4th UPDATE: ANZ To Buy ING JV In Australia, New Zealand For EUR1.1 Billion

September 25 2009 - 3:29AM

Dow Jones News

Australia and New Zealand Banking Group Ltd. (ANZBY) said Friday

it will buy ING Groep NV's (ING) 51% stake in their Australia and

New Zealand wealth management and life insurance joint venture for

EUR1.1 billion.

The cash deal makes good on ANZ's ambitions to boost its

exposure to the fast growing wealth management sector, where it has

been underweight compared with many of its peers.

It will also free up capital for ING, which is selling assets as

part of its "Back to Basics" program as it looks to repay a

government lifeline.

ING expects a profit of around EUR300 million on the sale, which

will improve its debt to equity ratio. It will also free up an

estimated EUR900 million of capital for the firm, it said in a

statement.

"The sale of our insurance and wealth management operations in

Australia and New Zealand is further proof of our determination to

simplify the organization by focusing on fewer, strong franchises

that form a coherent group," ING Chief Executive Jan Hommen

said.

The group is targeting EUR6 billion-EUR8 billion in asset sales

to help pay down a EUR10 billion lifeline it received from the

Dutch government last October to underpin its core capital.

It has put its Asian and Swiss private banking assets up for

sale, either to be bought together or separately. Offers for both

are estimated at around US$2 billion and ING is likely to decide on

the winning bidders next month, a person familiar with the

situation said Thursday.

ANZ Chief Executive Mike Smith said he wasn't interested in the

ING private banking business in Asia, but expects more

opportunities to emerge around the region as the fallout from the

global financial crisis forces more banks to shift their focus back

to their home markets.

ANZ said it expects the deal, which is expected to close by the

end of the year, to boost its earnings per share in the 2010

financial year, even before taking into account "significant"

synergies.

ANZ's Smith said that he'd approached ING about buying out the

joint venture, in which ANZ currently holds 49%, for some time.

ING's regional CEO for Investment Management Alan Harden told Dow

Jones Newswires that the two had started talks "a few months

ago."

ING will retain its ING Direct, ING Investment Management, ING

Wholesale Banking and ING Real Estate operations in Australia.

The deal remains subject to regulatory approval.

It fits well with ING's strategy to shrink and simplify the

company, said KBC Securities analyst Dirk Peeters. He said it is

also good for the group's cash position and debt/equity ratio and

will free up EUR900 million of capital. He kept his reduce rating

and a EUR11 target price on the stock.

ING shares closed Thursday at EUR11.18. They have risen by 53%

since the beginning of 2009 but are down by around 37% from a year

ago.

Company Web site: www.ing.com }

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

(Robin Van Daalen in Amsterdam and Ellen Sheng in Hong Kong

contributed to this article)

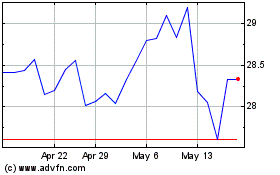

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From May 2024 to Jun 2024

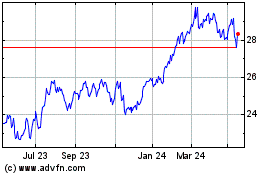

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jun 2023 to Jun 2024