2nd UPDATE: Alinta Has Received Indicative Takeover Bids

June 23 2010 - 12:51AM

Dow Jones News

Debt laden Australian power generator Alinta Energy Group

(AEJ.AU) said Wednesday that it has received indicative takeover

bids from a number of sources and dismissed speculation that it has

considered appointing a voluntary administrator.

The owner of 12 operational power stations, however, said that

its loan covenants could come under pressure and that it has asked

its lenders to vary them.

Any buyer of Alinta would have to take on about A$3 billion in

debt, with the company currently trading at a market value of

around A$50 million after its securities were hammered in the wake

of the global financial crisis.

A number of indicative, non-binding bids have been received for

both the whole company and individual assets, Alinta said,

confirming various media reports.

The former satellite fund of failed investment house Babcock

& Brown Ltd. said in April it had hired Lazard to examine ways

to reduce its heavy debt load, including potential asset sales and

capital management opportunities.

An unsourced report on The Australian newspaper's website said

Wednesday that a consortium comprising Origin Energy Ltd. (ORG.AU),

APA Group (APA.AU) and Japan's Marubeni Corp. (MARUY) has emerged

as a key bidder for Alinta.

Other media reports have cited French energy giant GDF Suez

(GSZ.FR) and diversified miner BHP Billiton Ltd. (BHP.AU) as

possible rival bidders.

Spokespeople for Origin, APA and BHP all declined to comment on

the reports. BHP sold two Western Australian power stations to

Alinta about 12 year ago and may be interested in repurchasing

those individual assets.

Credit Suisse Analyst Sandra McCullagh said Tuesday that while

Origin, with a healthy balance sheet, is well placed to buy power

stations from Alinta, it may overlook them for more accretive

opportunities, including the looming privatization of energy

retailers in New South Wales state.

Origin already has an offtake agreement for Alinta's Braemer

power station in Queensland state, so owning the asset may not be a

priority, McCullagh said.

She added that the natural owner of Alinta's Western Australia

state generators would probably want to have its own gas supply to

hedge against gas price risk and Origin's Perth Basin gas

production is insufficient to cover the Alinta load.

According to Alinta's interim accounts lodged February, the

company at Dec. 31 had total current and non-current assets,

including intangibles, of A$5.15 billion and total liabilities of

A$4.43 billion, including A$3.26 billion of current and non-current

borrowings.

The company said a report on subscription service debtwire.com

indicated it had threatened its lenders with voluntary

administration if they didn't amend its covenants.

"Alinta Energy has made a request to its banking syndicate for

the variation of covenants for the period to 31 March 2011, as

under some trading scenarios, these covenants could come under

pressure and frustrate the deleveraging activities," the company

said.

It added that it "has been working closely and co-operatively

with its banking syndicate and is not considering the appointment

of a voluntary administrator".

Alinta reiterated its guidance for the year to June 30 for

normalized earnings before interest, tax, depreciation and

amortization of A$288 million.

Alinta Energy securities have risen sharply in Wednesday's

trading and at 0418 GMT were up 1.6 cents or 35% at 6.1 cents.

-By Ross Kelly, Dow Jones Newswires; 61-2-8272-4692;

Ross.Kelly@dowjones.com

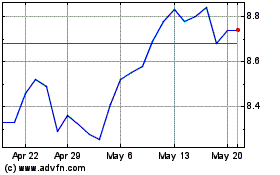

APA (ASX:APA)

Historical Stock Chart

From Oct 2024 to Nov 2024

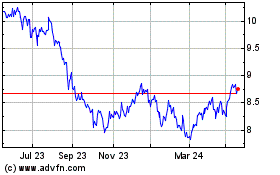

APA (ASX:APA)

Historical Stock Chart

From Nov 2023 to Nov 2024