NN Group Offers $2.7 Billion for Delta Lloyd

October 05 2016 - 3:00AM

Dow Jones News

NN Group NV said Wednesday it plans to offer €2.4 billion ($2.7

billion) to buy fellow Dutch financial services group Delta Lloyd

NV in a move it says would create a leader in the country's

pensions, insurance and banking sectors.

NN is offering €5.30 a share for Delta Lloyd, a 29% premium to

Delta Lloyd's latest closing price.

"We believe there is a clear and compelling logic to bring

consolidation to the Dutch insurance market through a combination

of the businesses of NN Group and Delta Lloyd in a way that

benefits both companies and their stakeholders," said NN Chief

Executive Lard Friese.

"The combination will be a leading player in the Dutch

insurance, banking and asset management markets, with a strong

international presence, which will benefit from economies of scale

and significant free cash flow generation potential, and offer an

array of attractive products and services to customers," he

said.

NN Group was formerly part of Dutch bank ING Groep NV, but split

from the company in 2014 and was floated on the Dutch stock

exchange in the same year.

Delta Lloyd operates in insurance, pensions, investment and

banking, under the Delta Lloyd, ABN Amro Insurance, BeFrank and

OHRA brands.

Write to Rory Gallivan at rory.gallivan@wsj.com

(END) Dow Jones Newswires

October 05, 2016 02:45 ET (06:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

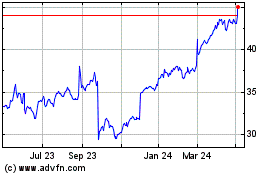

NN Group NV (EU:NN)

Historical Stock Chart

From Dec 2024 to Jan 2025

NN Group NV (EU:NN)

Historical Stock Chart

From Jan 2024 to Jan 2025