Bitcoin Rebounds Past $56,000, Ethereum Over $2,500: Key Factors

August 06 2024 - 8:00AM

NEWSBTC

Bitcoin and crypto markets experienced a robust recovery Tuesday,

with Bitcoin surging past the $56,000 mark and Ethereum breaking

above $2,500, bouncing back from the “Block Monday.” Yesterday,

Bitcoin plummeted over 15%, touching lows near $49,000, while

Ethereum dropped by more than 20% to a low of $2,115. The recovery

in Bitcoin and crypto paralleled a broader resurgence in global

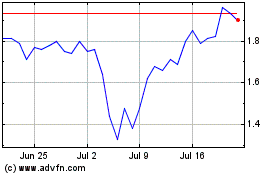

financial markets, driven by several key factors. #1 Nikkei

Rebounds, Bitcoin Follows Japan’s primary stock index, the Nikkei

225, experienced a record-breaking recovery following its most

significant drop since the 1987 Black Monday crash. The index

surged by 10.23%, closing at 34.675,46 points. This rebound came

after a sharp 12.4% decline on Monday, spurred by global market

instability and looming recession fears in the US, alongside

complications arising from the unwinding of the Yen ‘carry trade.’

Related Reading: Bitcoin Price Crashes To $49,000: Key Reasons

Explained Popular crypto analyst JACKIS (@i_am_jackis) remarked via

X: “I think that crypto right now is reacting to macro conditions

but nothing specific IMO is happening to crypto itself. Here is BTC

& Nikkei in comparison. When macro conditions settle Bitcoin /

crypto should rebound stronger but until then be careful.” #2 ISM

Services Data Is Bullish The US Institute for Supply Management

reported on Monday that its non-manufacturing PMI rose to 51.4 in

July from June’s 48.8, which was the lowest since May 2020. This

index measures the health of the services sector, which constitutes

over two-thirds of the US economy. A PMI above 50 suggests

expansion, and the latest data indicates a rebound in service

sector activity, easing some concerns over an impending recession.

Eric Wallerstein of Yardeni Research expressed relief and cautious

optimism about the data: “Woah, maybe the US economy is not

crashing? ISM services employment up 5 points to 51.1. Entire PMI

in expansion,” he stated via X. Andreas Steno Larsen of Steno

Research also commented, highlighting the precariousness of market

sentiment: “ISM Services away from the recession zone again. Not

sure it is strong enough to convince Markets. We are not trading

macro currently. We are trading leveraged stops.” Related Reading:

Analyst Warns Bitcoin (BTC) Price Could Drop Another 20% Ram

Ahluwalia, CEO of Lumida Wealth, added: “ISM Services are *up*

reversing the signal from the ISM Manufacturing data last Friday.

No recession folks. This is a technical / positioning driven

correction. Consider that Earnings are up 12% YOY vs Consensus of

9%. That doesn’t happen at a Recession turning point.” #3 Market

Anticipates Aggressive Fed Rate Cuts The financial markets are

currently pricing in significant monetary easing by the US Federal

Reserve. According to the CME FedWatch Tool, there is now a 73.5%

probability of a 50 basis points rate cut by September, with a

minimal rate cut of 25 basis points now seen as certain. This shift

in expectations reflects a drastic change in sentiment compared to

just a week ago when the probability of such cuts was much lower.

Matt Hougan, CIO at Bitwise, underscored the rapid shift in market

dynamics: “One week ago, the market was pricing in an 11% chance of

a 50 bps rate cut in September. Today, it’s 100%. Things come at

you fast,” he remarked via X. #4 Overblown Reaction The market

crash was also exacerbated by what some analysts are calling an

overreaction to fears of a US recession. Macro analyst Alex Krüger

pointed out the cyclicality of this fear-driven market behavior.

“The world suffering from a case of mass hysteria on fears of a US

recession. A display of letting price action create a narrative

that feeds into price action as everything spirals down in a

negative feedback loop. VIX hits 65, third largest spike in

history. Then a strong bounce comes this morning on the open while

ISM data shows better than expected demand and employment growth,”

Krüger remarked. At press time, BTC traded at $56,010. Featured

image created with DALL.E, chart from TradingView.com

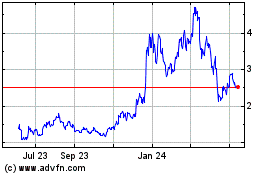

Optimism (COIN:OPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024