BNB Smart Chain Shines In Q1: Triple-Digit Surges In Key Metrics

April 25 2024 - 8:00PM

NEWSBTC

The Binance Smart Chain (BNB Chain), developed by the world’s

largest cryptocurrency exchange by trading volume, Binance,

experienced significant growth and performance in the first quarter

(Q1) of 2024. As highlighted in a recent report by Messari,

Binance Smart Chain has surged in market cap, revenue, average

daily active addresses, decentralized finance (DeFi), total value

locked (TVL), and average daily decentralized exchange (DEX)

volume. BNB Outperforms Bitcoin In Q1 2024 During Q1 2024,

BNB Smart Chain demonstrated notable market cap growth, soaring by

89% quarter-over-quarter (QoQ). It reached a market cap of $92.5

billion, securing the third position among all tokens, excluding

stablecoins. Only Ethereum (ETH) and Bitcoin (BTC) surpassed BNB in

market cap. Interestingly, the report notes that BNB’s

performance surpassed that of Bitcoin, which saw a 65% increase in

outstanding market capitalization over the same period. Related

Reading: SEC Anticipated To Reject Spot Ethereum ETFs In Upcoming

Decision, ETH Price Takes 5% Hit Revenue generated by the Binance

Smart Chain experienced a substantial boost in Q1. The network

collected $66.8 million in revenue, marking a 70% QoQ

increase. According to Messari, this surge in revenue was

primarily driven by the appreciation of BNB’s price. Notably, Q1’s

revenue exceeded that of any quarter in 2023. DeFi transactions,

particularly gas fees, were significant in revenue contributions,

accounting for 46% of the total. Despite a slight decrease in

average daily transactions, BNB Smart Chain experienced a 27%

year-over-year (YoY) increase, demonstrating sustained growth in

network activity. Average daily active addresses surged by

26% QoQ, reaching 1.3 million. Several protocols on the BNB Smart

Chain witnessed increased transaction volumes and active addresses,

with Tether’s USDT and decentralized exchange (DEX) PancakeSwap

leading the way. DEX Trading Volume Explodes BNB Smart Chain’s DeFi

TVL, denominated in USD, experienced a 67% QoQ surge, reaching $7.2

billion. This growth positioned the Binance Smart Chain as the

third-highest chain regarding DeFi TVL, denominated in USD.

However, when denominated in BNB, TVL decreased slightly by 12%.

This indicates that the surge in USD value was primarily driven by

BNB price appreciation and capital inflows. Decentralized exchanges

on the Binance Smart Chain witnessed a staggering 193% QoQ increase

in average daily trading volume. The total DEX volume for Q1

reached $1.1 billion, with PancakeSwap emerging as the dominant DEX

on the platform. PancakeSwap’s average daily DEX volume

surged by 140% QoQ, surpassing other competitors and solidifying

its position as the preferred DEX on the BNB Smart Chain. Related

Reading: HBAR Prices Crashes 35% As BlackRock Denies Any Ties To

Hedera Overall, Binance Smart Chain’s performance in the first

quarter of 2024 showed significant growth across various

parameters, reinforcing its position as an important blockchain

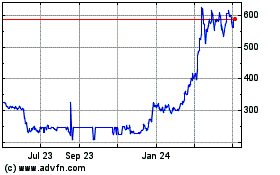

platform. The exchange’s native token, Binance Coin, is

currently trading at $607, reflecting a 2% price increase over the

past 24 hours and a 10% increase over the past 7 days. These

positive price movements bring the token closer to its all-time

high of $686, reached in May 2021. Featured image from

Shutterstock, chart from TradingView.com

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024