Heineken Holding N.V. reports on 2022 third-quarter trading

Amsterdam, 26 October 2022 – Heineken Holding

N.V. (EURONEXT: HEIO; OTCQX: HKHHY) publishes its trading

update for the third quarter of 2022.

-

Revenue growth 27.5%

- Net

revenue (beia) organic growth 19.8%; net revenue (beia) per

hectolitre organic growth 11.1%

-

Beer volume organic growth 8.9%; premium volume organic growth

15.0%

-

Heineken® volume growth 11.3%

-

2022 full year expectations unchanged

Heineken Holding N.V. engages in no activities

other than its participating interest in Heineken N.V. and

the management or supervision of and provision of services to

that company.

For the first nine months of the year,

revenue was €25,816 million

(2021: €19,354 million). Net revenue

(beia) was €21,273 million (2021: €16,000

million), increasing organically by 22.6%. Currency translation

positively impacted net revenue (beia) by €1,168 million or 7.3%,

mainly driven by the Brazilian Real, the Mexican Peso and the

Vietnamese Dong. The consolidation of United Breweries Limited

(UBL) in India positively impacted net revenue (beia) by €564

million or 3.5%.

In the third quarter,

revenue was €9,415 million (2021:

€7,383 million). Net revenue

(beia) grew organically by 19.8% and came to

€7,788 million (2021: €6,029 million), benefitting from the sharp

post-COVID recovery in Asia Pacific. Total consolidated volume grew

7.6% and net revenue (beia) per hectolitre was up 11.1%. Price mix

on a constant geographic basis was up 13.2%, driven by pricing to

mitigate inflationary pressure and premiumisation effects.

Throughout the rest of this report, figures refer to quarterly

performance unless otherwise indicated.

|

Revenue1 |

|

|

|

|

|

|

|

(in € million or %) |

3Q22 |

Total growth |

Organic growth |

YTD 3Q22 |

Total growth |

Organic growth |

|

Revenue (IFRS) |

9,415 |

27.5 % |

|

25,816 |

33.4 % |

|

|

Net revenue (beia) |

7,788 |

|

19.8 % |

21,273 |

|

22.6 % |

Beer volume grew

8.9% organically versus last year and came 1.4% ahead of 2019 on an

organic basis. The year on year growth was mainly driven by the

strong recovery in Asia Pacific from the COVID-related restrictions

of last year. Europe, the Americas and Africa, Middle East &

Eastern Europe saw a low-single digit growth.

|

Beer volume |

|

|

|

|

|

|

|

(in mhl or %) |

3Q22 |

Total growth |

Organic growth |

YTD 3Q22 |

Total growth |

Organic growth |

|

Heineken N.V. |

66.8 |

10.9 % |

8.9 % |

193.6 |

13.9 % |

8.1 % |

Premium beer

volume grew 15.0% (18.1% excluding Russia), outperforming the

portfolio and boosted by the strong recovery of Tiger in Vietnam.

Heineken® continued its strong momentum and grew 11.3% in volume

(14.9% excluding Russia), significantly outperforming the total

beer market and ahead of 2019 by 29%. Volume grew double-digits in

close to 50 markets. The growth was mainly driven by Brazil, China,

South Africa, Vietnam, the Netherlands, Poland, Germany and

Nigeria. Heineken® 0.0 grew 7.9%

excluding Russia, driven by the Americas and Europe.

Heineken® Silver is now launched

in 28 markets, including Mexico, Chile and India. Overall,

Heineken® Silver more than doubled its volume, driven by the

recovery of Vietnam, continued strong growth in China and its

global roll-out.

|

Heineken® volume |

|

|

|

|

|

(in mhl or %) |

3Q22 |

Organic growth |

YTD 3Q22 |

Organic growth |

|

Heineken N.V. |

14.2 |

11.3 % |

40.1 |

12.9 % |

|

|

Reported Net Profit of Heineken N.V. |

The reported net profit of Heineken N.V. for the

first nine months of 2022 was €2,199 million (2021: €3,083

million). Last year included an exceptional gain of €1.270 million

from the remeasurement to fair value of the previously held equity

interest in United Breweries in India.

|

|

Translational Currency Calculated Impact |

Based on the impact to date, and applying spot

rates of 24 October 2022 to the 2021 financial results as a

baseline for the remainder of the year, HEINEKEN calculates a

positive currency translational impact of approximately €1,680

million in net revenue (beia), €250 million at operating profit

(beia) and €180 million at net profit (beia).

|

|

Reconciliation of non-GAAP measures |

In the internal management reports, HEINEKEN uses

the measure of net revenue (beia).

|

Reconciliation net revenue (beia) |

|

|

|

|

|

In millions of € |

3Q22 |

3Q21 |

YTD 3Q22 |

YTD 3Q21 |

|

Revenue (IFRS) |

9,415 |

7,383 |

25,816 |

19,354 |

|

Excise tax expense |

(1,627) |

(1,353) |

(4,543) |

(3,313) |

|

Net revenue |

7,788 |

6,030 |

21,273 |

16,041 |

|

Exceptional items included in net revenue |

— |

(1) |

— |

(41) |

|

Net revenue (beia) |

7,788 |

6,029 |

21,273 |

16,000 |

Note: due to rounding, this table will not

always cast

|

Media Heineken Holding N.V. |

|

|

|

Kees Jongsma |

|

|

|

tel. +31 6 54 79 82 53 |

|

|

|

E-mail: cjongsma@spj.nl |

|

|

| |

|

|

|

Media |

|

Investors |

|

Sarah Backhouse |

|

José Federico Castillo Martinez |

|

Director of Global Communication |

|

Director of Investor Relations |

|

Michael Fuchs |

|

Mark Matthews / Robin Achten |

|

Corporate & Financial Communication Manager |

|

Investor Relations Manager / Senior Analyst |

|

E-mail: pressoffice@heineken.com |

|

E-mail: investors@heineken.com |

|

Tel: +31-20-5239355 |

|

Tel: +31-20-5239590 |

Editorial information:Heineken Holding N.V. engages

in no activities other than its participating interest in Heineken

N.V. and the management or supervision of and provision of services

to that company.

HEINEKEN is the world's most international brewer.

It is the leading developer and marketer of premium and

non-alcoholic beer and cider brands. Led by the Heineken® brand,

the Group has a portfolio of more than 300 international, regional,

local and specialty beers and ciders. With HEINEKEN’s over 82,000

employees, HEINEKEN brews the joy of true togetherness to inspire a

better world. HEINEKEN's dream is to shape the future of beer and

beyond to win the hearts of consumers. HEINEKEN is committed to

innovation, long-term brand investment, disciplined sales execution

and focused cost management. Through "Brew a Better World",

sustainability is embedded in the business. HEINEKEN has a

well-balanced geographic footprint with leadership positions in

both developed and developing markets. HEINEKEN operates breweries,

malteries, cider plants and other production facilities in more

than 70 countries. Most recent information is available on the

websites: www.heinekenholding.com and

www.theHEINEKENcompany.com and follow HEINEKEN on LinkedIn,

Twitter and Instagram.

Market Abuse Regulation

This press release contains inside information

within the meaning of Article 7(1) of the EU Market Abuse

Regulation.

Disclaimer:

This press release contains forward-looking

statements with regard to the financial position and results of

HEINEKEN's activities. These forward-looking statements are subject

to risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking

statements. Many of these risks and uncertainties relate to factors

that are beyond HEINEKEN’s ability to control or estimate

precisely, such as future market and economic conditions,

developments in the ongoing COVID-19 pandemic and related

government measures, the behaviour of other market participants,

changes in consumer preferences, the ability to successfully

integrate acquired businesses and achieve anticipated synergies,

costs of raw materials, interest-rate and exchange-rate

fluctuations, changes in tax rates, changes in law, change in

pension costs, the actions of government regulators and weather

conditions. These and other risk factors are detailed in HEINEKEN's

publicly filed annual reports. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only of

the date of this press release. HEINEKEN does not undertake any

obligation to update these forward-looking statements contained in

this press release. Market share estimates contained in this press

release are based on outside sources, such as specialised research

institutes, in combination with management estimates.

®

All brand names mentioned in this report, including

those brand names not marked by an ®, represent registered

trademarks and are legally protected.

Beia

Before exceptional items and amortisation of

acquisition-related intangible assets.

Brand specific volume (Heineken®

Volume, Amstel Volume, etc.)

Brand volume produced and sold by consolidated

companies plus 100% of brand volume sold under licence agreements

by joint ventures, associates and third parties.

Beer Volume

Beer volume produced and sold by consolidated

companies.

Premium beer

Beer sold at a price index equal or greater than

115 relative to the average market price of beer.

Consolidation

changes

Changes as a result of acquisitions, disposals,

internal transfer of businesses or other reclassifications.

Licensed Beer

Volume

100% of volume from HEINEKEN's beer brands sold

under licence agreements by joint ventures, associates and third

parties.

Group Beer

Volume

The sum of Beer Volume, Licensed Beer Volume and

attributable share of beer volume from joint ventures and

associates.

Digital sales

value

Value of the digital transactions with our

customers for our products via our eB2B platforms at outlet level,

including our net revenue and the margins captured by third party

distributors.

Gross merchandise

value

Value of all products sold via our eB2B platforms.

This includes our own and third-party products, including all

duties.

Eia

Exceptional items and amortisation of

acquisition-related intangible assets.

Exceptional

items

Items of income and expense of such size, nature or

incidence, that in the view of management their disclosure is

relevant to explain the performance of HEINEKEN for the period.

Net revenue

Revenue as defined in IFRS 15 (after discounts)

minus the excise tax expense for those countries where the excise

is borne by HEINEKEN.

Net revenue per

hectolitre

Net revenue divided by total consolidated

volume.

Non-Beer

Volume

Cider, soft drinks and other non-beer volume

produced and sold by consolidated companies.

Organic

Growth

Organic growth in volume excludes the effect of

consolidation changes.

Third-Party Products

Volume

Volume of third-party products (beer and non-beer)

resold by consolidated companies.

Total Consolidated

Volume

The sum of Beer Volume, Non-Beer Volume and

Third-Party Products Volume.

1 Refer to the Glossary for an explanation of

organic growth and other terms used throughout this report.

- Heineken Holding NV Q3 2022 Trading Update (26_10_2022)

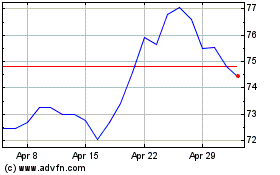

Heineken (EU:HEIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Heineken (EU:HEIO)

Historical Stock Chart

From Nov 2023 to Nov 2024