the

Company’s board of directors on the exercise or non-exercise of the

Put Option in accordance with article 7:97 of the BCCA.The key

conclusions from the detailed review conducted by the Committee of

Independent Directors in accordance with article 7:97 of the BCCA

which were material for the decision by the Company to exercise the

Put Option are summarised as follows:I. The valuation performed by

Moore Corporate Finance shows that the fair market valuation of the

Company’s 2% equity interest is in the range of EUR 0 million to

EUR 3.4 million as at 31 May 2022. This valuation is substantially

below the EUR 20 million exercise price of the PutOption. The

amount of EUR 20 million that the Company would receive upon

exercising the Put Option would thus result in a clear financial

advantage to the Company compared to not exercising it. The Put

Option expires on 31 July 2022. II. The exercise of the Put Option

would result in the cancellation of NN2’s commitments under the

LRLF and the requirement for repayment of certain amounts

outstanding thereunder (subject to the limited recourse

provisions). The net effect of any obligation to repay amounts

under the LRLF would be to reduce the portion of the EUR 20 million

proceeds received from the exercise of the Put Option available for

use by the Company. However, the limited recourse provisions of the

LRLF result in the Company not being required to pay amounts under

the LRLF to the extent it would not have sufficient Company net

assets (as defined in the LRLF). This allows deduction of the

Company’s non-LRLF liabilities (including its contingent

liabilities), which are broadly defined. (The Company net assets

are defined in the LRLF and such definition is unrelated to IFRS or

Belgian GAAP rules and reporting).As long as the Company net asset

position, calculated on the basis of the provisions of the LRLF,

remains negative, the EUR 20 million that the Company will receive

upon exercising the Put Option (and the sale completing subject to

any applicable mandatory regulatory conditions being satisfied)

will therefore not be required to be used towards repayment of the

LRLF. However, exercising the Put Option would terminate the

provision of certain ongoing operational and administrative

services under the LRLF (the “Ongoing Services”). The effect of the

latter would be minimal as the Ongoing Services period also

automatically expires on 31 July 2022.III. As a result of the

limited recourse provisions in the LRLF, the exercise of the Put

Option provides the Company with sufficient headroom to cover its

expected near-term costs and consider appropriate use for the net

proceeds In this context, however, and as noted above, the Company

will continue to monitor the development of its Company Net Asset

position to consider whether any repayment of the LRLF needs to be

made in accordance with its terms.IV. The consequence of exercising

the Put Option (and the sale completing subject to any applicable

mandatory regulatory conditions being satisfied) will result in the

Company forfeiting the opportunity to receive future dividends from

NN2, if any, and will result in the Company no longer having the

option to dispose of the Company’s 2% equity interest in NN2 to a

third party or Trafigura at a potentially higher price than the Put

Option exercise price of EUR 20 million. The Company has assessed

the probability of not exercising the Put Option and instead

waiting until a future moment in time when the value of the

Company’s 2% equity interest would exceed EUR 20 million or a third

party or Trafigura would offer more. The Company considers, based

on the Expert Report and lack of interest shown, including by

sector players, that this seems a very unlikely hypothesis as the

Company has already approached the market to learn whether there

would be a possibility of any substantiated third-party bids and

did not receive any bids since the announcement in its press

release on 18 November 2021.V. Importantly, the proposition not to

exercise the Put Option before it is set to expire on 31 July 2022

would likely place the Company in insolvency during H1 2023 as the

Company’s liquidity forecasts, in the absence of the EUR 20 million

of Put Option proceeds, show the Company becoming illiquid in Q2

2023.The opinion of the Committee of Independent Directors is

therefore as follows:On the basis of the considerations set out

above, including the Expert Report, the information provided [by

management] in Annex 2 as well as the comments made by minority

shareholders, the Committee is of the opinion that the decision to

exercise the Put Option is not such as to imply a disadvantage to

the Company that, in light of its current policies, would be

manifestly illegitimate.Furthermore, the Committee is of the

opinion that it is unlikely that the decision to exercise the Put

Option would lead to disadvantages for the Company which will not

be outweighed by the benefits for the Company of such decision.The

Company’s statutory auditor, BDO, has reviewed the Expert Report,

the report by the Committee and the minutes of the Board of

Directors of the Company in accordance with article 7:97 BCCA and

its assessment is as follows.Based on our review, nothing has come

to our attention that causes us to believe that the financial and

accounting data reported in the advice of the committee of

independent directors dated 27 July 2022 and in the minutes of the

administrative body dated 27 July 2022, which justify the proposed

transaction, are not consistent, in all material respects, compared

to the information we have in the context of our assignment as

statutory auditor of Nyrstar NV.Our assignment is solely executed

for the purposes described in article 7:97 of the Code of Companies

and Associations and therefore our report is not to be used for any

other purpose.The Expert Report, the report by the Committee and

BDO’s report are all available on the Company’s website:

https://www.nyrstar.be/en/investors/results-reports-and-presentations/2022About

Nyrstar NVThe Company is incorporated in Belgium and, following

completion of the recapitalisation/restructuring has a 2%

shareholding in the Nyrstar group. The Company is listed on

Euronext Brussels under the symbol NYR. For further information

please visit the Nyrstar website: www.nyrstar.be.About Moore

Corporate FinanceMoore Corporate Finance is the largest independent

professional services provider in Belgium. Moore Corporate Finance

provides services in the areas of Accountancy, Audit, Business

Analytics, Business Consulting, Corporate Finance, Interim

Management and Tax & Legal Services. As a member of Moore

Global – a global accounting and consulting network – Moore

Corporate Finance assists its clients in more than 100 countries.

More information about Moore Corporate Finance can be found at

www.moore.beFor further information contact:Anthony Simms - Head of

External Affairs & Legal anthony.simms@nyrstar.com

- Nyrstar NV Put Option declaration 28072022

ENGLISH(261175987.1)

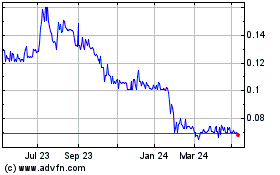

Nyrstar NV (EU:NYR)

Historical Stock Chart

From Nov 2024 to Dec 2024

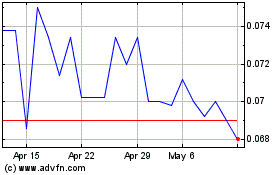

Nyrstar NV (EU:NYR)

Historical Stock Chart

From Dec 2023 to Dec 2024