Campari Upbeat on Sales Growth, Margins Ahead After Booking Higher 2022 Profitability

February 21 2023 - 5:49AM

Dow Jones News

By Joshua Kirby

Davide Campari-Milano NV said Tuesday that it is confident of

maintaining profitability in the year ahead despite rising

inflation, as it beat margin guidance for 2022.

The Italian drinks group booked adjusted earnings before

interest and taxes of 569.9 million euros ($609 million,) rising

19% on year organically and in line with forecasts, according to a

poll of analysts' estimates compiled by FactSet.

Sales rose 16% organically to EUR2.7 billion, with an adjusted

operating margin that climbed to 21.1% from 20% previously. The

maker of Aperol and Campari aperitifs had guided for a flat margin

on the year.

Growth in sales and profitability had come via strong demand as

well as pricing power, Chief Executive Bob Kunze-Concewitz said.

For the year ahead, the group expects further brand

momentum--including more price rises and premiumization in brown

spirits--and to maintain its operating margin on an organic basis,

despite the challenges posed by inflation.

Further ahead, Campari is confident of securing further top-line

growth and expanding its margins, thanks to improvements its

product-price mix, Mr. Kunze-Concewitz said.

To ensure demand is met, the group will invest to double its

production capacity in key aperitifs, bourbon and tequila, he

added.

The group will proposes a dividend of 6 European cents a share

for 2022, unchanged from the previous year.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

February 21, 2023 05:34 ET (10:34 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

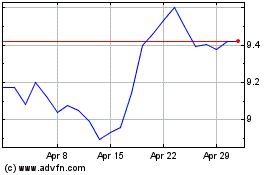

Davide Campari (BIT:CPR)

Historical Stock Chart

From Apr 2024 to May 2024

Davide Campari (BIT:CPR)

Historical Stock Chart

From May 2023 to May 2024