BNP Paribas SA : 2024 MREL requirements notification

June 24 2024 - 12:30PM

BNP Paribas SA : 2024 MREL requirements notification

2024 MREL requirements

notification

Press ReleaseParis, 24 June 2024

The BNP Paribas Group has received the

notification by the Autorité de Contrôle Prudentiel et de

Résolution (ACPR), implementing the decision of the Single

Resolution Board, of the updated Minimum Requirement for Own Funds

and Eligible Liabilities (MREL) requirements applicable in

2024.

The total MREL requirement applicable for 2024

thus amounts to 22.64% to which the CBR1 must be added, of the

Group’s RWA and 5.91% of the Group’s leverage exposures.

As regards the subordination constraint, the

requirement applicable in 2024 for the BNP Paribas Group is

respectively 14.52% to which the CBR1 must be added, of Group’s RWA

and 5.86% of the Group’s leverage exposures.

As at 31 March 2024, the BNP Paribas Group is

well above the updated MREL requirements with a total MREL ratio of

31.0% based on Group’s RWA and a Group subordinated MREL ratio of

28.0% on the same basis. These ratios were respectively 9.1% and

8.2% of Group’s leverage exposures as at 31 March 2024.

About BNP ParibasBNP Paribas is

the European Union’s leading bank and key player in international

banking. It operates in 63 countries and has nearly 183,000

employees, including more than 145,000 in Europe. The Group has key

positions in its three main fields of activity: Commercial,

Personal Banking & Services for the Group’s commercial &

personal banking and several specialised businesses including BNP

Paribas Personal Finance and Arval; Investment & Protection

Services for savings, investment and protection solutions; and

Corporate & Institutional Banking, focused on corporate and

institutional clients. Based on its strong diversified and

integrated model, the Group helps all its clients (individuals,

community associations, entrepreneurs, SMEs, corporate and

institutional clients) to realise their projects through solutions

spanning financing, investment, savings and protection insurance.

In Europe, BNP Paribas has four domestic markets: Belgium, France,

Italy and Luxembourg. The Group is rolling out its integrated

commercial & personal banking model across several

Mediterranean countries, Turkey, and Eastern Europe. As a key

player in international banking, the Group has leading platforms

and business lines in Europe, a strong presence in the Americas as

well as a solid and fast-growing business in Asia-Pacific. BNP

Paribas has implemented a Corporate Social Responsibility approach

in all its activities, enabling it to contribute to the

construction of a sustainable future, while ensuring the Group's

performance and stability.

Press contactSandrine Romano –

sandrine.romano@bnpparibas.com – +33 6 71 18 23 05Hacina Habchi –

hacina.habchi@bnpparibas.com - +33 7 61 97 65 20

1 Combined buffer requirement of 4.59% as at 31

March 2024

- 20240304_PR_mrel notification

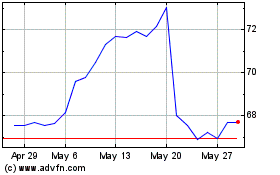

BNP Paribas (BIT:1BNP)

Historical Stock Chart

From Oct 2024 to Nov 2024

BNP Paribas (BIT:1BNP)

Historical Stock Chart

From Nov 2023 to Nov 2024