UPDATE: Bannerman To Step Up Talks With Potential Development Partners

April 09 2012 - 11:48PM

Dow Jones News

Bannerman Resources Ltd. (BMN.AU) will step up negotiations with

potential backers for a key uranium project it is developing in

Namibia now that a completed study supports estimates that the

operation can produce up to 9 million pounds a year, Chief

Executive Officer Len Jubber said Tuesday.

The Australian company is pushing ahead with the Etango project

near the central western coast of the southern African country as a

"nuclear renaissance" takes hold in Asia, Jubber said in a

telephone interview.

Bannerman plans to continue investigations into the potential

longevity of Etango, which the definitive feasibility study found

currently has a mine life of at least 16 years, Jubber said. "It is

a big project, so we're trying to get a feel for just how big,"

Jubber added.

Bannerman has been discussing possible investment in the project

with interested parties for several years, but will now step that

up, he said, adding that the company remains open to options

including working with an established mine operator or an Asian

energy company seeking long-term supplies of uranium.

Earlier Tuesday, Bannerman in a statement said it has agreed to

sell a minority stake in the unit that owns the project, raising

about A$3.9 million (US$4 million) toward the estimated US$870

million capital cost of bringing Etango to production.

Namibia's state-owned mining company, Epangelo Mining Co., will

buy a 5% interest and has an option to acquire a further 5% stake,

it said. After the initial sale, Bannerman will hold 76% of the

unit that owns the Etango project and nonexecutive director Clive

Jones and former director Nathan McMahon will together have

19%.

The agreement comes amid heightening interest in sources of

uranium to power planned new nuclear power stations in countries

including China and India. China Guangdong Nuclear Power Holding

Corp. and China-Africa Development Fund this year bought

Australia's Extract Resources Ltd., which is developing a promising

uranium deposit that neighbors Rio Tinto PLC's (RIO) producing

Rossing mine in Namibia.

Bannerman said it has now completed a definitive feasibility

study for Etango, which supports building an operation that would

produce between 7 million and 9 million pounds a year of U3O8

uranium for the first five years and then 6 million-8 million

pounds annually to rank Etango as one of the world's largest

uranium-only projects. Etango is located southwest of Rio's Rossing

mine.

"The number of technically viable, globally significant uranium

projects is small, and there is an emerging consensus that uranium

prices will need to rise substantially in order to incentivize new

supply," said David Smith, chairman of Bannerman. "The involvement

of Epangelo as a key partner in the Etango project designates the

start of a new period in advancing the Etango project."

-By Robb M. Stewart, Dow Jones Newswires; +61 3 9292 2094;

robb.stewart@dowjones.com

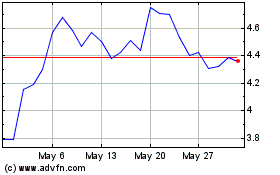

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Apr 2024 to May 2024

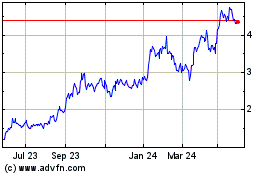

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From May 2023 to May 2024