AXA Raises Guidance, Launches Buyback as Underlying Profit Beats Views

February 23 2023 - 1:32AM

Dow Jones News

By Ed Frankl

AXA SA on Thursday raised its outlook and launched a new share

buyback, buoyed by a strong operating performance in 2022.

The French insurer said full-year underlying earnings rose to

7.26 billion euros ($7.70 billion), from EUR6.76 billion in 2021,

reflecting resilient underwriting and higher investment income at

its property & casualty business and better margins in its life

& savings operation.

Gross revenues climbed 2% on year to EUR102.34 billion, driven

by its health and P&C businesses, although this was partly

offset by tumbling reinsurance revenue as it pursued its strategy

of reducing its natural-catastrophe exposure.

Underlying earnings and revenues topped expectations of EUR7.14

billion and EUR102.03 billion, respectively, from its

company-compiled consensus.

However, full-year net profit fell below estimates, declining 8%

on year to EUR6.68 billion, as unfavorable markets hit the value of

its invested assets, alongside the write-off of its stake in

Russian insurer Reso Garantia, AXA said.

Still, the Paris-based company raised its guidance, targeting

underlying earnings-per-share compound growth above its previously

guided 3%-7% target range in 2020-23, assuming current operating

conditions persist.

AXA said its outlook was aided by a strong balance sheet,

actions to counterbalance higher inflation, and measures taken to

limit losses from natural disasters.

The CAC-40-listed company also launched a share-buyback program

of up to EUR1.1 billion, expected to be completed by year end, and

declared a dividend of EUR1.70 per share, up 10% on year.

Write to Ed Frankl at edward.frankl@wsj.com

(END) Dow Jones Newswires

February 23, 2023 01:17 ET (06:17 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

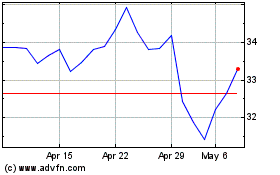

Axa (EU:CS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Axa (EU:CS)

Historical Stock Chart

From Jan 2024 to Jan 2025