Crown Resorts Gets Increased Buyback Proposal From Oaktree

June 14 2021 - 7:27PM

Dow Jones News

By Stuart Condie

SYDNEY--Australian casino operator Crown Resorts Ltd. said

Oaktree Capital Management has raised the size of the financing it

proposes to fund a buy back of shares held by billionaire James

Packer's investment firm.

Crown on Tuesday said it had received a revised proposal from

Oaktree to provide a funding commitment of up to 3.1 billion

Australian dollars (US$2.39 billion) to buy back some or all of the

37% stake held by Mr. Packer's firm, Consolidated Press Holdings.

Oaktree in April proposed a A$3 billion facility.

The board has not yet formed a view of the proposal, Crown

said.

Last month, Crown rejected an improved takeover offer from U.S.

private-equity firm Blackstone Group Inc., saying it undervalued

the company and presented too much regulatory uncertainty. It has

also asked Australian rival The Star Entertainment Group Ltd. for

more information on a merger proposal that Star made in May.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

June 14, 2021 19:17 ET (23:17 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

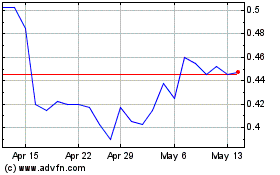

Star Entertainment (ASX:SGR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Star Entertainment (ASX:SGR)

Historical Stock Chart

From Mar 2024 to Mar 2025