UPDATE:At Least 6 Bid For ING Private Banking Assets-Sources

August 26 2009 - 2:36AM

Dow Jones News

Dutch banking and insurance company ING Groep NV (ING) has

picked at least six financial institutions to enter the second

round of bidding for its Swiss and Asian private banking assets,

people familiar with the situation said Wednesday.

Market watchers expect the two offshore private banking entities

owned by ING to fetch between US$1.8 billion and US$2 billion,

which will help ING pay down a EUR10 billion ($14.2 billion)

lifeline it received from the Dutch government in October last

year.

Among the bidders to make it to the second round, according to

two people, are Zurich-based Credit Suisse Group (CS), Singapore's

DBS Group Holdings Ltd. (D05.SG), Swiss wealth manager Julius Baer

Holding AG (BAER.VX) and emerging market-focused U.K. bank Standard

Chartered PLC (STAN.LN). Commonwealth Bank of Australia (CBA.AU) is

also bidding for the ING assets, a third person said. There's no

information on who the remaining bidders are.

Shortlisted bidders have until Sept. 3 to submit their final

bids, two people said.

While ING is selling the Asian and Swiss private banking assets

separately, bidders can choose to bid for just one operation or

both entities. Most bidders have expressed interest in scooping up

the two operations together, two people said, as high net worth

clients are characterized by their high fund mobility and demand

for a great variety of investment options, both in terms of the

product and geographical mix.

Credit Suisse declined to comment while DBS and Standard

Chartered couldn't be immediately reached for comment.

Australia and New Zealand Banking Group Ltd. (ANZ.AU) had hired

HSBC Holdings PLC's investment bankers to look at the assets, but

eventually didn't bid for them, a fourth person said.

The Australian bank's wealth management business targets middle

class individuals, not ING's ultra-high net worth segment, its

Chief Executive Mike Smith told Dow Jones Newswires earlier this

month, when he announced the Austarlian bank's US$550 million

purchase of Royal Bank of Scotland Group PLC's Asian banking

operations.

ING, which had grown into a banking, investment and insurance

giant from merging insurance company Nationale-Nederlanden and NMB

Postbank Group in 1991, was hit hard during the recent financial

crisis, with losses on real estate and other securities forcing it

to seek government aid.

The firm is now streamlining its business and expects to raise

between EUR6 billion and EUR8 billion by selling between 10 and 15

units.

-By Amy Or, Dow Jones Newswires; 852-2832 2335;

amy.or@dowjones.com

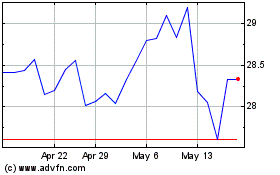

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From May 2024 to Jun 2024

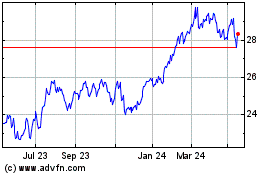

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jun 2023 to Jun 2024