Wesfarmers Chairman Backs Carbon Tax; Urges Caution On Timing

October 06 2010 - 1:16AM

Dow Jones News

The chairman of Wesfarmers Ltd. (WES.AU), an Australian

conglomerate with substantial coal mine assets, said Wednesday he

backed the idea of a carbon tax but wanted the federal government

to wait for other countries to introduce a levy first.

Bob Every said reform to put a price on carbon in Australia was

"inevitable" and likely to happen during the current parliament of

Prime Minister Julia Gillard.

Debate on tackling emissions growth in Australia has largely

focused up to now on the introduction of a cap-and-trade emissions

scheme--a market-based trading system similar to one in Europe that

caps the amount of carbon dioxide that companies such as power

generators are allowed to vent.

However, there is concern among business leaders that a

cap-and-trade emissions system is too complicated.

"I personally favor a carbon tax. Having just gone through the

Global Financial Crisis where there was too much use and misuse of

derivatives, I don't see why we should produce another derivative,"

Every said on a panel at The Australian & Deutsche Bank

Business Leaders Forum in Sydney.

He added the Gillard government must be mindful of the

consequences of any reform, and taking action before other

countries would put "Australia beyond its station".

"Energy-intensive industries will have to be recognized

otherwise we'll just be exporting jobs and industry," Every

said.

Michael Chaney, chairman of gas producer Woodside Petroleum Ltd.

(WPL.AU), said on the same panel that Australia "shouldn't be ahead

of the pack" in putting a price on carbon.

"We should not be introducing and mandating any laws before

major emitters are on board," Chaney said.

The executives' comments signal a consensus may be forming in

the business community on regulation to tackle climate change in

Australia--the developed world's biggest per capita polluter

because of its reliance on fossil fuels for power generation.

Marius Kloppers, chief executive of BHP Billiton Ltd. (BHP),

said Sept. 15 there is a need for a clear tax on carbon emissions

and urged the Australian government and businesses to anticipate

changes.

"The decisions we take now on power production will still be

with us long after a global price for carbon is finally in place,"

Kloppers said.

However, Prime Minister Gillard vowed during the election

campaign not to push for any form of tax on carbon emissions during

the current parliamentary term.

She now seems to be shifting position as the government looks to

protect a wafer-thin majority in parliament that includes relying

on support of a lawmaker from the small environmentalist Greens

party. The Greens back the introduction of a carbon tax as an

interim measure before introducing a full carbon trading scheme

once a global agreement is reached.

Acknowledging the reality of global warming and putting a price

on carbon emissions are "priorities for the new Parliament,"

Gillard said Sept. 18 in her first major policy speech since

securing a second term for her center-left administration.

-By David Winning, Dow Jones Newswires; +61-2-82724688;

david.winning@dowjones.com

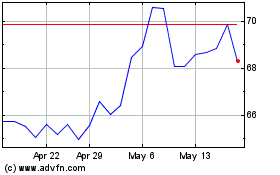

Wesfarmers (ASX:WES)

Historical Stock Chart

From Jan 2025 to Feb 2025

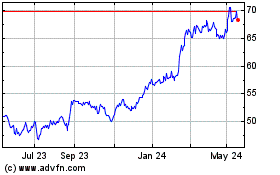

Wesfarmers (ASX:WES)

Historical Stock Chart

From Feb 2024 to Feb 2025