McPhy Energy: McPhy specifies the conditions for the Annual General

Meeting of May 20, 2020, issues an update on the impact of the

Covid-19 pandemic on its activity and recalls the terms of the

exercise of stock warrants

Press release

McPhy specifies the conditions for the

Annual General Meeting of May 20, 2020, issues an update on the

impact of the Covid-19 pandemic on its activity and recalls the

terms of the exercise of stock warrants

La Motte-Fanjas (France), April 29, 2020

– 5:45 pm CEST – McPhy (Euronext Paris Compartment C: MCPHY,

FR0011742329) is a specialist in hydrogen production and

distribution equipment.

General Meeting to be held in closed

session

In the current health context of the Covid-19

pandemic, McPhy has exceptionally decided to hold its Annual

General Meeting of May 20, 2020 at 11:00 am CEST in closed session,

without the presence (physical or by conference / video call) of

its shareholders or other participants (such as the auditors or

staff representative bodies), at the Company’s head offices, 1115

route de Saint-Thomas, 26190 La Motte-Fanjas, France.

This decision is a result of the measures

adopted by the French Government, and notably order 2020-321 of

March 25, 2020 pertaining to the holding of Shareholders’

Meetings.

The minutes of the Annual General Meeting will

be made available to shareholders on the Company’s website:

www.mcphy.com/fr/investisseurs/information-financiere/information-financiereassemblee-generale/.

Voting procedures at the General

Meeting

The eligibility to participate in the Annual

General Meeting is subject to having shares registered in the

Company’s shareholders’ account in accordance with the terms

indicated in the convening notice published in the BALO public

notices on April 10, 2020, available on the Company’s website in

the Shareholders’ Meetings section.

In these conditions, the Company’s shareholders

will be able to exercise their voting rights exclusively via a

postal voting form or by granting proxy to the Chairman of the AGM.

Therefore, no admission cards will be issued.

The completed and signed postal voting form or

proxy provided to the Chairman of the AGM should therefore be

sent:

- either by email to emilie.maschio@mcphy.com by

11:59 pm CEST on Sunday May 17, 2020, which is recommended within

the current context;

- or by regular post to BNP PARIBAS Securities

Services, CTO Assemblées Générales, Les Grands Moulins de Pantin, 9

rue du Débarcadère, 93761 Pantin Cedex, France.

Registered shareholders will receive the voting

form with their usual convocation.For bearer shareholders, the

postal voting or proxy form must be accompanied by the shareholding

certificate issued by the approved intermediary who manages the

securities account.

The postal voting form is also available in the

Shareholders’ Meetings section of the Company’s website

(www.mcphy.com/fr/investisseurs/information-financiere/information-financiereassemblee-generale/).

Written questions

Given the exceptional circumstances associated

with the Covid-19 pandemic, written questions may be sent to the

Chairman of the Board of Directors by email at the following

address: emilie.maschio@mcphy.com, which is the preferred method,

or by recommended letter with acknowledgment of receipt, no later

than the fourth business day prior to the date of the AGM, i.e.

Thursday, May 14, 2020. They should be accompanied by the

shareholding certificate.

Availability of documents relating to

the AGM

All the documents relating to this Annual

General Meeting are made available to shareholders on the Company’s

website

(www.mcphy.com/fr/investisseurs/information-financiere/information-financiereassemblee-generale/).

Update on the impact of the Covid-19 pandemic on the

Group’s activity

As previously announced1, faced with the

Covid-19 pandemic, the Group has taken measures to protect the

health of its employees, clients and partners and to uphold its

commitments under the best possible conditions.

Thus, in order to take effective action within a

rapidly changing context, the Group has implemented business

continuity plans across all its sites that are updated according to

changes in the situation in each country. The production sites in

France and Germany have remained operational with limited on-site

resources and strengthened safety conditions. In Italy, operations

on the San Miniato site were suspended on March 23 and are

gradually resuming.

Within this uncertain context, risks have been

identified regarding delays in the execution of the Group’s

contracts, notably due to the domino effect of any delays McPhy may

see from its suppliers. At this stage, the extent of these delays

cannot be accurately quantified, and will depend on the ability of

the Group’s suppliers to meet their own commitments, on the length

of the restrictions put in place by the various governments, on the

extent of the global resumption in activity and on the Group’s

ability to make up for the delays.

Moreover, the realization of certain contracts

with potential new clients is likely to be delayed or suspended due

to the cancelling or pushing back of key sector events. As a

result, the Group’s short- and medium-term order book and revenue

are likely to be affected by delays and impacts that are currently

impossible to precisely estimate.

McPhy pledges to communicate, as soon as

possible, any objective information that could clarify the impact

of this pandemic on its industrial and commercial roadmap.

In order to minimize the impacts on its cash

position and to ensure the continuity of its operations, McPhy has

implemented cost reduction measures and has planned to initiate the

necessary procedures enabling it to benefit from the aid announced

by the French government and the European Union (partial activity

measures, cancellation or deferral of tax payments, etc.) The

Group has also received an agreement in principle from its banking

partners to formalize additional State-backed credit lines of €4

million. Lastly, in order to strengthen its financial flexibility

and secure access to additional resources, the Company renewed on

April 10 its equity financing line with Kepler Cheuvreux for a

period of two years, representing an indicative amount of €18.3

million2.

Bolstered by a solid and secured financial

situation to continue its activity, McPhy has confidence in the

pertinence of its corporate project to enable it to cope with the

challenges of this pandemic. Indeed, the Group is driven by robust

fundamentals and the positive outlook for the hydrogen and energy

transition market, which will be more relevant than ever in the

post-crisis world.

McPhy is fully committed to achieving its

“Driving Clean Energy Forward” corporate project, i.e. being able

to accelerate the roll-out of zero-carbon ecosystems thanks to its

zero-carbon hydrogen production and distribution equipment, and

strongly believes in the possibility of seizing new opportunities

once this global crisis is over.

Reminder regarding the admission for

trading on the Euronext Paris regulated market of shares resulting

from the exercise of the Company’s BSA stock warrants

McPhy’s Extraordinary Shareholders’ Meeting of

January 16, 2020 approved the resolution concerning the issuance of

14,773,307 BSA stock warrants enabling all shareholders (with the

exception of Fonds Ecotechnologies and EDF Pulse Croissance

Holding, who have agreed not to exercise any warrants allocated to

them) to participate in the operation and benefit from the same

subscription conditions.

As a reminder, the stock warrants can be

exercised from January 17, 2020 until May 18, 2020, i.e. two days

before the Company’s Annual General Meeting called to approve its

annual accounts for the year to December 31, 2019. These stock

warrants give holders the right to subscribe to new shares at a

price of €2.70 per share. One stock warrant is attributed for each

share held, and 10 stock warrants allow the holder to subscribe to

one new ordinary share. The exercise of the stock warrants could

strengthen the Company’s shareholders’ equity by up to €2.8

million.

At March 31, 2020, 4,059,490 of these stock

warrants had been exercised, resulting in the issuance of 405,949

new shares representing €1.1 million.

Upcoming events

- Annual General Meeting, on May 20, 2020

- Publication of 2020 first-half results, on July 28, 2020 (after

market)

About McPhy

|

In the framework of the energy transition, and as a leading

supplier of hydrogen production and distribution equipment, McPhy

contributes to the roll-out of zero-carbon hydrogen throughout the

world. Thanks to its wide range of products and services dedicated

to the industrial, mobility and energy markets, McPhy provides

turnkey solutions to its clients adapted to their applications in

industrial raw material supply, fuel cell electric car refueling or

renewable energy surplus storage and valorization. As a designer,

manufacturer and integrator of hydrogen equipment since 2008, McPhy

has three development, engineering and production units based in

Europe (France, Italy, Germany). The company’s international

subsidiaries ensure a global sales coverage of McPhy’s innovative

hydrogen solutions. McPhy is listed on NYSE Euronext Paris (Segment

C, ISIN code: FR0011742329; ticker: MCPHY). |

CONTACTS

|

NewCap |

|

|

Investor Relations

Théodora Xu | Emmanuel HuynhT. +33 (0)1 44 71 20 42mcphy@newcap.eu

|

Media Relations Nicolas

MerigeauT. +33 (0)1 44 71 94 98mcphy@newcap.eu |

Follow us on

@McPhyEnergy

1 See press releases of March 10 and March 30,

2020.2 See press release of April 14, 2020.

- PR_McPhy_General Meeting_PR_28042020_vF

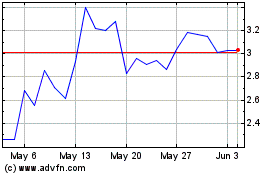

Mcphy Energy (EU:MCPHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mcphy Energy (EU:MCPHY)

Historical Stock Chart

From Nov 2023 to Nov 2024