The Paris Court of Appeal confirms the conformity of Capgemini's

friendly tender offer for Altran

|

Press relations:Florence LièvreTel: +33 1 47 54 50

71florence.lievre@capgemini.com |

Press & Investor Relations:Stéphanie BiaTel:

+33 1 46 41 72 01stephanie.bia@altran.com |

|

Investor Relations:Vincent BiraudTel: +33 1 47 54

50 87vincent.biraud@capgemini.com |

|

The Paris Court of

Appeal confirms the conformity of Capgemini's friendly tender offer

for Altran

- Capgemini's takeover of Altran

is now effective

- A final reopening of the offer will take place from 16

to 27 March 2020 (inclusive)

Paris, March 13, 2020 - In a judgment dated

today, the Paris Court of Appeal dismissed the appeal filed against

the clearance decision issued by the French financial market

authority (Autorité des marchés financiers - AMF) in connection

with Capgemini’s friendly tender offer (Euronext Paris: CAP) for

the shares of Altran Technologies (Euronext Paris: ALT). The Court

of Appeal thus confirmed the validity of the offer with regard to

applicable laws and regulations and the validity of Altran's

response document.

The takeover of Altran by Capgemini, which currently holds

55.13% of the share capital and 55.06% of the voting rights of

Altran1, is now effective. The Group can now implement its strategy

to create a world leader in the digital transformation of

industrial companies, which it calls "Intelligent Industry".

Paul Hermelin, Chairman and Chief Executive Officer of the

Capgemini Group and Aiman Ezzat, the next Chief Executive Officer

of the Capgemini Group following the May 2020 Annual General

Meeting, are pleased and stated: "We are delighted with the

decision of the Court of Appeal. We welcome all of Altran's

employees in the Group. Together, we will build a world leader in

“Intelligent Industry” through our complementary technological

expertise and the strength of our business. A final stage of the

friendly tender offer will begin as soon as Monday with the

reopening of the offer for a period of 10 trading days. This

reopening is the last opportunity for Altran shareholders to

benefit from Capgemini's offer at a price of €14.5 per share, which

is a particularly attractive offer in the current market

conditions".

Dominique Cerutti, Chairman and Chief Executive Officer of the

Altran Group added: "Today’s decision is excellent news and we look

forward to working together with Capgemini's teams to create the

global leader in the “Intelligent Industry” addressing our clients'

needs for innovation and digital transformation. I would like to

sincerely thank all of our employees who have remained committed to

our clients throughout this tender offer process”.

In accordance with the commitments made by Capgemini2, the offer

will be reopened from 16 to 27 March 2020 (inclusive) on the same

financial terms, allowing shareholders who have not yet tendered

their shares to the offer to do so at a price of 14.50 euros per

Altran share.

Capgemini reiterates that it has also undertaken, for a period

of 18 months from January 14, 2020, not to file a new offer or

implement a merger on the basis of a price per Altran share higher

than the offer price3.

Altran's financial results will be consolidated in the

Capgemini Group's financial statements as from April 1, 2020. The

publication of results for the first half of 2020, which will be

the first consolidated publication, will take place at the

beginning of September 2020.

CAPGEMINI CALENDAR

- April 28, 2020

Publication of Q1 2020 revenues

- May 20, 2020

Combined Shareholders’ Meeting

- September 3, 2020 Publication of H1 2020

results

ALTRAN CALENDAR

- April 22, 2020

Publication of Q1 2020 revenues

- June 23, 2020

Combined Shareholders’ Meeting

- September 2, 2020 Publication of H1

2020 results

Capgemini's offer document and

Altran's response document, as approved by the AMF on October 14,

2019 under visa no. 19-489 and visa no. 19-490 respectively, as

well as documents relating to the other information of each

company, are available on the AMF website (www.amf-france.org), and

on the websites of Capgemini (www.capgemini.com/altran-en) or

Altran Technologies (www.altran.com). These documents can be

obtained free of charge from Capgemini (11 rue de Tilsitt, 75017

Paris, France) or Altran Technologies (96 avenue Charles de Gaulle,

92200 Neuilly-sur-Seine, France), depending on whether they relate

to Capgemini or Altran Technologies.

IMPORTANT INFORMATION

This press release is disseminated for

information purposes only and does not constitute an offer to

purchase, or a solicitation of an offer to sell, any securities of

Altran.

Investors and shareholders are strongly advised

to read the documentation relating to the tender offer, which

includes the terms and conditions of the offer, as well as any

amendments or supplements to those documents as they will contain

important information about Capgemini, Altran and the proposed

transaction.

This press release must not be published,

broadcast or distributed, directly or indirectly, in any country in

which the distribution of this information is subject to legal

restrictions. The tender offer will not be open to the public in

jurisdictions in which its launch is subject to legal

restrictions.

The publication, broadcasting or distribution of

this press release in certain countries may be subject to legal or

regulatory restrictions. Therefore, persons located in countries

where this press release is published, broadcasted or distributed

must inform themselves about and comply with such restrictions.

Capgemini disclaims any responsibility for any violation of such

restrictions.

About Capgemini

A global leader in consulting, technology

services and digital transformation, Capgemini is at the forefront

of innovation to address the entire breadth of clients’

opportunities in the evolving world of cloud, digital and

platforms. Building on its strong 50-year heritage and deep

industry-specific expertise, Capgemini enables organizations to

realize their business ambitions through an array of services from

strategy to operations. Capgemini is driven by the conviction that

the business value of technology comes from and through people. It

is a multicultural company of almost 220,000 team members in more

than 40 countries. The Group reported 2019 global revenues of

EUR 14.1 billion.Visit us at www.capgemini.com. People matter,

results count.

About Altran

Altran is the undisputed world leader in

engineering and R&D services. The Group offers its customers a

unique value proposition to meet their transformation and

innovation challenges. Altran supports its customers, from concept

to industrialization, to develop the products and services of

tomorrow. Altran has been working for more than 35 years with major

players in many sectors: Automotive, Aeronautics, Space, Defence

& Naval, Rail, Infrastructure & Transport, Industry &

Consumer Products, Life Sciences, Communications, Semiconductor

& Electronics, Software & Internet, Finance & Public

Sector. The acquisition of Aricent expands the Group's portfolio of

expertise in semiconductors, digital experience and design

innovation. Altran generated €3.2 billion in revenue in 2019, with

nearly 50,000 employees in more than 30 countries.

www.altran.com

1 Taking into account treasury shares and on the

basis of a share capital of Altran comprised of 257,021,105 shares

representing 257,351,451 voting rights as of February 28, 2020.

2 See AMF notice 219C2818 dated December 18, 2019.

3 See Capgemini Press Release date January 14,

2020.

-

Capgemini_-_2020-03-13_-_conformity_of_capgemini_tender_offer_for_Altran_is_confirmed

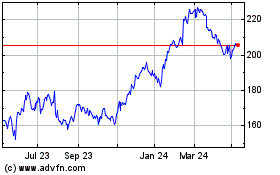

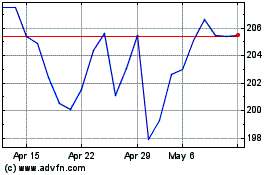

Capgemini (EU:CAP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Capgemini (EU:CAP)

Historical Stock Chart

From Nov 2023 to Nov 2024