WINFARM : 2023 revenue of €137.4m, up 5%.

PRESS RELEASE Loudéac, 1 February

2024

2023 revenue of €137.4m, up 5%

Continued market share gains against a

backdrop of falling prices

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), the number-one French distance seller of goods and

solutions and provider of advisory and other services for the

farming and breeding industry, today reported its revenue for

financial year 2023.

|

|

Q4 |

|

12 months |

|

in €m, unaudited |

2022 |

2023 |

Chg. |

|

2022 |

2023 |

Chg. |

Chg. organic |

|

Farming Supplies |

31.7 |

28.1 |

-11.3% |

|

116.8 |

125.1 |

+7.1% |

-2.4% |

|

Farming Production |

3.2 |

2.4 |

-25.0% |

|

12.2 |

10.0 |

-18.2% |

-18.2% |

|

Other |

0.5 |

0.5 |

+2.9% |

|

1.8 |

2.3 |

+25.4% |

+25.4% |

|

TOTAL |

35.4 |

31.0 |

-12.4% |

|

130.8 |

137.4 |

+5.0% |

-3.5% |

Farming Supplies: growth of 7.1% in

2023

The Farming Supplies business (91%

of revenue at 31 December 2023), marketed under the Vital Concept

brand, posted revenue of €125.1m in 2023, up 7.1%.

Sales in 2023 were driven by:

- the acquisition of

Kabelis in the Landscaping and Green Spaces business (consolidated

since August 2022), which recorded revenue of nearly €17.0m at the

end of December 2023;

- a return to

sustained momentum in the equestrian market at the end of the year,

with growth of 4% over the full year;

- the confirmed

robust performance of BTN de Haas, acquired in the Netherlands in

July 2021.

Given the negative price effect combined with an

unfavourable calendar (4 fewer days invoiced than in 2022), WINFARM

successfully maintained a satisfactory level of business activity

with a change in the organic scope, excluding the contribution of

Kabelis, which posted a limited decline of 2.4%. This performance

should also be seen in the light of particularly unfavourable

weather conditions in the fourth quarter that weighed on order

numbers, as well as the Group’s determination to safeguard its

gross margin by limiting price concessions.

Farming Production:

Group export revenue adversely affected by the geopolitical

environment

The Farming Production business

(7% of revenue at 31 December 2023), marketed under the Alphatech

brand, generated revenue of €10.0m in 2023, down 18.2%.

Despite a few signs of a recovery in the second

half of the year, business activity in the Middle East (Pakistan,

Egypt, Iraq, Saudi Arabia, UAE), accounting for 17% of Farming

Production revenue, remained weak in FY 2023 (compared with 25% in

N-1). In an already difficult context marked by the unavailability

of foreign currencies for export in the first half of the year, the

difficulties in the Red Sea in the fourth quarter slowed sales

momentum in the region by postponing certain orders to 2024 owing

to the extension of their delivery times.

“Other activities”, which include consulting and

training services, marketed under the Agritech brand, and the

operating activities of the Bel-Orient pilot farm increased revenue

by over 25%.

Cash position at end-December

2023

Given Kabelis’ prospects in the Green Spaces

segment, the Group decided to immediately buy back 30% of the

remaining capital in mid-December. At the end of FY 2023, WINFARM’s

cash position amounted to €7m, reflecting the renewed confidence of

its banking partners with the granting of long-term financing in

addition to the financing obtained in the third quarter.

EBITDA margin improvement targets

maintained in H2 2023

The financial discipline measures implemented by

the Group in the first half of 2023, combined with the gross margin

management measures initiated at the end of the financial year,

should now enable the Group to gradually improve its EBITDA margin

after a low point reached at the end of June 2023.

Au Pré!: signature of the first

contracts

After the launch in September of “Au

Pré!”, an innovative concept to enhance dairy production for a

network of independent farmers based on an initial proprietary

industrial processing facility located at the Group’s Bel Orient

pilot farm, WINFARM is pleased to announce the signing of initial

contracts with central kitchens supplying schools, hospitals and

nursing homes.

WINFARM is also in advanced discussions with

numerous delicatessens and bakeries, which have shown substantial

interest in featuring Au Pré! brand products in their stores with a

view to proposing them to their customers.

2024: focus on returning to organic

growth and improving EBITDA margin

Through the initiatives taken in 2023 to lower

the profitability threshold in connection with the adaptation of

the expense structure, WINFARM in 2024 will be focusing primarily

on boosting business activity and improving its results.

Next release:2023 annual

results, on 28 March 2024 after the market closes.

About WINFARM

Founded in Loudéac, in the heart of Brittany, at

the beginning of the 1990s, the Winfarm group is today the leading

French player offering the agricultural, livestock, horse-breeding

and landscape markets a range of consultancy, service and distance

selling products and global, unique and integrated solutions to

help them meet the new technological, economic, environmental and

social challenges of the new generation of agriculture.

With a vast catalogue of more than 35,000

product references (seeds, phytosanitary, harvesting products,

etc.), two-thirds of which are marketed under own brands, WINFARM

has more than 45,000 customers in France, Belgium and the

Netherlands.

For more information about the company:

www.winfarm-group.com

Contacts :

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

SEITOSEI.ACTIFIN |

|

|

Financial communicationBenjamin LEHARI+33 (0) 1 56

88 11 25benjamin.lehari@seitosei-actifin.com |

Financial press relationsJennifer JULLIA+33 (0)1

56 88 11 19jennifer.jullia@seitosei-actifin.com |

- WINFARM_CP_CA_T4_2023_FR_01_02_2024_vdef_EN

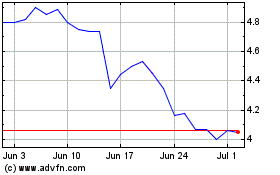

Winfarm (EU:ALWF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Winfarm (EU:ALWF)

Historical Stock Chart

From Jan 2024 to Jan 2025