Q1 results Brunel: Revenue up, EBIT down, limited impact from

COVID-19

Amsterdam, 30 April 2020

Key points Q1

2020

- Revenue excluding BIS up 6% (yoy) to EUR 257 million over the

quarter;

- EBIT excluding BIS down by 28% (yoy) to EUR 8 million, mainly

due to decrease in the DACH region;

- Impact of COVID-19 on Q1 results limited, more impact in

Q2;

- Strong financial position, cash and borrowing capacity,

enabling Brunel to cope with the current crisis

Jilko Andringa, CEO of

Brunel:“Brunel’s results in Q1 continued to show an

excellent performance in our Middle East & India region and

positive developments in Australasia and The Rest of the World.

Australasia’s new leadership made great progress and reached

break-even-level, for the first time in many years. The Netherlands

improved its profitability as a result of significant cost savings

to mitigate the challenges on the flex market.

As communicated in March, we were confronted

with the effects of the Corona virus early in the year in our

international operations. In The Netherlands and the DACH region,

the impact started from mid-March. In total, our revenues over the

first quarter were still largely unaffected. Having said that, the

Corona virus is impacting our business and our everyday lives. Our

main priority continues to be the health and safety of all

Brunellers. We follow this closely and are happy to see that only a

few colleagues got the Corona virus and none of them is in a

critical condition at the moment. I also would like to share my

gratefulness for the flexibility and dedication of all Brunellers

and their family and friends. It is impressive to see how everybody

makes the extra step for Brunel.

Looking forward, we expect revenue decline in

the coming quarters and see tough economic conditions in most of

our regions and industries. Our response plan has great depth and

is built on our historic experiences for internal adjustments and

on external models for future revenue and margin expectations. We

have the flexibility to adjust our structure and costs where needed

to manage through this crisis. In addition, we are comfortable that

our cash position and borrowing capacity are adequate to get Brunel

through this situation, with the room to invest when opportunities

arise.”

Q1 2020 results by divisionP&L amounts in

EUR million

Summary:

|

Revenue |

Q1 2020 |

Q1 2019 |

VAR.% |

| |

|

|

|

| DACH

region |

69.6 |

73.6 |

-5% |

| The

Netherlands |

50.8 |

54.5 |

-7% |

|

Australasia |

30.0 |

28.7 |

5% |

| Middle East

& India |

33.8 |

27.0 |

25% |

| Americas |

28.7 |

22.3 |

29% |

| Rest of

world |

44.2 |

36.7 |

20% |

|

Subtotal |

257.1 |

242.8 |

6% |

| |

|

|

|

| BIS |

0.8 |

23.4 |

|

| |

|

|

|

|

Total |

257.9 |

266.2 |

-3% |

|

EBIT |

Q1 2020 |

Q1 2019 |

VAR.% |

| |

|

|

|

| DACH

region |

4.0 |

8.5 |

-53% |

| The

Netherlands |

3.2 |

2.8 |

14% |

|

Australasia |

0.0 |

-0.6 |

|

| Middle East

& India |

3.2 |

2.9 |

10% |

| Americas |

-0.8 |

0.3 |

-367% |

| Rest of

world |

1.1 |

-0.3 |

467% |

|

Unallocated |

-2.6 |

-2.4 |

-8% |

|

Subtotal |

8.1 |

11.2 |

-28% |

| |

|

|

|

| BIS |

-0.1 |

0.9 |

|

| |

|

|

|

|

Total |

8.0 |

12.1 |

-34% |

| Brunel

International (unaudited) |

|

|

|

| P&L amounts in EUR

million |

|

|

|

|

|

| |

Q1 2020 |

Q1 2019 |

Change % |

|

|

| Revenue continued operations |

257.1 |

242.8 |

6% |

|

|

| Revenue BIS |

0.8 |

23.4 |

|

|

|

| Total revenue |

257.9 |

266.2 |

-3% |

a |

|

| Gross Profit |

54.4 |

59.1 |

-8% |

|

|

| Gross margin |

21.1% |

22.2% |

|

|

|

| Operating costs |

46.4 |

47.0 |

-1% |

b |

|

| EBIT |

8.0 |

12.1 |

-34% |

|

|

| EBIT % |

3.1% |

4.5% |

|

|

|

| |

|

|

|

|

|

| Average directs |

11,447 |

12,987 |

-12% |

|

|

| Average indirects |

1,567 |

1,609 |

-3% |

|

|

| Ratio direct / Indirect |

7.3 |

8.1 |

|

|

|

| |

|

|

|

|

|

| a -3 % like-for-like |

|

|

|

| b -1 % like-for-like |

|

|

|

| Like-for-like is measured

excluding the impact of currencies and acquisitions |

|

|

|

The Group’s revenue excluding

BIS increased by 6%, especially due to the excellent performance in

our Middle East & India region and the positive developments in

Australasia and The Rest of the World and the additional working

day in Germany and The Netherlands. EBIT excluding BIS decreased by

28%.

The COVID-19 outbreak and the sharp decrease in

oil price had an impact on the valuation of the Group’s assets and

liabilities. We have added EUR 1.0 million to the provision for

doubtful debt, of which EUR 0.5 million relates to the DACH

region, due to the diversified client base. The changing

environment increased the expected credit losses on our trade

receivables.

| DACH

region (unaudited) |

|

| P&L amounts in EUR

million |

|

|

|

| |

Q1 2020 |

Q1 2019 |

Change % |

|

| Revenue |

69.6 |

73.6 |

-5% |

|

| Gross Profit |

21.3 |

24.8 |

-14% |

|

| Gross margin |

30.6% |

33.7% |

|

|

| Operating costs |

17.3 |

16.3 |

6% |

|

| EBIT |

4.0 |

8.5 |

-53% |

|

| EBIT % |

5.7% |

11.5% |

|

|

| |

|

|

|

|

| Average directs |

2,548 |

2,698 |

-6% |

|

| Average indirects |

510 |

503 |

2% |

|

| Ratio direct / Indirect |

5.0 |

5.4 |

|

|

As anticipated, revenue and gross margin

decreased due to the lower headcount and expected lower

productivity. From mid-March, the performance in the DACH region

was affected by COVID-19. Work from home policies are in effect and

although only a few projects were cancelled or postponed, this has

resulted in an even lower productivity and a significant reduction

of the number of new projects.

We applied for the government relief plan of

short-time working (“Kurzarbeit”) for over 450 professionals and

200 staff, starting 1 April. The relief plan allows for part of the

employees’ compensation to be paid by the government. Although this

will have a positive effect on costs, we will see a significant

reduction of the revenue and gross profit contribution of these

professionals in Q2.

Revenue per working day in the DACH

region decreased by 7%. The gross margin adjusted for

working days is 29.7% in Q1 2020 (2019: 33.7%).

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2020 |

64 |

59 |

66 |

65 |

254 |

|

2019 |

63 |

59 |

66 |

62 |

250 |

Headcount as of 31 March was 2,545 (2019: 2,713).

| The

Netherlands (unaudited) |

|

| P&L amounts in EUR

million |

|

|

|

| |

Q1 2020 |

Q1 2019 |

Change % |

|

| Revenue |

50.8 |

54.5 |

-7% |

|

| Gross Profit |

14.1 |

15.1 |

-7% |

|

| Gross margin |

27.8% |

27.7% |

|

|

| Operating costs |

10.9 |

12.3 |

-11% |

|

| EBIT |

3.2 |

2.8 |

14% |

|

| EBIT % |

6.3% |

5.1% |

|

|

| |

|

|

|

|

| Average directs |

2,016 |

2,377 |

-15% |

|

| Average indirects |

367 |

429 |

-14% |

|

| Ratio direct / Indirect |

5.5 |

5.5 |

|

|

Mid-March the Dutch government decided to

implement measures to stop the spreading of COVID-19. Many of our

professionals and staff work from home. The number of new projects

reduced significantly and the bench is increasing. At the moment,

we do not yet meet the conditions to use the government relief plan

(‘NOW-regeling’), but if the headcount decreases significantly or

the conditions of the plan are adjusted, this might also be

applicable for us.

Revenue per working day in The

Netherlands decreased by 8%, mainly due to the challenging

circumstances in the Dutch flex market. Gross margin adjusted for

working days is 26.8% in Q1 2020 (Q1 2019: 27.7%). EBIT improved as

the result of all cost saving initiatives that were started in

2019.

Working days The Netherlands:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2020 |

64 |

60 |

66 |

65 |

255 |

|

2019 |

63 |

62 |

66 |

64 |

255 |

Headcount as of 31 March was 2,000 (2019:

2,339).

|

Australasia (unaudited) |

|

| P&L amounts in EUR

million |

|

|

|

| |

Q1 2020 |

Q1 2019 |

Change % |

|

| Revenue |

30.0 |

28.7 |

5% |

a |

| Gross Profit |

2.6 |

2.3 |

13% |

|

| Gross margin |

8.7% |

8.0% |

|

|

| Operating costs |

2.6 |

2.9 |

-10% |

b |

| EBIT |

0 |

-0.6 |

100% |

|

| EBIT % |

0.0% |

-2.1% |

|

|

| |

|

|

|

|

| Average directs |

1,059 |

908 |

17% |

|

| Average indirects |

82 |

85 |

-4% |

|

| Ratio direct / Indirect |

13.0 |

10.7 |

|

|

| |

|

|

|

|

| a 11 % like-for-like |

|

| b -6 % like-for-like |

|

| Like-for-like is measured

excluding the impact of currencies and acquisitions |

|

Australasia shows a mixed

picture. Both the oil & gas and mining sectors are considered

essential to the economy and projects continue, also following the

COVID-19 related developments in China, where companies are going

back to business. However, in Australia and PNG there are travel

restrictions that limit the availability of expats and hence

require a larger local workforce. We see a rapid response in the

mining sector, requesting support to fill these local

positions.

Measures taken in 2019 by Australia’s new

leadership are starting to show a return. Revenue is up and so is

our operational leverage, leading to a break-even level in Q1.

| Middle

East & India (unaudited) |

|

| P&L amounts in EUR

million |

|

|

|

| |

Q1 2020 |

Q1 2019 |

Change % |

|

| Revenue |

33.8 |

27.0 |

25% |

a |

| Gross Profit |

5.9 |

4.8 |

23% |

|

| Gross margin |

17.5% |

17.8% |

|

|

| Operating costs |

2.7 |

1.9 |

42% |

b |

| EBIT |

3.2 |

2.9 |

10% |

|

| EBIT % |

9.5% |

10.7% |

|

|

| |

|

|

|

|

| Average directs |

2,711 |

3,932 |

-31% |

|

| Average indirects |

146 |

129 |

13% |

|

| Ratio direct / Indirect |

18.5 |

30.4 |

|

|

| |

|

|

|

|

| a 22 % like-for-like |

|

| b 36 % like-for-like |

|

| Like-for-like is measured

excluding the impact of currencies and acquisitions |

|

The region Middle East &

India continued its strong performance, supported by

investments in our operations to support growth. The effects of

COVID-19 are most visible in the speed of onboarding new

professionals. Most countries are now in lockdown and do not allow

expats to enter the country. This delays projects we have won, but

we expect these to commence once travel restrictions are

lifted.

| Americas

(unaudited) |

| P&L amounts in EUR

million |

|

|

| |

Q1 2020 |

Q1 2019 |

Change % |

| Revenue |

28.7 |

22.3 |

29% |

| Gross Profit |

3.2 |

2.9 |

10% |

| Gross margin |

11.1% |

13.0% |

|

| Operating costs |

4.0 |

2.6 |

54% |

| EBIT |

-0.8 |

0.3 |

-367% |

| EBIT % |

-2.8% |

1.3% |

|

| |

|

|

|

| Average directs |

877 |

797 |

10% |

| Average indirects |

121 |

124 |

-2% |

| Ratio direct / Indirect |

7.2 |

6.4 |

|

| |

|

|

|

| a 28 % like-for-like |

| b 53 % like-for-like |

| Like-for-like is measured

excluding the impact of currencies and acquisitions |

In the Americas, revenues grew

by 29%, while margin in Q1 has decreased compared to Q1 2019,

mainly due to lower perm fees. Operating costs have increased to

support the (anticipated) growth and will be adjusted to the

current economic circumstances, as COVID-19, in combination with

the decrease in oil price, caused a disruption in the market.

Working from home policies are in place and we see lay-offs at our

clients. The decrease in oil price has the most immediate effect in

the shale play, where our presence is limited. We continue to work

on projects that will continue for the foreseeable future and have

adjusted our organisation to match this new reality.

| Rest of

world (unaudited) |

|

| P&L amounts in EUR

million |

|

|

|

| |

Q1 2020 |

Q1 2019 |

Change % |

|

| Revenue |

44.2 |

36.7 |

20% |

a |

| Gross Profit |

7.3 |

5.7 |

28% |

|

| Gross margin |

16.5% |

15.5% |

|

|

| Operating costs |

6.2 |

6.0 |

3% |

b |

| EBIT |

1.1 |

-0.3 |

467% |

|

| EBIT % |

2.5% |

-0.8% |

|

|

| |

|

|

|

|

| Average directs |

2,195 |

1,798 |

22% |

|

| Average indirects |

275 |

277 |

-1% |

|

| Ratio direct / Indirect |

8.0 |

6.5 |

|

|

| |

|

|

|

|

| a 19 % like-for-like |

|

| b 4 % like-for-like |

|

| Like-for-like is measured

excluding the impact of currencies and acquisitions |

The Rest of World includes

South East Asia, Russia & Caspian area, Belgium and Europe

& Africa. Revenues increased by 20%, mainly driven by our

activities in China and Singapore. The margin in Q1 has been

supported by positive developments in exchange rates. The impact of

the COVID-19 virus on the Q1 results is limited. In most cases, the

projects we are working on are at a point that they will be

completed and are marked essential to local economies. In China we

are almost back to business-as-usual. We expect a change in the

market as global mobility will be limited and companies will look

for local solutions.

Closure of Brunel Industry

ServicesIn October 2019, we took the decision to halt the

activities of Brunel Industry Services in the US. Following

termination of all existing client contracts in 2019, the only

remaining project is the water treatment plant. This project is

marked essential, which means that following the outbreak of

COVID-19, we can continue our work under strict HSE measures. These

measures however cause a delay in the project. Nonetheless, we

confirm our expectation to finalise the water treatment project in

Q2 2020 and in line with the estimates.

OutlookLooking ahead, we

foresee revenue decline in the coming quarters and challenging

economic conditions in most of our regions and industries. The

second quarter is always our weakest quarter due to the

seasonality, and will significantly be affected by the impact of

COVID-19. However, we also see that many of our professionals can

continue to work, either from home or because they are working on

essential projects. Our results are also supported by relief plans

and flexibility in our cost structure.

In the DACH region, at the moment 75% of our

professionals continue to work on our clients’ projects. Most of

the remaining professionals are in the short-term working program.

For these employees, compensation is paid by the government. In The

Netherlands, headcount is decreasing and the bench has increased to

7% in April. Americas is facing cancellations of projects, also due

to the low oil price. Overall, we are adjusting the cost base to

reflect the anticipated lower level of activities.

The overall impact will depend on how fast

COVID-19 can be controlled, and how soon economies can start

recovering. Brunel’s financial position remains strong and we have

sufficient cash and borrowing base to deal with these circumstances

in a healthy manner. In times of declining activities, our cashflow

is supported by the release of working capital. Slightly better

than our normal seasonal pattern, our net cash position only

decreased to EUR 87 million at 31 March 2020 (31 December 2019: EUR

92 million).

- Brunel Press Release Q1.pdf

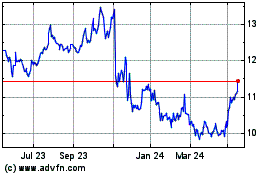

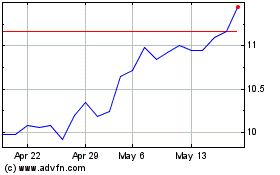

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Jul 2023 to Jul 2024