Australia & New Zealand Banking Group Ltd. (ANZ.AU) said

Tuesday it will pay US$550 million for some of Royal Bank of

Scotland Group PLC's (RBS) Asian banking operations in what the

group described as a stepping stone into the region.

The Australian lender will also keep watch for further deals in

the region to help it achieve its ambition of becoming a

significant player in the Asian market, but said a

"transformational deal" is still some way off.

ANZ Chief Executive Mike Smith, a former HSBC executive, wants

to transform Melbourne-based ANZ into a "super regional bank",

competing with the likes of HSBC and Citigroup. He hopes to

generate 20% of ANZ's revenues from Asia by 2012 amid intense

competition and slowing loan growth in its home markets.

ANZ said it will buy RBS' retail and commercial banking

operations in Taiwan, Singapore, Indonesia and Hong Kong, and its

institutional businesses in Taiwan, the Philippines and

Vietnam.

But it is not buying operations in India or China - considered

by some as the jewels of RBS' Asian business - due to a combination

of price and a lack of banking licenses, Smith said.

RBS said in a statement it "remains in advanced discussions with

bidders" for its operations in India and China. People familiar

with the situation have said Standard Chartered PLC (STAN.LN) is in

talks to buy the operations in those two countries.

"The acquisition of these RBS businesses is a further stepping

stone in our super regional strategy and creates a new platform for

our retail and wealth businesses in Asia," ANZ's Smith said in a

statement.

"This acquisition is consistent with our strategy and involves

the businesses that we wanted from the RBS sale process, in markets

that we know well, with regulatory approval processes which we

believe are achievable for ANZ," he said.

Analysts said that if Smith is serious about transforming ANZ -

Australia's fourth largest lender by market capitalization - into a

major force in Asian banking, he'll have to look at further

acquisitions.

ANZ already owns stakes in several banks around the region,

including a 19.9% stake in Shanghai Rural Commercial Bank, an 85%

stake in Indonesia's PT ANZ Panin bank and a 20% stake in AmBank in

Malaysia.

Smith said that the RBS deal boosts ANZ's critical mass in Asia,

but is not "transformational" for the group or its strategy in the

region.

Any future "transformational" deal, which could conceivably

double the group's size, is likely a long way off and may be based

on a share deal rather than cash, Smith said. His focus will be on

bedding down the RBS operations, but Smith said the group will keep

an eye open for further bolt-on deals.

After the RBS deal, ANZ will still be sitting on around A$4

billion in capital, some of which could be used for acquisitions,

after raising A$4.7 billion through recent share placements.

Smith told Dow Jones Newswires in an interview there will be

further acquisition opportunities in Asia as foreign banks sell

assets to shore up their retrench in their domestic markets after

the global financial crisis.

"There are one or two things on the horizon," he said. "There

are a few (opportunities) around."

ANZ is also on the lookout for deals to "bulk up" in Australia,

and Smith said he was still keen to pursue opportunities to expand

in both India and China.

Still, Smith said he is comfortable with the group's organic

growth strategy in China, with ANZ set to open a rural bank in

Chongqing in September, and told reporters that ANZ hopes to get a

banking license in India before the end of the year.

He told Dow Jones Newswires ANZ had felt that integrating RBS'

Indian operations would have been too complex, while the operations

in China were too expensive. But he said that ANZ would consider

future opportunities to expand through acquisition in both

countries, though its organic growth in China was "going well".

As ANZ grows scale in Asia, it may consider a secondary listing

in the region, the group's CEO said.

Not A Super Regional Bank Yet

Analysts expect the lender to look at further deals in Asia,

with Citi analysts noting the bank is "not a super regional

yet."

"While this (RBS) is a good deal, more will likely be required

to achieve the super-regional vision and the goal of 20% of

earnings from Asia by FY12," Citi analysts said.

There is speculation that ANZ could look at ING Groep NV's (ING)

private banking business in Asia.

"Views in the market suggest these assets would represent a

compelling strategic fit, especially considering the RBS asset

purchases," IG Markets analyst Ben Potter said.

ANZ is also hoping to get a banking license to operate in India,

and Smith said the group is making progress on achieving local

incorporation in China.

Under Tuesday's deal, ANZ will triple its customer base in Asia

to an estimated 3 million clients from the current 1 million.

It will also add 54 branches, US$3.2 billion in loans and,

perhaps most importantly, US$7.1 billion in deposits.

The assets being acquired recorded a profit of A$127 million in

the most recent 12 months before provisions. Provisions totaled

A$238 million, ANZ said.

In addition to the purchase price, ANZ will have to tip around

US$650 million more into the assets to be acquired to boost their

Tier 1 capital levels to 8%.

ANZ said the deal is expected to be cash earnings per share

accretive within two years after the deal is completed - expected

by the second quarter of 2010.

ANZ's head of Asia Alex Thursby said the RBS deal presents

significant opportunities to add to the group's growth in the

region.

"We are well advanced with integration plans for each country so

we can hit the ground running," Thursby said.

Retention agreements have been put in place with key RBS

employees, ANZ said.

The sale of the assets is a step in unwinding RBS' partial

acquisition of ABN AMRO. The US$101 billion, peak-of-the-market

deal was spearheaded by RBS and is widely seen as the strategic

misstep that led to RBS' downfall and the ouster of former chief

executive Fred Goodwin. RBS will retain its presence in about a

dozen markets in Asia.

RBS head of Global Banking & Markets for Asia Pacific, John

McCormick, said RBS will continue to be a global wholesale,

transaction and private bank, with a significant presence in Asia

in the 11 markets that account for 90% of its revenues in the

region.

Credit Suisse acted as financial adviser to ANZ on the

acquisition, which remains subject to regulatory approvals.

Investors reacted positively to the RBS deal. ANZ shares closed

up 3% at A$19.57, while the benchmark S&P/ASX 200 index rose

1.1% to 4309.3 points.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

(Andrew Peaple in Beijing contributed to this article)

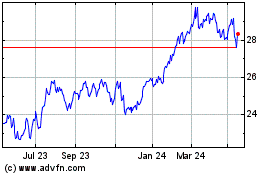

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From May 2024 to Jun 2024

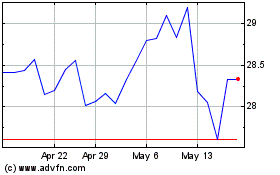

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jun 2023 to Jun 2024