Results Q3 2019

Amsterdam, 1 November 2019

Key points Q3 2019

- Revenue up by 11% to EUR 260 million

- EBIT continued operations up by 13% to EUR 14 million

- EBIT (including BIS) down by 39% to EUR 7 million

Key points YTD 2019

- Revenue continued operations up by 12%

- EBIT continued operations up by 27% to EUR 31 million

- EBIT (including BIS) down by 19% to EUR 19 million

Dividend

- Dividend will be based on normalised earnings

Jilko Andringa, CEO of Brunel International

N.V.: “Our continued operations achieved double digit growth in

revenue and profitability. DACH and Middle East had another strong

quarter. Growth in the Rest of the World remains high. The

discontinuation of BIS has a significant impact on the results this

year. Together with the global leadership team, Peter de Laat and I

will continue to execute the communicated strategy to achieve our

multiyear goals.”

Q3 2019 results by division

(P&L amounts in EUR million)

| Revenue |

Q3 2019 |

Q3 2018 |

Δ% |

|

YTD 2019 |

YTD 2018 |

Δ% |

| DACH region |

74.5 |

70.5 |

6% |

|

217.7 |

200.5 |

9% |

| The Netherlands |

49.4 |

52.8 |

-7% |

|

155.7 |

163.1 |

-5% |

| Australasia |

31.1 |

30.4 |

2% |

|

88.4 |

86.4 |

2% |

| Middle East & India |

29.5 |

22.6 |

31% |

|

85.1 |

62.1 |

37% |

| Rest of world |

72.8 |

55.1 |

32% |

|

197.1 |

149.8 |

32% |

| Total continued

operations |

257.3 |

231.5 |

11% |

|

744.0 |

661.9 |

12% |

| Discontinued - BIS* |

2.4 |

3.2 |

|

|

40.0 |

7.9 |

|

| Total

revenue |

259.7 |

234.6 |

11% |

|

784.0 |

669.7 |

17% |

| EBIT |

Q3 2019 |

Q3 2018 |

Δ% |

|

YTD 2019 |

YTD 2018 |

Δ% |

| DACH region |

10.7 |

8.5 |

25% |

|

23.5 |

18.9 |

24% |

| The Netherlands |

2.7 |

3.0 |

-11% |

|

7.0 |

8.3 |

-15% |

| Australasia |

-0.3 |

0.0 |

- |

|

-1.2 |

-0.5 |

-129% |

| Middle East & India |

2.6 |

2.1 |

24% |

|

7.7 |

5.5 |

41% |

| Rest of world |

-0.4 |

0.5 |

-172% |

|

-1.1 |

-1.2 |

9% |

| Unallocated |

-1.4 |

-1.8 |

24% |

|

-5.2 |

-6.8 |

24% |

| Total continued

operations |

13.9 |

12.2 |

13% |

|

30.8 |

24.1 |

27% |

| Discontinued - BIS* |

-6.5 |

-0.2 |

|

|

-11.8 |

-0.8 |

|

| Total

EBIT |

7.3 |

12.0 |

-39% |

|

18.9 |

23.3 |

-19% |

* Brunel Industry Services – discontinued in October 2019

|

Brunel International (unaudited) |

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q3

2019 |

Q3

2018 |

Δ% |

|

|

YTD

2019 |

YTD

2018 |

Δ% |

|

| Revenue |

259.7 |

234.6 |

11% |

a |

|

784.0 |

669.7 |

17% |

b |

| Gross Profit |

55.8 |

54.9 |

2% |

|

|

161.9 |

153.5 |

5% |

|

| Gross margin |

21.5% |

23.4% |

|

|

|

20.7% |

22.9% |

|

|

| Operating costs |

48.5 |

42.9 |

13% |

c |

|

143.0 |

130.2 |

10% |

d |

| EBIT |

7.3 |

12.0 |

-39% |

|

|

18.9 |

23.3 |

-19% |

|

| EBIT % |

2.8% |

5.1% |

|

|

|

2.4% |

3.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

11,225 |

12,087 |

-7% |

|

|

12,273 |

11,734 |

5% |

|

| Average indirects |

1,651 |

1,542 |

7% |

|

|

1,637 |

1,536 |

7% |

|

| Ratio direct / Indirect |

6.8 |

7.8 |

|

|

|

7.5 |

7.6 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 9 % like-for-like |

|

|

|

|

|

|

| b 15 % like-for-like |

|

|

|

|

|

|

| c 11 % like-for-like |

|

|

|

|

|

|

| d 9 % like-for-like |

|

|

|

|

|

|

| Like-for-like is measured excluding the impact of

currencies and acquisitions |

|

The decrease in gross margin (YoY) is the result of the impact

of BIS and a change in the mix.

|

DACH region (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q3

2019 |

Q3

2018 |

Δ% |

|

|

YTD

2019 |

YTD

2018 |

Δ% |

|

| Revenue |

74.5 |

70.5 |

6% |

|

|

217.7 |

200.5 |

9% |

|

| Gross Profit |

27.1 |

23.8 |

13% |

|

|

72.5 |

64.6 |

12% |

|

| Gross margin |

36.3% |

33.8% |

|

|

|

33.3% |

32.2% |

|

|

| Operating costs |

16.4 |

15.3 |

7% |

|

|

49.0 |

45.7 |

7% |

|

| EBIT |

10.7 |

8.5 |

25% |

|

|

23.5 |

18.9 |

24% |

|

| EBIT % |

14.3% |

12.1% |

|

|

|

10.8% |

9.4% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,717 |

2,698 |

1% |

|

|

2,713 |

2,609 |

4% |

|

| Average indirects |

518 |

472 |

10% |

|

|

512 |

473 |

8% |

|

| Ratio direct / Indirect |

5.2 |

5.7 |

|

|

|

5.3 |

5.5 |

|

|

This region includes Germany, Switzerland,

Austria and Czech Republic. In the DACH region, we have seen a

revenue growth of 6%, slightly impacted by the slowdown in the

automotive industry. We expect these circumstances to further

impact revenue growth in Q4, with a slight decrease of

profitability due to a higher bench in Q4. Revenue per working day

increased by 4.6% in Q3. The Q3 gross margin adjusted for working

days is 35.5% (Q3 2018: 33.8%).

|

Working days |

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2019 |

63 |

59 |

66 |

62 |

250 |

|

2018 |

63 |

60 |

65 |

62 |

250 |

|

Brunel Netherlands (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q3

2019 |

Q3

2018 |

Δ% |

|

|

YTD

2019 |

YTD

2018 |

Δ% |

|

| Revenue |

49.4 |

52.8 |

-7% |

|

|

155.7 |

163.1 |

-5% |

|

| Gross Profit |

13.8 |

15.4 |

-11% |

|

|

42.1 |

46.6 |

-10% |

|

| Gross margin |

27.9% |

29.2% |

|

|

|

27.0% |

28.5% |

|

|

| Operating costs |

11.1 |

12.4 |

-10% |

|

|

35.1 |

38.3 |

-8% |

|

| EBIT |

2.7 |

3.0 |

-11% |

|

|

7.0 |

8.3 |

-15% |

|

| EBIT % |

5.4% |

5.7% |

|

|

|

4.5% |

5.1% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,172 |

2,449 |

-11% |

|

|

2,277 |

2,441 |

-7% |

|

| Average indirects |

405 |

449 |

-10% |

|

|

417 |

435 |

-4% |

|

| Ratio direct / Indirect |

5.4 |

5.4 |

|

|

|

5.5 |

5.6 |

|

|

The performance in the Netherlands is still

hindered by the scarcity in specialized IT and Engineering talent.

To improve profitability, we have adjusted the structure in Q4, to

start 2020 with a leaner organization, with full focus on the

growth areas.

Revenue per working day decreased by 7.4%. The

Q3 gross margin adjusted for working days is 27.0% (2018: 29.2%),

where the YTD gross margin adjusted for working days is 26.7 %

(2018: 28.5%).

|

Working days |

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2019 |

63 |

62 |

66 |

64 |

255 |

|

2018 |

64 |

61 |

65 |

64 |

254 |

|

Australasia (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q3

2019 |

Q3

2018 |

Δ% |

|

|

YTD

2019 |

YTD

2018 |

Δ% |

|

| Revenue |

31.1 |

30.4 |

2% |

a |

|

88.4 |

86.4 |

2% |

b |

| Gross Profit |

2.6 |

2.5 |

5% |

|

|

7.3 |

7.0 |

3% |

|

| Gross margin |

8.3% |

8.1% |

|

|

|

8.2% |

8.1% |

|

|

| Operating costs |

2.9 |

2.5 |

16% |

c |

|

8.5 |

7.5 |

13% |

d |

| EBIT |

-0.3 |

- |

|

|

|

-1.2 |

-0.5 |

-129% |

|

| EBIT % |

-0.8% |

-0.1% |

|

|

|

-1.4% |

-0.6% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

906 |

917 |

-1% |

|

|

907 |

925 |

-2% |

|

| Average indirects |

86 |

80 |

8% |

|

|

85 |

77 |

10% |

|

| Ratio direct / Indirect |

10.5 |

11.5 |

|

|

|

10.7 |

12.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 3 % like-for-like |

|

|

|

|

|

|

| b 3 % like-for-like |

|

|

|

|

|

|

| c 14 % like-for-like |

|

|

|

|

|

|

| d 13 % like-for-like |

|

|

|

|

|

|

| Like-for-like is measured excluding the impact of

currencies and acquisitions |

|

Australasia includes Australia and Papua New

Guinea. We achieved limited growth despite the low number of new

projects in the Oil & Gas industry in this year. The increase

in operating costs mainly relates to increased sales activities to

prepare for upcoming projects.

|

Middle East & India (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q3

2019 |

Q3

2018 |

Δ% |

|

|

YTD

2019 |

YTD

2018 |

Δ% |

|

| Revenue |

29.5 |

22.6 |

31% |

a |

|

85.1 |

62.1 |

37% |

b |

| Gross Profit |

5.1 |

4.0 |

26% |

|

|

15.0 |

11.0 |

37% |

|

| Gross margin |

17.2% |

17.8% |

|

|

|

17.7% |

17.7% |

|

|

| Operating costs |

2.5 |

1.9 |

32% |

c |

|

7.3 |

5.5 |

33% |

d |

| EBIT |

2.6 |

2.1 |

24% |

|

|

7.7 |

5.5 |

41% |

|

| EBIT % |

8.6% |

9.1% |

|

|

|

9.1% |

8.8% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,605 |

3,478 |

-25% |

|

|

3,411 |

2,992 |

14% |

|

| Average indirects |

142 |

116 |

23% |

|

|

136 |

114 |

19% |

|

| Ratio direct / Indirect |

18.3 |

30.0 |

|

|

|

25.0 |

26.2 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 23 % like-for-like |

|

|

|

|

|

|

| b 30 % like-for-like |

|

|

|

|

|

|

| c 21 % like-for-like |

|

|

|

|

|

|

| d 26 % like-for-like |

|

|

|

|

|

|

| Like-for-like is measured excluding the impact of

currencies and acquisitions |

|

Middle East & India continues its strong,

double digit growth, mainly driven by the results in Qatar and

Kuwait. We have seen a small decline in revenue in India.

As a result of the implementation of IFRS 16,

for Q3 an amount of EUR 0.4 million is now recorded under operating

costs, which was previously (2018) recorded in cost of sales.

|

Rest of world (unaudited) |

|

| P&L amounts in EUR million |

|

|

|

|

|

|

|

|

| |

Q3

2019 |

Q3

2018 |

Δ% |

|

|

YTD

2019 |

YTD

2018 |

Δ% |

|

| Revenue |

72.8 |

55.1 |

32% |

a |

|

197.1 |

149.7 |

32% |

b |

| Gross Profit |

11.0 |

8.4 |

31% |

|

|

28.6 |

22.7 |

26% |

|

| Gross margin |

15.1% |

15.3% |

|

|

|

14.5% |

15.2% |

|

|

| Operating costs |

11.4 |

7.9 |

44% |

c |

|

29.7 |

23.9 |

24% |

d |

| EBIT |

-0.4 |

0.5 |

|

|

|

-1.1 |

-1.2 |

9% |

|

| EBIT % |

-0.5% |

0.9% |

|

|

|

-0.6% |

-0.8% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,688 |

2,490 |

8% |

|

|

2,659 |

2,735 |

-3% |

|

| Average indirects |

418 |

365 |

15% |

|

|

413 |

374 |

10% |

|

| Ratio direct / Indirect |

6.4 |

6.8 |

|

|

|

6.4 |

7.3 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 29 % like-for-like |

|

|

|

|

|

|

| b 29 % like-for-like |

|

|

|

|

|

|

| c 39 % like-for-like |

|

|

|

|

|

|

| d 21 % like-for-like |

|

|

|

|

|

|

| Like-for-like is measured excluding the impact of

currencies, acquisitions and discontinued operations |

|

Rest of World includes Americas, Asia, Russia

and the remaining European countries, but excludes the results from

BIS. Asia and Americas are the main growth drivers, following

increased activities in the Oil & Gas sector. Revenue growth

exceeds growth in direct headcount due to a change in the mix.

Operating cost increased due to further

investments in our sales force, new branches in China and

Guyana.

Discontinued operations – Brunel

Industry Services

As announced in our press release on 23 October,

we have decided to halt our operations in BIS. The market for shale

oil & gas experienced a slowdown bringing the revenues of our

BIS-activities at a very low level of EUR 2.4 million in Q3.

As we had built up our organisation in the past period, there was a

disbalance between capacity and activities, resulting in

significant operational losses of EUR 6.5 million in Q3.

As announced in the October press release, we expect to incur

operational losses for BIS in Q4 of EUR 2.5 million and one-off

costs of EUR 8 million to cease activities and speed up the

finalization of current projects.

Cash position

In line with seasonal patterns, the cash

position increased to EUR 81.7 million (30 June 2019: EUR 60.6

million).

Effective tax rate

Due to the fact that the losses incurred by BIS

in 2019 will not result in a refund of corporate income tax, nor

result in a deferred tax asset, our effective tax rate for 2019

will be over 70%, compared to 34% over 2018. Additionally, the

deferred tax asset on the balance sheet relating to the US of EUR

3.7 million is expected to be (partially) impaired.

Dividend

Brunel has the dividend policy to pay out

between 30% and 100% of the result over the year. In light of the

developments in BIS, we will exclude the results from discontinued

activities and use normalised earnings as the basis for dividend

over 2019.

Outlook for

2019

For our continued activities,

revenue for the full year is expected to be between EUR 980 million

and EUR 1,030 million, with EBIT between EUR 37 million and EUR 42

million.

Reported EBIT is expected to be between EUR 15

million and EUR 20 million for the full year 2019. Including BIS,

revenue will be between EUR 1,025 million and 1,075 million.

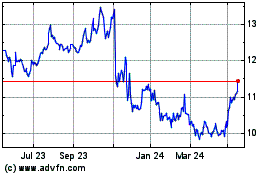

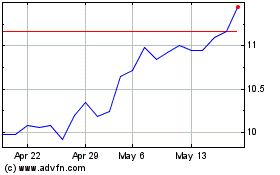

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Jul 2023 to Jul 2024