U.K.'s Osborne Sees Tax Increases if Brexit Approved

June 14 2016 - 9:00PM

Dow Jones News

LONDON—A vote in favor of a British exit from the European Union

could require the U.K. government to implement emergency tax

increases and fresh cuts to public spending, Treasury chief George

Osborne will say Wednesday, as polls show support for exiting the

EU is gaining ground.

In a speech in southern England, Mr. Osborne will say the

government may need to find some £ 30 billion ($42.8 billion) of

savings over the next four years to plug a possible gap in the

public finances that could be caused by weaker growth as a result

of a British exit, or "Brexit."

Proponents of quitting the bloc dispute such analyses, saying

the U.K. would have more money to spend on public services outside

the EU as it would no longer need to contribute around £ 8 billion

a year to the 28-member bloc's budget.

Leaving the EU "would mean an emergency budget where we would

have to increase taxes and cut spending. Far from freeing up money

to spend on public services as the Leave campaign would like you to

believe, quitting the EU would mean less money," Mr. Osborne will

say Wednesday, according to extracts of his planned remarks

released in advance by the pro-EU Britain Stronger In Europe

campaign.

Mr. Osborne's warning comes as opinion polls signal the

pro-Brexit camp is gaining ground ahead of a referendum on

continued membership June 23.

An online poll of almost 2,500 people, published Tuesday by TNS

Omnibus, put support for leaving the EU in the lead with 35% of the

vote, with those favoring remaining at 33%. The remainder were

undecided or didn't plan to vote. Adjusted for likely turnout among

different groups, the leave camp are on course for 47% of the vote

and their opponents 40%, TNS said, with the rest undecided or not

planning to vote.

Several other polls in recent days have also given the

pro-Brexit side the lead, adding to pressure on Prime Minister

David Cameron to win over wavering voters.

Mr. Osborne's warning is based on research by the Institute for

Fiscal Studies, a nonpartisan think tank. In a report in May, the

IFS said government borrowing to be between £ 20 billion and £ 40

billion higher in the fiscal year ending in March 2020 than it is

forecast to be if the U.K. remains an EU member, due largely to

lower tax receipts from weaker growth.

That would leave Mr. Osborne some way from his self-imposed goal

of closing the nation's budget deficit completely that same fiscal

year, the institute said.

Mr. Osborne will share a platform Wednesday with Alistair

Darling, his predecessor as Treasury chief, who was in office when

the financial crisis hit in 2008. Mr. Darling's Labour Party, the

U.K.'s main opposition, has already said a Brexit vote could lead

to more government belt-tightening by the ruling Conservatives.

"I am even more worried now than I was in 2008," Mr. Darling

will say, according to extracts of his planned remarks.

Write to Jason Douglas at jason.douglas@wsj.com

(END) Dow Jones Newswires

June 14, 2016 20:45 ET (00:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

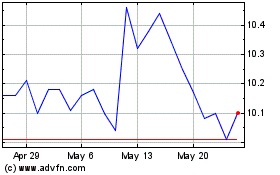

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pacific Current (ASX:PAC)

Historical Stock Chart

From Feb 2024 to Feb 2025