KBC Group: First-quarter result of 506 million euros

May 16 2024 - 1:00AM

KBC Group: First-quarter result of 506 million euros

‘We recorded a net profit of 506 million euros in the first

quarter of 2024. Compared to the result of the previous quarter,

our total income benefited from several factors, including higher

net interest income, net fee and commission income and insurance

revenues, though these items were partly offset by lower levels of

dividend income and trading & fair value income. Costs were up,

since the bulk of the bank and insurance taxes for the full year

are recorded – as usual – in the first quarter of the year.

Disregarding bank and insurance taxes, costs fell by as much as 9%

quarter-on-quarter and 1% year-on-year. Impairment charges too were

down significantly, as the previous quarter had included a sizeable

one-off impairment on goodwill.

Our loan portfolio continued to increase by 1%

quarter-on-quarter and 4% year-on-year, with growth being recorded

in each of the group’s core countries. Customer deposits were up 1%

quarter-on-quarter and 1% year-on-year, despite the outflow of

deposits triggered by the issue of the retail State Note

(‘Staatsbon’) in Belgium at the start of September 2023.

We have always been at the forefront of new digital

developments, the most visible example of which being our personal

digital assistant Kate, which we continuously develop further with

the aim of ensuring maximum convenience for our customers. To date,

around 4.5 million customers have already used Kate, up more than

40% on the year-earlier figure. Moreover, the proportion of cases

resolved fully autonomously by Kate continues to improve and now

stands at 65% in both Belgium and the Czech Republic, up from 57%

and 54% respectively a year ago.

As regards our ongoing share buyback programme of 1.3 billion

euros, we had already bought back approximately 15.3 million shares

for a total consideration of approximately 0.9 billion euros by the

end of April 2024. The programme is planned to run until 31 July

2024.

On 15 May 2024, we paid a final dividend of 3.15 euros per

share, bringing the total dividend for full-year 2023 to 4.15 euros

per share. In line with our announced capital deployment plan for

full-year 2023, the Board of Directors has also decided to

distribute the surplus capital above a fully loaded common equity

ratio of 15% (approximately 280 million euros) in the form of an

extraordinary interim dividend of 0.70 euros per share on 29 May

2024.

Our solvency position remained strong, with a fully loaded

common equity ratio of 14.9% at the end of March 2024 (which

already fully incorporates the effect of the ongoing share buyback

programme of 1.3 billion euros and the extraordinary interim

dividend of 0.70 euros per share). Not taking into account the

extraordinary interim dividend, our common equity ratio would have

been 15.2%. Our liquidity position remained very solid too, with an

LCR of 162% and NSFR of 139%.

In closing, I would like to sincerely thank all our customers,

employees, shareholders and other stakeholders for their trust and

support. More than anything else, that trust and support is and

remains fundamental to the success of our group, now and in the

future.’

Johan ThijsChief Executive Office

- 1q2024-quarterly-report-en

- 1q2024-pb-en

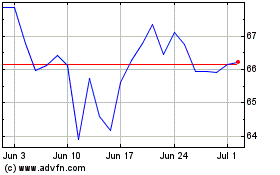

KBC Groep NV (EU:KBC)

Historical Stock Chart

From Oct 2024 to Oct 2024

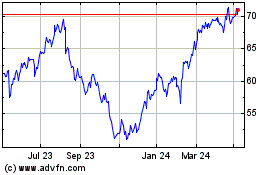

KBC Groep NV (EU:KBC)

Historical Stock Chart

From Oct 2023 to Oct 2024