- H1 2021-2022 revenue: €281m (+1%)

- EBITDA1 steady at €23m with an EBITDA margin of

8.2%

- Cash flow2 stable at €22m (vs. €23m for the same period last

year)

- FY 2022-2023 revenue target moved forward one year to

reflect uncertainties related to changes in PlanetArt's customer

acquisition methods (with no impact on the EBITDA margin

target)

This press release presents Group consolidated

figures prepared on the basis of IFRS that were subject to a

limited review.

“With €281m in revenue and €23m in EBITDA in H1 2021-2022, we

were successful in stabilizing earnings despite the unprecedented

context, particularly for PlanetArt, impacted by the combined

effects of the end of lockdown measures, supply chain constraints

that continued during the year-end holiday season and a structural

transformation in customer acquisition channels. However, by

leveraging its strategic strengths based on a fabless3,

multi-channel and global approach supported by significant

expertise in digital marketing, the division was able to overcome

these challenges and outperform its competitors in terms of revenue

growth, while maintaining its EBITDA margin.

With revenue of €51m and EBITDA of €8m, up 22% and 56%

respectively over the period, Avanquest continues to benefit from

its move to a SaaS4 subscription-based business model. On this

basis, the virtuous circle of subscription renewals is now boosting

both its growth and profitability.

Finally, our IoT business has taken advantage of the improved

COVID-19 situation to accelerate commercial deployments and expand

its network of channel partners. World-class leaders like Sodexo

are continuing to join our network, highlighting the interest of

manufacturers in this maturing sector.

This first half performance offered further confirmation of the

value of our diversified approach within a global context that

nevertheless calls for considerable caution and has led us to

postpone our medium-term revenue target.

Finally, it is not possible for me to speak during this period

of renewed armed conflict in Europe, without having a thought for

our Ukrainian partners and subcontractors. While Claranova has a

limited commercial exposure to Ukraine or Russia, our Avanquest

division has maintained close relationships for years with IT

development and customer support partners based there. Our efforts

are focused on supporting them on a daily basis during this tragic

period," declared Pierre Cesarini, CEO of Claranova.

Regulatory News:

Claranova (Paris:CLA) reported revenue for H1 2021-2022

(July-December 2021) of €281m, up 1% at actual exchange rates and

down 2% at constant exchange rates (-6% like-for-like5).

Despite an unprecedented and challenging environment, Claranova

has maintained the level of its H1 2021-2022 operating profit.

Group EBITDA amounted to €23m in the period, in line with the level

of H1 2020-2021, which had already registered a twofold increase.

The Group's EBITDA margin also remained stable at 8.2%, compared

with 8.3% in H1 2020-2021.

With €152m in cash and cash equivalents and an increase in

financial debt6 to €150m, the Group’s net debt amounted to -€2m at

December 31, 2021 after taking into account the OCEANES bond issue

and the buyout of the minority interests in the Avanquest division

in respectively August and November 2021.

Claranova is still anticipating a gradual rebound in PlanetArt's

growth over the next few quarters, after a phase devoted to

restructuring its customer acquisition channels in response to the

introduction of Apple's iOS 14.5, along with continuing momentum

for Avanquest. However, lower growth in the period by the

personalized e-commerce division is expected to delay the

achievement of the Group's medium-term objectives. Claranova is

thus now expecting to reach the €700m revenue milestone at the end

of FY 2023-2024.

The Group maintains its target for an EBITDA margin above 10% in

FY 2022-20237.

In €m

H1 2021-2022

H1 2020-2021

Change

Revenue

281

278

+1%

EBITDA

23

23

-

EBITDA margin (% of Revenue)

8.2%

8.3%

-0.1pt

Recurring Operating Income

20

21

-4%

Net Income

4

11

-59%

Net cash flow from (used in) operating

activities

52

40

+31%

Of which Cash flow from operations before

changes in working capital

22

23

-3%

Closing cash and cash

equivalents

152

118

+29%

PlanetArt: personalized e-commerce remains resilient in an

unprecedented market context

PlanetArt reported revenue of €227m, down 3% at actual exchange

rates and 6% at constant exchange rates (-10% like-for-like)

And while this pace of revenue growth is considerably lower than

the division’s historical levels, it remains higher than that of

its competitors and was achieved during a period of unprecedented

market conditions. H1 2021-2022 was clearly impacted by the

cumulative effects of post-lockdown impacts on online consumption,

additional pressure on supply chains during year-end holiday

period, and new constraints on targeted marketing within Apple's

iOS ecosystem since the rollout of its App Tracking Transparency

feature.

However, by combining its mostly fabless, multi-channel and

global approach with the digital marketing expertise of its teams,

PlanetArt is continuing to strengthen its market position. The work

carried out in the first half to redirect and diversify the

division’s marketing investments helped PlanetArt’s revenue return

to a level largely back on track in the second quarter (-1%,

compared to -8% in the first quarter at actual rates).

New marketing initiatives launched in H1 2021-2022 helped

contain the overall increase of variable costs (customer

acquisition, logistics and raw materials) and partially offset the

rise in the division's embedded fixed costs. PlanetArt preserved

the profitability of its businesses with €17m in EBITDA, or an

EBITDA margin of 7.6% compared to 8.3% for the previous period.

In €m

H1 2021-2022

H1 2020-2021

Change

Revenue

227

234

-3%

EBITDA

17

19

-11%

EBITDA margin (% of Revenue)

7.6%

8.3%

-0.7pt

Avanquest: positive momentum initiated in prior periods

remains on track

With €51m in revenue,

Avanquest passed the symbolic €50m milestone in H1 2021-2022. The

software publishing division thus registered growth in revenue of

22% in actual rates in the first half (+17% like-for-like). Each

software segment (PDF, Security, Photo) has contributed to this

performance, with growth rates exceeding 20% for all three

verticals.

This positive momentum across

the entire software portfolio confirms the success of the shift in

business model implemented over the last few years. This growth is

accompanied by the increasing contribution of recurring revenue,

both from the acquisition of new subscribers and the renewal of

existing subscriptions acquisition, which now stands at 60%8 and

reinforces visibility for the future growth and margins of these

activities.

This increase in recurring

revenue also contributes to an improvement in operating

profitability. The division achieved EBITDA of €8m, an increase of

56%, with an EBITDA margin of 14.7% compared to 11.5% for the

previous period. This virtuous circle, which reinforces both

Avanquest's growth and profitability, should help the division

gradually raise the level of its standards in line with the best

practices of the SaaS industry.

In €m

H1 2021-2022

H1 2020-2021

Change

Revenue

51

42

+22%

EBITDA

8

5

+56%

EBITDA margin (% of Revenue)

14.7%

11.5%

+ 3.2 pts

myDevices: investments ramped up to accelerate commercial

deployments

myDevices reported revenue of €2.3m during the period, an

increase of 5% at actual exchange rates (3% like-for-like).

Adjusted for non-recurring items related to the partnership with

the US carrier T-Mobile, recognized in the prior year’s first half,

revenue in the first half grew 49% (46% like-for-like).

This performance reflects the acceleration of commercial

rollouts that benefited from easing of COVID-19 restrictions in the

division's main business sectors. In particular, at December 31,

2021, ARR (Annual Recurring Revenue) stood at €1.8m8, up 82% from

one year earlier at constant exchange rates.

myDevices has supported the acceleration of its commercial

deployments through new investments over H1 2021-2022. In

particular, the division has bolstered its sales teams to support

this expansion. The IoT division’s EBITDA registered a loss of

€1.6m, up from a €1.0m loss one year earlier.

In €m

H1 2021-2022

H1 2020-2021

Change

Revenue

2.3

2.2

+5%

EBITDA

(1.6)

(1.0)

+63%

EBITDA margin (% of Revenue)

-72.2%

-46.5%

-25,7 pts

Group capital resources and cash flow amounts

Claranova ended H1 2021-2022 with cash and cash equivalents of

€152m, up €62m from June 30, 2021, including €4m from net foreign

exchange differences during the period. This increase reflected net

inflows from operating activities of €52m, including €22m from

operations and €35m from changes in working capital requirements in

relation to June 30, 2021.

This increase in working capital reflects the seasonal nature of

PlanetArt’s businesses (significant activity during year-end

festivities generating an exceptional peak in cash flow at the end

of December) and its specific business model (B2C9 distribution

with negative working capital requirements).

Net cash flows used in investing activities represented an

outflow of €61m at December 31, 2021. This includes the impact of

the cash payment for the acquisition of the minority interests in

the Avanquest division finalized in early November 2021

representing an outflow of €48m, and to a lesser extent the

acquisition of I See Me! by the PlanetArt division in July 2021 as

well as a joint investment in myDevices with Semtech.

Net cash flows from financing activities represented an inflow

of €66m at December 31, 2021 Financing activities that impacted the

Group's cash position included the strategic investment announced

in August 2021 that included a €50m convertible bond issue

(OCEANES) by the Group, and a reserved capital increase of €15m.

Following the acquisition of certain assets of I See Me!, PlanetArt

also obtained additional bank financing of US$11m in H1

2021-2022.

In €m

H1 2021-2022

H1 2020-2021

Cash flow from operations before changes

in working capital

22

23

Change in working capital requirements

(WCR)10

35

21

Taxes and net interest paid

(4)

(4)

Net cash flow from (used in) operating

activities

52

40

Net cash flow from (used in) investing

activities

(61)

(4)

Net cash flow from (used in) financing

activities

66

3

Change in cash11

58

38

Opening cash position

90

83

Effects of exchange rate fluctuations on

cash and cash equivalents

4

(3)

Closing cash position

152

118

Financial position, borrowing conditions and financing

structure

Claranova’s financial position remains sound with a cash

position of €152m and financial debt (excluding IFRS 16 impact on

the recognition of leases) of €150m compared to respectively €90m

and €65m at June 30, 2021.

The increase in the Group's financial debt includes the €50m

OCEANES convertible bond issue, the issuance of €24m in promissory

notes related to the buyout of minority interests in the Avanquest

division, and US$11m in new bank financing obtained by the

PlanetArt division for the acquisition of certain assets of I See

Me!

On that basis, the Group's net debt at December 31, 2021

amounted to €2m, down from net debt of €25m at June 30, 2021.

In €m

12/31/2021

06/30/2021

Bank debt

23

14

Bonds

98

49

Other financial liabilities

27

2

Accrued interest

2

0

Total financial liabilities12

150

65

Available unpledged cash

152

90

Net debt

(2)

(25)

Governance

The Board of Directors duly noted the resignation of Mr. Chahram

Becharat as a Director of the Company and, in consequence, from his

duties as member of the Appointments and Compensation Committee.

The Board would like to thank Mr. Becharat for his constructive

participation in the work of the Board and the Committee during

term of office.

Availability of the Interim Financial Report

Claranova's Interim Financial Report for the six-month period

ended December 31, 2021 was filed with the French Autorité des

Marchés Financiers (AMF) on March 30, 2022.

Claranova's Interim Financial Report and the presentation on its

H1 2021-2022 results are available on the Company's website:

https://www.claranova.com/investisseurs/publications-financieres/

Financial calendar: May 10, 2022: Q3

2021-2022 revenue

About Claranova:

As a diversified global technology company, Claranova manages

and coordinates a portfolio of majority interests in digital

companies with strong growth potential. Supported by a team

combining several decades of experience in the world of technology,

Claranova has acquired a unique know-how in successfully turning

around, creating and developing innovative companies.

With average annual growth of more than 40% over the last three

years and revenue of €472m in FY 2020-2021, Claranova has proven

its capacity to turn a simple idea into a worldwide success in just

a few short years. Present in 15 countries and leveraging the

technology expertise of nearly 800 employees across North America

and Europe, Claranova is a truly international company, with 95% of

its revenue derived from international markets.

Claranova’s portfolio of companies is organized into three

unique technology activities operating in all major digital

sectors. Claranova stands out for its technological expertise in

personalized e-commerce, software publishing and the Internet of

Things, through its three business divisions, PlanetArt, Avanquest

and myDevices. These three technology platforms share a common

vision: empowering people through innovation by providing simple

and intuitive digital solutions that facilitate everyday access to

the very best of technology.

For more information on Claranova group:

https://www.claranova.com or

https://twitter.com/claranova_group

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements.

Appendices

Appendix 1: Consolidated Income Statement

In €m

H1 2021-2022

H1 2020-2021

Net revenue

280.5

277.8

Raw materials and purchases of goods

(84.4)

(91.0)

Other purchases and external expenses

(127.1)

(119.1)

Taxes, duties and similar payments

(0.4)

(0.4)

Employee expenses

(35.2)

(32.4)

Depreciation, amortization and provisions

(net of reversals)

(4.9)

(4.1)

Other recurring operating income and

expenses

(8.8)

(10.1)

Recurring Operating Income

19.9

20.8

Other operating income and expenses

0.3

(3.3)

Operating Profit

20.2

17.5

Net financial income (expense)

(10.5)

(3.5)

Tax expense

(5.4)

(3.5)

Net Income

4.3

10.5

Net income attributable to owners of

the Company

3.0

8.5

Appendix 2: Earnings per share

(In €)

H1 2021-2022

H1 2020-2021

Average number of shares outstanding*

(in units)

42,616,876

39,200,753

Average number shares outstanding after

potential dilution (in units)

46,863,760

39,905,818

Net income per share

€ 0.10

€ 0.27

Net income per share after potential

dilution

€ 0.09

€ 0.26

Adjusted net income per share

€ 0.20

€ 0.36

Adjusted net income per share after

potential dilution

€ 0.19

€ 0.36

Net income per share attributable to

owners of the Company

€ 0.07

€ 0.22

Net income per share attributable to

owners of the Company after potential dilution

€ 0.06

€ 0.21

Adjusted net income per share attributable

to owners of the Company

€ 0.17

€ 0.31

Adjusted net income attributable to owners

of the Company after dilution

€ 0.16

€ 0.30

Appendix 3: Calculation of EBITDA and Adjusted net

income

EBITDA and Adjusted net income are non-GAAP measures and should

be viewed as additional information. They do not replace Group IFRS

aggregates. Claranova’s Management considers these measures to be

relevant indicators of the Group’s operating and financial

performance. It presents them for information purposes, as they

enable most non-operating and non-recurring items to be excluded

from the measurement of business performance.

The transition from Recurring Operating Income to EBITDA is as

follows:

In €m

H1 2021-2022

H1 2020-2021

Recurring Operating Income

19.9

20.8

Impact of IFRS 16 on leases expenses

(2.0)

(1.8)

Share-based payments, including social

security expenses

0.4

0.0

Depreciation, amortization and

provisions

4.9

4.1

EBITDA

23.1

23.1

The reconciliation of Net Income to Adjusted Net income is as

follows:

In €m

H1 2021-2022

H1 2020-2021

Net Income

4.3

10.5

IFRS 16 impact on Net income

0.0

0.2

Share-based payments, including social

security expenses

0.4

0.0

Fair value remeasurement of financial

instruments

4.3

0.1

Other operating income and expenses

(0.3)

3.3

Adjusted net income

8.7

14.2

Appendix 4: Simplified Statement of Financial

Position

Claranova’s total assets increased from €224.9m to €312.2m

between June 30, 2020 and December 31, 2020. This €87.3m increase

reflects mainly the significant growth in cash and cash equivalents

of €61.7m generated by the Group’s operations in the first half in

relation to June 30, 2021. The increase in liabilities is largely

the result of the increase in financial debt and the seasonal

effect of PlanetArt's activities as reflected by a sharp rise in

trade payables at the end of the calendar year.

Group balance sheet highlights:

In €m

12/31/2021

06/30/2020

Goodwill

75.2

64.4

Other non-current assets

27.6

25.1

Right-of-use lease assets

14.6

7.0

Current assets (excl. Cash and cash

equivalents)

42.8

38.0

Cash and cash equivalents

152.0

90.4

Total assets

312.2

224.9

Equity

35.6

83.1

Financial liabilities

150.2

65.2

Lease liabilities

15.2

7.5

Other non-current liabilities

5.2

4.5

Other-current liabilities

106.0

64.6

Total equity and liabilities

312.2

224.9

Shareholders' equity decreased by €47.6m between June 30 and

December 31, 2021, mainly in response to the recognition of the

buyout of Canadian minority interests during the period.

On the one hand, shareholders' equity was reduced by a total of

€99.9m linked to the buyout of Canadian minority shareholders. On

the other hand, this negative impact was partly offset by inflows

from capital increases during the period totaling €42.6m, with the

balance resulting from translation differences and other

transactions with shareholders, including the myDevices Inc.

capital increase. Shareholders are invited to refer to Paragraph

2.4 of Chapter 2 of the interim Financial Report for further

details.

___________________________ 1 EBITDA (earnings before interest,

taxes, depreciation and amortization) is a non-GAAP aggregate used

to measure the operating performance of the businesses. It is equal

to Recurring Operating Income before depreciation, amortization and

share-based payments including related social security expenses and

the IFRS 16 impact on the recognition of leases. Details on the

calculation of EBITDA are provided in the Appendix to this

presentation. 2 Cash flow from operations before changes in working

capital. 3 A business model that involves outsourcing production to

third-party partners 4 Software as a Service. 5 Like-for-like

(organic) growth equals the increase in revenue at constant

consolidation scope and exchange rates. 6 Excluding the IFRS 16

impact on the accounting of leases 7 EBITDA as a percentage of

revenue. 8 Based on management reporting 9 B2C or

Business-to-Consumer refers to the process where businesses sell

products and services directly to individual consumers. 10 Change

in Working Capital Requirements in relation to the opening cash for

the fiscal period. 11 Change in cash in relation to the opening

cash position for the fiscal period. 12 Excluding lease liabilities

resulting from the adoption of IFRS 16.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220330005756/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 65

ir@claranova.com

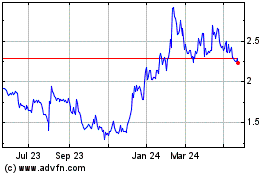

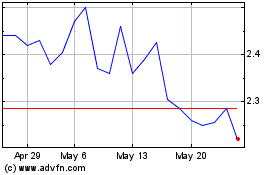

Claranova (EU:CLA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Claranova (EU:CLA)

Historical Stock Chart

From Nov 2023 to Nov 2024