Generation Mining Limited (CSE:GENM) ("

Gen Mining"

or the "

Company") is pleased to announce that it

has completed its previously announced bought deal private

placement (the “

Bought Deal Offering”) and

concurrent non-brokered private placement (the

“

Non-Brokered Offering”, and together with the

Bought Deal Offering, the “

Offering”) of an

aggregate of 20,577,403 units of the Company (the

“

Units”) at a price of C$0.52 per Unit (the

“

Issue Price”), for aggregate total gross proceeds

of C$10,700,250. Each Unit consists of one common share (a

“

Common Share”) in the capital of the Company and

one-half (1/2) of one common share purchase warrant (each whole

common share purchase warrant, a “

Warrant”) of the

Company. Each Warrant is exercisable to acquire one Common Share (a

“

Warrant Share”) at a price per Warrant Share of

C$0.75 for a period of 24 months from the closing date of the

Offering.

Under the Bought Deal Offering, the Company

issued an aggregate of 19,231,250 Units (including 3,846,250 Units

issued upon the exercise in full by the Underwriters (as defined

herein) of the Underwriters’ Option) at the Issue Price for gross

proceeds of C$10,000,250. Under the Non-Brokered Offering, the

Company issued an aggregate of 1,346,153 Units at the Issue Price

for gross proceeds of C$700,000.

The Bought Deal Offering was led by Haywood

Securities Inc. and Mackie Research Capital Corporation as co-lead

underwriters and joint-bookrunners on behalf of a syndicate of

underwriters including PowerOne Capital Markets Limited and Raymond

James Ltd. (collectively, the "Underwriters").

The net proceeds from the sale of the Units will

be used for exploration and development of the Company’s Marathon

Palladium Project, as well as working capital and general corporate

purposes.

Mr. Eric Sprott, through 2176423 Ontario Ltd., a

corporation which is beneficially owned by him, acquired 9,615,386

Units pursuant to the Bought Deal Offering. As a result of the

Offering, Mr. Sprott beneficially owns or controls 9,615,386 Common

Shares and 4,807,693 Warrants of the Company, representing 7.83% of

the issued and outstanding common shares of the Company on a

non-diluted basis and 11.30% of the issued and outstanding common

shares of the Company on a partially-diluted basis, assuming the

exercise of Mr. Sprott’s warrants as of the date hereof. Prior to

the Offering, Mr. Sprott did not beneficially own or control any

common shares of the Company.

The Units were acquired by Mr. Sprott for

investment purposes. Mr. Sprott has a long-term view of the

investment and may acquire additional securities of the Company,

including on the open market or through private acquisitions, or

sell securities of the Company, including on the open market or

through private dispositions, in the future depending on market

conditions, reformulation of plans and/or other relevant factors. A

copy of Mr. Sprott’s early warning report will appear on the

Company’s profile on SEDAR and may also be obtained by calling his

office at (416) 945-3294 (200 Bay Street, Suite 2600, Royal Bank

Plaza, South Tower, Toronto, Ontario M5J 2J2).

The Offering constituted a related party

transaction within the meaning of Multilateral Instrument 61-101

(“MI 61-101”) as insiders of the Company

subscribed for an aggregate of 163,000 Units. The Company is

relying on the exemptions from the valuation and minority

shareholder approval requirements of MI 61-101 contained in

sections 5.5(a) and 5.7(1)(a) of MI 61-101, as the fair market

value of the participation in the Offering by insiders does not

exceed 25% of the market capitalization of the Company, as

determined in accordance with MI 61-101. The participants in the

Offering and the extent of such participation were not finalized

until shortly prior to the completion of the Offering. Accordingly,

it was not possible to publicly disclose details of the nature and

extent of related party participation in the Offering pursuant to a

material change report filed at least 21 days prior to the

completion of the Offering.

In connection with the Bought Deal Offering, the

Underwriters received: (i) a cash commission of 6.0% of the gross

proceeds of the Bought Deal Offering, excluding gross proceeds from

the issuance of Units to Eric Sprott for which a commission of 4.0%

of such gross proceeds was paid by the Company to the Underwriters;

and (ii) that number of non-transferable compensation options (the

“Compensation Options”) as is equal to (a) 6.0% of

the aggregate number of Units sold under the Bought Deal Offering,

excluding those Units sold to Eric Sprott, and (b) 4.0% of the

aggregate number of Units sold under the Bought Deal Offering to

Eric Sprott. Each Compensation Option is exercisable into one

Common Share of the Company at the Issue Price for a period of 24

months from the closing date of the Bought Deal Offering. No fees

were paid in connection with the Non-Brokered Offering.

The Units issued under the Offering are subject

to a hold period in Canada expiring four months and one day from

the closing date. The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

About Generation Mining

Limited

Generation Mining Limited is focused on

advancing the Marathon Deposit, the largest undeveloped platinum

group metal Mineral Resource in North America. The Marathon

Property covers a land package of approximately 22,000 hectares or

220 square kilometres. Gen Mining acquired a 51% interest in the

Marathon Property from Sibanye Stillwater on July 10, 2019 and can

increase its interest to 80% by spending $10 million over a period

of four years. More than $3 million of this has already been spent.

Sibanye Stillwater has certain back-in rights that can bring its

interest in the Property back to 51% after such time as Gen Mining

has earned its 80% interest (see the Company’s press release of

July 11, 2019, for more details). The Company’s common shares trade

on the Canadian Securities Exchange (“CSE”) under the symbol

GENM.

For further information please contact:

Jamie LevyPresident and Chief Executive

Officer(416) 640-2934(416) 567-2440jlevy@genmining.com

Forward-Looking Information

This press release includes certain information

that may be deemed “forward-looking information” under applicable

securities laws. All statements in this press release, other than

statements of historical facts, is forward-looking information. In

particular, statements in this press release relating to the use of

net proceeds from the sale of the Units and the possible

acquisition by Mr. Sprott of additional securities of the Company

constitute forward-looking information. Although the Company

believes the expectations expressed in such statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in the statements. There are certain factors

that could cause actual results to differ materially from those in

the forward-looking information. These include the results of the

Company’s due diligence investigations, market prices, exploration

successes, continued availability of capital and financing, and

general economic, market or business conditions.

Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments

may differ materially from those projected in the forward-looking

information. For more information on the Company, investors are

encouraged to review the Company’s public filings at www.sedar.com.

The Company disclaims any intention or obligation to update or

revise any forward- looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

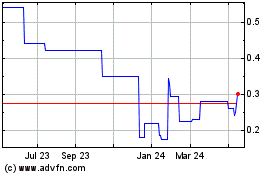

Generation Mining (CSE:GENM)

Historical Stock Chart

From Jan 2025 to Feb 2025

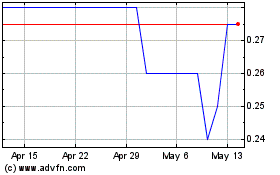

Generation Mining (CSE:GENM)

Historical Stock Chart

From Feb 2024 to Feb 2025