XRP U-Turn: Ex-Critic Reveals 4 Reasons To Buy And A Price Target

July 23 2024 - 5:00AM

NEWSBTC

Crypto analyst CryptoCondom (@crypto_condom), who had previously

been a vocal critic of XRP, has done a U-turn and is now endorsing

the crypto asset as a potential investment to his 82,400 followers.

This turnaround is rooted in an analysis of Ripple’s lawsuit with

the US Securities and Exchange Commission (SEC) and its

implications for the XRP price. 4 Reasons To Be Bullish On XRP

@crypto_condom, who had never envisioned investing in XRP,

disclosed that his change of perspective was prompted by what he

perceives as an overshoot in the recent sell-off, triggered by

delays in the Ripple-SEC settlement. His analysis suggests that the

resolution of this lawsuit could catalyze a series of

transformative developments. “Never in my life did I think I’d want

to own/long some XRP…but here we are. I think it got oversold the

other day on its settlement delay. In my mind, the Ripple

settlement will RAPIDLY [propel 4 reasons to be bullish on XRP],”

the analyst remarked. Related Reading: XRP Adoption & Activity

Spike: What This Means For Its Price Firstly, the conclusion of the

lawsuit between Ripple and the SEC is expected to clarify the

regulatory status of XRP, potentially allowing Ripple to resume

operations at full capacity within the United States. “[It will]

permit the company to operate again in the US,” @crypto_condom

claimed. Historically, despite Ripple securing over 31 money

transmitter licenses across various states, the persistent legal

uncertainty has significantly hampered broader institutional

adoption of XRP. In the past, Ripple CEO Brad Garlinghouse unveiled

that institutions like the Bank of America are waiting on the

sideline until the resolution of the lawsuit. Moreover, Ripple and

MoneyGram parted ways due to SEC lawsuit. Secondly, @crypto_condom

points to the potential listing of XRP futures on prominent US

exchanges such as Coinbase following the lawsuit’s resolution. This

would not only enhance XRP’s liquidity but also its visibility and

attractiveness to a broader range of institutional investors.

Furthermore, this regulated futures market of significant size

could pave the way for an US based spot XRP ETF, according to the

crypto analyst. “MAYBE allow it to get an ETF someday via a second

tier issuer (has CFTC futures). As shown by the massive success of

the US spot Bitcoin ETFs, this could mark a significant milestone

in providing retail and institutional investors with a regulated

vehicle to invest in XRP, thereby broadening its investor base.

Related Reading: Crypto Analyst Predicts XRP Price To Hit $1.03

Soon, Warns Of Initial Dip Fourth, the prospect of a Ripple Initial

Public Offering (IPO) also looms large, contingent upon a shift in

the regulatory environment. @crypto_condom speculates that a

potential presidential win by Donald Trump, who is perceived as

more favorable towards the crypto industry, could create a

regulatory climate conducive to such a move. Ripple CEO Brad

Garlinghouse has previously noted that an IPO under the current

regulatory conditions would be impractical, signaling that the

company’s strategy could pivot dramatically with changes at the

federal level. Price Target And Community Reactions Despite his

newly minted support for XRP, @crypto_condom remains guarded about

its price potential. In a spirited exchange with his followers, he

tempered expectations, dismissing the possibility of XRP reaching

$10 even in the most bullish scenarios, though he conceded that a

climb to near $1 might be within reach. This careful optimism

stands in contrast to more bullish projections within the

community. For instance, a user named Nefarious boldly predicted

that “6 years accumulation will break and XRP will send $10+ easy,”

a sentiment that @crypto_condom sharply refuted. He responded,

“errr…$10 is not a snowballs chance in hell. Close to $1 possible

though.” At press time, XRP traded at $0.5994. Featured image

created with DALL·E, chart from TradingView.com

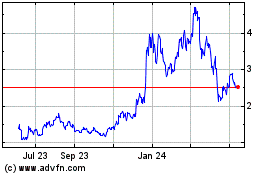

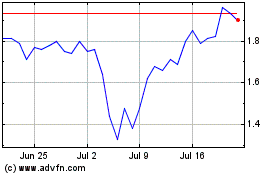

Optimism (COIN:OPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024