ArcelorMittal acquires majority stake in voestalpine’s state-of-the-art HBI facility in Texas

April 14 2022 - 1:30AM

14 April

2022,

07:30

CET

ArcelorMittal (‘the Company’) today announces it has signed an

agreement to acquire an 80% shareholding in voestalpine’s

world-class Hot Briquetted Iron (‘HBI’) plant located in Corpus

Christi, Texas. voestalpine will retain the remaining 20%. The

transaction values the Corpus Christi operations at $1 billion and

closing is subject to customary regulatory approvals.

The state-of-the-art plant, which was opened in October 2016, is

one of the largest of its kind in the world. It has an annual

capacity of two million tonnes of HBI, a high-quality feedstock

made through the direct reduction of iron ore which is used to

produce high-quality steel grades in an electric arc furnace

(‘EAF’), but which can also be used in blast furnaces, resulting in

lower coke consumption. HBI is a premium, compacted form of Direct

Reduced Iron (‘DRI’) developed to overcome issues associated with

shipping and handling DRI.

In parallel with the transaction, ArcelorMittal has signed a

long-term offtake agreement with voestalpine to supply an annual

volume of HBI commensurate to voestalpine’s equity stake to its

steel mills in Donawitz and Linz, Austria. The remaining balance of

production will be delivered to third parties under existing supply

contracts, and to ArcelorMittal facilities, including to AM/NS

Calvert in Alabama, upon the commissioning of its 1.5 million tonne

EAF, expected in the second half of 2023.

Commenting, ArcelorMittal CEO, Aditya Mittal,

said:

“This is a compelling strategic acquisition for our company. It

accelerates both our progression into producing high-quality

metallic feedstock for EAFs and our global decarbonisation journey.

The facility is world-class and is ideally located, with its own

deep-water port. There is also unused land on the site which

provides interesting options for further development.

“ArcelorMittal is already one of the world’s largest producers

of DRI. This acquisition will further strengthen our position and

guarantee security of supply to AM/NS Calvert, while our experience

will bring significant value to the asset. DRI is a feedstock which

has a very important role to play in our decarbonisation ambitions,

as we have announced plans to construct DRI facilities at several

sites across Europe and in Canada. Today’s transaction therefore

represents an important further step in our climate action journey.

Finally, I would like to thank the executive management team at

voestalpine and look forward to developing a strong partnership

with them.”

The Corpus Christi facility, which covers an area of two square

kilometers and employs over 270 people, is located in an optimal

coastal position with direct access to a broad and deep shipping

channel which enables cost effective transportation to the Americas

and Europe. It incorporates best-in-class technology and equipment

supplied by MIDREX Technologies Inc., a leading supplier of DRI

solutions. It currently uses natural gas to directly reduce iron

ore pellets into HBI with an Fe content which exceeds 91%. However,

the plant does have the potential to transition to 100% hydrogen,

with the Texas coast presenting advantageous weather conditions to

produce renewable energy powered green hydrogen. The use of natural

gas rather than coal as the current energy input and reductant

means that DRI-EAF steelmaking carries a significantly lower carbon

footprint than blast furnace-basic oxygen furnace steelmaking.

DRI/HBI is therefore expected to play a prominent role in the

decarbonisation of the steel industry, a process ArcelorMittal

intends to lead.

ArcelorMittal is a world leader in DRI production, with c. nine

million tonnes of annual production capacity (c. 15 million tonnes

including AM/NS India). DRI – ultimately produced using green

hydrogen – sits at the heart of the Company’s Innovative-DRI

steelmaking pathway, one of two pathways ArcelorMittal has

developed which hold the potential to deliver carbon-neutral

steelmaking.

Over the past year, the Company has accelerated its

Innovative-DRI strategy, announcing projects to construct

additional DRI and EAF capacity at its operations in Belgium,

Canada, France and Spain. The combined investment for the four

projects totals US$5.6 billion, with anticipated carbon emissions

reduction totalling 19.5 million tonnes, which is 1equivalent to

the greenhouse gas emissions from 4,240,858 cars being driven for a

year. These projects sit at the heart of the company’s target to

reduce its CO2e emissions intensity by 25% by 2030 group-wide, and

in Europe by 35% by 2030.

More details on ArcelorMittal’s climate action ambitions,

strategy, technologies and ongoing decarbonisation projects can be

found here.

ENDS

About ArcelorMittal

ArcelorMittal is the world's leading steel and

mining company, with a presence in 60 countries and primary

steelmaking facilities in 16 countries. In 2021, ArcelorMittal had

revenues of $76.6 billion and crude steel production of 69.1

million metric tonnes, while iron ore production reached 50.9

million metric tonnes.

Our goal is to help build a better world with

smarter steels. Steels made using innovative processes which use

less energy, emit significantly less carbon and reduce costs.

Steels that are cleaner, stronger and reusable. Steels for electric

vehicles and renewable energy infrastructure that will support

societies as they transform through this century. With steel at our

core, our inventive people and an entrepreneurial culture at heart,

we will support the world in making that change. This is what we

believe it takes to be the steel company of the future.

ArcelorMittal is listed on the stock exchanges

of New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and

on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and

Valencia (MTS).

For more information about ArcelorMittal please

visit: http://corporate.arcelormittal.com/

| |

|

| Contact

information ArcelorMittal Investor Relations |

|

| |

|

| General |

+44 20 7543

1128 |

| Retail |

+44 20 3214

2893 |

| SRI |

+44 20 3214

2801 |

|

Bonds/CreditE-mail |

+33 171 921

026investor.relations@arcelormittal.com |

|

|

|

|

|

|

| Contact

information ArcelorMittal Corporate Communications |

|

| Paul

WeighTel:E-mail: |

+44 20

3214 2419press@arcelormittal.com |

|

|

|

1 Calculated using the US EPA greenhouse gas equivalencies

calculator -

https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator

ArcelorMittal (EU:MT)

Historical Stock Chart

From Oct 2024 to Nov 2024

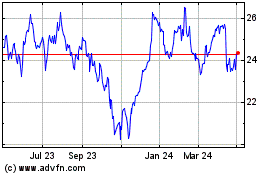

ArcelorMittal (EU:MT)

Historical Stock Chart

From Nov 2023 to Nov 2024