Solana Empty Glasses: BEER Coin Fizzles 70% In Alleged Rug Pull

June 14 2024 - 6:15AM

NEWSBTC

The Solana blockchain has revealed a sobering story, adding to the

turbulence in the bubbly world of memecoins, such as BEER. The coin

rose to prominence in recent weeks, experienced a dramatic price

swing, and raising concerns about the inherent volatility and risks

associated with these internet-driven tokens. Related Reading:

Bitcoin Ownership Trends: Short-Term Spike As ETFs Gain Popularity

– Report Whales And Rug Pulls: A Recipe For Disaster BEER’s wild

ride began with a classic memecoin scenario: a surge in popularity

fueled by online hype and community buzz. However, this exuberance

masked a lurking danger – the outsized influence of large token

holders, often nicknamed “whales.” When several whales decided to

cash out, their massive sell orders triggered a domino effect. The

price of BEER plummeted a staggering 70% in a matter of hours,

pulling the token’s price down from around $0.0003 to $0.0001.

Fears of a “rug pull” – a scenario where developers create a

memecoin, inflate its price through marketing, and then vanish with

investor funds – ran rampant. While the BEER team vehemently denied

any wrongdoing, the incident highlighted the vulnerability of

memecoins to manipulation by large holders. 🚨 LATEST: Someone sold

$10 million worth of Solana Memecoin $BEER (@beercoinmeme), causing

its price to drop by 70%. pic.twitter.com/22H5cM5wFq — SolanaFloor

(@SolanaFloor) June 13, 2024 Unlike established cryptocurrencies

with diverse ownership structures, memecoins often have a high

concentration of tokens held by a small group of individuals. This

creates an environment where a few whales can significantly impact

the price, leading to extreme volatility. BEER Weathers The Storm,

But Questions Remain Fortunately for some BEER holders, the token

price staged a partial recovery after the initial selloff. However,

the damage was done. The incident served as a stark reminder of the

inherent risks associated with memecoin trading. BEER currently

sits nearly 40% lower than its pre-crash price, currently trading

at $$0.00026, with a cloud of uncertainty hanging over the horizon.

The question of who triggered the sell-off remains unanswered, with

the BEER team pointing fingers at presale investors. BEERUSDT

trading at $0.00028 on the daily chart: TradingView.com Solana’s

Memecoin Boom: A Double-Edged Sword The BEER episode also sheds

light on the double-edged sword of Solana’s burgeoning memecoin

scene. Solana, known for its faster transaction speeds compared to

Ethereum, has become a breeding ground for memecoin developers.

Related Reading: Ethereum Longs Crushed! Who Got Burned In The $62

Million Fire Sale? The ease of launching tokens on Solana has

attracted a wave of new projects, but it has also led to a

potential oversaturation of the market. This, coupled with the lack

of inherent utility for many memecoins, creates a speculative

frenzy where price movements are driven more by hype than by actual

value. Featured image from Pixabay, chart from TradingView

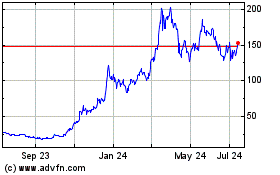

Solana (COIN:SOLUSD)

Historical Stock Chart

From May 2024 to Jun 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024