Bitcoin NFT Market Thrives, Franklin Templeton Remains Bullish, Binance Ends Support

April 04 2024 - 7:00PM

NEWSBTC

Franklin Templeton’s digital assets division has released a note to

its investors introducing Bitcoin-based non-fungible tokens (NFTs),

highlighting a surge in activity within the Bitcoin

ecosystem. The asset manager attributes this increased

momentum to various factors, including the emergence of Bitcoin

(BTC) NFTs called Ordinals, the development of new fungible

standards like BRC-20 and Runes, the growth of Bitcoin Layer 2

(L2s) solutions, and the expansion of decentralized finance (DeFi)

applications built on the Bitcoin network. Bitcoin Ordinals Shine

According to the Bitcoin ETF issuer’s report, activity in the

Bitcoin NFT space is gaining momentum. In particular, Ordinals have

seen a significant increase in trading volume over the past few

months. This growth is evident in Bitcoin’s dominance in

terms of trading volume, which surpassed Ethereum (ETH) in December

2023, as shown in the accompanying chart. Related Reading:

Trouble Ahead? Binance Coin Futures Market Under Pressure With

Negative Funding Rates In addition, several collections of Bitcoin

Ordinals are emerging as dominant players in the NFT market, both

in terms of trading volume and market capitalization. These

collections include NodeMonkes, Runestone, and Bitcoin Puppets,

which have an aggregate market cap of $353 million, $339 million,

and $168 million, respectively. They are the most notable

collections. In terms of trading volume over the past 30

days, the report shows that these three collections recorded

trading volumes of $81 million, $85 million, and $38 million,

respectively, over the past month. The asset manager further

claimed that what distinguishes BTC Ordinals from NFTs on other

blockchains, such as Ethereum or Solana, is that they contain raw

data recorded directly on the Bitcoin blockchain. This feature

contributes to the attractiveness and growing popularity of Bitcoin

Ordinals, as evidenced by market cap and trading volume figures.

Franklin Templeton, known for its involvement in the ETF market,

was one of the issuers that launched a spot BTC ETF in the

United States earlier this year. Its ETF, which trades under the

ticker name “EZBC,” has seen total inflows of 281.8 million since

its January 11 launch, according to BitMEX research data as of

April 3. Despite its zero-fee structure, Franklin Templeton’s

ETF has seen a significant difference in flows compared to the

leading players in the newly approved ETF market, such as Blackrock

(IBIT) and Fidelity (FBTC), which have seen flows of over 14

billion and 7.7 billion, respectively. Binance To Discontinue

Support For BTC NFTs In a recent blog post, crypto exchange Binance

announced it would discontinue support for Bitcoin-based NFTs on

its marketplace. Less than a year after their introduction, Binance

will no longer facilitate airdrops, benefits, or utilities

associated with BTC NFTs, citing a need to streamline its product

offerings in the NFT space. Related Reading: Injective Whales Go On

$24.8 Million Buying Spree, Is This The Next Solana? Binance states

that users who own Bitcoin NFTs are advised to withdraw them from

the Binance NFT marketplace via the Bitcoin network before May 18,

2024. Effective April 18, 2024, users can no longer purchase,

deposit, bid, or list NFTs via the BTC network on the Binance NFT

Marketplace. Any existing listing orders affected by this change

will be automatically canceled simultaneously. Currently, BTC is

trading at $68,300, up a modest 3% in the last 24 hours. It is

approaching the significant milestone of $70,000, a level the

cryptocurrency has struggled to maintain several times. Featured

image from Shutterstock, chart from TradingView.com

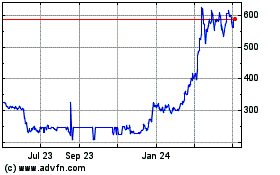

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024