Toncoin Tsunami: $1 Billion Whale Activity Shakes Up Price – What’s Next?

May 19 2024 - 9:00AM

NEWSBTC

Despite a recent surge in activity from large investors, often

referred to as “whales,” the price of Toncoin (TON) appears headed

for choppier waters. This comes as analysts raise concerns about

the cryptocurrency’s weakening technical indicators and its

potential breach of a key support level. Related Reading: Crypto

Alert: VeChain Bull Run Imminent, Expert Predicts 500% Rally Whales

Make A Splash, But Can They Save The Day? In a recent report, Joao

Wedson, a crypto analyst at CryptoQuant, observed a significant

spike in whale activity on the Toncoin network. Transactions

exceeding 100,000 TON (roughly equivalent to $645,000 at current

prices) surpassed a staggering $1 billion in the past few weeks.

This indicates that major holders have been actively moving large

amounts of TON, but the purpose behind these movements remains

unclear. While the whales are certainly making a splash, Wedson

said it’s not necessarily translating to smooth sailing for TON’s

price. He pointed out that while large transactions dominate the

network’s volume (over 50%), their impact on the price seems

negligible. Conversely, smaller transactions, although constituting

the majority of overall activity, contribute a much smaller share

of the total volume. Technical Indicators Flash Red Toncoin’s price

has been exhibiting signs of weakness despite the influx of whale

activity. Notably, TON recently dipped below its 20-day Exponential

Moving Average (EMA), a technical indicator used to gauge

short-term trends. This suggests that the average price of TON over

the past 20 days has been on a downward slope, signifying a shift

towards selling pressure. Adding to the bearish sentiment is the

imminent crossover of the Moving Average Convergence Divergence

(MACD) indicator. The MACD line appears poised to fall below its

signal line, which traditionally indicates a loss of upward

momentum and a potential price decline. These technical indicators

are flashing red flags for TON. If the price breaches the lower

line of its ascending channel, which has been acting as a support

level, a drop to $5.70 is a distinct possibility. Related Reading:

Floki Inu Frenzy: Memecoin Eyes New Highs As Open Interest Soars Is

This A Buying Opportunity Or A Sinking Ship? The current situation

surrounding Toncoin presents a conundrum for investors. The

substantial whale activity hints at potential bullish interest, but

the technical indicators paint a bleak picture. The key question

remains: are the whales accumulating or distributing? If they’re

accumulating, this could be a buying opportunity before the price

rebounds. However, if they’re selling off their holdings, it could

be a sign of a distressed ship. Featured image from

Vikks/Shutterstock, chart from TradingView

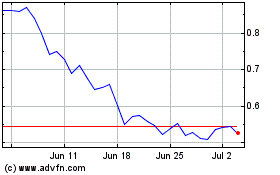

Mina (COIN:MINAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024