- Governance evolution in line with the agreement with Sanyou

Medical

Regulatory News:

IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible for

PEA-PME equity savings plan), a medical technology company

specialized in implants for orthopedic surgery and the distribution

of technological medical equipment, today announced its 2023

full-year results, as of December 31, 2023, as approved by the

Board of Directors on March 5, 2024.

Ludovic Lastennet, IMPLANET’s Chief Executive Officer,

stated: “The results we reported today are impacted by the poor

performance we experienced in 2023 on the international front. Our

objectives for 2024 are therefore logically focused on revitalizing

our sales activity in all the regions we cover. Thus, following the

capital increase carried out on February 2, 2024, we now have the

resources we need to continue expanding our product offer and

strengthening our international presence, particularly in the

United States. The appointment of Max W. Painter as Vice President

and General Manager of Implanet America is a decisive first step in

ensuring the deployment of our innovative solutions in this

critical market. We also look forward to Sanyou Medical's

commercial launch of our proprietary JAZZ® range in China,

scheduled for later this year. Finally, as a result of the close

collaboration between the teams of our reference shareholder,

Sanyou Medical, and our R&D team, we are finalizing the

development of a unique range of hybrid posterior fixation systems

for the European market, which should be completed this year. All

these achievements, coupled with our new medical equipment

distribution activity, should enable us to strengthen our sales

momentum in our main markets and return to growth in the years

ahead.”

In € thousands - IFRS - Simplified income

statement

2023

2022

Change %

Revenue

7,447

8,028

-7%

Cost of goods sold

-3,215

-3,067

5%

Gross margin

4,233

4,961

-15%

Gross margin %

56.8%

61.8%

-5.0 bp

Operating costs

-10,295

-8,930

15%

Recurring operating profit/loss

-6,063

-3,968

-53%

Other non-recurring operating income and

expenses

-325

-

n.a

Operating profit/loss

-6,388

-3,968

-61%

Financial profit/loss

-288

428

-n.a

Net result

-6,676

-3,540

-89%

*Unaudited figures

Revenue

Overall, the Company reported revenue of €7.45 million in 2023,

compared with full-year revenue of €8.03 million in 2022.

Spine activity recorded revenue of €7.07 million in 2023,

compared with €7.93 million in 2022. Revenue in France remained

stable at €3.45 million. Revenue in the United States in 2023

amounted to €1.36 million, down 18% from €1.67 million in the

previous year, due to the poor performance in the second half of

2023. Export revenue in the Rest of the World also fell by 23% over

the period, to €2.26 million in 2023 from €2.93 million in

2022.

The medical equipment distribution activity generated €0.30

million in 2023.

Gross margin and operating

loss

The gross margin amounted to €4.23 million in 2023, compared

with €4.96 million in 2022, a decline of around 5 basis points.

This decrease is mainly due to the product mix, with the launch of

the SMTP medical equipment ranges and the minimally invasive

pedicle screw positioning system driving down the margin rate from

61.8% to 56.8%.

At the same time, the Company's operating costs rose from €8.93

million to €10.30 million. This €1.37 million increase is due to

the impairment of goodwill and other intangible assets associated

with the company OSD in the amount of €1.75 million. This

impairment considers the possible cannibalization of existing OSD

products by the launch of a new range of hybrid posterior fixation

systems planned jointly with Sanyou Medical in 2024.

Excluding the impact of this impairment, the Company continued

its strict control of operating expenses over the period.

As a result, the recurring operating loss increased by 53% to

-€6.06 million in 2023, compared with -€3.97 million in 2022.

Other non-recurring expenses correspond to restructuring costs

at the U.S. subsidiary and the renegotiation of financial debt.

Taking into account these various items, non-recurring exceptional

expenses of €0.33 million and net financial loss of €0.29 million,

net result for 2023 stands at €6.68 million, compared with €3.54

million for 2022.

Cash position

As of December 31, 2023, Implanet’s cash position stood at €0.25

million.

On February 2, 2024, the Company announced the completion of a

€5.5 million capital increase. The net proceeds of this capital

increase amounted to 5.3 M€.

As mentioned in its press releases of October 11 and December

11, 2023, the Company redeemed the bond loan contracted in October

2023 for a total amount of €1.3 million.

The Company also concluded an agreement with some of its lenders

(Banque Populaire Méditerranée, Bpifrance, Région Nouvelle

Aquitaine and Société Générale) to reschedule part of its financial

debt over the remaining term of each of the loans concerned, whose

maturity has been extended by nine months. This agreement took

effect on March 4, 2024.

In view of these elements, and the cash consumption forecasts

based on current activity assumptions and anticipated business

developments with Sanyou Medical over the 2024 and 2025 financial

years, the Company considers that it will be able to cover the

financing requirements of its operations for the next twelve

months.

Corporate governance

As mentioned in its previous press releases, and in particular

that of February 2, 2024, on the completion of the capital increase

announced on January 4, 2024, Sanyou Medical asked to benefit from

the majority of directorships on the Company's Board of Directors

as of the completion of the said capital increase.

During its meeting on March 5, 2024, Ms. Paula Ness Speers, Ms.

Mary Shaughnessy and Mr. Jean Gérard Galvez each tendered their

resignations from the Company's Board of Directors. These

resignations took effect on March 5, 2024.

Ms. Minhui Yang, CFO of Sanyou Medical, and Mr. Michael Mingyan

Liu, co-founder and R&D Director of Sanyou Medical, were

co-opted as directors for the remainder of their respective

predecessors' terms of office, i.e. for the former until the end of

the Annual General Meeting called to approve the financial

statements for the year ended December 31, 2024, and for the latter

until the end of the Annual General Meeting called to approve the

financial statements for the year ended December 31, 2025.

Implanet's Board of Directors is now made up of David Fan, who

were appointed Chairman of the Board to replace Jean-Gérard Galvez,

Minhui Yang, Michael Mingyan Liu, Ludovic Lastennet and Benjamin

Letienne.

The Board of Directors also decided to convene the shareholders

to the Annual General Meeting on April 25, 2024, to approve the

financial statements for the year ended December 31, 2023, and to

ratify the co-options of Ms. Minhui Yang and Mr. Michael Mingyan

Liu.

The Company would particularly like to thank Ms. Paula Ness

Speers, Ms. Mary Shaughnessy and Mr. Jean Gérard Galvez for their

involvement and active contribution to Implanet's development, and

to commend the quality of their governance during their respective

terms of office.

2023 highlights and post-closing events

- Commercial launch of the ultrasound surgical scalpel from SMTP,

a subsidiary of Sanyou Medical;

- FDA approval for the SqualeTM range of anterior cervical cages

in the United States;

- Commercial launch in Europe of the MIS range, a minimally

invasive pedicle screw positioning system;

- Launch of a training program for surgeons in preparation for

the commercial launch of the JAZZ® range in China;

- Appointment of Max W. Painter as Vice President and General

Manager of Implanet's US subsidiary;

- Capital increase in cash with shareholders' preferential

subscription rights, raising €5.5 million.

Strategy and outlook for the coming 12

months

- Finalize the registration of existing products within the

framework of the European Medical Device Regulation (MDR).

- Reinvigorate the Company’s presence in the United States:

- strengthen the resources and commercial means made available to

the historical team;

- strengthen the Company’s direct approach by expanding the

scientific team of opinion leaders;

- Strengthen market momentum and the product offering:

- deploy the commercial and technological partnership with Sanyou

Medical to jointly develop an innovative new European range of

hybrid posterior fixation;

- initiate the distribution of the JAZZ® platform in China (the

world’s largest spine market by volume) with Sanyou Medical;

- distribute technological medical equipment in Europe such as

SMTP Technology Co.’s ultrasound surgical scalpel.

Next financial press

release

- Q1 2024 Revenue, April 9, 2024, after market close

About IMPLANET

Founded in 2007, IMPLANET is a medical technology company that

manufactures high-quality implants for orthopedic surgery and

distributing medical technology equipment. Its activity revolves

around a comprehensive innovative solution for improving the

treatment of spinal pathologies (JAZZ®) complemented by the product

range offered by Orthopaedic & Spine Development (OSD),

acquired in May 2021 (thoraco-lumbar screws, cages and cervical

plates). Implanet’s tried-and-tested orthopedic platform is based

on the traceability of its products. Protected by four families of

international patents, JAZZ® has obtained 510(k) regulatory

clearance from the Food and Drug Administration (FDA) in the United

States, the CE mark in Europe and ANVISA approval in Brazil. In

2022, IMPLANET entered into a commercial, technological and

financial partnership with SANYOU MEDICAL, China's second largest

medical device manufacturer. IMPLANET employs 43 staff and recorded

a consolidated revenue of €7.4 million in 2023. Based near Bordeaux

in France, IMPLANET opened a US subsidiary in Boston in 2013.

IMPLANET is listed on the Euronext Growth market in Paris.

For further information, please visit www.Implanet.com.

Disclaimer

This press release contains forward-looking statements about

Implanet and its activity. Implanet estimates that these

forward-looking statements are based on reasonable assumptions.

However, no assurance can be given that the forecasts expressed in

these forward-looking statements will materialize, as they are

subject to risks, including those described in Implanet's reference

document filed with the Autorité des marchés financiers (AMF) on

April 16, 2018 under number D.18-0337, as well as in the annual

financial report for December 31, 2022 and the half-year financial

report for June 30, 2023, which are available on the Company's

website (www.implanet-invest.com), and to changes in economic

conditions, financial markets and the markets in which Implanet

operates. The forward-looking statements contained in this press

release are also subject to risks unknown to Implanet or that

Implanet does not currently consider material. The occurrence of

some or all of these risks could cause Implanet's actual results,

financial condition, performance or achievements to differ

materially from those expressed in the forward-looking statements.

Implanet does not undertake any obligation to update any

forward-looking information or statements, except as required by

applicable law, in particular articles 223-1 et seq. of the general

regulations of the Autorité des marchés financiers.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240305999225/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tél. : +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Nicolas Fossiez Tél.: +33 (0)1

44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Arthur Rouillé Tél.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

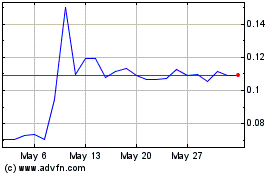

Implanet (EU:ALIMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Implanet (EU:ALIMP)

Historical Stock Chart

From Nov 2023 to Nov 2024