Heineken Holding N.V. reports 2022 half year results

Amsterdam, 1 August 2022 – Heineken Holding N.V.

(EURONEXT: HEIO; OTCQX: HKHHY) announces:

- The net result of

Heineken Holding N.V.'s participating interest in Heineken N.V. for

the first half year of 2022 amounts to €633 million

- Revenue growth

37.0%

- Net revenue (beia)

24.3% organic growth; per hectolitre 15.6%

- Beer volume organic

growth 7.6%; premium beer volume 10.2% organically

- Heineken® volume

13.8% growth

- Operating profit

growth 20.6%; operating profit (beia) organic growth 24.6%

- Net profit growth

22.3%; net profit (beia) organic growth 40.2%

- Full year 2022 expectations unchanged.

2023 guidance revised

|

IFRS Measures |

€ million |

|

Total growth |

|

BEIA Measures |

€ million |

Organic growth2 |

| Revenue |

16,401 |

|

37.0% |

|

Revenue (beia) |

16,401 |

22.4% |

| Net revenue |

13,485 |

|

34.7% |

|

Net revenue (beia) |

13,485 |

24.3% |

| Operating

profit |

2,070 |

|

20.6% |

|

Operating profit (beia) |

2,155 |

24.6% |

| |

|

|

|

|

Operating profit (beia) margin |

16.0% |

|

| Net profit of

Heineken Holding N.V. |

633 |

|

22.3% |

|

Net profit (beia) |

1,326 |

40.2% |

| Diluted EPS (in

€) |

2.20 |

|

22.2% |

|

Diluted EPS (beia) (in €) |

2.30 |

48.0% |

| |

|

|

|

|

Free operating cash flow |

1,122 |

|

|

|

|

|

|

|

Net debt / EBITDA (beia)3 |

2.4x |

|

1 Consolidated figures are used throughout this report unless

otherwise stated; please refer to the Glossary for an explanation

of non-GAAP measures and other terms used throughout this report.

Heineken Holding N.V.’s half year report has not been audited nor

reviewed by its external auditor.2 Organic growth shown, except for

Diluted EPS (beia), which is total growth. 3 Includes acquisitions

and excludes disposals on a 12 month pro-forma basis.

Heineken Holding N.V. engages in no activities other than its

participating interest in Heineken N.V. and the management or

supervision of and provision of services to that company.

HEINEKEN's ambition is to deliver superior growth with a good

balance between volume- and value-driven revenue expansion,

positioning HEINEKEN among the fastest growing global beverage

companies. HEINEKEN aims to achieve this by sharp consumer and

customer orientation, leveraging its leading premium brands,

developing winning consumer propositions in fast-growing segments

and continuously shaping its geographic and portfolio

footprint.

Revenue for the first half of 2022 was 16,401

million (2021: 11,970 million). Net revenue (beia)

increased 24.3% organically, driven by a 7.7% increase in total

consolidated volume and a 15.6% increase in net revenue (beia) per

hectolitre. The underlying price-mix on a constant geographic basis

was up 15.3%, driven by pricing across all markets, covering input

cost inflation on a euro-for-euro basis, a positive channel mix and

premiumisation. Compared to 2019, total consolidated volume

increased organically by 0.8% and net revenue (beia) is 14.4%

ahead, excluding consolidation changes, driven by post-COVID volume

recovery, growth of HEINEKEN's premium brands and the impact of

inflation-led pricing.

Beer volume increased 7.6% organically versus

last year and came 4.2% ahead of 2019 on an organic basis. The

growth was faster in the second quarter as beer volume grew 9.7%,

led by strong growth in the Americas, the continued recovery of

Asia Pacific and the on-trade in Europe and modest growth in the

Africa, Middle East and Eastern Europe (AMEE) region. HEINEKEN

gained or held market share in more than half of its markets.

| Beer

volume |

2Q22 |

|

2Q21 |

|

Organicgrowth |

|

HY22 |

|

HY21 |

|

Organicgrowth |

|

(in mhl) |

|

|

|

|

|

| Heineken

N.V. |

70.4 |

|

59.6 |

|

9.7 % |

|

126.9 |

|

109.9 |

|

7.6 % |

Premium beer volume grew by 10.2%, driving

close to half of HEINEKEN's organic growth in beer volume, led by

Heineken®.

Heineken® continued its strong

performance and grew volume by 14.6% in the second quarter to close

the first half with a 13.8% increase, up 32.9% versus 2019. The

brand grew double-digits in more than 50 markets, notably in

Brazil, China, Vietnam, South Africa, the Netherlands, Spain,

Italy, Laos and the United Arab Emirates.

Heineken®

Silver, now present in 22 markets, has nearly

doubled its volume, driven by strong growth in Vietnam and China

and its rollout across Europe and Asia. As the next step of its

global roll-out, HEINEKEN introduced Heineken® Silver in Mexico

this month.

As per the Kantar BrandZ 2022 global survey,

Heineken® was the fastest growing

in 'Brand Value' among top alcohol brands, driven by its strong

growth momentum, innovations and creativity. The latter was further

recognised at this year's Cannes Lions, the prestigious Festival of

Creativity, as the most awarded alcohol brand. The brand's most

recent campaign, "The Closer", aims to spark conversation on

work-life imbalance, with a smile.

Heineken® supports inclusion in

the bar and on the football field and is a proud sponsor of the

UEFA Women's EURO football tournament.

|

Heineken® volume |

|

2Q22 |

|

Organicgrowth |

|

HY22 |

|

Organicgrowth |

|

(in mhl) |

|

|

|

|

| Heineken

N.V. |

|

14.0 |

|

14.6% |

|

25.9 |

|

13.8% |

HEINEKEN's multi-year EverGreen strategy aims to deliver

superior, balanced growth for sustainable, long-term value

creation. HEINEKEN is encouraged by the speed and progress made so

far on its key strategic programmes, and by the strong post-COVID

recovery of its business.

At the same time, HEINEKEN continues to observe a challenging

global environment and an uncertain economic outlook. Whilst

consumer demand in aggregate has been resilient in the first half,

there is increasing risk that mounting pressure on consumer

purchasing power will affect beer consumption.

HEINEKEN expects significant inflationary pressures on its cost

base and ongoing investment in its business to continue and impact

the second half of 2022 and into 2023. The recent softening in some

commodities is being offset by the unprecedented price levels and

availability risk of natural gas, most notably affecting Europe,

our biggest region. HEINEKEN's pricing and revenue management

actions have effectively offset these inflationary pressures so far

in absolute terms, and HEINEKEN remains committed to continuing to

do so. In addition, HEINEKEN's productivity programme continues at

pace, lifting the aggregate gross savings contribution to €1.7

billion by end of 2022 compared to the cost base of 2019. This will

continue to offset cost pressures and enable increased investments

in brand support, digital transformation and sustainability

initiatives.

For 2022, HEINEKEN keeps its outlook unchanged and expect a

stable to modest sequential improvement in operating profit margin

(beia) versus last year. HEINEKEN is changing its previous guidance

for 2023. HEINEKEN will move from an operating profit margin

objective towards delivering operating profit (beia) organic

growth, in the range of a mid- to high-single digit, excluding any

major unforeseen macroeconomic and political developments. Over the

medium term, HEINEKEN reconfirms its aspiration to deliver

superior, balanced growth with operating leverage over time.

|

|

Translational Calculated Currency Impact |

| |

|

Based on the impact to date, and applying spot rates of 28 July

2022 to the 2021 financial results as a baseline for the remainder

of the year, the calculated positive currency translational impact

would be approximately €1.5 billion in net revenue (beia), €210

million at consolidated operating profit (beia), and €140 million

at net profit (beia).

According to the Articles of Association of Heineken Holding

N.V. both Heineken Holding N.V. and Heineken N.V. pay an identical

dividend per share. HEINEKEN's dividends are paid in the form of an

interim dividend and a final dividend. In accordance with its

dividend policy, HEINEKEN fixes the interim dividend at 40% of the

total dividend of the previous year. As a result, an interim

dividend of €0.50 per share (2021: €0.28) will be paid on 11 August

2022. Both the Heineken Holding N.V. shares and the Heineken N.V.

shares will trade ex-dividend on 3 August 2022.

|

Media Heineken Holding N.V. |

|

|

|

Kees Jongsma |

|

|

| Tel. +31-6-54798253 |

|

|

| E-mail: cjongsma@spj.nl |

|

|

| |

|

|

|

Media |

|

Investors |

|

Sarah Backhouse |

|

José Federico Castillo Martinez |

| Director of Global

Communication |

|

Investor Relations

Director |

| Michael

Fuchs |

|

Mark Matthews / Robin

Achten |

| Global Corporate and Financial

Communications Manager |

|

Investor Relations Manager /

Senior Analyst |

| E-mail:

pressoffice@heineken.com |

|

E-mail:

investors@heineken.com |

| Tel: +31-20-5239355 |

|

Tel: +31-20-5239590 |

|

|

Investor Calendar Heineken N.V. |

| |

|

(events also accessible for Heineken Holding N.V.

shareholders)

|

Trading Update for Q3 2022 |

|

26 October 2022 |

| Capital Markets Event in

Amsterdam |

|

1-2 December 2022 |

| Full Year 2022 Results |

|

15 February 2023 |

HEINEKEN will host an analyst and investor conference call in

relation to its 2022 Half Year results today at 14:00 CET/ 13:00

GMT. This call will also be accessible for Heineken Holding

N.V. shareholders. The call will be audio cast live via the

website: www.theheinekencompany.com. An audio replay service will

also be made available after the conference call at the above web

address. Analysts and investors can dial-in using the following

telephone numbers:

United Kingdom (Local): 020 3936 2999

Netherlands (Local): 085 888 7233

USA: 1 646 664 1960

All other locations: +44 203 936 2999

Participation password for all countries: 810785

Editorial information:Heineken Holding N.V. engages in no

activities other than its participating interest in Heineken N.V.

and the management or supervision of and provision of services to

that company.

HEINEKEN is the world's most international brewer. It is the

leading developer and marketer of premium and non-alcoholic beer

and cider brands. Led by the Heineken® brand, the Group has a

portfolio of more than 300 international, regional, local and

specialty beers and ciders. With HEINEKEN’s over 85,000 employees,

HEINEKEN brews the joy of true togetherness to inspire a better

world. HEINEKEN's dream is to shape the future of beer and beyond

to win the hearts of consumers. HEINEKEN is committed to

innovation, long-term brand investment, disciplined sales execution

and focused cost management. Through "Brew a Better World",

sustainability is embedded in the business. HEINEKEN has a

well-balanced geographic footprint with leadership positions in

both developed and developing markets. HEINEKEN operates breweries,

malteries, cider plants and other production facilities in more

than 70 countries. Most recent information is available on

www.heinekenholding.com and

www.theHEINEKENcompany.com and follow HEINEKEN on LinkedIn,

Twitter and Instagram.

Market Abuse Regulation:This press release contains

price-sensitive information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Disclaimer:This press release contains forward-looking

statements with regard to the financial position and results of

HEINEKEN’s activities. These forward-looking statements are subject

to risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking

statements. Many of these risks and uncertainties relate to factors

that are beyond HEINEKEN’s ability to control or estimate

precisely, such as future market and economic conditions,

developments in the ongoing COVID-19 pandemic and related

government measures, the behaviour of other market participants,

changes in consumer preferences, the ability to successfully

integrate acquired businesses and achieve anticipated synergies,

costs of raw materials, interest-rate and exchange-rate

fluctuations, changes in tax rates, changes in law, change in

pension costs, the actions of government regulators and weather

conditions. These and other risk factors are detailed in HEINEKEN’s

publicly filed annual reports. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only of

the date of this press release. HEINEKEN does not undertake any

obligation to update these forward-looking statements contained in

this press release. Market share estimates contained in this press

release are based on outside sources, such as specialised research

institutes, in combination with management estimates.

- Click here for the full press release: Heineken Holding NV 2022

Half Year press release (1 August 2022)

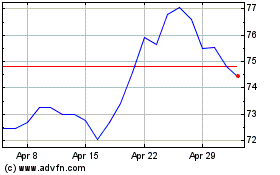

Heineken (EU:HEIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Heineken (EU:HEIO)

Historical Stock Chart

From Nov 2023 to Nov 2024