Copper and gold miner OZ Minerals Ltd. (OZL.AU) will return

nearly half of its 1.33 billion Australian dollars ($1.35 billion)

cash holdings to shareholders after surging back to profit in 2010

after a near-death experience during the financial crisis.

The capital return comes at the start of a reporting season for

Australian miners in which analysts expect to see a wave of cash

flowing to shareholders, as booming commodities prices and a

cautious approach to spending in the wake of the financial crisis

leave the sector sitting on outsized cash piles.

BHP Billiton Ltd. (BHP) and Rio Tinto PLC (RIO), the world's

largest and third-largest miners by revenues, are expected to hand

back around US$10 billion in their results over the next week,

according to a note by Deutsche Bank analysts.

OZ Minerals, whose sole producing asset is the Prominent Hill

mine in South Australia, said it planned to pay back around A$600

million by the end of June through a capital return, share buyback

and dividends.

The cash return was "the right balance between returning funds

to shareholders and having balance sheet strength to continue to

grow value in the business", Chairman Neil Hamilton said in a

statement.

Record copper prices have buoyed the miner, which said in annual

results Wednesday that net profit hit A$586.9 million last year,

reversing a A$517.3 million loss in 2009.

Three-month copper futures on the London Metal Exchange hit an

all-time high of $10,160 a metric ton Monday, while spot gold

peaked at $1,431.30 an ounce on Dec. 7.

However, OZ Minerals' announcement Wednesday underlines the

potential pitfalls of such cash distributions, with some analysts

querying the shareholder benefits of the move and suggesting the

money could be better used for investment.

"They need to go and get an acquisition," said Hayden Bairstow,

an analyst at CLSA in Sydney. "They need to extend the life of the

company beyond Prominent Hill because once the open pit is finished

they need to find some longer-term growth options."

Chief Executive Terry Burgess said that while the company had

looked at several potential acquisitions over the past year, the

booming copper price meant there were few good assets

available.

"There are opportunities out there but we just don't see the

value we're looking for," he said. "If you rush into things you can

repent at your leisure, and we're not going to do that. The copper

price is fantastic (but price) expectations have risen

accordingly."

Over the past year, investors have been keen to see how OZ

Minerals would deploy its capital against a backdrop of rising

copper and gold prices and busy mergers and acquisitions activity

in the sector.

With no debt, the company's A$1.33 billion cash holdings at Dec.

31 account for nearly a quarter of its market capitalization,

though they have ebbed slightly from A$1.43 billion at the end of

June due to dividend payments and capital spending.

Another Sydney-based analyst, who didn't want to be named as he

wasn't authorized to speak to the media, said OZ had missed

opportunities when it failed to make takeover offers for Citadel

Resource Group Ltd. and Sandfire Resources NL (SFR.AU).

"It's tough for OZ. These opportunities are few and far between,

but Citadel and Sandfire were good opportunities and they were in a

position to make a move earlier than their peers because they had

the cash from the get-go," he said.

Equinox Minerals Ltd. (EQN.AU) spent A$1.25 billion taking over

Saudi-focused Citadel in an offer that closed last month, while the

share price of Western Australia-focused explorer Sandfire has more

than doubled since OZ took out a 19% stake in the miner last July,

making a full cash offer likely beyond OZ's reach.

Acquisitions are essential because, given the typical

uncertainties around mining operations and commodities prices,

investors prefer companies that have more than one producing

mine.

"A company that has one commodity and one operation is quite

risky from a financial sense," said Chief Financial Officer Andrew

Coles.

OZ Minerals also needs to move forward as Prominent Hill's own

outlook weakens. Analysts expect the mine, which started production

in 2009 and produces around 0.7% of the world's mined copper, to

have around eight years of good production left.

It produced 112,171 metric tons of copper and 196,400 troy

ounces of gold during 2010 at average cash costs of 46.4 U.S. cents

per pound.

But lower ore grades and larger quantities of overburden needing

to be removed to get at its ore bodies will push up cash costs to

60c/lb next year, while production volumes will be roughly

static.

The cash return to shareholders will comprise a 12 Australian

cents per share capital return, costing around A$388 million; a

A$200 million share buyback; and a year-end dividend of 4 cents per

share, the company's first since 2008.

Last year, OZ Minerals proposed a half-year dividend of 3 cents

per share, bringing the full-year total to 7 cents per share.

The company will also carry out a 1-for-10 share consolidation,

a move which the Sydney-based analyst said would be marginally

negative for shareholders.

OZ Minerals almost collapsed under its debt load after it was

created from a merger of Zinifex Ltd. and Oxiana Ltd. on the eve of

the global financial crisis in March 2008. The bulk of the merged

company was sold off to Chinese state-owned miner China Minmetals

Corp. in June 2009, but Prominent Hill was held back because of

national security concerns.

The mine is in the Woomera Prohibited Area, a weapons-testing

range where the U.K.'s atomic bombs were tested in the 1950s.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

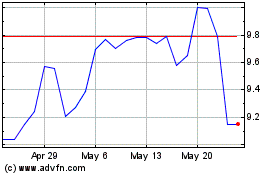

Sandfire Resources (ASX:SFR)

Historical Stock Chart

From Dec 2024 to Jan 2025

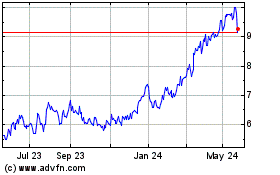

Sandfire Resources (ASX:SFR)

Historical Stock Chart

From Jan 2024 to Jan 2025