MARKET COMMENT: S&P/ASX 200 May Rise Before Australia Jobs Data

March 13 2013 - 7:29PM

Dow Jones News

2258 GMT [Dow Jones] Australia's S&P/ASX 200 may rise early

Thursday after stronger-than-expected U.S. retail sales data added

to signs the world's biggest economy is recovering. U.S. February

retail sales rose 1.1% vs 0.6% expected, helping the S&P 500

close up 0.1% after an early fall. While the DJIA Transports index

lost ground, the DJIA and Nasdaq rose, and the CBOE VIX volatility

index fell 3.6%. Further bolstering U.S. market sentiment, JPMorgan

upgraded its 1Q U.S. GDP forecast to 2.3% from 1.5%, and Deutsche

Bank raised its to 3% from 1.5%, while also lifting its 2013

estimate to 2.3% from 2.0%. Banks may lead an early rise after the

S&P 500 Financials sector rose 0.4%, although Citi has cut NAB

(NAB.AU) to Neutral from Buy, following its strategy update.

Resources may lag after LME copper fell 0.6% and spot iron ore lost

3.1%. London-listed BHP (BHP.AU) fell 1.3%, Rio Tinto (RIO.AU)

dropped 2% and Cliffs Natural Resources dived 4.7% in the U.S. ADRs

suggest BHP should open down about 1%. Domestic jobs data are due

at 0030 GMT, with the market expecting a 10,000 rise in the number

of people employed and a 5.5% jobless rate. Index last closed at

5092.4. (david.rogers1@wsj.com)

Write to Shani Raja at shani.raja@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

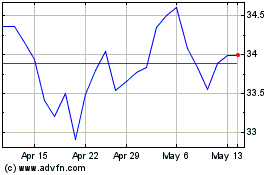

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Oct 2024 to Nov 2024

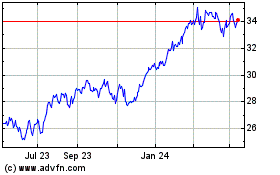

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Nov 2023 to Nov 2024