Changing Tides: Restaking Takes Center Stage In Ethereum (ETH) Staking Landscape

April 10 2024 - 6:00PM

NEWSBTC

In recent months, the Ethereum staking landscape has witnessed

significant transformations, prompting a shift in investor

preferences and reshaping the sector’s dynamics. According to

on-chain data researcher and strategist at 21Shares, Tom Wan, key

metrics indicate a notable change in the approach towards Ethereum

staking, with restaking gaining prominence as a preferred method.

Ethereum Restaking Landscape Wan’s observations, shared on the

social media platform X (formerly Twitter), highlight a steady

increase in ETH staking deposits from restaking, rising from 10% to

60% since 2024. Restaking can be accomplished in two primary

ways: through ETH natively restaked or by utilizing a liquid

staking token (LST). By staking their ETH, users secure additional

applications known as Actively Validated Services (AVS), which

yield additional staking rewards. A significant player in the

staking landscape is EigenLayer, which has emerged as the

second-largest decentralized finance (DeFi) protocol on the

Ethereum network. Related Reading: Are The Odds In Bitcoin

Bulls Favor? These Analysts Forecast BTC’s Future EigenLayer has

achieved a significant milestone with the release of EigenDA, its

data availability Actively Validated Service (AVS), on the

mainnet. According to a research report by Kairos, this

launch marks the beginning of a new era in restaking, where liquid

restaking tokens (LRTs) will become the dominant way for restakers

to do business. Currently, 73% of all deposits on EigenLayer

are made through liquid restaking tokens. The report highlights

that the growth rate of LRT deposits has been significant,

increasing by over 13,800% in less than four months, from

approximately $71.74 million on December 1, 2023, to $10 billion on

April 9, 2024, demonstrating the growing confidence in EigenLayer’s

approach to restaking and contributing to the shifting tides in

Ethereum’s staking landscape. According to Wan, the rise of

liquid restaking protocols has also contributed to a decline in the

dominance of Lido (LDO), a staking service solution for Solana

(SOL), Ethereum, and Terra (LUNC). On the other hand, Etherfi

has emerged as the second-largest stETH withdrawer, with 108,000

stETH withdrawn through the first quarter of 2024. This trend

exemplifies the increasing popularity of liquid restaking

protocols, allowing stakers to withdraw and actively utilize their

staked assets while still earning rewards. Ether.fi Set To Surpass

Binance In ETH Staking Data provided by Wan also shows a decline in

the dominance of centralized exchanges (CEXs) in ETH staking. Since

2024, CEXs have seen their share of staking decline from 29.7% to

25.8%, a significant drop of 3.7%. As a result, the

decentralized staking provider Kiln Finance has surpassed Binance

and become the third-largest entity in terms of ETH staking. With

Ether.fi poised to follow suit, it is expected to surpass Binance’s

position shortly, according to the researcher. Related

Reading: Crypto Experts Predict Massive Price Surge For XRP Price,

Is $20 Possible? In short, these developments signify a paradigm

shift in the Ethereum staking landscape, with re-staking

methodologies gaining traction and decentralized protocols like

EigenLayer and Ether.fi challenging the dominance of established

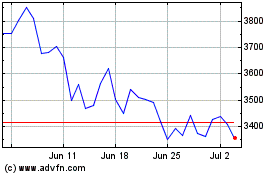

players. As of this writing, ETH’s price stands at $3,500. It

has been exhibiting a sideways trading pattern over the past 24

hours, remaining relatively stable compared to yesterday. Featured

image from Shutterstock, chart from TradingView.com

stETH (COIN:STETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024