INTERVIEW:ANZ May Look At ING's Asian Private Banking Assets

August 04 2009 - 5:02AM

Dow Jones News

Australia and New Zealand Banking Group Ltd. (ANZ.AU) Chief

Executive Mike Smith said Tuesday that the group will look at ING

Groep NV's (ING) Asian private banking business, but those assets

may not fit in with the Australian bank's strategy.

ING is seeking buyers for its private-banking business in Europe

and Asia, according to people familiar with the situation last

month, the latest step by the financial-services firm to slim down

after it was forced to turn to the Dutch government for aid last

year.

But Smith said that ANZ's target market in wealth management is

less the ultra-high net worth individual catered to by private

bankers than the mid-range wealth management offerings of retail

banks.

"I am not sure how much ING works with our core business class,"

Smith told Dow Jones Newswires. "We are better with the HSBC

Premier and Citigold sort of business class, rather than private

banking. I don't think we should be competing with the UBS's (AG)

or the Goldman Sachs's (Group Inc.) of the world."

ANZ said Tuesday it will pay US$550 million for some of Royal

Bank of Scotland Group PLC's (RBS) Asian banking operations,

including institutional businesses in Taiwan, the Philippines and

Vietnam.

RBS has entered into a two-year non-compete agreement with ANZ

in those markets it sold the Australian bank its institutional

businesses. That means RBS won't participate in domestic deals in

Taiwan, the Philippines and Vietnam, whether it is traditional

"flow businesses" such as foreign exchange swaps or more

traditional investment banking operations like debt issuances,

equity underwriting and advising on mergers & acquisitions.

Smith said, however, that ANZ is not interested in bulge-bracket

investment banking, and has no plans to launch M&A advisory and

equity underwriting in those places.

"The acquisitions give us a branch presence, and a commercial

banking business, especially in trade, forex, and normal debt

finance," he said. "This is good for flow business and money

transactions. All this makes money."

In the short-term, the bank plans to focus on serving local

corporates with businesses in Australia or vice versa. But in the

medium-term, it hopes to tap Asian corporates engaged in

intra-Asian trade, Smith said.

-By Amy Or, Dow Jones Newswires; 852-2832 2335;

amy.or@dowjones.com

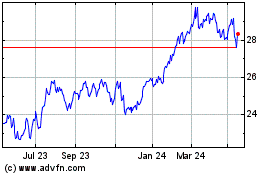

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From May 2024 to Jun 2024

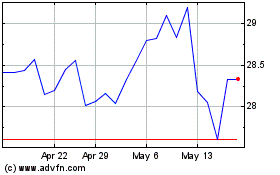

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jun 2023 to Jun 2024