VanEck Sees Bitcoin As Key Global Reserve Asset, Projecting $3 Million Price Tag By 2050

October 29 2024 - 3:30AM

NEWSBTC

As Bitcoin rebounds from its brief correction and approaches the

$70,000 mark, Matthew Sigel, head of digital asset research at

asset manager and crypto ETF issuer VanEck, shared his insights on

the cryptocurrency’s potential trajectory in light of the upcoming

US presidential election and broader economic factors in a recent

CNBC interview. Bitcoin Recovery Tied To M2 Growth And Seller

Exhaustion Sigel noted the correlation between former President

Donald Trump’s lead in betting polls against Vice President Kamala

Harris and Bitcoin’s rise. He characterized Trump as the most

pro-crypto candidate, suggesting that his policies may favor the

cryptocurrency market. Conversely, Sigel expressed skepticism

about Harris’s understanding of Bitcoin, indicating that her

administration may not prioritize cryptocurrency issues. Related

Reading: If Dogecoin Breaks Above Key Resistance ‘We Could See A

25% Rally’ – Top Analyst Delving deeper into Bitcoin’s price

dynamics, Sigel highlighted several critical correlations. He

pointed out a negative correlation with the US dollar and a

positive correlation with the global money supply growth, known as

M2, leading to the current uptrend. Sigel also attributed the

recent price recovery to the Federal Reserve’s pivot towards

reacceleration of M2 growth, alongside what he described as a

current “seller exhaustion” in the BTC market.

Additionally, Sigel identified a promising bullish setup for

Bitcoin as the election approaches, particularly its rising

correlation with the Nasdaq, reaching a two-year high of 1.5.

Sigel recalled a similar pattern from the 2020 elections, where

Bitcoin exhibited low volatility until the election outcome was

announced, leading to a substantial rally as new buyers flooded the

market. “New buyers are born every day,” he emphasized, indicating

a steady influx of interest in Bitcoin. When discussing Bitcoin’s

relationship with gold and M2, Sigel described Bitcoin as a

“chameleon,” highlighting its dynamic correlations that can shift

over time. This variability makes it challenging to accurately

predict Bitcoin’s short- and long-term behaviors. $180,000

Post-Election, $3 Million By 2050 In addition to US political

dynamics, Sigel pointed to recent activities within the BRICS

intergovernmental organization, particularly the involvement of new

members Argentina, the UAE, and Ethiopia in Bitcoin mining.

The researcher noted that these countries are leveraging government

resources to mine Bitcoin to counter what he termed the

“irresponsible” fiscal policies of the US. Sigel also

mentioned Russia’s plans for its sovereign wealth fund to invest in

Bitcoin mining through BRICS, proposing settling global trade in

Bitcoin. Related Reading: GOAT Outpaces PEPE Growing To $900M

Market Cap In 2 Weeks – Details When asked about potential future

price points for BTC, Sigel explained that historical rallies have

seen increases of around 2,000%. If Bitcoin were to achieve half of

that rise post-election, it could reach approximately

$180,000. Looking further ahead, Sigel referenced a model

from VanEck’s digital asset research team, predicting that by 2050,

Bitcoin could serve as a reserve asset for global trade, held by

central banks at a rate of 2%. This model suggests a staggering $3

million per Bitcoin price by that year. At the time of writing, BTC

is trading at $68,900, up 1.7% over the past 24 hours.

Featured image from DALL-E, chart from TradingView.com

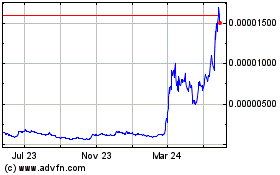

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

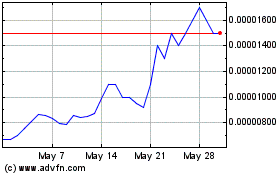

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024