→ Final stage in the financing of the acquisition of Sopra

Banking Software with the launch of a share capital increase with

shareholders' preferential subscription rights for approximatively

€131m; → Birth of a new major player in enterprise software,

achieving critical scale with a bold 2025 ambition of c.€700m

revenue and c.€100m profit on operating activities.

Key terms of the transaction

- Capital increase with shareholders' preferential subscription

rights; - Subscription price: €16.10 per new share; - Subscription

ratio: 3 new shares for 8 existing shares; - Theoretical value of

the preferential subscription right: €3.11; - Trading period for

preferential subscription rights: from July 24, 2024 to August 16,

2024 included; - Subscription period: from July 26, 2024 to August

20, 2024 included; - Settlement and delivery and admission to

trading of the new shares: August 27, 2024; - Subscription

commitments by Sopra GMT for approximately 52.8% of the total

amount of the capital increase on an irreducible basis and for any

new share not subscribed at the end of the subscription period (on

an irreducible and reducible basis).

Regulatory News:

NOT TO BE PUBLISHED, FORWARDED OR DISTRIBUTED,

DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OF AMERICA, CANADA,

AUSTRALIA OR JAPAN

Axway (Paris:AXW) (the “Company”) announces today the launch of

a share capital increase with shareholders' preferential

subscription rights for a gross amount of approximately EUR €131

million to partially finance the acquisition of a significant

portion of Sopra Banking Software's activities.

Following the signing of the Sopra Banking Software acquisition

agreement announced on June 3, 2024 and on the date of the

Prospectus, the Company obtained all regulatory authorizations

required to proceed with the closing of the acquisition. In

addition, the exemption from the mandatory filing of a tender offer

by Sopra GMT for the Company's share capital was granted by the

Autorité des marchés financiers (the “AMF”) on June 4, 2024, under

the number 224C0810.

Completion of the acquisition is expected in early September

2024.

Patrick Donovan, Axway's Chief Executive Officer,

said:

"With the launch of its capital increase, Axway is taking a new

step in the acquisition of Sopra Banking Software announced last

February. We are giving birth to one of France’s top enterprise

software publishers, with unique positions in banking and financial

services. The acquisition of Sopra Banking Software represents a

major leap forward in our development, and is a perfect

illustration of our external growth ambitions. Beyond the change in

dimension, I am proud of our success in building an alliance

project that creates value for all our stakeholders, with

meaningful levers for our customers, employees and shareholders

alike."

Rationale of the issue and use of proceeds

The net proceeds of the capital increase will be used to finance

part of the purchase price1 of Sopra Banking Software's activities

for an amount of €330m, in addition to new confirmed credit

facilities for €200m.

This acquisition will enable Axway to accelerate its strategic

project through:

- the birth of a new major player in

enterprise software, achieving critical scale with a bold 2025

ambition of c.€700m revenue and c.€100m profit on operating

activities2; - a secured leadership position in a combined total

addressable market of c. $90B, with unique strengths in banking and

financial services; - a diversified product portfolio extending

across geographies, clients, and industries, capturing a variety of

profitable niche markets to enhance overall stability; - a

substantial opportunity to accelerate shareholder value creation

through the combined entity’s scale, becoming EPS accretive in

2026; - a maintained prudent and efficient capital structure with a

40% equity and 60% debt financing mix, with quick deleveraging

possibilities; - a reaffirmed software pure-player project founded

on shared DNA, culture, vision, and driven by an experienced

management team.

Birth of the 5th largest French Enterprise Software

Publisher

Axway Software + SBS 2023 Restated*AXW + 12M SBS

2024 GuidanceAXW + 4M SBS 2025 AmbitionAXW + SBS

2027 Ambition3-Years Plan Revenue €651m

c. €460m c. €700m > €750m Margin on

Operating Activities

12%

13 to 17% 14 to 16 % > 17% * Restated items

correspond to end-of-contract revenues and intra-group billings

with Sopra Steria Group considered as non-recurring.

On a restated from non-recurring items basis, the new combined

entity would have generated annual revenue of €651m in 2023, with

operating profit representing 12% of revenue.

Sopra Banking Software's consolidation into Axway is scheduled

for beginning of September 2024. Axway will therefore include Sopra

Banking Software 's activities for the last four months of 2024 in

its next annual financial statements. On this basis, the combined

entity is aiming at 2024 revenue of around €460m and a margin on

operating activities of between 13% and 17%.

By 2025, pursuing its development at an annual organic growth

rate of between 2% and 4%, Axway targets revenue of around €700m

and a margin on operating activities of between 14% (around €100

million) and 16% which will reflect the full materialization of

cost optimizations, of the order of €15m, expected on a full-year

2025 basis.

By 2027, Axway ambitions to achieve revenue above €750m and a

margin on operating activities of more than 17%. By 2028, the

Company is aiming for a margin on operating activities at around

20% of revenue.

In terms of cash generation and debt leverage, Axway has

outlined the following ambitions:

Axway Software + SBS End-2024Ambition

End-2025Ambition End-2027Ambition Free Cash

Flow / Revenue ≈ 4% ≈ 10% > 15% Net

Leverage Ratio > 2.5x < 2.0x <

1.0x

Free cash flow should represent around 10% of the new entity's

revenue in 2025, gradually improving to over 15% by the end of

2027. This significant improvement in free cash flow will provide

the Company with opportunities to rapidly reduce its financial

leverage.

At year-end 2024, Axway expects its net debt to EBITDA ratio to

exceed 2.5x. By the end of 2025, this ratio should be below 2.0x,

and by 2027 it is expected to be below 1.0x.

Main terms of the capital increase

The capital increase will be carried out with shareholders’

preferential subscription rights, in accordance with the 18th

resolution of Axway's shareholders general meeting held on May 11,

2023, and will result in the issuance of 8 112 597 new shares, at a

subscription price of €16.10 per share (i.e. a nominal value of

€2.0 plus an issue premium of €14.10), to be fully paid up upon

subscription, representing gross proceeds, including the issue

premium, of €130,612,811.70.

The preferential subscription rights will be detached from the

underlying existing shares on July 24, 2024 and the existing shares

will be traded ex-right from July 24, 2024.

Each share that a shareholder holds in its securities account on

July 25, 2024 (as close of trading) will entitle it to receive one

Right. 8 Rights will entitle the holder to subscribe for 3 new

shares, on an irreducible basis.

Subscriptions on a reducible basis will be allowed. Any new

share not subscribed on an irreducible basis will be distributed

and allocated to the holders of Rights having submitted additional

subscription orders on a reducible basis, subject to reduction in

the event of oversubscription.

Based on the closing price of Axway’s share price on the

regulated market of Euronext in Paris on July 19, 2024, i.e.

€27.50, the theoretical value of one Right is €3.11, and the

theoretical value of the ex-right share is €24.39.

For information purposes, the subscription price of the new

shares reflects a discount of 34.0% to Axway’s theoretical ex-right

share price, based on the closing price on July 19, 2024, and a

facial discount of 41.5% to the closing price on July 19, 2024.

These values neither necessarily reflect the value of the Rights

during their trading period, nor the value of Axway shares

ex-rights, as they will be observed in the market.

The capital increase will be opened to the public in France

only.

The capital increase is subject to a placement agreement between

the Company and Crédit Agricole CIB and Société Générale as joint

global coordinators and joint bookrunners.

Indicative timetable of the share capital increase

The Rights will be detached on July 24, 2024 and will be

tradable on Euronext Paris from July 24, 2024 until the close of

the preferential subscription rights trading period, i.e. until

August 16, 2024 included, according to the indicative timetable,

under the ISIN code FR001400QJH1.

The subscription period for the new shares will run from July

26, 2024 to August 20, 2024 included, according to the indicative

timetable. Any Right not exercised before the end of the

subscription period, i.e. on August 20, 2024, shall automatically

become null and void.

The settlement and delivery of the new shares and admission of

trading on Euronext Paris are expected to take place on August 27,

2024. They will be immediately fungible with the Company's existing

shares and will be traded under the same trading line and under the

same ISIN code FR0011040500.

Subscription and other commitments by Axway's main

shareholders

Under the terms of the purchase agreement entered into between

Sopra GMT, as acquirer, and Sopra Steria Group, as seller, dated

May 31, 2024, Sopra GMT undertook to acquire:

- 3,619,423 Axway shares, representing 16.73%

of Axway's share capital and 10.98% of its theoretical voting

rights, from Sopra Steria Group, at a price of €26.50 per Axway

share, i.e. a total price of €95,914,709.5 (“Axway Block

Acquisition”), which was completed on July 19 2024; and - all

3,293,637 preferential subscription rights attached to the Axway

shares held by Sopra Steria Group following the Axway Block

Acquisition, which may be exercised as part of the capital

increase, for a total price of €10,243,211.07 (the "Rights

Acquisition").

Sopra GMT has irrevocably undertaken to subscribe, on an

irreducible basis, to the capital increase by exercising all of its

preferential subscription rights, including those acquired as part

of the Rights Acquisition from Sopra Steria Group, representing a

total of approximately 52.8% of the capital increase.

Moreover, Sopra GMT has irrevocably undertaken to subscribe for

new shares not subscribed at the end of the subscription period

(either on an irreducible or on a reducible basis), in order to

ensure that all new shares are subscribed.

Patrick Donovan, the Company’s CEO, has indicated that he

intends to exercise all his preferential subscription rights,

representing 0.7% of the capital increase.

As of the date of the Prospectus, Axway is not aware of any

subscription intentions from shareholders of the Company other than

that mentioned above, nor of any subscription intentions from

members of its administrative bodies.

Lock-up undertakings

Axway has committed to a lock-up period starting on the signing

date of the placement agreement and ending 180 calendar days

following the settlement and delivery date of the new shares,

subject to certain customary exceptions.

Patrick Donovan, Chief Executive Officer, Sopra GMT and Sopra

Steria Group have committed to a lock-up period starting on the

date of approval by the AMF of the Prospectus related to the

capital increase and ending 180 calendar days following the

settlement and delivery date of the new shares, subject to certain

customary exceptions (including, with respect to Patrick Donovan,

his ability to pledge existing shares for the purposes of

benefiting a financing dedicated to the subscription of new shares

resulting from the exercise of his preferential subscription

rights).

Dilution

For illustrative purposes only, following the issue of the new

shares, a shareholder holding 1% of the Company's share capital as

of July 22, 2024 and who does not participate in the capital

increase, would hold 0.73% of the share capital.

Availability of the Prospectus

Copies of the French language Prospectus approved by the AMF on

July 22 2024 under number 24-328, comprising and (i) the 2023

universal registration document filed with the AMF on March 25,

2024 under number D.24-0175 (Document d'Enregistrement Universel

2023), (ii) its amendment filed with the AMF on July 22 2024 under

number D.24-0175-A01 (Amendement au Document d'Enregistrement

Universel 2023), and (iii) a securities note (Note d'Opération)

(including the summary of the Prospectus) is available free of

charge from the Company's registered office, PAE Les Glaisins - 3

rue du Pré Faucon, Annecy-le-Vieux - 74940 Annecy, France, as well

as on the website of Axway Software (www.investors.axway.com/fr)

and the AMF (www.amf-france.org).

Risk factors

Investors’ attention is drawn by Axway Software to the chapter

2.1 ("Risk Factors") of the 2023 universal registration document

filed with the AMF on March 25, 2024 under number D. 24-0175 and

its amendment filed with the AMF on July 22 2024 under number

D.24-0175-A01 and to section 2 "Risk factors related to the

offering" of the securities note.

About Sopra Banking Software

Sopra Banking Software (SBS) is a global financial technology

company that is helping banks and the financial services industry

to reimagine how to operate in an increasingly digital world. SBS

is a trusted partner of more than 1,500 financial institutions and

large-scale lenders in 80 countries worldwide. Its cloud platform

offers clients a composable architecture to digitize operations,

ranging from banking, lending, compliance, to payments, and

consumer and asset finance. SBS is recognized as a Top 10 European

Fintech company by IDC and as a leader in Omdia’s Universe: Digital

Banking Platforms.

About Axway

Axway enables enterprises to securely open everything by

integrating and moving data across a complex world of new and old

technologies. Axway’s API-driven B2B integration and MFT software,

refined over 20 years, complements Axway Amplify, an open API

management platform that makes APIs easier to discover and reuse

across multiple teams, vendors, and cloud environments. Axway has

helped over 11,000 businesses unlock the full value of their

existing digital ecosystems to create brilliant experiences,

innovate new services, and reach new markets.

This document may not be published,

forwarded or distributed, directly or indirectly, in the United

States of America, Canada, Australia or Japan.

This document does not constitute a public offer, an offer to

purchase or an intention to solicit the interest of the public for

a public offering of any securities.

The distribution of this document in these and certain other

countries may be restricted by law. The persons into whose

possession this document comes should inform themselves about and

observe any such restrictions.

Disclaimer:

This document is an advertisement and does not constitute a

prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and the Council of June 14th, 2017 (as amended,

the “Prospectus Regulation”).

Potential investors are advised to read the Prospectus before

making an investment decision in order to fully understand the

potential risks and rewards associated with the decision to invest

in the securities.

The approval of the Prospectus by the AMF should not be

understood as an endorsement of the securities offered or admitted

to trading on a regulated market.

This document does not constitute an offer to sell or the

solicitation of an offer to buy the securities of Axway Software in

the United States or in any other jurisdiction.

The securities referred to herein may not be offered or sold in

the United States or to US persons unless such securities are

registered under the US Securities Act of 1933 ("U.S. Securities

Act"), as amended, or an exemption from the registration

requirements of the Act is available. Axway Software shares have

not been and will not be registered under the U.S. Securities Act

and Axway Software does not intend to undertake a public offering

of its securities in the United States.

With respect to the Member States of the European Economic Area

(each a “Relevant Member State”), no action has been

undertaken or will be undertaken to make an offer to the public (as

defined in the Prospectus Regulation) of the securities requiring a

publication of a prospectus in any Relevant Member State, other

than France. As a result, the new or existing shares of Axway

Software may not be offered and will not be offered in any Relevant

Member State other than France, except (i) to any legal entity

which is a qualified investor as defined under the Prospectus

Regulation, (ii) to fewer than 150, natural or legal persons (other

than qualified investors as defined in the Prospectus Regulation)

as permitted under the Prospectus Regulation; or (iii) in any other

circumstances not requiring Axway Software to publish a prospectus

as provided under Article 1(4) of the Prospectus Regulation and/or

regulations applicable in the Relevant Member State, provided that

such an offer of new or existing shares in Axway Software does not

give rise to an obligation for Axway Software to publish a

prospectus pursuant to Article 3(1) of the Prospectus Regulation or

a prospectus supplement pursuant to Article 23 of the Prospectus

Regulation.

In the United Kingdom, this document does not constitute an

approved prospectus for the purpose of and as defined in section 85

of the Financial Services and Markets Act 2000 (as amended) (the

“FSMA”), has not been prepared in accordance with the

Prospectus Rules issued by the UK Financial Conduct Authority (the

“FCA”) pursuant to section 73A of the FSMA and has not been

approved by or filed with the FCA or any other authority which

would be a competent authority for the purposes of the Prospectus

Regulation. The new and existing shares in Axway Software may not

be offered or sold and will not be offered or sold to the public in

the United Kingdom (within the meaning of sections 85 and 102B of

the FSMA) save in the circumstances where it is to be lawful to do

so without an approved prospectus (within the meaning of section 85

of the FSMA) being made available to the public before the offer is

made. This document is for distribution in the United Kingdom only

to persons who (i) have professional experience in matters relating

to investments falling within section 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (as

amended, the “Financial Promotion Order”), (ii) are persons

falling within sections 49(2)(a) to (d) (“high net worth companies,

corporate, unincorporated associations etc”) of the Financial

Promotion Order, or (iii) are persons otherwise permitted by law to

receive it (all such persons together being referred to as

“Relevant Persons”). In the United Kingdom this document is

directed only at Relevant Persons and must not be distributed to,

acted on or relied on by persons who are not Relevant Persons. Any

investment or investment activity to which this document relates is

available in the United Kingdom only to Relevant Persons and will

be engaged in only with Relevant Persons.

This document is not, and under no circumstances is it to be

construed as, a prospectus, offering memorandum, advertisement or

an offer to sell or solicitation of an offer to buy any of the

securities referred to herein in Canada. Any offering in Canada

will be made on a private placement basis only to purchasers

resident in Ontario who subscribe for or acquire offered shares or

rights, or are deemed to subscribe for or acquire them, for their

own account and are “accredited investors”, within the meaning of

National Instrument 45-106 – Prospectus Exemptions or subsection

73.3 (1) of the Securities Act (Ontario).

The release, publication or distribution of this document in

certain jurisdictions may be restricted by laws or regulations.

Persons in such jurisdictions into which this document is released,

published or distributed must inform themselves about and comply

with such laws or regulations.

Any decision to subscribe for or purchase the shares or other

securities of Axway Software must be made solely based on

information publicly available about Axway Software. Such

information is not the responsibility of Crédit Agricole Corporate

and Investment Bank and Société Générale and has not been

independently verified by Crédit Agricole Corporate and Investment

Bank and Société Générale.

Forward-looking

statements:

This document contains certain forward-looking statements about

Axway Software and its subsidiaries. These statements include

financial projections and estimates and their underlying

assumptions, statements regarding plans, objectives, intentions and

anticipated results as well as events, operations, future services

or product development and potential or future performance.

Forward-looking statements are generally identified by the words

“expects”, “anticipates”, “believes”, “intends,” “estimates,”

“anticipates,” “projects,” “seeks,” “endeavors,” “strives,” “aims,”

“hopes,” “plans,” “may,” “goal,” “objective,” “projection,”

“outlook” and similar expressions. Although the management of Axway

Software believes that these forward-looking statements are

reasonably made, investors and holders of the group’s securities

are cautioned that these forward-looking statements are subject to

a number of known and unknown risks, uncertainties and other

factors, a large number of which are difficult to predict and

generally outside the control of Axway Software, that may cause

actual results, performance or achievements to be materially

different from any future results, performance or achievement

expressed or implied by these forward-looking statements. These

risks and uncertainties include those developed or identified in

any public documents approved by the French financial markets

authority (the Autorité des marchés financiers – the “AMF”)

made or to be made by the group, in particular those described in

Chapter 2.1 “Risk Factors” of the 2023 universal registration

document filed with the AMF under number D. 24-0175 on March 25,

2024 and in Chapter 3 of the 2023 universal registration document

amendment filed with the AMF under number D. 24-0175-A01 on July

22, 2024. These forward-looking statements are given only as of the

date of this document and Axway Software expressly declines any

obligation or commitment to publish updates or corrections of the

forward-looking statements included in this document in order to

reflect any change affecting the forecasts or events, conditions or

circumstances on which these forward-looking statements are based.

Any information relating to past performance contained herein is

not a guarantee of future performance. Nothing herein should be

construed as an investment recommendation or as legal, tax,

investment or accounting advice.

____________________ 1 At the date of the prospectus, taking

into account the factors and adjustments, it is indicated for

illustrative purposes that the purchase price of 100% of SBS’s

share capital and voting rights should be between €113m and €128m

and that the current shareholder account to be repaid should be

approximately of an amount of €190m. 2 Profit from recurring

operations adjusted for the non-cash share-based payment expense,

as well as the amortization of allocated intangible assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722546784/en/

Investor Relations: Arthur Carli – +33 (0)1 47 17 24 65 –

acarli@axway.com

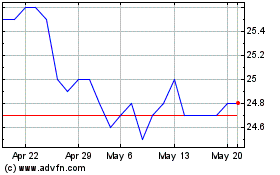

Axway Software (EU:AXW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Axway Software (EU:AXW)

Historical Stock Chart

From Jul 2023 to Jul 2024