Ethereum Stretches Gains Versus Bitcoin, Adds 10% Ahead Of Shanghai

April 06 2023 - 5:50AM

NEWSBTC

Trading at around $1,900, Ethereum is one of the top-performing

cryptocurrencies, only trailing Dogecoin, CoinMarketCap data on

April 6 shows. Ethereum Outperforming Bitcoin When writing,

Ethereum is also relatively firm against Bitcoin. While liquid and

remains the most valuable digital asset, BTC has been consolidating

below $29,000. Ethereum is up roughly 1% against BTC in the last

trading day. However, from the candlestick arrangement in the daily

chart, the coin is up approximately 10% versus Bitcoin from March

2023 lows. Related Reading: Ethereum Hits Multi-Month High, But

$2,000 Price Point Remains Crucial Looking at the ETHBTC formation,

it is evident that ETH buyers are in the driving seat. However,

Bitcoin was firmer in the first three months of 2023, adding about

20% against ETH. By the time Q1 2023 ended, Bitcoin had

managed to reverse the losses it had posted against ETH in the

second half of 2022. From September 2022 to March 2023, BTC gained

30% against ETH, forcing prices back to important reaction points

defined in the second half of 2022. Bitcoin Is King But Trails ETH

Ahead Of Shanghai There were several factors behind this Ethereum

upswing, outpacing Bitcoin. Although Bitcoin and Ethereum are two

of the most liquid cryptocurrencies, BTC’s first-mover advantage

and regulatory clarity make an option for some institutions. From a

regulatory standpoint, Bitcoin also has support from United States

Securities and Exchange Commission (SEC) and Commodity Futures

Trading Commission (CFTC). Both agencies have clarified that

Bitcoin is a commodity. Also, institutions are accumulating BTC.

MicroStrategy, whose shares are listed on NASDAQ, is one of the

largest BTC holders and continues to accumulate, recently

purchasing more coins. MicroStrategy has acquired an additional

1,045 #bitcoin for ~ $29.3M at an average price of $28,016 per

bitcoin. As of 4/4/2023 @MicroStrategy holds 140,000 bitcoin

acquired for ~$4.17 billion at an average price of $29,803 per

bitcoin. $MSTR https://t.co/IBufTxalnv — Michael Saylor⚡️ (@saylor)

April 5, 2023 Meanwhile, Ethereum’s liquidity position makes

ETH an option for investors. Even so, considering its position in

the market cap leaderboard and continuous upgrades, ETH can draw

traders’ and investors’ attention. For this reason, investors

are closely monitoring events ahead of the Ethereum Shanghai

upgrade in mid-April. It is a crucial network update that will see

the platform fully transition as a proof-of-stake blockchain, with

stakers freely able to withdraw their coins. Until this upgrade

happens, ETH stakers cannot move their coins from the Beacon Chain.

When writing on April 6, there was 18,077,351 ETH worth over $34

billion locked. Related Reading: Will Ethereum’s (ETH)

Shapella Upgrade Trigger A Sell-Off Or Bull Run? Traders are

optimistic that this update could support prices, possibly

explaining the sharp gains of the past few trading days.

Besides the ETH rally, the total value locked (TVL) in liquid

staking platforms, such as Lido Finance and Rocket Pool, has

been rising for the better part of Q1 2023. Feature

Image From Canva, Chart From TradingView

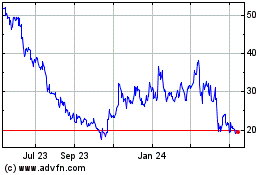

Rocket Pool (COIN:RPLUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

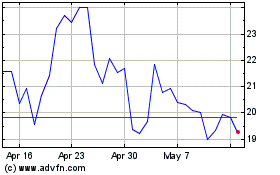

Rocket Pool (COIN:RPLUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025