PRESS RELEASE: NACON: ACQUISITION OF THE REMAINING CAPITAL OF LUNAR GREAT WALL STUDIOS / ISSUANCE OF NEW SHARES IN CONNECTION WITH THE ACQUISITION OF BIG ANT STUDIOS

September 29 2021 - 2:06PM

PRESS RELEASE: NACON: ACQUISITION OF THE REMAINING CAPITAL OF LUNAR

GREAT WALL STUDIOS / ISSUANCE OF NEW SHARES IN CONNECTION WITH THE

ACQUISITION OF BIG ANT STUDIOS

Press

release

Lesquin, 29 September 2021 18:00hrs

ACQUISITION OF THE

REMAINING CAPITAL

OFLUNAR

GREAT

WALL

STUDIOS

ISSUANCE OF NEW SHARES IN CONNECTION WITH

THE ACQUISITION OF BIG

ANT

STUDIOS

Nacon (the "Company") today

announces that it has reached an agreement with the partners of the

Milan-based Italian video game studio Lunar Great Wall Studios to

acquire 46.85% of the studio's share capital, bringing the

Company's ownership to a 100% shareholding; Nacon has also issued

new shares in connection with the acquisition of the Australian

video game studio Big Ant Studios

-

Acquisition of

100% of

Lunar

Great

Walls

Studios

After acquiring a 43.15% stake in Lunar Great

Wall Studios better known under its trade name "RaceWard Studio" on

July 27, 2019, Nacon had acquired an additional 10.00% on October

19, 2020 from Marco Ponte, founding manager of the studio.

Nacon today announced that it has reached an

agreement with the partners of the video game studio Lunar Great

Wall Studios to acquire the remaining equity from them in order to

increase its ownership to 100% of the studios’ share capital.

Lunar Great Wall Studios developed the RiMs

Racing game for the Nacon Group, a realistic and ambitious

motorcycle racing simulation that introduces many new game

mechanics for the genre.

- Issuance

of new shares in

connection with

the acquisition

of Big Ant Studios

On January 21, 2021, the Company announced the

acquisition of Big Ant Studios, a leading Australian video game

studio in major sports such as rugby, tennis and cricket. As

specified in the terms of the transaction, the acquisition

agreement provided for the payment of earnouts based on performance

criteria to the selling partners.

Given the strong performance of Big Ant Studios,

some of the performance criteria previously established have been

met. The selling partners of Big Ant Studios have decided to

reinvest half of their earn-outs in the capital of the Company.

Thus, the Board of Directors of the Company has

decided today, using the delegation of authority granted to it by

the General Meeting of the Company on July 30, 2021 under the terms

of its 15th resolution and in accordance with the provisions of

article L. 411-2 1° of the French Monetary and Financial Code, an

issue without preferential subscription rights of 337,208 new

ordinary shares of the Company, representing approximately 0.4% of

the existing share capital of the Company, at a price per share of

4.93 euros including the issue premium (the

"Transaction"). The subscription

price for the Transaction does not involve any discount to the

average closing price of Nacon shares over the 20 trading days

preceding its determination.

For Alain Falc, Chairman and CEO of the Company,

"This reinvestment of a portion of their earn-out payment by the

Big Ant Studios selling partners is a sign of their strong support

and confidence in the Company ».

Following the Transaction, the share capital of

the Company will amount to € 86,291,410 divided into 86,291,410

ordinary shares of one (1) euro nominal value each.

The settlement-delivery of the new ordinary

shares issued in the context of the Transaction and their admission

to trading on the regulated market of Euronext in Paris are

scheduled for October 31, 2021.

The impact of the Transaction on the

distribution of the Company's share capital is as

follows :

|

Shareholders |

Before

implementationof

the Transaction |

After

implementation of the

Transaction |

|

Shares |

% of

capital |

Shares |

% of

capital |

|

Bigben Interactive |

65,097,988 |

75.74 |

65,097,988 |

75.44 |

|

Bpifrance

Investissement |

1,818,181 |

2.12 |

1,818,181 |

2.11 |

|

CDC Croissance |

2,169,600 |

2.52 |

2,169,600 |

2.51 |

|

Public |

16,868,433 |

19.62 |

17,205,641 |

19.94 |

|

Total |

85,954,202 |

100.00 |

86,291,410 |

100.00 |

By way of illustration, the shareholding of a

shareholder holding 1.00% of the Company's share capital, prior to

the issue of new shares, amounts to 0.996% after the

Transaction.

In accordance with the provisions of article

211-3 of the General Regulations of the Autorité des Marchés

Financiers, the issue of new ordinary shares of the Company in the

context of an offer referred to in paragraph 1° of article L. 411-2

of the French Monetary and Financial Code, has not led to a

prospectus submitted for approval to the Autorité des Marchés

Financiers.

Detailed information about the Company,

including its business, results and related risk factors, can be

found in the annual financial report for the year ended March 31,

2021, which, together with other regulated information and all of

the Company's press releases, is available on its website

(https://corporate.nacongaming.com/).

Upcoming

events:Q2 2021/22

sales: 25 October 2021, Press release after close of the

Paris stock exchange

* * *

|

ABOUT

NACON |

|

2020-21

ANNUAL SALES177.8

M€ HEADCOUNTOver 600

employees INTERNATIONAL16 subsidiaries

and a distribution network across 100

countrieshttps://corporate.nacongaming.com/ |

NACON is a company of the BIGBEN Group founded in 2019 to

optimize its know-how through strong synergies in the video game

market. By bringing together its 11 development studios, the

publishing of AA video games, the design and distribution of

premium gaming devices, NACON focuses 30 years of expertise at the

service of players. This new unified business unit strengthens

NACON's position in the market, enables it to innovate by creating

new unique competitive advantages. Company

listed on Euronext Paris, compartment B ISIN :

FR0013482791 ; Reuters : NACON.PA ; Bloomberg :

NACON:FP PRESS CONTACTCap Value – Gilles

Broquelet gbroquelet@capvalue.fr - +33 1 80 81 50 01 |

- Nacon - CP 29 09 2021 Bigant+Lunar - Diffusion -ENG

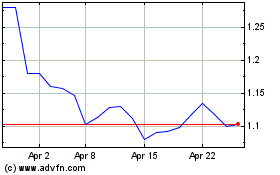

Nacon (EU:NACON)

Historical Stock Chart

From Jul 2024 to Aug 2024

Nacon (EU:NACON)

Historical Stock Chart

From Aug 2023 to Aug 2024