Goodman Group (Goodman or Group) today announces that it has

entered into an agreement with California-based, Birtcher

Development and Investments (Birtcher), focused on the development

of, and investment in, prime quality logistics and industrial

facilities in key locations across North America.

In addition, Goodman is in final stages of due diligence with

regard to a capital partnership targeting approximately US$800

million of equity commitments, which will focus on the key North

American logistics and industrial property markets.

Key features of Goodman’s North American market entry are:

+ Deployment of a highly experienced team, combining

Birtcher’s local market expertise with Goodman’s global funds

management capability, to establish the Group’s North American

operations. Birtcher will have a management carried interest, post

a Goodman preferred return. + Development led investment

strategy focused initially on the development of prime logistics

and industrial facilities in key logistics hubs, with the ability

to invest in stabilised properties over time. + Secured four

development sites, two in the Inland Empire (Los Angeles area),

Oakland (San Francisco Bay Area) and Lehigh Valley (Philadelphia),

with in excess of 9.8 million sq ft of gross rentable area and a

combined total completion value of more than US$700 million.

Strategic rationale

The US is the world’s largest, most liquid and transparent real

estate market. The current market remains highly fragmented with

obvious capital constraints, making this an attractive time to

enter key logistics and industrial locations and access top tier

development sites to deliver new investment product for global and

local customers with our global capital partners. Major customers

of Goodman include Amazon, DHL and Coca Cola.

“Today’s announcement reinforces Goodman’s position as a leading

global logistics property group,” said Greg Goodman, Goodman

Group’s Chief Executive Officer. “With US$19 billion of assets

under management throughout Asia Pacific and Europe, our entry into

North America is a logical step in the expansion of our operating

platform to service our global customers and equity partners in the

world’s largest logistics and industrial market. Over time we also

see the US and Canadian markets growing to be among Goodman’s

largest markets in terms of assets under management.”

Capital partnership approach

Goodman is establishing a new North American logistics and

industrial partnership, to provide funding to invest in the

properties developed and sourced by the Group’s North American

platform.

“The investment strategy for the partnership will be to target

investment in logistics and industrial property in key North

American markets, focusing initially on development led

opportunities, with value add and stabilised asset acquisitions to

be considered over time in line with market conditions,” added Mr

Goodman.

Goodman Group is in final stages of due diligence with a major

capital partner. Commercial terms have been agreed and

documentation is anticipated to be completed shortly.

Goodman will fund its interest in the partnership from retained

earnings and proceeds from the recycling of assets.

Management company

The management company combines Goodman’s global expertise as a

leading specialist fund manager of industrial property and business

space, extensive global customer and capital partner relationships,

with the strength of Birtcher’s local knowledge, long established

track record and reputation in the US and Canada.

“A key success factor to entering a new market is ensuring you

have the requisite local knowledge and expertise,” said Mr Goodman.

“We are delighted to have sourced the local expertise of such a

highly regarded property group as Birtcher to drive the expansion

of our international operating platform into key logistics markets

in North America. Birtcher’s local acumen and first-rate track

record will be supported by a group of Goodman’s global

professionals who will be joining the management group to help

provide our operational expertise and compliance.”

Birtcher is a Los Angeles area based, privately-owned industrial

and logistics real estate developer which has built a solid

reputation as one of the most innovative and successful developers

on the West Coast of the United States. Birtcher has developed more

than 60 million square feet of warehouse, distribution,

manufacturing and office projects throughout the Western and

Southern United States for leading customer names including Kroger,

Nike, Xerox and General Electric.

“This represents a new chapter in Birtcher’s 73 year history,

said Brandon Birtcher, President and CEO of Birtcher Development

and Investments. We are excited by the tremendous opportunity that

comes through working as part of one of the world’s leading

industrial property groups. We look forward to utilising the wealth

of our local market knowledge and relationships, together with our

considerable development and investment experience to drive the

growth of the company.”

The management team will be incentivized through its carried

interest in the management company, post a Goodman preferred

return.

Investment strategy

A targeted geographic investment strategy will be implemented to

secure opportunities on a ‘through the cycle’ basis, by focusing on

developing and investing in A-grade logistics and industrial

facilities. A development-led approach will initially be pursued to

maximise returns given the under supply of quality space in

specific target logistics markets.

In this regard, opportunities will be sought in the key West

Coast logistics hubs of Los Angeles (Inland Empire), San Francisco

and Seattle, with New York, New Jersey and Philadelphia to be

targeted on the East Coast. Other key logistics hubs based around

inland ports, intermodals and tier one ports will also be

considered.

Secured development sites

Initial development opportunities have been identified in

California through three prime land sites. Two sites have been

secured in the Inland Empire, California’s largest industrial

market, with a third site acquired in the San Francisco Bay Area of

Oakland, in close proximity to the city’s air and sea ports. A

fourth site is under offer in the Philadelphia Lehigh Valley

industrial market. The four sites are capable of delivering a total

combined gross rentable area in excess of 9.8 million sq ft and a

total completion value of more than US$700 million.

Mr Goodman said, “Having secured these significant land sites,

we are well positioned to take advantage of the very positive

market dynamics in the Inland Empire, Oakland and Philadelphia.

These regions are experiencing an undersupply of high quality

logistics space, providing us with a compelling opportunity to meet

the strong customer demand that exists for A-grade ‘big box’

facilities.”

“We are separately assessing further development opportunities

in our other target North American locations and we expect to be in

a position to announce these shortly,” Mr Birtcher added.

For more information on Goodman’s entry into the North American

market, refer to Section 2 in the Investor Update presentation

available from the Investor Centre section of Goodman’s

website.

About Goodman

Goodman Group (ASX: GMG) is an integrated property group with

operations throughout Australia, New Zealand, Asia, Europe and the

United Kingdom. Goodman Group, comprised of the stapled entities

Goodman Limited and Goodman Industrial Trust, is the largest

industrial property group listed on the Australian Securities

Exchange and one of the largest listed specialist fund managers of

industrial property and business space globally.

Goodman’s global property expertise, integrated

own+develop+manage customer service offering and significant fund

management platform ensures it creates innovative property

solutions that meet the individual requirements of its customers,

while seeking to deliver long-term returns for

investors.

For more information visit www.goodman.com or

www.us.goodman.com

About Birtcher Development & Investments

Since 1939, the Birtcher name has been synonymous with enduring

design and performance in project execution. Birtcher has developed

more than 60 million square feet of industrial, office and retail

projects throughout the United States, achieving national expertise

and strong reputations in development and construction. Today,

Birtcher Development & Investments is solely owned by Brandon

Birtcher who carries on the family’s five-generation development

legacy.

Birtcher’s core focus is on providing warehouse and

build-to-suit solutions for logistics service providers,

manufactures and retailers throughout North America. This is

achieved by maintaining land inventory through control of the best

sites in America’s most attractive logistics markets.

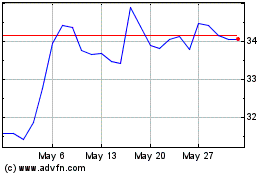

Goodman (ASX:GMG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Goodman (ASX:GMG)

Historical Stock Chart

From Mar 2024 to Mar 2025